Macro Principle:

The entire media and sell side industry of financial markets is centered around linear macro views with price targets and a focus on tails (the most extreme part of the distribution). This is why predictability is functionally nonexistent from these sources of information. Consensus is consensus not because of WHO says it but because of HOW they establish conclusions. Fundamentally, the media takes what is currently taking place and makes linear extrapolations.

In complex systems, path dependency is THE RULE for making implications. Technical definition:

Path dependency in complex systems and financial markets refers to how the future state is inherently a function of the present, with each state setting the distribution for the next. Unlike a linear progression toward a fixed outcome, each stage shapes possible trajectories, creating unique distributions of future possibilities. This dynamic underscores how financial markets evolve through interdependent conditions, where present influences dictate a range of potential paths rather than a deterministic destination.

One of the most valuable things you can do is remove yourself from the interpretive biases of external influences. This is part of having an edge (see full book here: Link)

This principle of path dependency sets the interpretive framework for WHERE we are right now.

The Macro Picture:

The macro context has been laid out for equities, rates, crude, gold, silver, and Bitcoin. See the following reports for these:

Comprehensive Macro Report: Link

Alpha Report: Disruptive Technology Is Built On Disruptive Knowledge: Link

Alpha Report: Will rate cuts reignite inflation?: Link

Bonds Update: Link

Equities into the election: Link

Additionally, the crude view that was laid out continues to pay as we move down from the $76 level. The report for the bearish crude view was laid out here:

And execution here:

In the short term we are likely to bounce after this gap down. Taking some gains here is a good idea. However, we are likely to remain BELOW the $72 high of last week and ultimately break into the $50s in the next 3-6 months.

Macro Data:

The macro catalysts and their hedging pressure were laid out in the previous alpha report:

Alpha Report: Election Hedging

We are entering an important period of time where hedging pressure and its connection to macro catalysts will be instrumental in taking asymmetrical trades that generate alpha. The macro views have been laid out in the following reports thus far:

The catalysts for this week will be critical for establishing a clearer view of positioning in the rates space and equities.

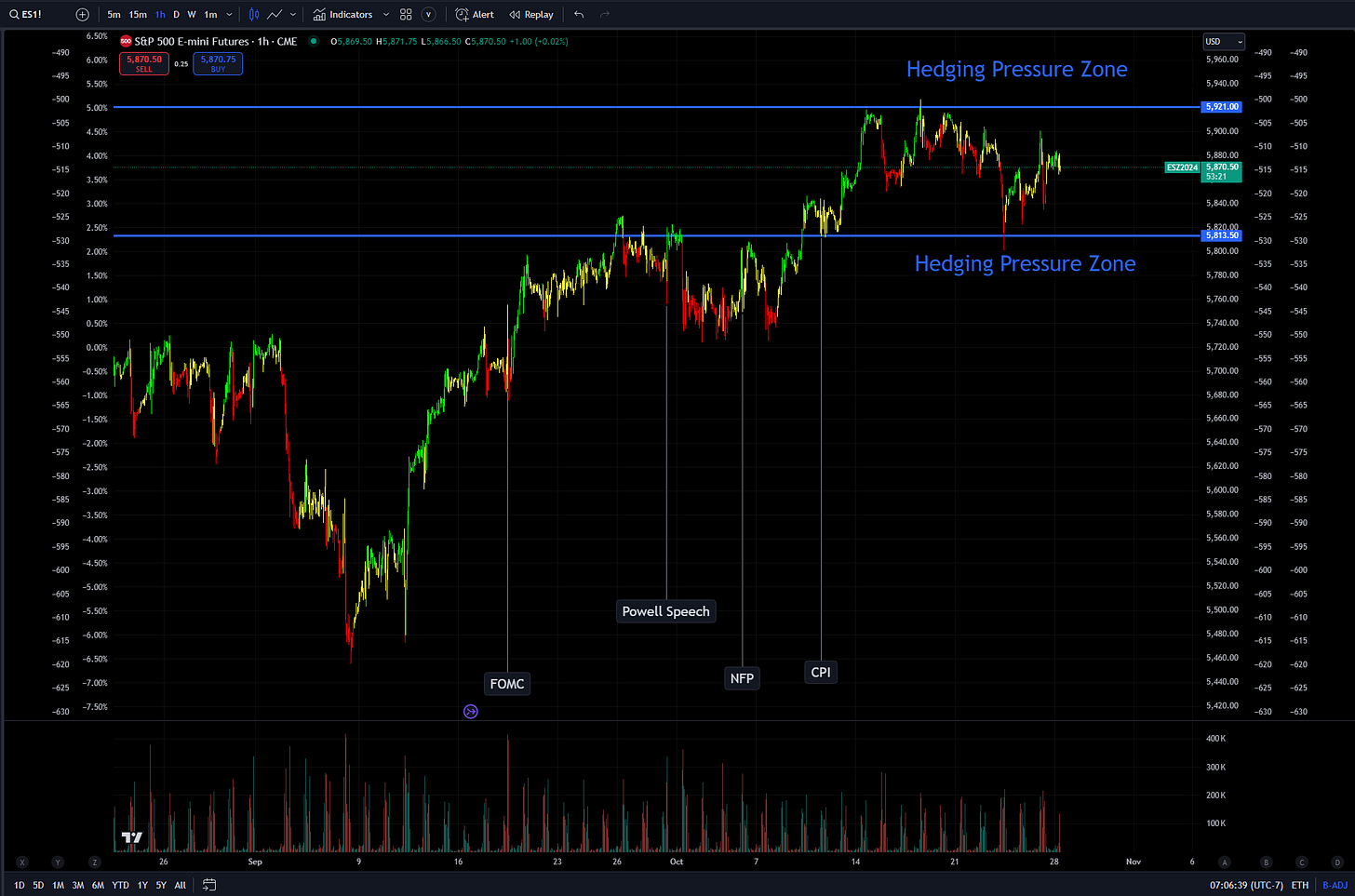

We are likely to remain in this range for ES until hedges for FOMC and the election are unwound.

The bond update explained why the ZN trade was taken off until NFP.

Trades: Update On Bonds

The macro report with the cyclical skew for interest rates has been laid out here:

This directly relates to metals and how implied vol has blown out in gold and silver. In other words, we are likely to see some consolidation in gold and silver as we move into the hedging catalysts this week. If bonds begin to make a bottom and vol comes down for gold and silver, then we are likely to set a short-term bottom for another leg up as real rates fall.

All of this brings us to the important part of the report with the specific alpha generation opportunities and their respective logic. This would be a great time to do a free trial if you aren’t a paid subscriber yet because this whole week will have a lot of important reports for paid subscribers.

Alpha Generation:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.