Information Age, Thinking Preemptively and Market Update

There is this guy and he's a ghost! No one knows who he is!

I would like to take a quick moment and welcome all the new subscribers. We are going to cover a lot together! Always feel free to DM me on Twitter or email me. I have a lot going on right now but I enjoy interacting and helping people.

In this publication, I am going to share several big-picture ideas and then we will get into some market views with scenario analysis.

Information Age

In the previous article, I wrote the following:

Let’s expand on this a little:

In markets and life, information is everything. As greater degrees of automation enter our lives (especially with the addition of ChatGPT4), the quality of our information becomes even more important.

The process by which we consume, interpret, and act upon information becomes fundamental to our success. An additional layer of complexity is added because we are operating against other market participants. For example, even if you know a CPI release before it occurs, the reaction of asset classes is dependent upon the net positioning as it reacts to that information.

You can begin to see that it is not enough to have quality information but also to know what information is priced into markets. This is why I laid out the framework in the last 5 articles. If you need the links for all of them they are in this article: Link

I spend all of my time refining my own mind, consuming information, interpreting it correctly, and then ensuring I execute strategies correctly. This entire process can be incredibly valuable because it functions similarly to any business that generates cash flow. This is why hedge funds or actually good research services charge a premium.

Thinking preemetively and redundancy planning:

THE SINGLE BEST ARTICLE I have ever read on this theme was by 13D Research. 13D is run by Kiril Sokoloff. He is the guy who did this interview with Druck.

So this article is really cool because it’s basically an interview with a guy named Divesh Makan. You might ask, who is that? Yeah, literally no one knows who he is!!! He is like a ghost! There are a few articles online speculating about him but he has never done an interview and doesn’t have any social media. But this short conversation was one of the most pivotal ones for my thinking.

Let me share a few experts and then expand on them:

History:

German General Staff and Redundancy Planning

As soon as I finished rereading the article, I immediately ordered the 11 volumes of The Story of Civilization and 5-6 books on the German General Staff. They were amazing!

Most of us understand the value of reading history but the problem is that most modern books on history fall short of actually teaching you how to think correctly. They are written at an 8th-grade level so that the publisher can sell as many copies as possible. Think about it, when it the last time someone published an 11-volume work?

I will share two thoughts from these books:

1) When you read history, it familiarizes you with those variables that are timeless and embedded in the fabric of reality and human nature. Having an understanding of these allows you to focus more time on the points of discontinuity with the past.

2) The books on the German General Staff were some of the best I have ever read. The main thing I learned was that the German General Staff had redundancy plans and scenario analysis to the extreme. After wars, you would go into their headquarters and see thousands of orders prewritten out for multiple scenarios that could take place but never did!

Once you shift your thinking from viewing the future as a deterministic outcome to a distribution of outcomes that you need to conduct scenario analysis upon, you can begin to execute on your information correctly.

This is why I shared this video from the CEO of Goldman Sachs on Twitter. It’s a perfect explanation of how you should think about this dynamic.

In my mind, these two insights of reading history and redundancy planning go hand and hand. The better I know history, the better redundancy planner I can be.

Bringing it together

So when I share all the educational articles, it is to show you all the various moving parts you need to account for. But this is only the beginning! You then need to interpret it and synthesize it correctly into scenario analysis with proper execution and risk management.

This is why I am having a guest writer come on and provide a comprehensive breakdown of how to build a strategy and implement risk management.

Market Set Up:

Let’s finally talk about the market a little! I would like to provide a brief overview of how I am thinking about things. I will be doing a more comprehensive macro report for you guys soon but I can’t go an article without talking about the markets :).

Right now there are two major forces I am thinking about for executing trades and taking views on various assets: the LEVEL of Core CPI and the LEVEL of unemployment (and broad labor market metrics):

Here is YoY and MoM Core CPI. CORE inflation is not having the type of pronounced and pervasive downtrend that we have seen in headline CPI. This is a problem for the FED and how the forward curve is currently priced.

I still see the possibility of a rally in commodities which could cause headline CPI to accelerate again. However, I am simply watching this risk for now, not betting on it.

The elevated level of CPI introduces problems. Regardless of your view of the FED’s ability to actually impact inflation through rate hikes, if inflation continues surprising to the upside, it is very likely that additional hikes will be on the table.

Bottom line, Core CPI doesn’t appear to be decelerating very fast. This means we are likely to play some version of stop-and-go with the forward curve since its pricing rate cuts into the end of the year.

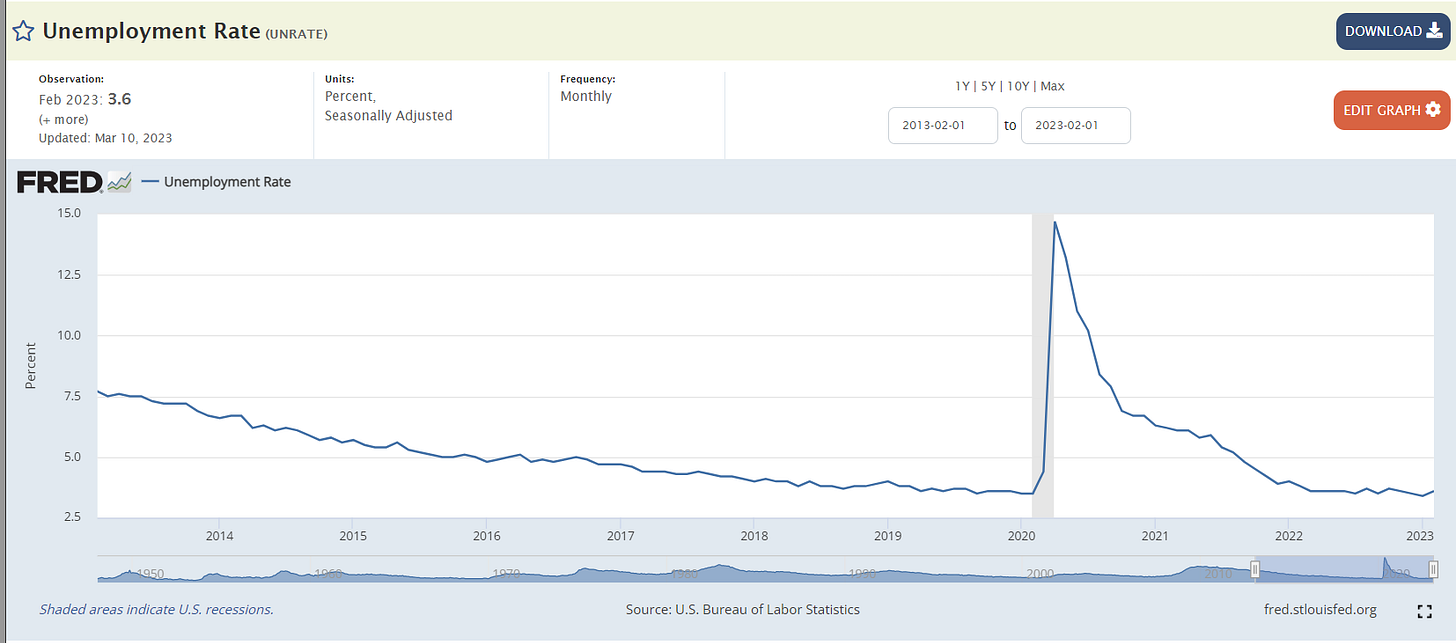

The other side of the equation is the labor market NOT deteriorating as much as expected. I think we have all been surprised at how resilient the labor market has been.

Cyclically, the setup is for us to have a recession and the unemployment rate to rise. Prometheus Research has done a great job providing evidence for this. The real question is WHEN this will occur.

In my mind, we are in a period of time where the LEVEL of both of these variables create a scenario where a decent amount of chop can occur. Until we begin to see a pronounced move in either (or both) of these data points, I don’t want to leverage up on a specific view. As additional information and data are released, this will allow me to incrementally adjust my positioning/leverage.

In the meantime, I want to identify periods of time where the market over-extrapolates unrealistic views and potentially fade them. These would be shorter-term trades though.

Just as a reminder, when you are getting paid 4% to hold cash, that is a pretty high hurdle rate for trades. The entire point of the FED and the cyclical setup is to incentivize investors to sell assets and put their money in cash thereby decreasing overall liquidity.

One signal I would keep an eye on is the ES/NQ ratio with rates. If the ES/NQ signal begins to move back up, we could see another move-up in rates. Watch this in connection with data releases coming in above or below expectations.

Here is the economic calendar for the week:

Alright, thanks for reading! The best is yet to come!

Being paid 4% to hold cash when Core inflation is at 6% isn't all that. Even if it was 2%, you can often make 2% on a single day trade. That's one day vs one year. I know it's not exactly a fair comparison, but it's not that unrealistic either.

Thanks for the insights!

Why do you think ES/NQ leads the 10Y? Seems they are correlated, but not certain there is a lead/lag relationship.

Also, that ratio picks up a bit of market beta, which is also (inversely) correlated with rates. Beta-neutral ES/NQ still correlates nicely with moves in rates, though.