Interest Rate Report: Strategy and Trades

The instrumental role of rates in this macro regime

All of us accept that we don’t know the future. However, this doesn’t mean we can’t have explicit clarity about what action we should take in the present. We often hear “we don’t know the future” as an excuse instead of the presupposition on which we take strategic action.

There are many things we DON’T know about the future of rates. However, this doesn’t mean we can’t make considerable returns by having clarity of thought in the present.

“Clear thinker” is a better compliment than smart

-Naval

Previous Interest Rate Report:

On May 24th, the interest rate report covering strategy and specific trades was published for paying Subscribers of this Substack: Link. Since the informational edge behind these views have been realized, the paywall has been take off so you can go back and review it for educational purposes.

Interest Rate Report: Strategy and Trades

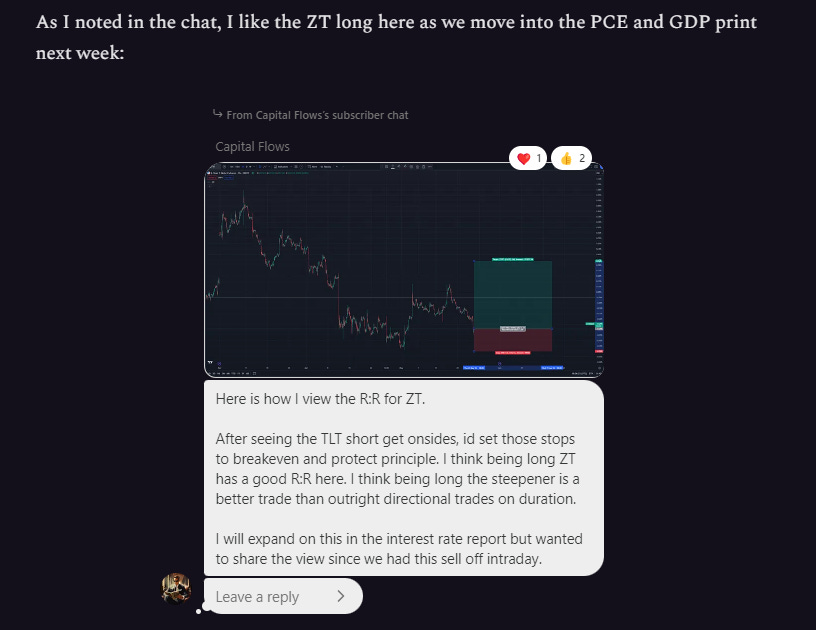

Hello everyone, The trading week is officially over but I wanted to summarize several important things for rates. First, I wrote the interest rate primer and my views on ZT. Check them out in these articles: Interest Rates Primer Macro Insights/Report: The Forward Curve

One of the primary trades that presented exceptional risk-reward was being long ZT (2 year T-Note Futures). This was due to the unrealistic expectations that the market was pricing. It wasnt that the future was known with certainty but that the future the market was implying was unrealistic: from report (link)

Since May 24th, ZT has realized considerable returns within the risk-reward that was provided:

Furthermore, the long ZT trade was added to at the NFP lows last Friday:

See links in the chat for adding to the ZT long at NFP lows:

The important thing to understand is that the informational edge in interpreting flows for this is in a constant state of change. Underlying growth, inflation and liquidity are always dynamically shifting in their impulses for markets.

I have written a full educational primer for interest rates here but the main idea is that interest rates and the respective currency (FX market) are the STARTING place for understanding every other risk asset across the duration and credit risk curve. If duration risk has to do with the time value of money and credit risk has to do with the quality of those respective cash flows, then this frames every other decision we will make.

Interest Rates Primer

The Big Picture: I remember when I first started studying why interest rates were important. It was one of the most eye-opening experiences of my life. I originally thought interest rates were irrelevant yields that the boring parts of portfolios were made of. Stocks were always where the cool kids were making money. After conducting a historical study …

Interest Rate Report: Strategy and Trades:

This brings us to the interest rate report breaking down all of these dynamics with clarity.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.