How To Navigate The Macro Uncertainty

The playbook for the largest players in the industry

How To Navigate The Macro Uncertainty

We’ve entered a phase of the cycle where credit is slowing relative to 2 months ago, equity breadth is narrowing, and currency volatility is picking up on the back of geopolitical risk (I laid all of this out in the recent macro video). In this kind of environment, the single most important starting point is how you frame the uncertainty.

One thing about markets: information is never evenly distributed. Central banks, governments, asset managers, and hedge funds often get access to, or share, key information with each other long before it hits the headlines. By the time it reaches the public tape, chasing it is a loser’s game.

That brings me to a tweet I posted recently, and to what I believe is the most important factor for anyone trying to succeed as an active risk taker in markets without the benefit of insider edges.

The Deck Is Stacked Against You In Short-Term Games:

When you look at markets through that lens – constraints and incentives – something uncomfortable becomes obvious very quickly: in the short term, almost every constraint and incentive is working against you. The people setting prices, moving size, and seeing flows are paid to live inside the noise. They have better information, faster algos, and balance sheets they can use to lean on you.

If you insist on playing their game on their time horizon, the odds are structurally tilted in their favor. The deck is stacked against you in short-term games.

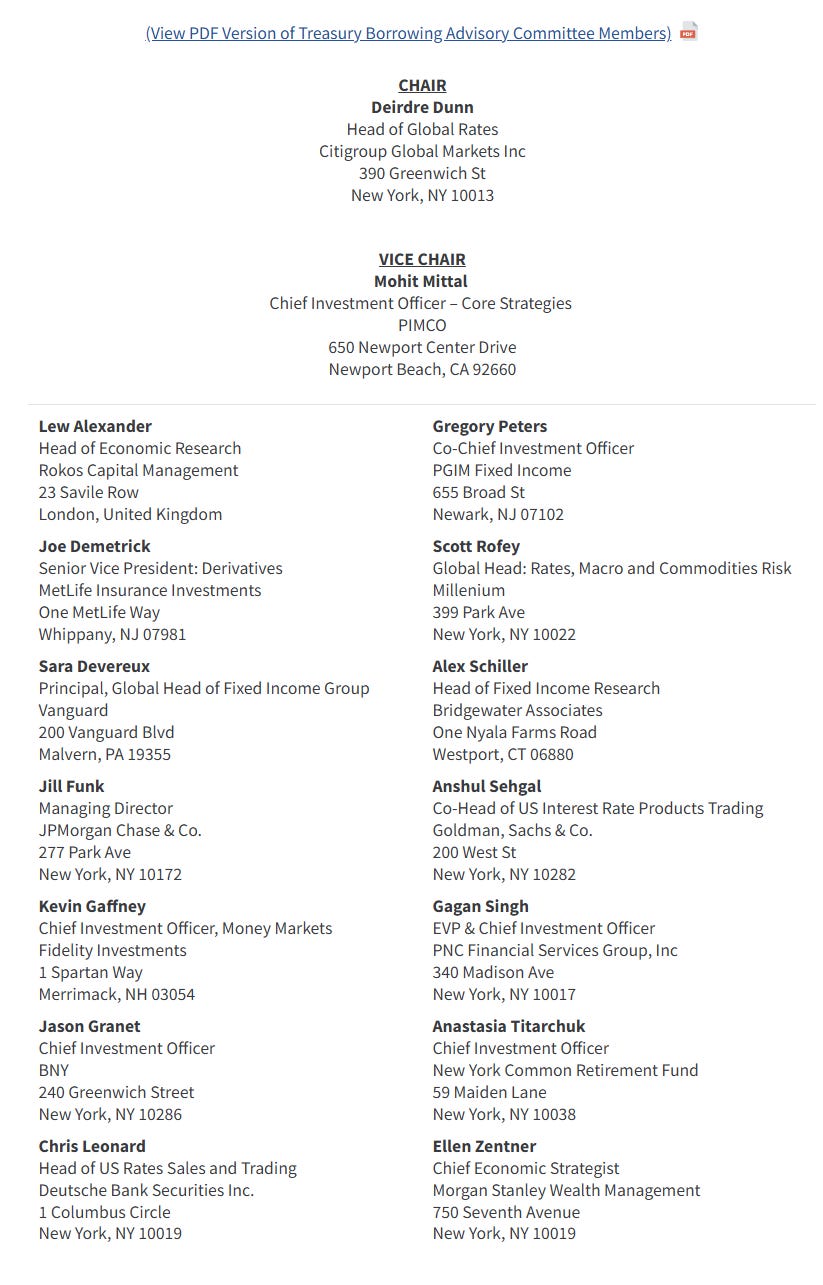

For example, there is intense attention on social media regarding U.S. Treasury issuance, its interaction with the Federal Reserve’s balance sheet, and the way both influence macro liquidity. If you ever look at WHO all of the advisors to the treasury are, it is literally every major CIO of every major investment bank or asset manager. Think about that for a minute, the guys who are trading the market are also giving input to one of the largest players in the market, the US treasury.

The Treasury Secretary (currently Scott Bessent) and Federal Reserve Chair (currently Mac Daddy Powell) are in constant communication in order to operate in short end markets, which is why Powell said the Treasury Secretary and Fed Chair have shared a weekly meal for 75 years.

At the end of the day, information flows very freely amongst the top players of Wall Street for short-term decisions. The same dynamic exists in the asset management and hedge fund space, where they actively take views on assets and float different narratives to Main Street. The clearest example of this is the “evolution” of views that Larry Fink has had on Bitcoin. And don’t forget Blackrock (the firm Fink is the CEO of) is the largest asset manager in the WORLD, managing over $10T.

The CEO of the largest asset manager in the world somehow has an uninformed view of Bitcoin, actively takes a negative stance toward it, and then suddenly flips when it presents an opportunity to gather assets?

Right……

My point is straightforward. Financial markets do not operate the way so-called experts portray them. This is why the incentives and constraints of the major players are the single most important starting point for understanding how markets really function.

How can anyone expect to compete when the largest institutions receive real-time information you will never see and routinely publish statements that are misleading or outright incorrect?

This is precisely why a macro framework is essential. No CIO, hedge fund, or central bank has any special insight into macro flows beyond a very short horizon. At best, they get certain data slightly earlier, but they are still operating under the same macro uncertainty as everyone else. This means that once you look beyond the next month, even the biggest players are navigating the same fog you are. On any horizon longer than that, you are competing on level terms. (THIS IS WHERE YOU WANT TO LIVE!)

Here is the key takeaway: when a large player is on the wrong side of macro, they have to move the market to get out of the way. This is WHY there is oppurtunities for individauls who understand macro flows, macro constraints, and HOW information is developing in real time. This is why I have written educational primers on every aspect of macro and publish reports every day on it.

If you want to dig into my current macro views further, the recording of the macro breakdown and following Q&A can be found here:

Welcome to global macro

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

![[FREE] Educational Primers On Every Aspect Of Macro & Markets](https://substackcdn.com/image/fetch/$s_!tfas!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F69c49472-3d63-47f0-9b8c-2a682fa625f1_1024x1024.jpeg)

Really well articulated