Macro Report: The End Game For Global Liquidity

How cross boarder flows and global rate markets are pushing capital flows into risk assets

Macro Report: The End Game For Global Liquidity

One of the biggest risks in the industry is that people constantly shift their interpretive lens to fit the endless complexity of the system. The underlying variables are already changing with such speed and dispersion that they confuse even sophisticated systematic models. But the deeper problem is that just when an explanation seems to perfectly account for why everything happens, it’s shattered by a macro inflection point where volatility spikes and correlations realign.

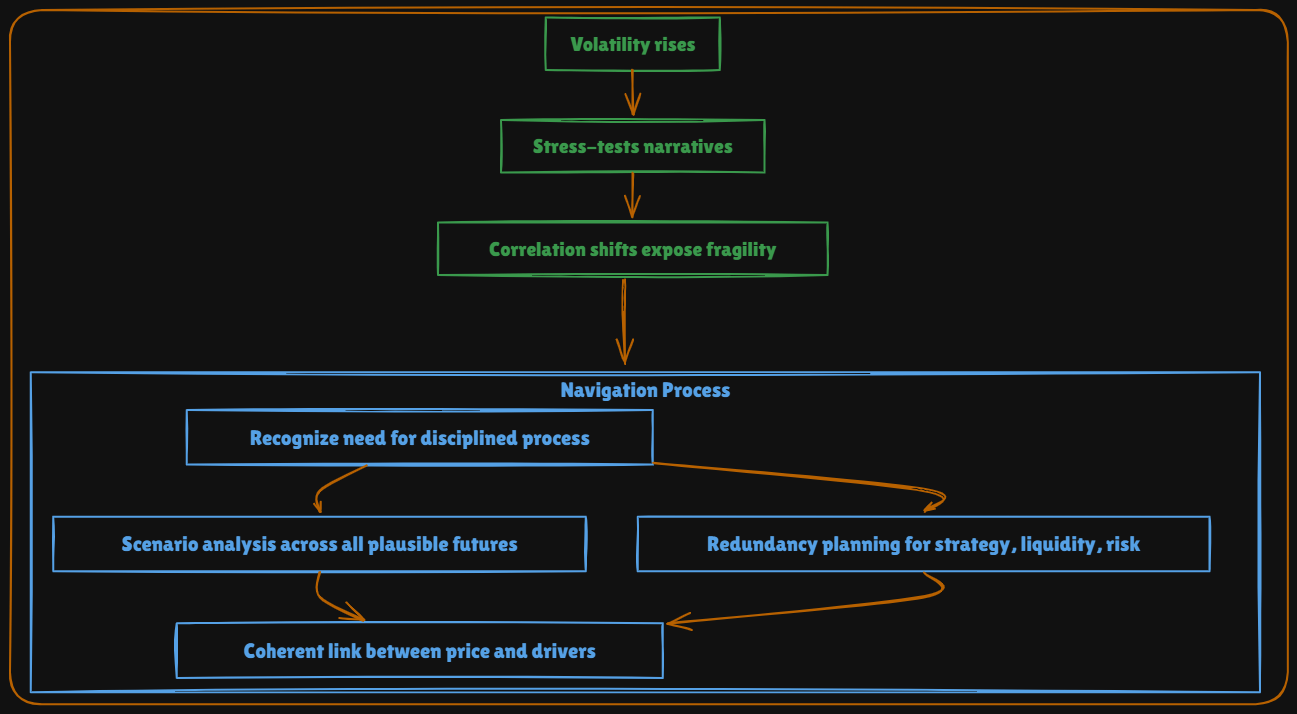

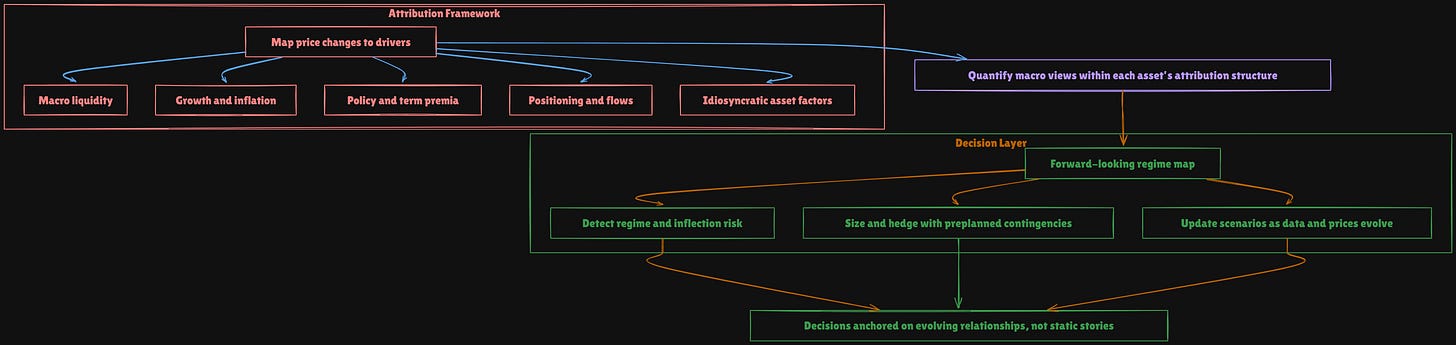

Volatility is the great cleanser of ideas in financial markets because it ruthlessly exposes what is fragile and unsustainable. Theories and narratives that appear airtight in stable conditions are stress-tested and often broken when volatility rises and correlations shift. The only way to navigate these inflection points and regime changes is through disciplined scenario analysis paired with redundancy planning across all possible futures. This requires a coherent and consistent connection between price and its underlying drivers. The process works by mapping changes in price back to an attribution framework—disentangling the specific macro forces at play—and then quantifying those macro views within the attribution structure of each asset. In doing so, you build a forward-looking map that anchors decisions not on static explanations but on the evolving relationship between prices, drivers, and regimes.

The Structural Mechanics of Monetary and FX Regimes:

When I analyze macro, my focus is always on the structural shifts in monetary and FX regimes and how they manifest through the interest rate complex and cross-border capital flows. In a world defined by global trade, these flows are inseparable from regime choices and directly determine how monetary policy operates in practice.

There are 3 moving parts to understand:

1#: Impossible Trinity

A country cannot have a fixed exchange rate, free capital flows, and an independent monetary policy at the same time.

It must choose two of the three, with the third sacrificed.

2#: Currency Regime

The system a country uses to manage its exchange rate (fixed, managed, or floating).

Determines how much freedom the central bank has in setting interest rates.

#3: Balance of Payments (BoP) and Its Effects

Records all transactions with the rest of the world, split between current account (trade, income) and capital/financial account (investments, reserves).

Surpluses boost growth through exports but can dampen inflation; deficits support demand but risk reliance on foreign capital.

A weaker currency from BoP deficits raises import prices and fuels inflation.

A stronger currency from BoP surpluses lowers inflation but hurts export competitiveness and growth.

How do these 3 moving parts connect together? A technical breakdown:

Foreign exchange regimes sit at the center of the impossible trinity, and they directly shape how a country’s balance of payments constrains both the central bank’s autonomy and the economy’s path for growth and inflation. If a country chooses to fix or heavily manage its exchange rate, it is committing to defend that currency value in foreign exchange markets. That means the central bank must either align domestic interest rates with the anchor currency (sacrificing independent monetary policy) or impose capital controls to limit flows. In practice, balance of payments dynamics (the net of current account flows and capital/financial flows) dictate the strain: a deficit country with a fixed FX rate must attract capital inflows or burn reserves to prevent depreciation, which often forces tighter monetary policy and slower growth. Surplus countries defending undervalued currencies accumulate reserves, importing foreign inflation but suppressing domestic price pressures. Conversely, countries with floating FX regimes allow the exchange rate to adjust to balance of payments pressures, giving the central bank room to target domestic inflation and growth through independent interest rate policy. However, the trade-off is that currency swings pass directly into inflation (via import costs) and growth (via trade competitiveness). In short, the choice of FX regime determines whether balance of payments pressures show up as reserve loss, forced rate moves, or currency volatility—and those channels set the hard limits on how much freedom a central bank has in steering growth and inflation.

If you want to dig into these moving parts further, you can review the 5 Part FX Primer:

These three moving parts form the foundation of my framework because once you understand HOW they have evolved since the 2008 GFC, you can begin to see WHY today’s macro regime looks the way it does. The progression of currency choices, balance of payments pressures, and monetary trade-offs explains not only the structure of the current system but also the constraints shaping every central bank’s decisions.

Shifts Since The 2008 GFC:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.