Brainstorms: The Path

Exceptional performance

Make the impossible necessary

Every day that goes by, the perception of what is “impossible” among financial professionals increases exponentially. Exceptional returns only appear possible by those who YOLO options on GME-type events and hope for the best. As a result, people have converted their thinking of markets into a lottery-like system where they simply need one payout to retire.

I talked to a friend last night who runs a hedge fund and he said, “Saying you focus on absolute returns is now an excuse for bad performance instead of having exceptional returns that are uncorrelated to the index.” It’s so true!

I have no interest in such thinking. The market is an entity that pushes you to your limits and refines you to become a better version of your current self. In order to get from point A to point B, you must bridge the gap by becoming a different person.

In today’s world, people are more infatuated with calling the next crisis via survivor bias than actually putting their ideas to the test in the most grueling environment of financial markets.

You will begin to realize that social media has glamorized calling financial crisis without having any skin in the game. People constantly use arguments from silence to justify irrational actions:

“The market could crash tomorrow and this could be a top so I’m staying in cash.”

“I’m shorting the market because it could crash tomorrow”

Let me just say, that if you have certainty about an action, all of the returns have already been extracted from it. But now people are coming up with sophisticated narratives about why the markets have “fundamentally changed.” Let me just say, that if anyone in the hedge fund space found a way that the markets “fundamentally changed” the last thing they are going to do is tell you about it. If you have any edge in predicting price, you monetize it with extreme leverage and speed before it disappears.

Any time someone pretends like they have a definite view of the future, just automatically ask them to make a bet on it. You think a GFC 2.0 is going to take place? Great, let’s bet $50k on it? Just watch how fast they back down.

I originally started this Substack for several people I do research and strategy for. I was then encouraged to take it public which resulted in me writing over 300 articles in under a year. While there are many upsides to meeting with exceptional market practitioners like yourself, the amount of social media distractions increases exponentially. I know all of us deal with this distraction. The key is not letting it distract you from accomplishing the impossible!

Make the impossible necessary

Macro Views:

I remain bullish equities. We are seeing a melt-up in direct confluence with the view I laid out: Link

Bonds are range-bound with limited downside in the short end. Understanding the macro tensions is critical for running trades: Link

Momentum trades in equities. Mean reversion trades in bonds and FX = the name of the game right now.

Several charts:

We are seeing a compression in FX:

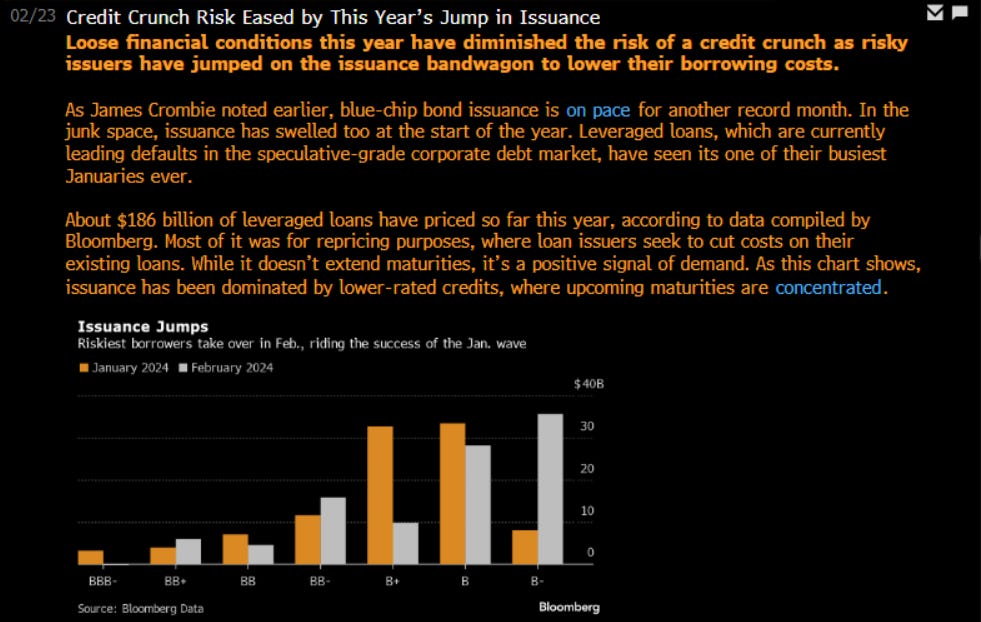

As I have noted over and over, when the SLOOS data marginally shifts as real rates move down and nominal growth is elevated, this turns the credit spigot back on. This is bullish until it causes inflation!

The curve is likely to steepen further from here and being long steepeners has more positive optionality than an outright bet on duration. Once the curve uninverts, I will put on large leverage bets in duration. We need to see the confluence of other signals but I will let you know when my strategy triggers longs.

Earnings are critical to watch here since rates remain elevated.

Conclusion:

I will end with one thing, everyone is afraid of buying stocks here because they feel as if they will toptick it. If you moderate your actions incrementally, you’ll be fine. Using short-term deleveraging events like CPI helps you establish entries when people need to hedge. See my article on this:

Trade: Post CPI

I have laid out the macro situation very clearly in the macro report, macro webinar, and previous articles.

I will be releasing a credit report for paid subscribers breaking down the tensions of how credit risk directly connects to growth, inflation, and liquidity. I will also break down the current tensions and skew of credit spreads moving into 2024. If you are new, feel free to do the free trial and check out all the educational articles here:

Research Synthesis / Direction Of Capital Flows Substack

Hello everyone, There has never been a time in history when understanding the world from a global perspective and interpreting it accurately paid such a high premium. Since the very beginning of this Substack, I have talked about the nature of the time we live in and how to act intentionally in it.

Make the impossible necessary

This a great note