Asset Class Report: Equities

What is the risk reward of equities?

There will always be confusion and fear about where equities are going when you aren’t analyzing them correctly. I have written extensively about HOW to analyze the S&P500 here:

The main question we are going to answer today is, what is the risk-reward of the S&P500 from here?

Attribution:

In the primer for the S&P500 (link), I explained that there are two drivers for equities: the earnings function and the valuation function. Many people don’t correctly distinguish between these when they are taking views on the index and it shows.

Earnings expectations are driven by growth and inflation in the underlying fundamentals of the economy. As we can see, they remain elevated at highs which is a positive and bullish signal:

It is during recessions that these earnings expectations get downgraded. For example, here is 2008: (btw, see the difference from today!)

Similar to how you would value a piece of real estate, there are the underlying cash flows and the discount rate you use to value those cash flows (here is a video breakdown if this is a new concept: Link).

The flip side of the coin is the valuation function which is driven by macro liquidity. If the earnings function remains constant, the primary driver moving the S&P500 will be liquidity. I wrote about macro liquidity briefly in my Bitcoin article:

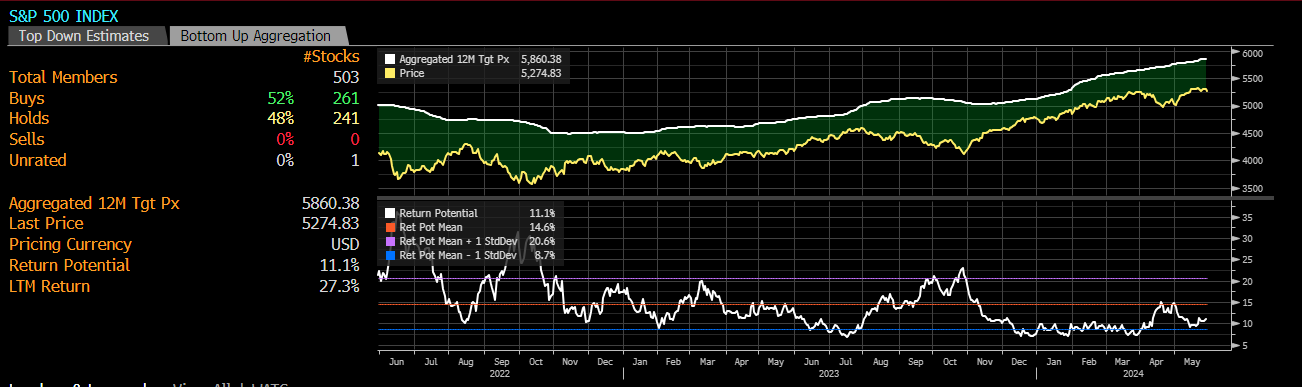

We can look at the valuation function in many different ways but several simple ones are: the earnings component as a yield compared to the risk-free rate, valuation multiples, or stdv from earnings targets.

Pulling this together:

Now there are many other signals we want to stack on top of the attribution analysis noted above but let’s cut to the point.

The S&P500 is in a regime where earnings expectations are elevated and rising. There isn’t a clear impulse across equity sectors or macro data indicating an imminent and significant revision in earnings. So the earnings function does not indicate a bearish skew.

The question is, what about the valuation function? This is why bonds are so important right now. The sell-off in bonds is pushing rates UP and causing capital to move back across the risk curve. This is WHY equities had the pullback in April and have seen a little bearishness over the past 2 days.

However, as I laid out in my interest rate report, there isn’t a ton of downside for bonds on a cyclical basis right now. This means it is going to be difficult for bonds to really drag equities down that much.

Think about it like this, the bearishness in bonds can drag on equities a little. How much downside is there though? In my analysis, not a ton from the bond side.

The reason why this is so scary for people is because they own a 60/40 type portfolio where they aren’t used to stocks AND bonds selling off at the same time. It’s important to understand these tensions because they frame how people think about equities.

My partner SpearPoint Equity Alpha writes a piece breaking down the positioning in equities every week on this topic and I would encourage you to follow his work.

If you want to hear about our backgrounds and how we approach markets, we did a podcast here on it:

Circling back to the S&P500. Let’s say this is all very confusing and you want it simplified even more. Here is a chart of the momentum regimes. We are clearly in a positive momentum regime which means it is going to take A LOT to shake us from this. (if you want to look into these momentum regimes more, read this paper: link and read about optimal lookbacks from this book: link)

Bottom line: there could be some marginal pullbacks in equities if bonds sell off a little but at the end of the day, the risk-reward of equities remains skewed to the upside. This is based on the data and facts, not biased narratives.

Conclusion:

Let me end with a story about a conversation that just stuck with me.

I remember talking to a friend who is a very successful trader. He said to me, you can’t afford to not be long in bull markets. You need to be able to cover your losses somehow and being long in bull markets gives you a significant edge to actually take additional bets that allow you to outperform.

I share this story because it has become so cool today to be bearish. Everyone wants to be Michael Burry 2.0. Let me just say, I would rather be long and get stopped out than try to call a top every day in the S&P500. I am not saying there isn’t a time to be bearish but if you truly understand how macro works, you’ll know how to time your bearishness very strategically. The S&P500 goes up 80% of the time which means by definition, your window for being bearish is incredibly small. On top of this, typically there is a better expression of risk premias expanding in FX or underlying pair trades than being outright short ES.

I will be breaking down these dynamics more.

For now, we move forward together and generate alpha.

Great article, thanks for putting it together

Interesting read. Thanks for sharing!