Comprehensive Macro Report: Capital Flows

Growth, Inflation, Liquidty and trades!

Macro Report:

Hello everyone,

Below is the monthly comprehensive macro report providing a full analysis of growth, inflation, and liquidity. The most important thing in these markets is understanding the tensions and scenarios that could unfold so that you can adapt accordingly. We will be doing the macro webinar soon where you can ask any question you want. Be sure to keep an eye on the work myself and SpearPoint Management LLC are doing on the SpearPoint Equity Alpha Substack.

The best is yet to come! Enjoy!

Main Idea:

Summary: Goldilocks (positive growth and decelerating inflation) remains the dominant macro regime. There continue to be key tensions to monitor with inflation and the SPEED at which the Fed cuts rates. However, we are at the beginning of a cutting cycle. The structural factors continue to exert themselves in cyclical moves and we are likely to see these further amplified as we move through 2024.

Report Table of Contents:

United States Growth

United States Inflation

United States Liquidity

Macro impact on stocks, bonds, currencies and commodities

Global Growth, Inflation, and Liquidity

Macro impact on global asset classes

Trades for US and global assets

Intro:

The structural changes in the global economy continue to be reflected in cyclical dynamics. Demographic shifts show a persistent impact on the labor market and deglobalization shifts are directly impacting domestic investment. This structural regime is characterized by the following:

The US dollar remains the reserve currency supporting cross-border flows into the US, a current account deficit, US consumption, and the “exorbitant privilege” (or as Michael Pettis and Matthew C. Klein say in their book, an “exorbitant burden”).

An increase in geopolitical volatility due to the rise in multipolarity (see Marko Papic’s book on this) directly impacts trade flows, transportation networks, and the supply of commodities. This directly transmits into shipping rates, commodity prices, and potentially into core inflation metrics.

An increase in nominal activity due to an increase in the fiscal impulse, domestic investment due to onshoring, higher service spending contribution to GDP, and lower consumer debt levels.

These underlying structural changes create two dynamics that confuse market participants about the macro regime and business cycle:

The structural changes cause cyclical growth and inflation impulses to be very different from the period of low growth and inflation in the 2010s. Additionally, the attribution and dispersion of growth in the underlying economy are continuing to shift.

For example, the onshoring is causing construction spending in the manufacturing sector to increase dramatically.

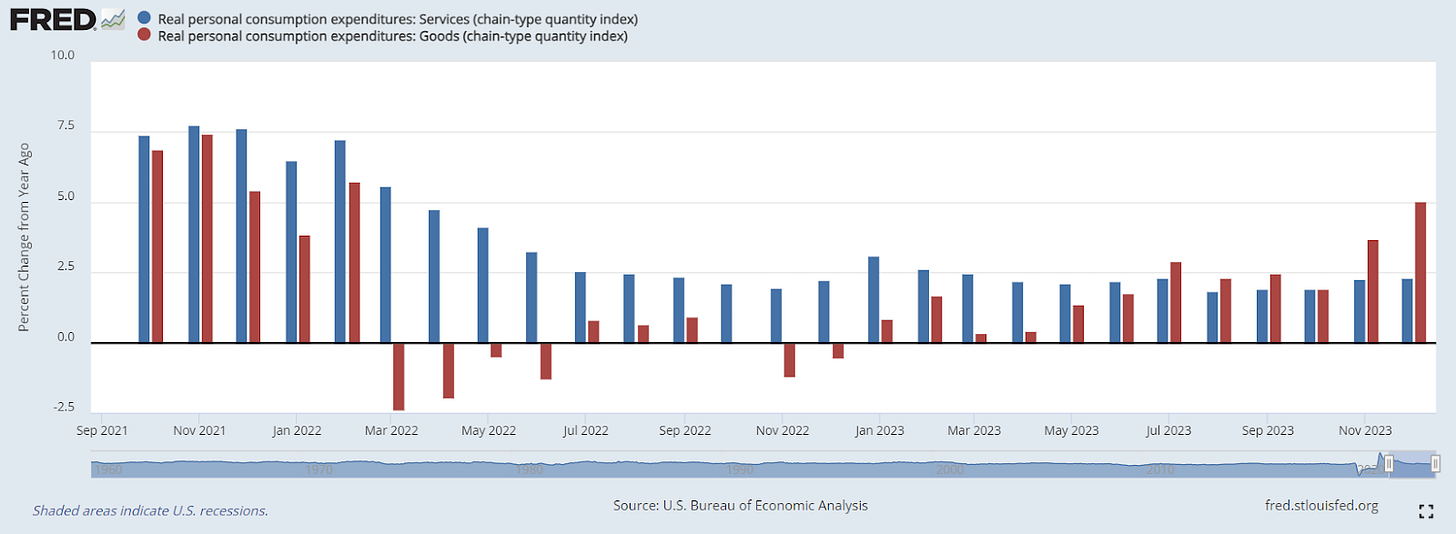

Another example is how the underlying consumption patterns are changing due to COVID-19, supply chain issues, interest rate hikes, and inflation. Below is a chart of YoY real personal consumption in both goods and services. We can see the deceleration in goods during the hiking cycle of 2022 and the more recent reacceleration due to the shift in monetary policy.

These underlying changes in both macro moves and attribution for growth directly connect with the second point that is confusing market participants.

The macro volatility vs underlying dispersions in the market: There is always a tension in macro of extrapolating the parts to the whole. Macro volatility occurs when there are significant standard deviations in growth, inflation, and liquidity. If these deviations are pervasive as opposed to siloed in idiosyncratic factors, cross-asset class implied volatility will rise as correlations move to 1.

For example, here is a chart of equity volatility (VIX in white), bond volatility (Move Index in blue), FX volatility (EURUSD implied vol in orange), and crude oil volatility (purple). We can see when all of these move in tandem that it is likely a macro impulse having a pervasive impact across ALL economic sectors.

When there isn’t significant macro volatility, there is typically a reasonable degree of underlying dispersions in both asset returns and equity sector returns. Market participants struggle with aligning themself with the macro regime when they extrapolate a single asset’s dispersion to the entire economic and financial system.

For example, many market participants who experienced credit difficulty in real estate during the GFC have used the underperformance of REITs to imply that there is a high probability (or in many cases complete certainty) that we are moving into another recession similar to 2008 (see the paper “Housing IS the business cycle.”). However, this is extrapolating a single sector’s performance to the entire economic system without accounting for how real estate dynamics are transmitted through the rest of the economy. Additionally, the fact that homebuilders are making all-time highs is almost completely ignored.

This tension between macro volatility and underlying dispersions is directly connected to how positioning, strategy returns, and the hurdle for active managers in markets. 2022 served as an example of macro volatility within this new regime. Below is a chart of the Macro Hedge Fund Return Index (white) overlaid with the S&P500 (blue). 2022 was characterized by a rise in implied volatility across all asset classes in which active management was the primary way to avoid a drawdown.

As macro volatility decreased and cross-asset implied volatility decreased into 2023, greater dispersions took place in underlying equity sectors. These underlying dispersions continue to be driven by the macro regime but they require refined focus to get over the hurdle of passively holding the index.

For example, in 2023, breadth slowed significantly as the index made highs:

A primary driver of this was quality tech flows and the Magnificent 7 stocks:

We have seen sectors such as REITs and Utilities underperform as industrials and homebuilders make all-time highs.

Additionally, the Dow and S&P500 have made all-time highs as the Russell remains in its range:

These dispersions in asset prices must be interpreted correctly and held in proper tension with the underlying drivers. This report will show a clear analysis of US growth, inflation, and liquidity. It will then show how all major US assets are pricing these variables and the most likely scenario for asset prices moving into 2024. Understanding positioning and the probabilities surrounding macro volatility is how one can properly manage the volatility similar to 2022 and the dispersions we are currently seeing.

United States Growth:

The previous macro report drew attention to the underlying drivers of growth and concluded that growth is likely to remain resilient. While many market participants are extrapolating specific data points to imply a pervasive recession, the data continues to confirm the view that growth is positive.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.