Brainstorms: Macro View, Lessons Learned, Focus

Macro life

“Do not many of us who fail to achieve big things….fail because we lack concentration - the art of concentrating the mind on the thing to be done at the proper time and to the exclusion of everything else?”

John D Rockefeller - Titan by Ron Chernow

When you enter the financial industry, especially the active trading space, you are constantly questioned about your view of assets. Bullish or bearish? Why be bullish or bearish? Because it fits into a perfect reductionistic box that lays perfectly on the headline of a TV screen.

When I think about markets, I try to have a specific and descriptive idea of the directional view and TYPE of price action characteristics that are likely to take place. This is necessary because I deal in very large amounts of leverage where the margin for error is very small.

This is something that I employ in all domains though. I don’t simply want to have a big-picture view. I want to quantify and be as specific as possible about the PATH and destination. Do I have an idea about the TYPE of volatility that will take place along the path? If I do then this dramatically changes my actions.

For example, if you owned a small business coming into 2021 and 2022, did you know there would be outsized volatility in both your inputs and outputs? Supply chain issues matched with workers demanding higher wages create volatility in the income statement of a business.

A business and a portfolio are functionally the same. Typically a portfolio has more liquidity and is marked to market at the end of each day but a small business experiences the same constraints.

This is actually one of the reasons we saw credit risk increase so much during 2022. It wasn’t because there was a recession, it was because the macro uncertainty was so high that credit went for a premium. (Chard below is the CDX index expressing credit risk)

A secret:

I’ll let you in on a little secret though. So many traders and individuals in the industry focus on the wrong things and don’t recognize the actual macro picture situation taking place. This provides an opportunity for those who have clarity in their thought process and a different time horizon.

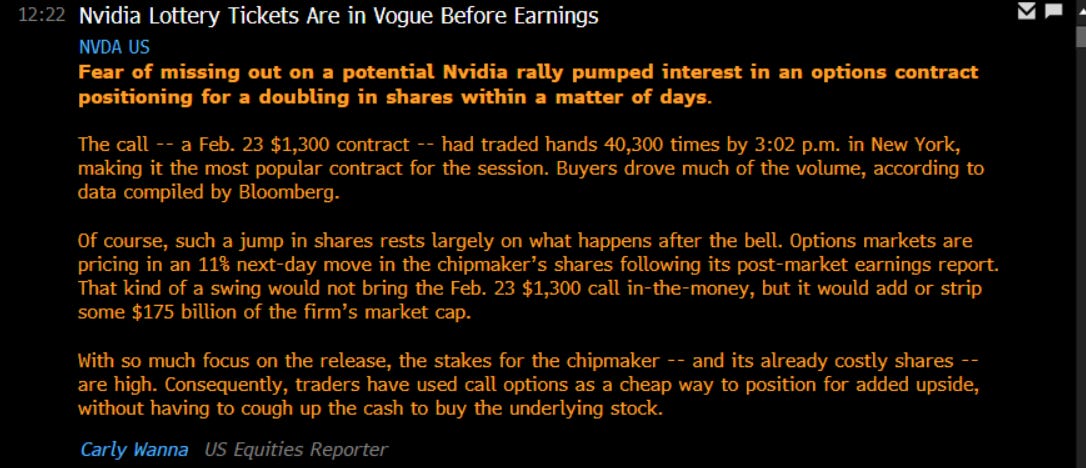

For example, the amount of focus being given to a single stock just tells me people aren’t focusing on the real opportunities that exist.

I started with a quote from JDR on focus. Here is a prime example. While everyone is watching NVDA earnings, you should be focusing on building and running the exceptional skill set and knowledge base you have acquired.

This is why I spent time writing the following reports. It allows me to take a step back and just think:

Fundamentally, you want to extract returns from the market cycle, not get trapped in the media cycle:

Conclusion:

I will end with this, all of the great ideas I have come up with or big breakthroughs I have made were a result of critical thinking in isolation, NOT scrolling Twitter. Private conversations and detachment from the constant social media stimulation will do wonders for your cognitive abilities.