Brainstorms: Options and Vol Compression

Tensions and risks

Recently there has been significant focus on implied correlations and the compression with implied volatility. Let me contextualize this and explain how you should think about situations like this.

First, implied vol is about LIQUIDITY. It isn’t about fear or greed. Implied vol is about liquidity on specific parts of the distribution of returns on an asset. Remember, even the outright price of an asset is pricing a distribution of outcomes, not a single destination. Options make this even more explicit by having various strikes and expirations with differing premiums and discounts.

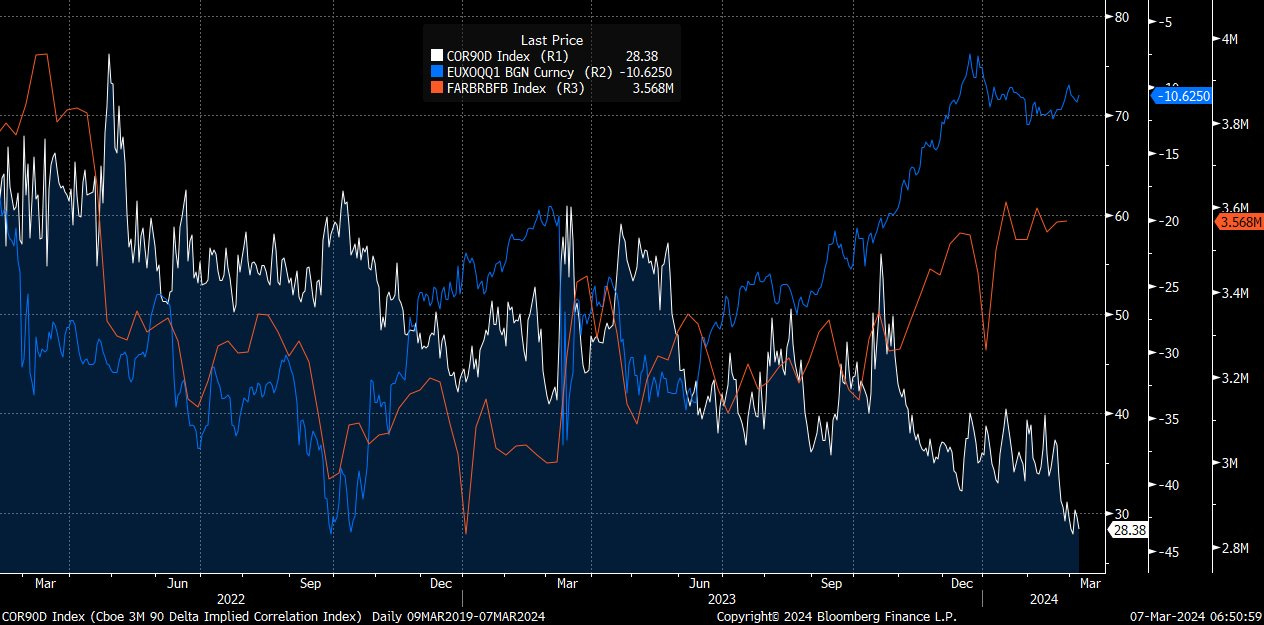

I shared this chart on Twitter but the fall in implied correlations over the past year has been directly connected to the quantity of dollars expanding in the system (link):

I also touched on the tensions around this liquidity in my recent report:

Second, when you have such a low level in volatility and implied correlations, IT IS LOW FOR A REASON. Many people say you should buy vol when it’s low because it’s “cheap.” Implied vol is only cheap when it’s MISPRICING realized vol, not when it’s low or high. Just look at the long-term VIX chart and think about if you would make money on net buying VIX calls every time vol is BELOW the median line. You need more of an edge than this:

I remember several traders I knew trying to short-vol on GME when it was at 300 because it was “cheap” due to its level. Needless to say, they were blown out of those positions because they conflated “level” with “cheap.”

More important than the LEVEL is if there is an implied vol premium or discount:

Watching implied vol discounts vs premiums and comparing this to market breadth and macro drivers is HOW you can refine your edge.

Final Thoughts:

Implied vol is directly connected to the total return analysis of portfolio and positions. When you have periods like right now, funds with a lot of systematic hedges are BLEEDING! Here is a chart of the PPUT Index and SPX Index. I also add the ratio below.

There is a reason that the Simplify short-vol ETF is up so much right now. It made all-time highs well before the S&P500 did because there has been so much implied vol premium in the market from PMs hedging recession fears.

As I noted in my report, it isn’t until these hedges get unwound and positioning is net long that we can have a meaningful bear market.

If you want to dig into this topic more, check out these resources:

Convex Strategies has one of the best blogs in the world in on vol: https://convex-strategies.com/blog/

Noel Smith has some great interviews and papers on dispersions, correlations and vol:

Simplify has some great products and educational resources for retail on impeding option structures into ETFs.

Kris Abdelmessih has some amazing Primers on options: link

And obviously Michael W. Green has a lot of experience because he shorted the historic XIV product. Check out the interview I did with him and SpearPoint Management LLC:

I will end with a chart of XIV to remind you that there is always a tail right around the corner:

Great piece. I have been reading on twitter that the cboe correlation index being useless/meaningless, would be nice if you could do a dig-in/analysis.