International Risks In The Global System

The world operates as a single, integrated system where finance, geopolitics, and nonkinetic warfare are deeply intertwined. Capital flows, trade routes, and industrial policy no longer stay within borders. Every imbalance or disruption transmits risk across nations in real time.

For the United States, this reality carries unique exposure. As the issuer of the global reserve currency and the anchor of global security, the U.S. must absorb global surpluses, maintain open markets, and stabilize regions it does not control. This creates structural pressure on its economy, financial system, and political cohesion.

International relationships now function as critical channels of both opportunity and risk.

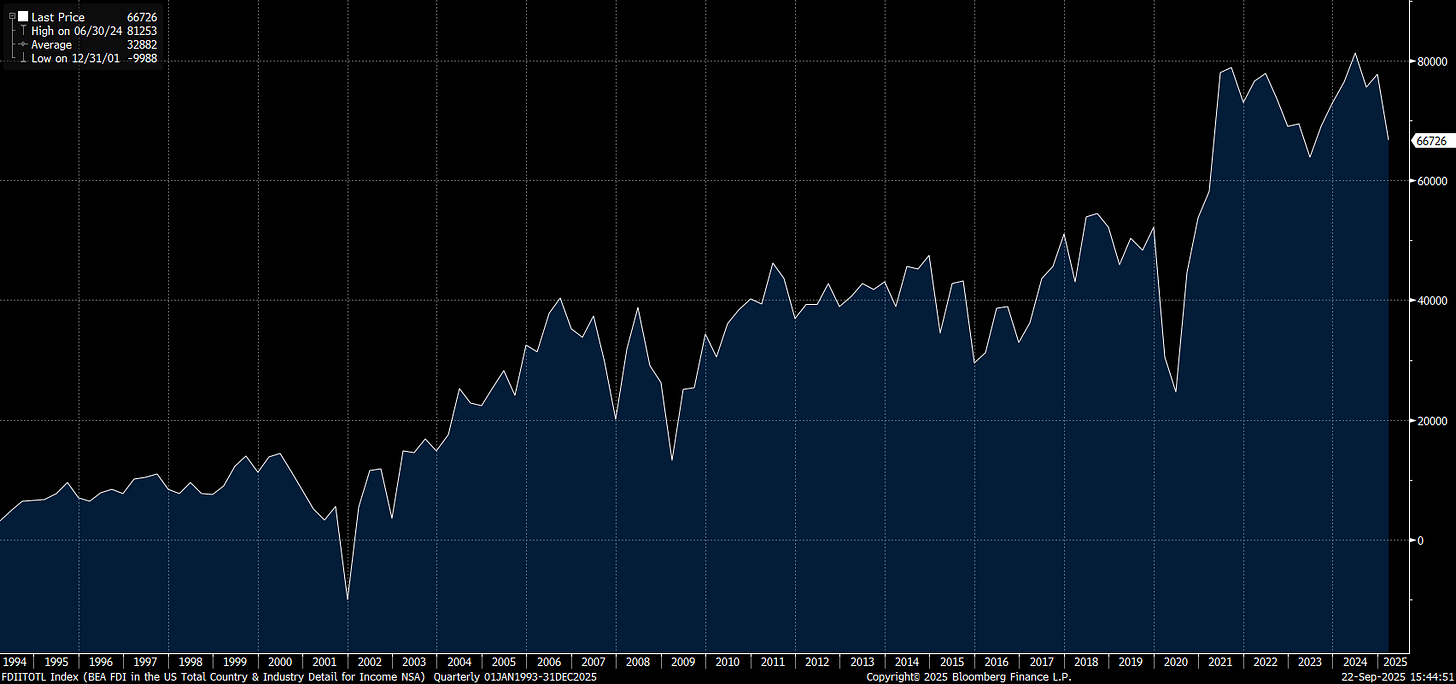

The most tangible expression of this is the sheer amount of foreign direct investment that has flown into US equities. In simple terms, A TON of capital from foreigners has bought US risk assets, which means if we have marginal changes in the global system, it can cause them to sell. (Chart is of foreign direct investment in the United States)

I covered this extensively in the last macro report:

Big Picture: What I want to do in this report is lay out WHERE we are in the development of the global system, how the most important relationships fuction, and then HOW this directly links with trades oppurtunities.

The Geopolitical Architecture Behind the Rise of Deglobalization:

At the heart of the global economy is an asymmetric and unstable arrangement: the United States serves as the world’s consumer of last resort, while surplus nations like China and Germany (Eurozone core) suppress domestic consumption in favor of export-driven growth. This imbalance is sustained by the dollar’s role as the global reserve currency, which allows surplus countries to accumulate U.S. assets instead of rebalancing internally.

This imbalance is clearly seen in the US current account being deeply negative (more imports than exports):

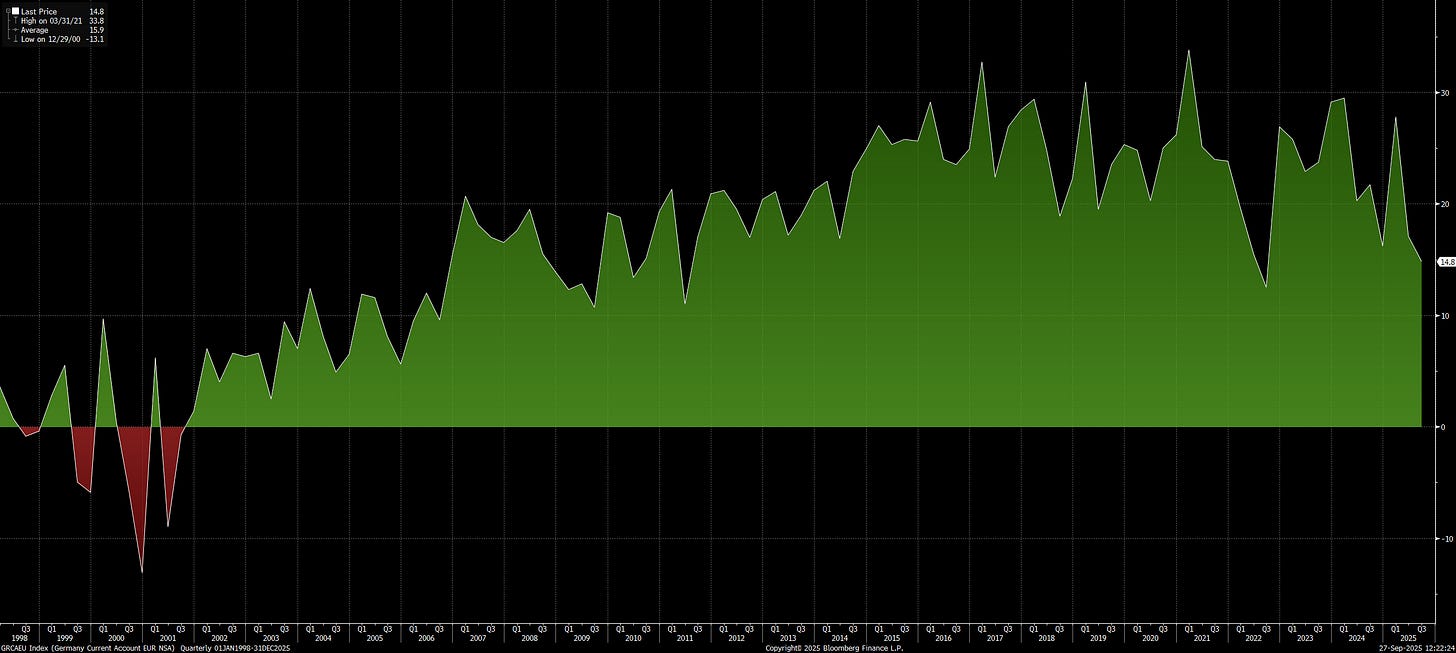

The German current account shows more exports than imports:

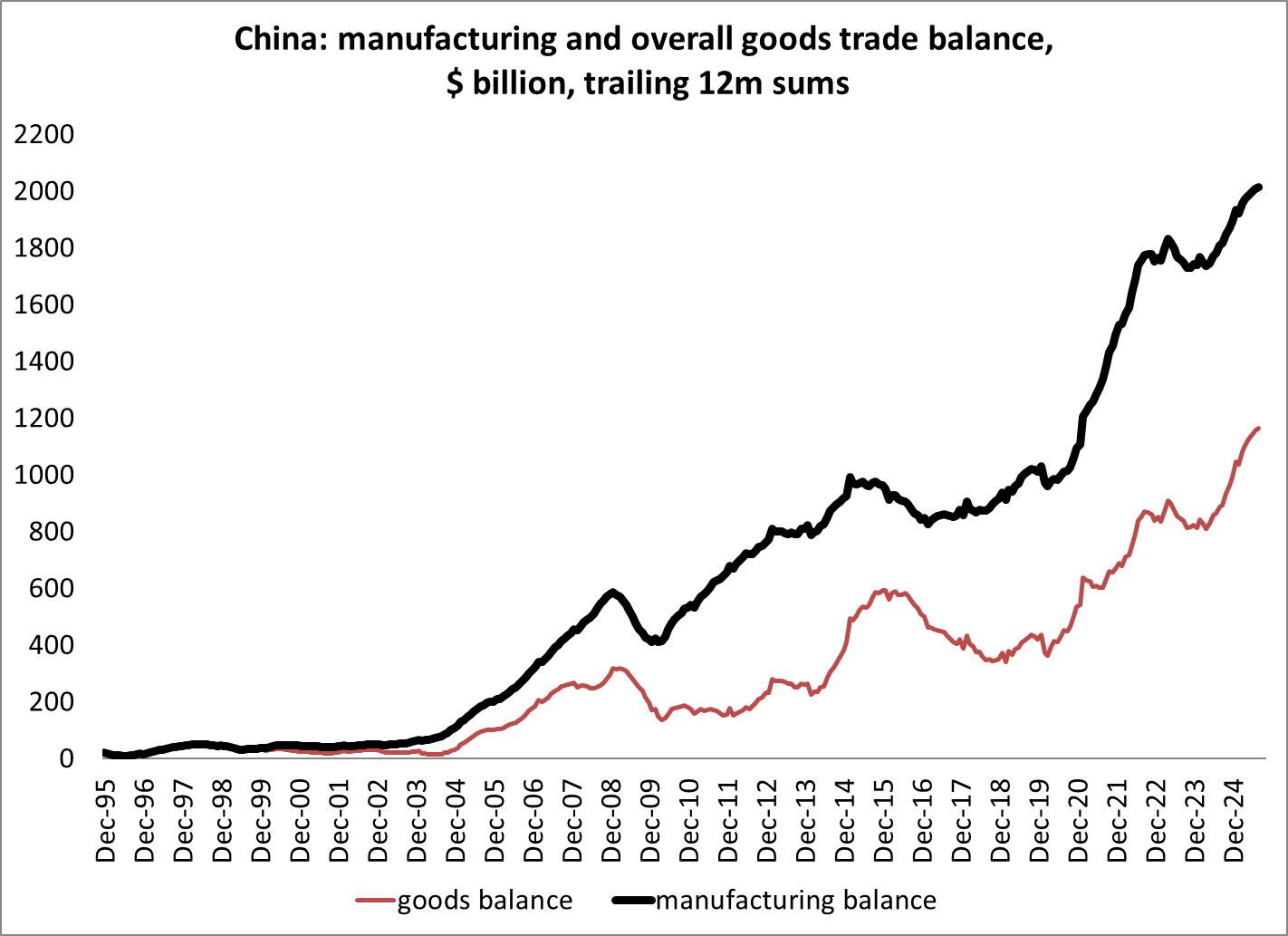

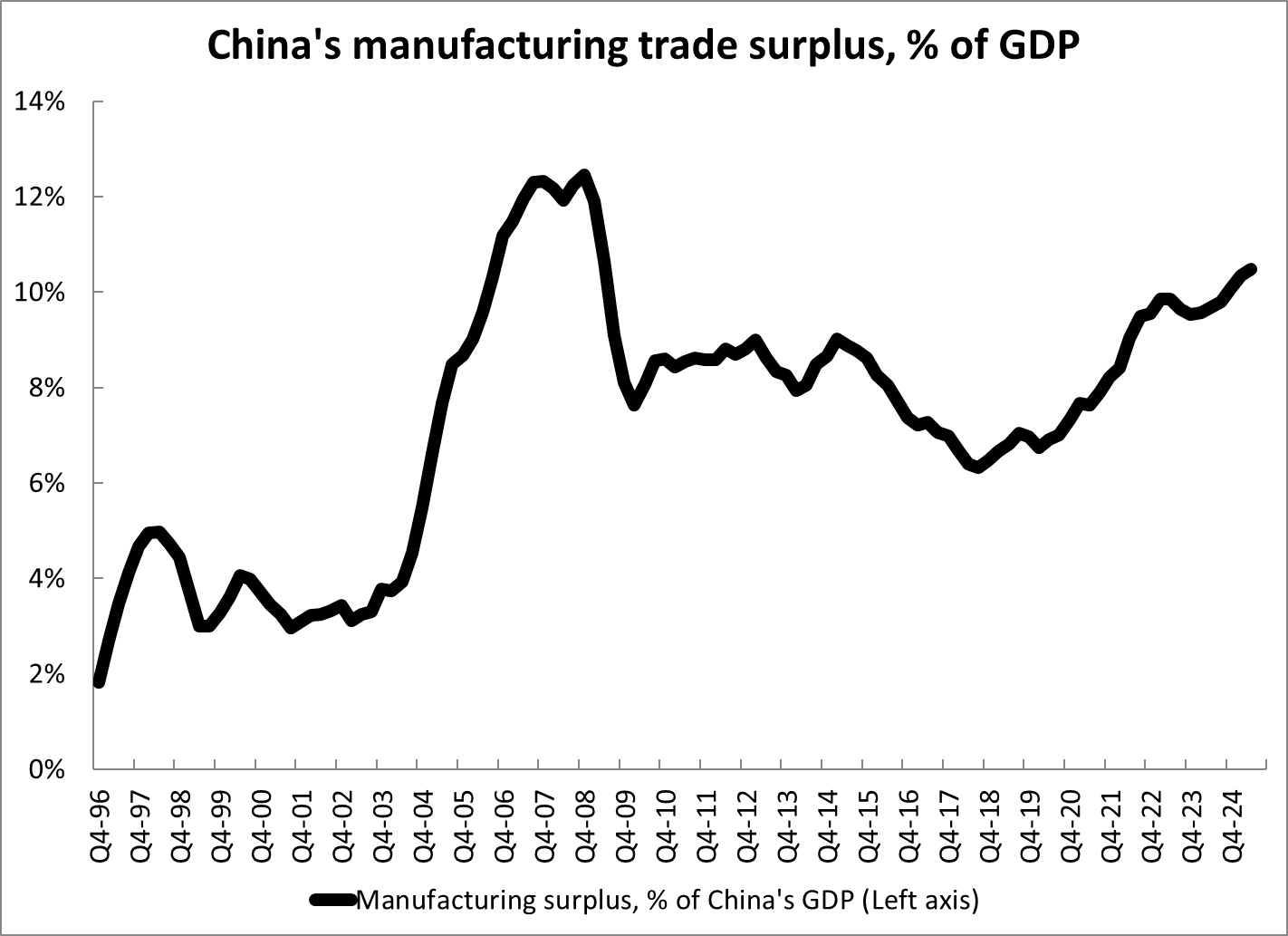

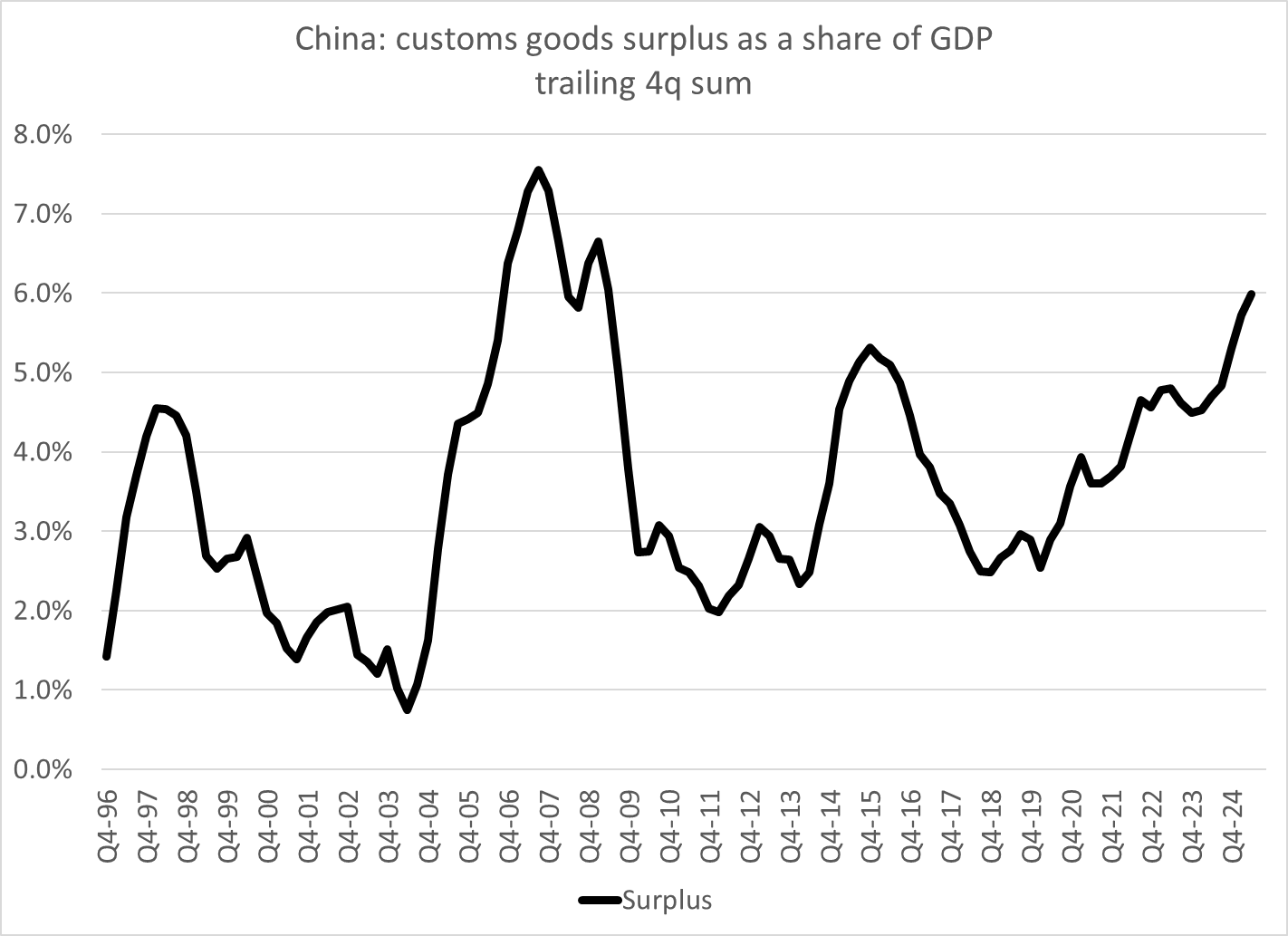

And China is the largest exporter in the world:

(Charts by https://x.com/Brad_Setser)

This system creates a feedback loop of capital and trade distortions: the U.S. must run persistent trade and fiscal deficits to absorb global surpluses, while surplus nations depend on those very deficits to sustain their growth. Instead of a virtuous cycle of mutual adjustment, we get a system where one side overproduces and saves, and the other over-consumes and borrows—fueled by financial markets and masked by asset bubbles.

United States: The Global Absorber

Reserve currency issuer, required to run deficits to meet global demand for dollar assets.

Sustains persistent current account and fiscal deficits to absorb foreign surpluses.

Domestic economy distorted by capital inflows, leading to asset bubbles and private debt booms.

Political and economic pressure mounts as U.S. workers absorb the shock of global labor arbitrage and import competition.

Bears the systemic burden of being the “dumping ground” for global overcapacity and excess savings.

China: Overproduction Machine, Capital Outflow Engine

Exports exceed imports, driven by suppressed wages and consumption.

High domestic saving rates not recycled inward but forced into external assets, especially U.S. dollar-based.

Capital controls nominally restrict outflows, but shadow flows (via crypto, trade misinvoicing, offshore havens) bypass controls.

Domestic overcapacity pushes deflationary pressures outward via global goods markets.

Political model depends on employment from industry, not household welfare, leading to global supply gluts.

Germany / Eurozone Core: Structural Mercantilists in a Broken Monetary Union

Runs large current account surpluses, driven by suppressed wage growth and constrained domestic demand.

The Euro locks in undervaluation for Germany, making it hyper-competitive against Southern Europe and global peers.

Internal adjustment mechanisms are blocked—deficit countries in the Eurozone can’t devalue or stimulate freely.

Germany’s surplus is structurally exported to the U.S. via capital flows.

Fiscal orthodoxy and political rigidity prevent the region from generating adequate internal demand.

International Implications For The Global System:

How does this structure in the system tangibly connect to financial markets, geopolitics, and the risks we are facing?

I have broken this down into 5 major points that will frame trading opportunities.

1. Flows of Capital: Global Recycling into Dollar Assets

Global surpluses (China, Germany, OPEC, etc.) are recycled into U.S. Treasuries, MBS, equities, and increasingly crypto/stables.

U.S. capital markets become the release valve for global imbalances.

Asset prices are inflated not just by Fed policy, but by global financial repression abroad.

Capital flows are asymmetric and persistent, reinforcing fragility in U.S. domestic demand composition.

2. FX Regimes: Artificial Suppression and the Reserve Currency Trap

China and the Eurozone manage or suppress FX appreciation to protect exports.

The dollar remains structurally overvalued, hollowing out U.S. tradables sectors.

The Triffin dilemma plays out: the U.S. must export dollars (via deficits) to provide reserves, but doing so undermines its own industrial base.

Floating FX markets are not truly free—they are the outcome of coordinated imbalances and policy asymmetry.

3. Flows of Goods and Services: Global Demand Paradox

The world produces more than it consumes, leading to excess capacity and downward price pressures.

The U.S. absorbs not just goods, but also the employment dislocation from foreign overproduction.

Countries exporting capital (China, Germany) simultaneously suppress imports of services and technology, reinforcing the cycle.

The imbalance suppresses wage growth and investment in deficit countries, breeding internal inequality.

4. Asymmetrical Economic Warfare: Strategic Leverage and Financial Dominance

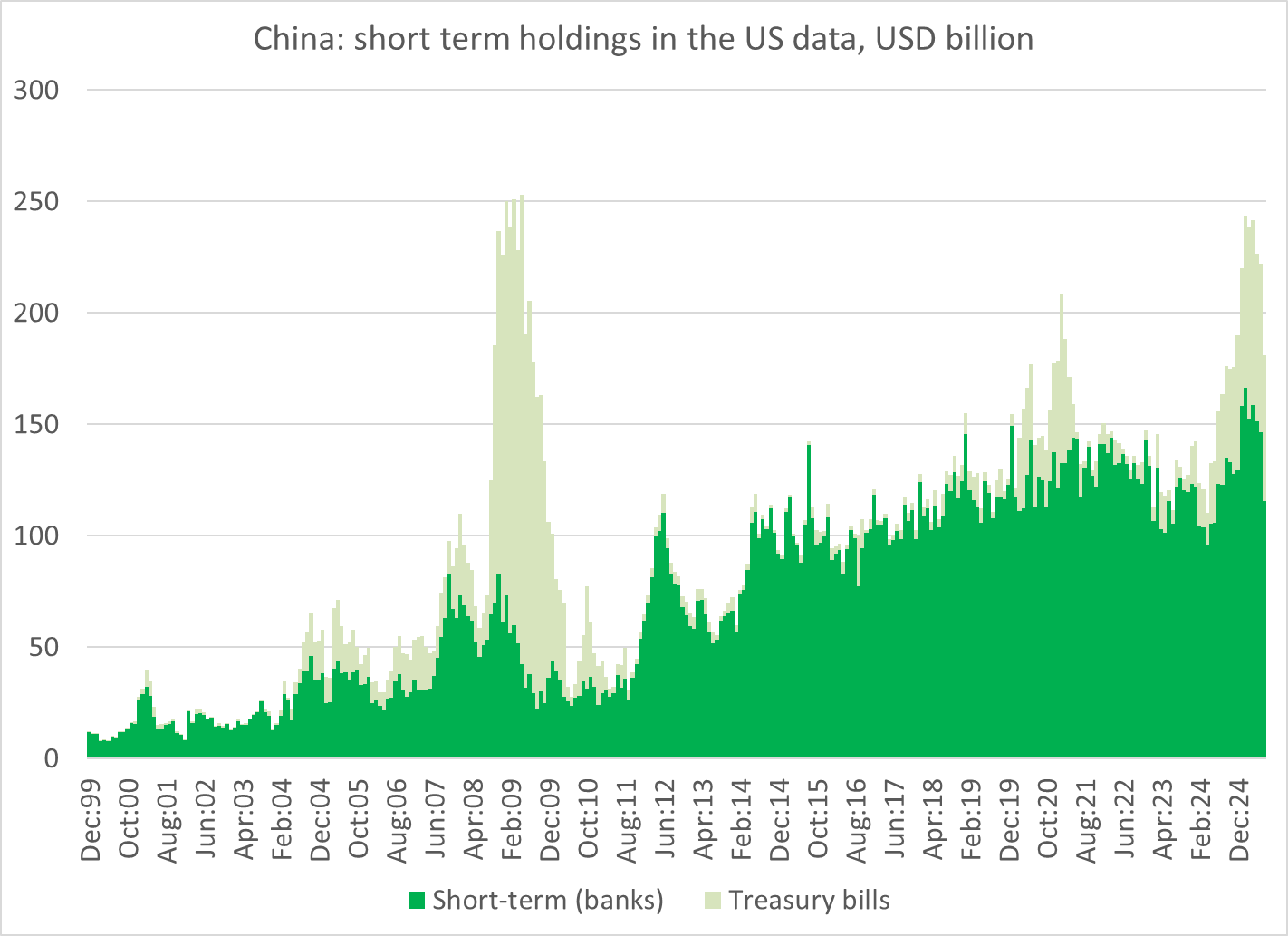

Surplus countries weaponize their financial surpluses, using dollar asset accumulation as leverage (e.g., China’s Treasury holdings).

The U.S., in turn, uses its control over the global financial system (SWIFT, sanctions, dollar clearing) as economic warfare.

The system is not neutral—it’s a battleground of geopolitical influence via financial dependencies.

Crypto markets increasingly act as neutral escape valves for asymmetric financial repression.

5. Systemic Risk: Fragility, Reversals, and the Endgame

The imbalance is unsustainable: either the U.S. resists absorbing surplus capital, or surplus countries rebalance.

Risk of financial crises, populist backlash, and strategic decoupling grows.

Structural rebalancing is politically difficult for all players, creating a volatile equilibrium.

Future crises may arise from sudden stops in capital flows, disorderly FX adjustments, or political ruptures (e.g., trade wars, reserve diversification).

Trade Opportunities:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.