The Dollar, Global Liquidity, And Interest Rates

How the international system is shifting to a new era

The Dollar, Global Liquidity, And Interest Rates

I have been discussing global liquidity extensively, particularly as we have entered this concentrated phase of the credit cycle. Accelerating growth, procyclical fiscal spending, procyclical monetary policy, and a surge in cross-border liquidity are all drastically expanding the amount of net liquidity in the system. Fundamentally, liquidity comes down to two primary factors to monitor:

the sources of liquidity and their net impact, and

the destinations of liquidity, since the distribution of money in the system is never even and always seeks the highest returns.

If you can understand these TWO factors, you can know WHERE we are in the credit cycle and HOW things are likely to develop.

I laid out the big picture dynamics for these factors here:

Credit Cycle and Sources Of Liquidity:

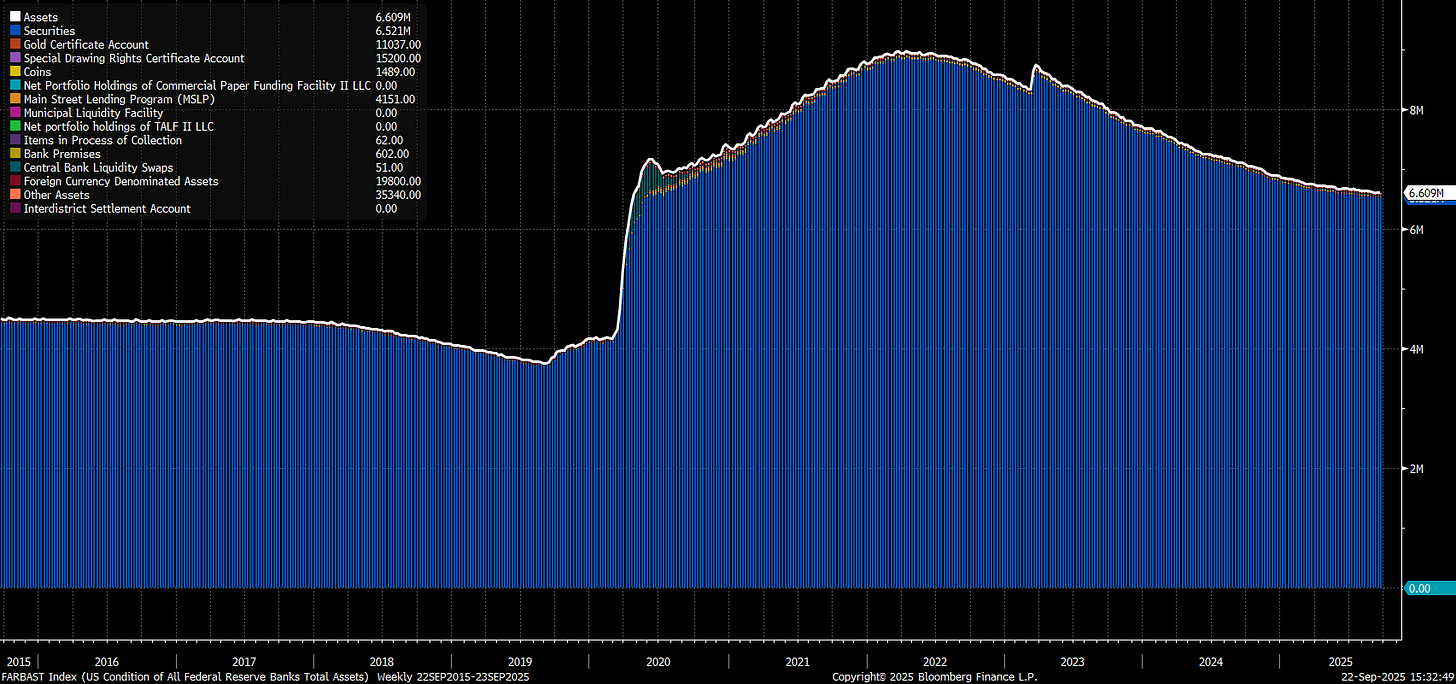

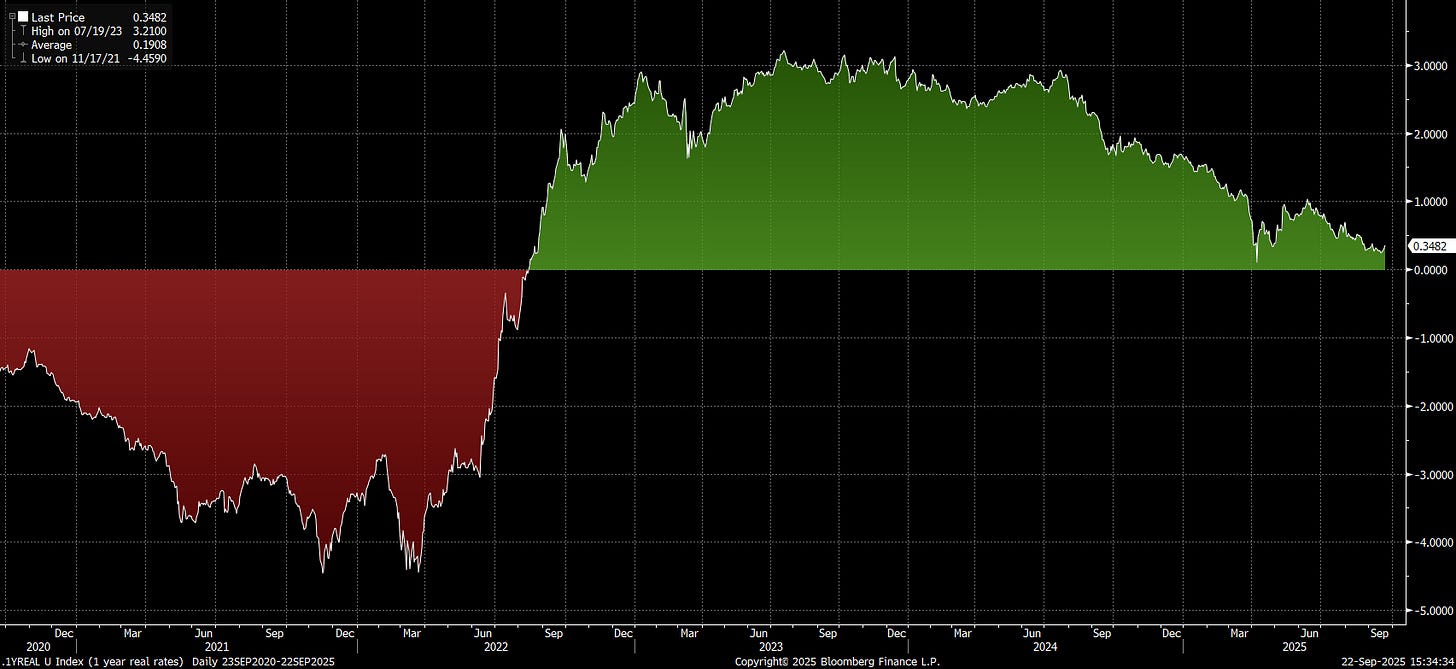

The PROBLEM is that there is always misdirection around the sources of liquidity because of recency bias. For example, in 2021, we saw the Fed expand its balance sheet, the Treasury General Account get drained, and short-end real rates pinned below zero.

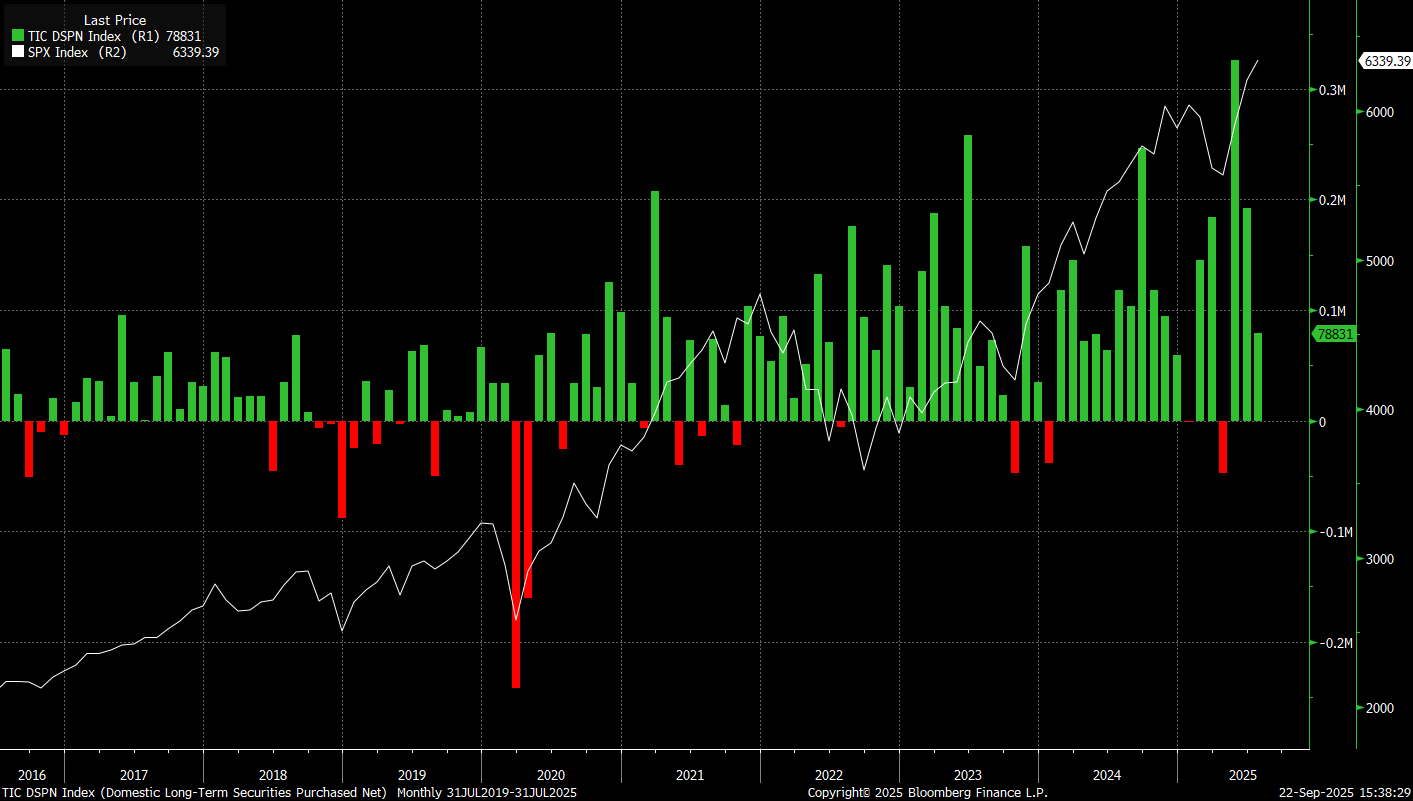

As everyone is becoming a Fed watcher, foreigners continue to buy US assets (net buying by foreigners).

Where do they get the dollars to buy US assets? By exporting their goods and services to the US. This pushes the current account as a pecentage of GDP DOWN as the US imports more than they produce.

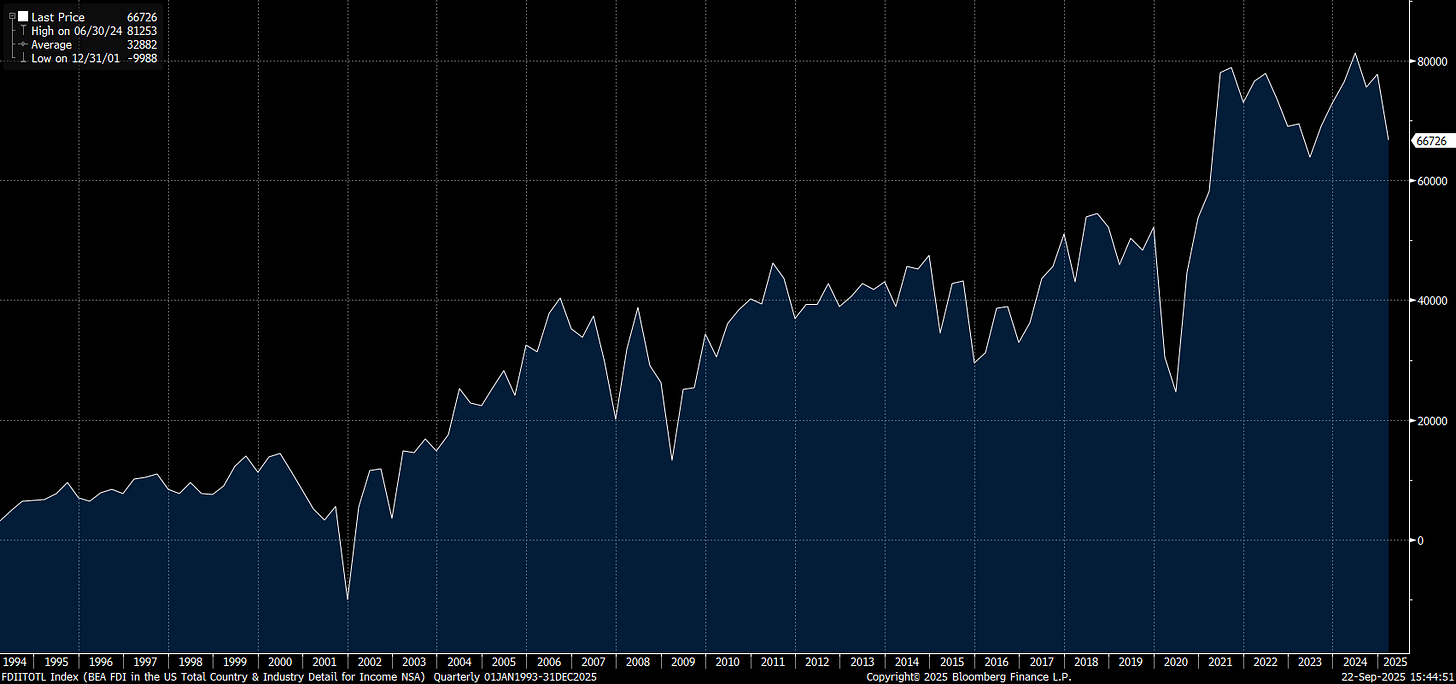

As foreigners get more dollars, they recycle those dollars back into US assets: (chart below is foreign direct investment)

All of these functions in an almost magical way because we have a utopian-like financial market fueled by positive growth, procyclical fiscal spending, and Fed rate cuts—even as inflation risk outweighs recession risk. This is WHY the S&P500 is at a historic valuation on a price to sale basis.

This will continue until the liquidity in public markets does one of two things: 1) causes long-end rates to blow out because inflation accelerates, or 2) causes significant selling pressure in the dollar to decrease real returns of US assets for foreigners.

This is why we are seeing gold and silver rally right now. Informed traders know these risks and are chasing anything that could potentially provide safety in the challenging environment we are approaching.

This is why I talked about being long Gold Minders in the credit cycle trades report. GDX has continued to melt up since this report.

So the question is, WHERE is all of this ultimately bringing us? What is the end game? And HOW do we track it in order to manage risk?

The Macro Inflection Point:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.