Today CPI was released and came out ABOVE expectations which surprised the market marginally. The key was how stocks and bonds responded to this. As the macro report laid out, there was a risk in bonds to the downside due to the durable goods component (link)

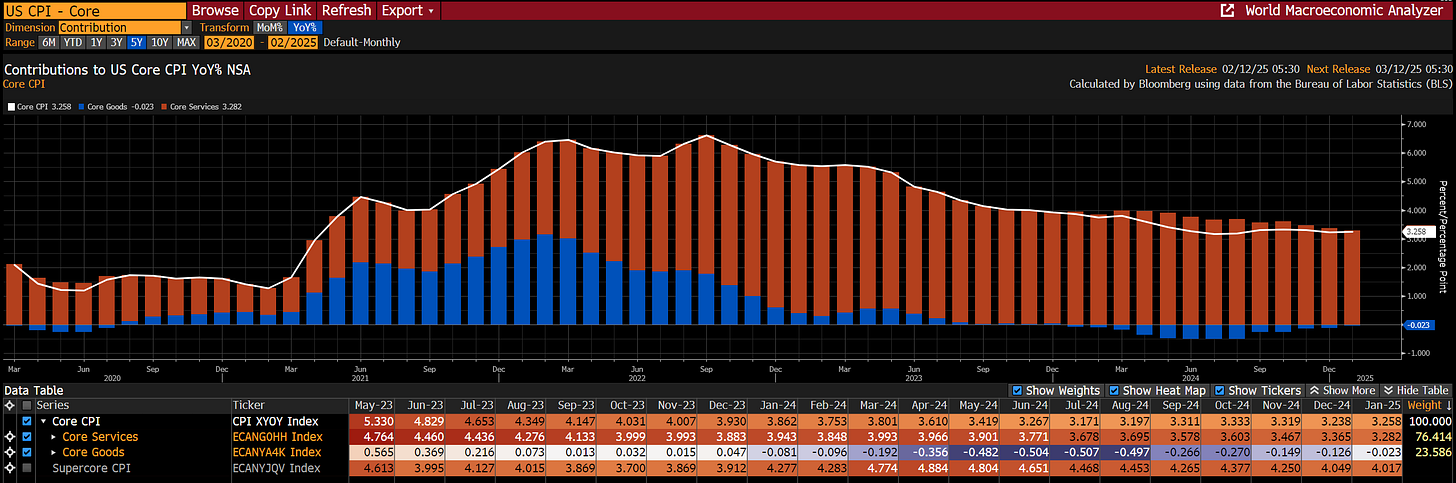

You will notice that it was the goods line item of core that accelerated even though services decelerated:

Why was it likely for goods to accelerate? Because the majority of imports are goods (link)

We continue to see the quantity of goods being imported accelerate in the monthly data which is likely connected to the tariff risk:

This is WHY understanding the signals laid out in the macro report relating to the value chain and HOW prices are transmitted through the economy are critical right now:

This is especially true as we move into PPI and the other inflation prints this week (see the alpha primer on hedging pressure and signals here Link):

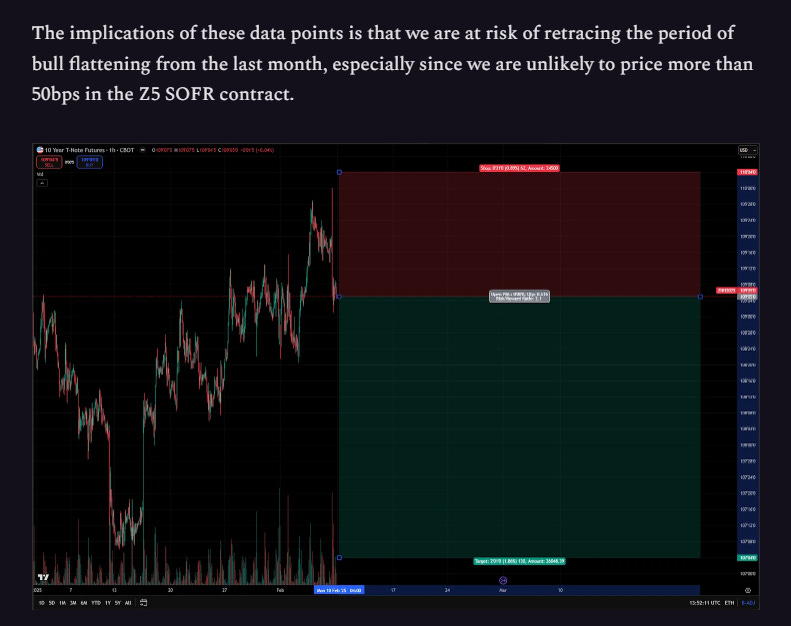

The more important thing to focus on is how asset prices responded to this dynamic and how it connects to the trades that have been laid out.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.