I have consistently laid out my bearish view for bonds:

I want to note a specific tension that is highly relevant for risk management.

It is going to be incredibly difficult for ZT to move out of this short-term range before FOMC because we need a lot more catalysts to reprice the rate cuts in 2026. In other words, we are likely to be in a neutral range until FOMC, which can have implications for holding risk.

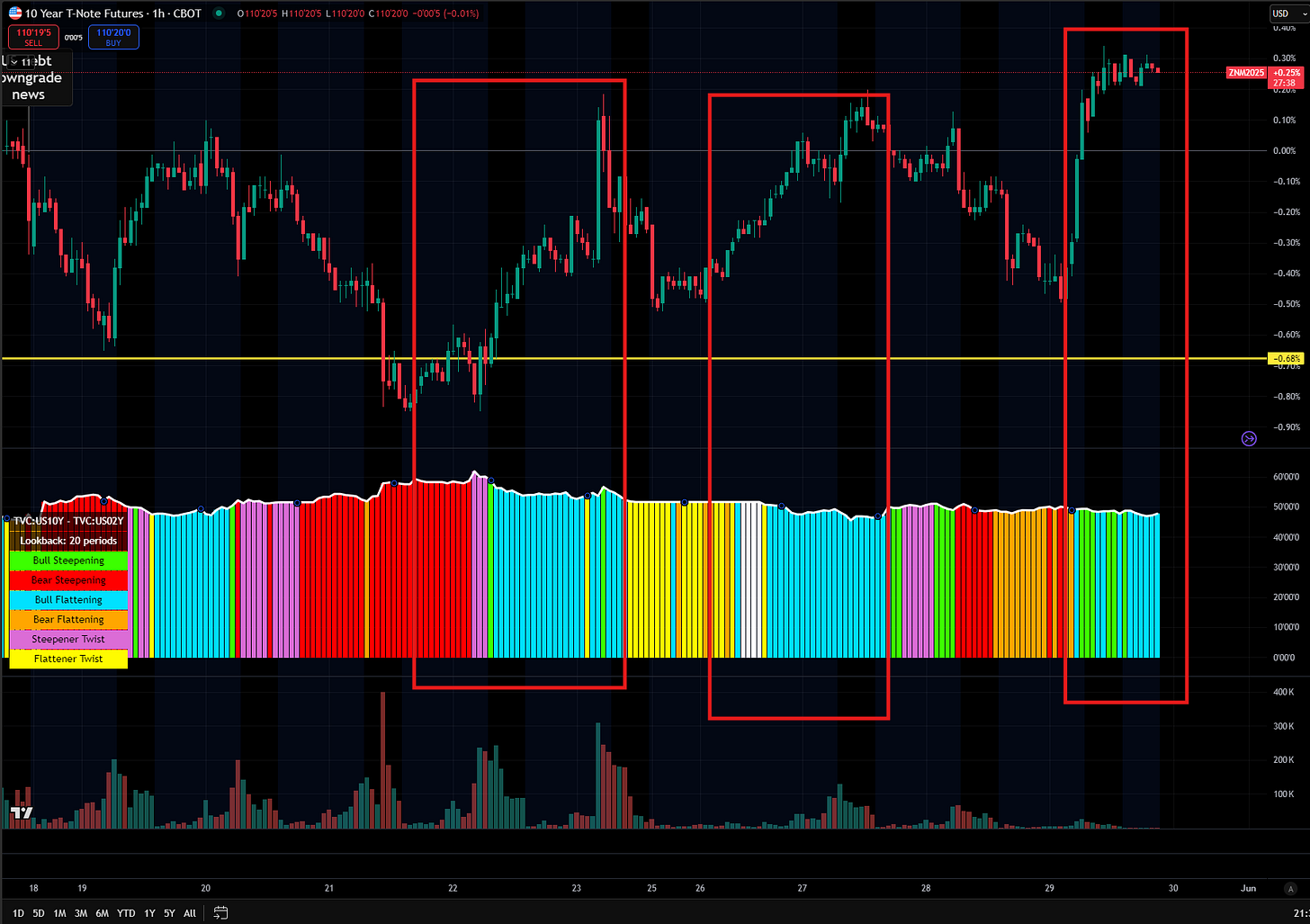

This is why bull flattening has occurred in the days when ZN was positive.Bull flattening in 2s10s is when 10 year rates are moving down MORE than short end rates. In other words, it is difficult to have 2 year rates move higher before FOMC simply because of the current pricing and the amount of things that can change between now and then remains minimal. However, the longer end can have much wider variance and the bull flattening in this context is a marginal positioning unwind because the full force of growth and inflation is yet to be seen.

This is why ZN and ES have had multiple days of an inverse relationship.

The main idea is that we might have to wait till AFTER FOMC for further downside to be realized in ZN, which can mean turning neutral in the short term for any bond shorts or hedging exposure. I have been running shorts in bonds for a bit of time now, so I have more cushion in terms of P&L but the important thing is understanding the logic for WHY things are taking place.

Fundamentally, returns of an asset are going to be distributed through time in an uneven manner, this is why volatility exists. If you understand HOW information is getting priced into markets and WHEN that information is being released, then you can begin to frame WHEN catalysts are going to function as clearing events for your macro view.

I laid out here that I believe bonds have downside risk. My view could be wrong which is why understanding the WHY behind flows and redundancy planning accordingly is key. I would encourage you to review all the pieces written on rates over the last month so you can have a clear flow of the developments and logic.

Thanks

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.