Information Broker/Alpha Generation

Let's Zoom Out A Little

I recognize that there is a broad array of people reading this Substack. So here's the deal: sometimes I will write things that go super deep and technical, and other times, I will simplify things and keep them broad-based. This is important for two reasons. First, all of the people who have minimal knowledge of financial markets need to remember that there are a lot of things to learn. Second, there are people reading this who are way smarter than me, and sometimes they need to be reminded that the simple things matter. :)

To maintain this tension between complexity and simplicity, I have several notebooks of principles, beliefs, and ideas that I read through every week or so. I do this so I don’t forget the big picture and get lost amidst all the small details. Maintaining a strong grasp of the small details and the big picture is one of the most valuable things you can do. Moderating execution and thinking between the details and the big picture is what allows you to progress and learn faster than others.

With that being said, I will cover a couple of simple subjects in this Substack:

The Communication Problem:

Very frequently, I witness a “communication problem” between experts in a field and newcomers. This happens in every domain, and it exists for a reason.

What happens is when you learn something, you begin to assume it’s true and then build additional conclusions on top of the original assumption. For example, I have embedded assumptions about how specific assets move. Whether these assumptions are right or wrong is a different discussion, but for the sake of argument, let’s assume they are correct. If you then ask me why bonds or equities are moving in a specific way, it is unlikely that I will explain the mechanics of causality surrounding that asset, and more likely, I will point to the specific variable that will impact the current mechanics of the asset in a specific instance.

Let me give you a practical example: say you’re a newcomer who begins playing basketball with the pros. There are pretty sophisticated strategies that professional athletes employ to achieve their objectives. If someone experienced begins telling you what to do in a specific instance, assuming you know all the basics of the game and all the strategies when you don’t, you won’t be able to understand him.

If you don’t even know how to dribble, drive and shoot, how can you begin to even understand complex strategies where you need to use certain combinations in specific instances against specific opponents? But think about it, if the pro doesn’t know how to communicate very well, they will probably use little anecdotal things about what you might need to do in a specific instance as opposed to breaking down every variable of his assumptions.

Part of the reason behind this is that as soon as we know something, we generally assume everyone else knows the same thing. We assume that people know how to drive correctly on the road, and yet for some reason, we still get frustrated when they don’t.

This communication problem exists in every domain and is one of the barriers to entry in mastering any skill. This is why as a newcomer, you need to master the art of asking good questions and navigating this communication problem. Figuring out the embedded assumptions that allow an individual to operate effortlessly is a skill.

This is why people who can communicate efficiently functionally arbitrage information between parties, even if they aren’t the smartest person themselves. People who can communicate information effectively in these scenarios are functionally the same as people who arbitrage different financial markets.

"What society and the internet at large have yet to realize is that these people who function as conduits of information to "arbitrage" information are incredibly valuable. Unfortunately, what we see today is a lot of people simply repeating information and moving it around, instead of explaining and connecting it in ways that wouldn't have occurred previously.

For example, a lot of social media is just regurgitating what has already been released, whether it's news, data, or some headline. My goal in this Substack is to help you learn, interpret, and frame information correctly for the purpose of executing on it. I am also self-interested because by interacting with all of you, I am refined by both the questions you ask and the smarter people who provide feedback and correction.

Bottom line, keep this "communication problem" in mind when interacting with people in any domain. Be a broker of information, questions, and thinking.

I will say this over and over again: in the information age, you simply need to be at the right place at the right time with the right piece of information to succeed. That is how the world works today."

Generating Alpha and Edge:

"In the financial industry, there's this whole idea of "alpha generation." What is alpha? Well, whatever I say here, there's going to be some person in a suit who doesn't like my definition.

In a semi-technical sense, "alpha" refers to a measure of an investment's performance in relation to a benchmark index, such as the S&P 500. Alpha represents the excess return earned by an investment over the return of the benchmark index. It's often used to evaluate the skill of an investment manager or a trading strategy. Positive alpha indicates that an investment has outperformed the benchmark index, while negative alpha indicates underperformance.

I don't really want to get into how this fits into each market, but let's just talk about how these concepts work. In my mind, people who maintain absolute positive returns (aka don't lose money) and generate alpha are the equivalent of top-tier athletes. This doesn't just apply to financial markets; it applies to every domain of life. If you can go through any environment without losing money and outperform every other individual, you're operating at peak performance.

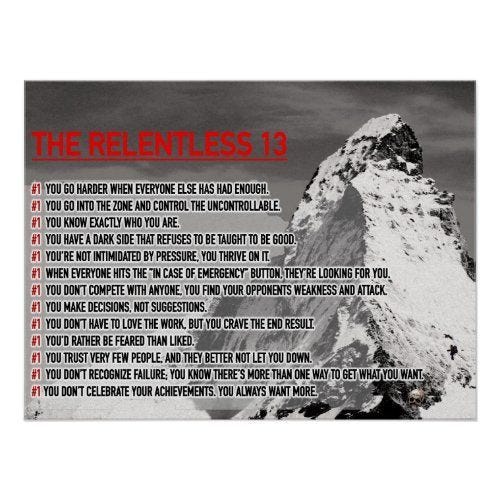

Someone I really like on this topic of peak performance is Tim Grover. He was the performance coach for MJ, Kobe, and a bunch of other big names in the NBA. Needless to say, he's the real deal. In one of his books, he lists the principles he lives by for being relentless. In my mind, the first one on the list is what I think about when I imagine someone who can have absolute positive returns and generate alpha:

Here's the thing: in one sense, it's easy to generate alpha during a market crash if you were previously sitting in cash for the last 3-5 years. I always hear people brag about how they bought the bottom in 2008 because they were sitting on the sidelines with cash. But I always ask, 'Did you underperform everyone on the upside by making 0% in a bull market? So how is that exceptional?' You have to weigh the opportunity cost of not being invested just as much as you have to weigh a market crash.

A simple example: we're still above the 2020 highs and we're in a bear market! I'm not saying you should be long/short or in cash. What I'm pointing out is that peak performance is absolute positive returns in every regime AND outperforming everyone else. The bar is set high for a reason. Just like in sports, only a few can truly achieve greatness.

On this topic, the single best resource I've come across this year has been a PDF that aggregates all the tweets from a really interesting Twitter account. The guy who sent me the PDF was very gracious in aggregating things, but the tweets can still be found on the Twitter account as well. It's well worth the time!

Where does that leave us?

Why am I talking about the 'communication problem' and 'alpha generation'? Part of my goal is to become one of these peak performers in financial markets who consistently generates uncorrelated alpha. I already have a good foundation and direction, but there is a lot of work ahead. My goal is to share a lot of this process with you and hopefully bridge the gap between a lot of the communication silos that exist.

My desire is for the Substack to be deep enough for traders to benefit from but still simple enough for anyone to read. We'll see how that goes... haha.

There is potential in the future for some podcasts/Twitter spaces as well as running an active portfolio. But I would need to see genuine interest from people. Let me know what you think!

As always, thanks for reading!

Much appreciate your time, effort and willingness to share with a simple fellow traveler making his way on this planet, what an amazing life we have on a spinning ball hurtling through an infinite cosmos. I wish you a full life!

awesome post! thank you. and thanks for the pdf share!