The Research HUB: FX Primer, Pt 1

The primer for understanding and trading FX

Hey everyone,

This article will serve as Part 1 of a 5-part series, acting as an FX primer. For those interested, I've previously written primers on both the S&P500 (link) and the bond market (link).

If you have spent any time at all in FX markets, you know that sometimes a move makes total sense, and then the next move makes zero sense. On top of that, FX isn’t like equities where it just always (theoretically ;) ) goes up and to the right!

FX is very complicated, and this is typically why it attracts those who are intellectually curious. It attracts those who thrive in complexity, chaos, and change. This is why I am breaking the primer into 5 parts!

There is so much to wrap your mind around that it can’t be distilled into a single article. There are so many unique idiosyncrasies in situations that have discontinuity with historical parallels, which requires significant a priori thinking. This is part of the reason I really like FX markets; they are a true challenge.

Here is where we will start: when I think about global macro trading, I think about the bond market and FX. Rates and FX are the purest forms of global macro trading. What you will see is that trading FX requires a lot more than just knowing the data releases for the week ahead or the momentum score of a currency pair. It requires understanding the underlying mechanics of the system, which always seems to elude people.

5-Part FX Primer Breakdown:

Part 1: FX - Resources, The Big Picture, Variables, Aggregating Knowledge, and Essential Tools.

Part 2: FX - Synthesizing Information from Part 1: Theory, Practice, Causal Mechanics vs. Regression Analysis.

Part 3: Delving into Historical Case Studies: The Importance of Studying History, Continuity vs. Discontinuity, and the Challenges of Backtesting in FX.

Part 4: Examining the Current Environment.

Part 5: Integrating Knowledge: Top-Down and Bottom-Up Analysis, Attribution Analysis, the Expectations vs. Actual Matrix, and Quantitative Models.

In this first article, I am going to focus on the knowledge bases you need to acquire and the variables you need to know before we go into actually using those knowledge bases and interpreting those variables.

Let me start with a basic premise:

To truly understand FX, you basically need to understand everything else. FX is kind of like the meta asset because it’s connected to every other asset.

Resources:

Books

Book #1: The classic book on FX and global macro is The Alchemy of Finance by George Soros. This book has been instrumental in my thinking, but the one qualification is that it was written during a specific period of time. There is so much additional work that needs to be done in order to correctly identify how drivers change through various FX regimes.

Book #2: The Art of Currency Trading by Brent Donnelly is an exceptional book by a true practitioner. I have read a lot of Brent’s research as well and have a lot of respect for him.

Book#3: The Fall of the Euro by Jens is a great book for understanding broad FX and specifically the Eurozone. As you will see, the Eurozone is incredibly difficult to quantify properly due to the data standards and data quality.

Book#4: Foreign Exchange: Practical Asset Pricing and Macroeconomic Theory by Adam S. Iqbal has a lot of technical sections which are fundamental for grasping the drivers of FX.

Book#5: Trade Wars are Class Wars by Michael Pettis and Matthew Klein. This book is essential for understanding how to net out the balance of payments in a country. I would recommend reading ALL of Michael Pettis’s books. A decent amount of my understanding of FX has been shaped by his books.

As I stated above, you need to have a grasp of ALL assets for a proper understanding of FX. Here is the thread on book recommendations that you can dig into. I would especially read all the books on fixed income: https://twitter.com/Globalflows/status/1645819494982651908

Additional Resources:

FXMacroGuy is doing an exceptional job at providing a lot of the data points you need to monitor for FX. I would encourage everyone to follow his work.

Exante has a great service for tracking international capital flows. As you dig into FX more, you will realize how difficult it is to curate and model data correctly. Exante has done a great job at this.

Brad Setser is basically the GOAT for modeling the data out of China. If you read the books by Michael Pettis, you will realize how important China is for the current FX regime we are in. The problem is the data out of China is incredibly difficult to model in a way that actually shows what is going on under the hood.

Prometheus Research is the single best systematic macro service out there. At the very least, this is the type of rigorous research you need in understanding the GIP (growth, inflation, and policy) of every country.

Big picture:

Now, let’s talk about some big-picture and introductory ideas pertaining to FX.

Issues with Learning FX:

I started by saying FX is incredibly complex and difficult to understand, but why is this? The primary reason is that the causal factors driving price action change through various structural and cyclical regimes.

For example, many times you will hear that “back in the day” FX just moved on nominal rate differentials. To trade FX, you simply needed to take views on nominal rates in both countries, and you could form very reasonable FX views. This was during the George Soros glory days.

Now what people try to do is run regressions on rates and FX pairs, but then realize nominal rate differentials don’t account for all FX moves. This frustrates many people, and they inevitably try to offset the discontinuity with technicals or momentum scores. The limitation of this is that you usually get blindsided at inflection points.

On top of this, there are always two sides to every FX pair, so you need to interpret which side of the FX pair is driving the price. The added complexity is that it is usually a combination of BOTH sides of the FX pair exerting causal force on the price, thereby creating a “net effect.”

Attribution Analysis:

This brings us to conducting attribution analysis correctly on a currency, which can partially be done by comparing a single currency to multiple currencies. For example, comparing the British Pound against the Dollar, Euro, Aussie Dollar, and Yen in order to determine how much of a Pound move is from the Pound moving vs. other currencies moving against the Pound. The problem with this is that you need to correctly understand these other currencies and their underlying drivers.

Needless to say, you can see that the complexities and problems are stacking up. Much of my job involves spending time breaking down all of these components and running proprietary models that identify and net out all of these causal drivers. Even if you correctly understand all the drivers and accurately perform attribution analysis, there is the explicit uncertainty of the future that limits you from having a “perfect understanding.”

Currency Regimes: Structural and Cyclical:

We have all of these “problems” we need to solve to correctly interpret data. So, how do we even start? We start by analyzing the structural regime.

The one principle you should remember as we go through all of this is that you can almost always quantify your views. I see a lot of narratives out there that are just thrown around nonchalantly. Always quantify views! If you believe the dollar is losing its reserve status then quantify it! If you believe the Yuan will be the next reserve currency, quantify it!

Currency regimes:

Here are the major currency regimes over the past 500 years:

Bimetallic Standards (16th - 19th Century):

Many countries used both gold and silver as the basis for their currencies, leading to a bimetallic system. The ratio between gold and silver varied across countries and periods.

Spanish Dollar or Pieces of Eight (16th - 19th Century):

The Spanish silver coin became a global currency, especially in the Americas and Asia, and played a significant role in international trade.

Gold Standard (19th - 20th Century):

Many countries pegged their currencies to gold, ensuring stability in exchange rates. The gold standard had different phases, including the classical gold standard, gold bullion standard, and gold exchange standard.

Sterling Bloc (19th - 20th Century):

The British pound sterling was the dominant global reserve currency, and many countries held their reserves in sterling or pegged their currencies to it.

Bretton Woods System (1944-1971):

After World War II, major world currencies were pegged to the U.S. dollar, which was convertible to gold at a fixed rate. This system aimed to provide stability to the post-war global economy.

Floating Exchange Rate Regime (1971-Present):

After the collapse of the Bretton Woods system, major currencies began to float against each other, with their values determined by market forces.

European Monetary System (EMS) and Euro (1999-Present):

The EMS was a system to reduce exchange rate variability and achieve monetary stability in Europe. It eventually led to the introduction of the Euro, a single currency used by many European Union countries.

Each of these currency regimes determines the transmission mechanism for capital flows. However, these regimes will be directly connected to other regimes or events. For example, geopolitical dynamics or wars will often be the determining factor for shifting currency regimes.

When I think about any asset, country, or domain, I start by identifying the capital structure and capital flows. Both of these are in a constant state of change. For instance, a company has a balance sheet functioning as its capital structure that transmits the flows from its income statement and cash flow statement. A country has a capital structure and capital flows in the same way as a company. The structures and flows are just a bit more complex.

How does a currency connect with this idea of a capital structure and capital flows? The Impossible Trinity……

Impossible Trinity:

When we approach a country, one of the most important ideas to understand is where it falls in the impossible trinity.

The Impossible Trinity, also known as the Trilemma, is a fundamental concept in international economics. It posits that it's impossible for a country to have all three of the following at the same time:

A fixed foreign exchange rate.

Free capital movement (absence of capital controls).

An independent monetary policy.

In other words, a country can achieve only two of the three objectives at once. Let's delve deeper into each of these components and the implications of the trilemma:

Fixed Foreign Exchange Rate: This is when a country pegs its currency to another currency (like the U.S. dollar or the Euro) or to a basket of currencies. This provides stability in trade and capital flows but can be challenging to maintain.

Free Capital Movement: This means there are no restrictions on the movement of capital in and out of the country. It's a hallmark of open, liberalized economies and is essential for deep and liquid financial markets.

Independent Monetary Policy: This allows a country to set its own interest rates and implement other monetary policies based on its economic conditions, such as controlling inflation or combating unemployment.

Now, let's explore the constraints posed by the Impossible Trinity:

If a country wants a fixed exchange rate and free capital movement, it can't have an independent monetary policy. Any attempt to set interest rates different from the world market rates will lead to capital flows that will threaten the fixed exchange rate. For instance, if a country sets its interest rates higher than the world rate, it will attract foreign capital looking for better returns, putting upward pressure on its currency.

If a country wants an independent monetary policy and free capital movement, it can't maintain a fixed exchange rate. The country's monetary policy might attract or repel capital flows, which will influence the exchange rate.

If a country wants a fixed exchange rate and an independent monetary policy, it must implement capital controls to prevent destabilizing capital flows that could threaten the fixed rate.

Real-world examples:

China for many years maintained capital controls and a fixed (or managed) exchange rate, allowing it some degree of independent monetary policy.

The Eurozone countries have a fixed exchange rate (they share a currency) and free capital movement, but they've essentially given up independent monetary policy to the European Central Bank.

Many developing countries with free capital movement and independent monetary policies allow their currencies to float to some degree against others.

In essence, the Impossible Trinity concept underscores the trade-offs countries face in international finance and how policy decisions in one area can have implications in others.

The FX regime and a country's constraints surrounding the Impossible Trinity are going to be intricately connected. You need to identify and quantify the capital structure and how it transmits volatility and capital flows. This is what begins to inform your view of the movement in capital flows.

These are the big picture ideas you need to quantify from a top-down approach when approaching FX (or for that matter, any asset) markets.

Variables and Knowledge to Aggregate:

Now that we have framed some of the bigger picture ideas, I am going to go through the majority of the data points you need to aggregate and understand. I will synthesize and expand on these in Part 2. I will try to be as comprehensive and systematic as possible here.

Education Articles and GIP:

I wrote a series of educational articles that can be found here:

Research Drop: Link

For FX, you need to have a comprehensive breakdown of all the variables I noted in this article. You need a clear handle on how all the economic data, in all its frequencies (quarterly, monthly, weekly), connects to all asset markets.

Country Analysis: Link

For FX, geography and geopolitical analysis is fundamental for framing flows. For example, the geography and natural resources of Russia were very important to know during the invasion when the Ruble made large bearish moves.

Economic Data: Link

For FX, you want to have a firm grasp of the economic data on how the balance sheet of the country functions, how the GDP structure of a country functions, and how its current account and capital account function in the balance of payments. For example, knowing the integrated macroeconomic accounts (found on the FRED website) helps you model the capital structure of the US. Modeling GDP of the US allows you to see the output capacity of the country, which will directly connect with the current account. All of these various accounts balance out.

For FX, the balance of payments is very important to understand correctly in both its net position and gross flows. On this topic, read Michael Pettis’s book or just some basic balance of payment manuals. All of these various accounts have to balance.

Model For Markets: Link

For FX, you need to have a clear understanding of the fundamental value and expected returns of each asset. This will be key to know in the next section. For example, knowing the earnings and valuation function of equities is key. Knowing the various inputs into the bond market (such as real yields, nominal yields, and breakevens) is especially important in today's world. See bond market primer for this: link

Positioning and Microstructure: Link

For FX, knowing the financial plumbing and liquidity transmission mechanism is fundamental for understanding FX. Once we begin to go into specific examples, you will see how those insights can be incredibly useful.

While there are qualifications we will go over, you fundamentally want to understand the growth, inflation, and policy (GIP) regime of the FX pair you are analyzing. In a sense, an FX pair is the expression of the GIP differential between two countries.

Additional Data Points:

I am going to walk through some more specific data points that I either closely watch or are inputs you would likely need for an FX model.

Rates:

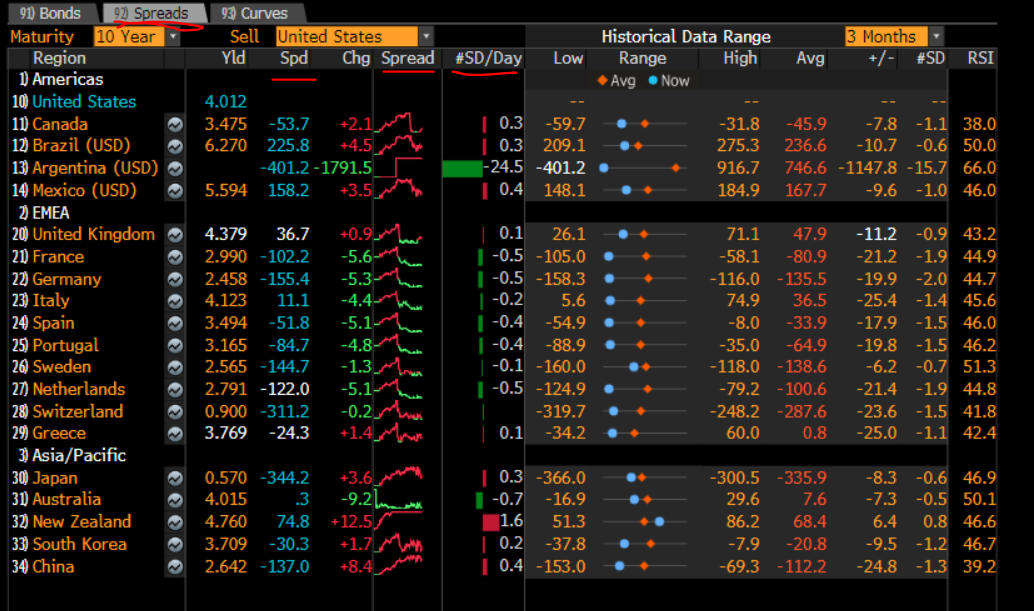

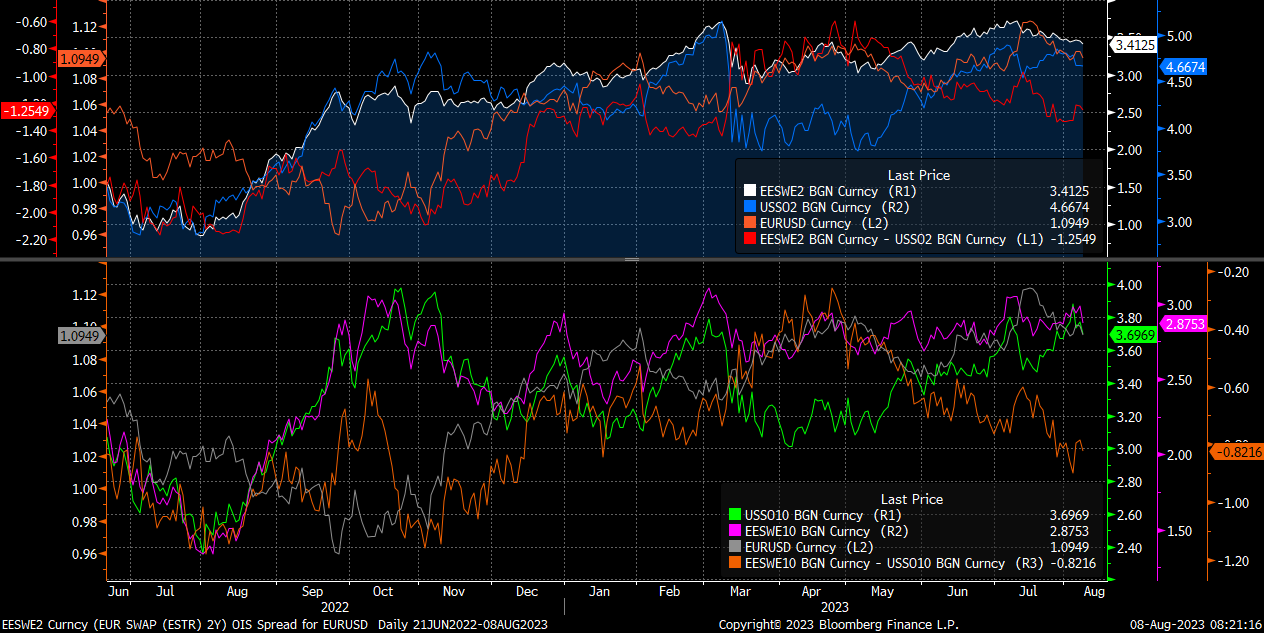

Nominal Rate Differentials: Watching the spread of nominal rates across the curve is very important.

Breakeven Differentials: Watching inflation swaps or breakeven differentials can be helpful for determining the relative inflationary impulse. There are qualifications for this, as breakevens don’t always accurately represent where inflation will be but simply how the market is pricing it. See my macro report on this dynamic (link).

Real Rate Differentials: Real rate differentials or OIS differentials are incredibly important to watch. Fundamentally, you want to see how the real rate side of things is functioning and how it impacts both the bond market and flows across the risk curve.

Hedged Yields: Watching hedged yields across multiple currencies is key as well.

XCCY: Cross-currency basis swaps are important for attribution analysis. It helps to discern if there is an actual liquidity shortage driving a move or simply nominal rate/OIS differentials.

As you will see, understanding the rates market is fundamental to understanding FX markets. However, it really depends on the specific country, because sometimes a currency is more leveraged to a specific export in the current account. You would know this if you model how much of a specific export accounts for gross national income and GDP in the country. Then, you would be able to understand WHY discontinuities might occur between rates and a specific export.

Data Quality:

A quick note on data quality and modeling:

Since currency regimes change, it is not always easy to simply run a backtest. This is why knowing some theory and causal mechanics behind a country can be incredibly valuable. It also offers an opportunity for those who can generate discretionary insights. When you understand the limitations of creating systematic strategies in specific situations, you can identify where you are able to generate alpha.

You will notice that the majority of systematic strategies are based in the US. Why? Well, part of it is because the US has the highest quality data of any other country. Correctly connecting all the frequencies of US economic data to the financial markets is already an incredibly difficult task. Now, try doing it where the data quality is poor, there are different standards for calculating data points, and sometimes governments are actively manipulating the data.

I am simply saying all of this so you have your eyes wide open when approaching the FX market.

Tools:

There are many great tools to conduct all of this research. Fundamentally, the process involves visiting government websites and importing data into Excel. Here are some other tools:

Bloomberg: I get the majority of my data from Bloomberg. I've also coded up some models and strategies using data from other sources.

CME Tool: The CME and CVOL tools are incredibly helpful for tracking implied volatility and positioning data in futures. However, keep in mind that the futures market for FX is small compared to the actual FX market. On a side note, I don’t really pay attention to FX volume. Since there isn't a single centralized exchange and much of the activity occurs OTC, volume data often doesn't offer much insight.

Data From FRED or Investing.com: These platforms are good starting points for economic data.

US Economic Data: FRED - Federal Reserve Economic Data

Broad Data: Investing.com

If you're aiming to import data into Excel, it's best to visit the official website or use a repository like Bloomberg or perhaps Harver.

Current Account: This is an excellent visualization of the current account. One approach is to model the current account by analyzing supply chains and determining the percentage of a company's revenue linked to a specific product. If a company's revenue is heavily tied to a particular import or export, this information can sometimes serve as a signal in specific scenarios.

Tradingview: Clearly, this is one of the most useful resources for a range of purposes.

Conclusion:

Alright, we covered a lot in Part 1 of 5!

As you can see, there's a significant complexity and numerous moving parts. Even if you aren't building comprehensive FX models, this series will provide guiding principles that frame how you generate trade ideas.

What I appreciate most about FX is the opportunity to generate alpha. Given the complexity, many individuals opt to employ CTA strategies or merely trade the dollar during risk-on/risk-off environments. This is totally fine but there are many opportunities for alpha beyond this.

Since the beginning, I have shared this quote:

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

Developing specific skill sets to interpret complex environments like FX is how you achieve this. When you grasp the asymmetry of how information functions in today's world, your perspective shifts. My ultimate goal is to commoditize and monetize the way I think about the world. Have you ever realized that people will pay just to hear your thoughts? Isn't that essentially what a hedge fund is?

Think about how many people and companies are impacted by FX. Yeah basically everyone! Developing a skillset in the field can be incredibly valuable.

I remember reading an article some time ago about an oil and gas company that spent tens of millions of dollars on data they would use just once. Why? Because when you understand how to navigate the world effectively, expenses like data merely become minor entries in your income statement.

I'm currently writing Part 2 of the FX primer, so keep an eye out for it! Additionally, I would be immensely grateful if you could share my work with anyone who might find it valuable.

Thanks for reading!

Thanks so much mate for making these FX Primer's available to all! 🙏

This is veryyy good stuff....