Macro Report/Insights: Comprehensive Macro Report

The bond market is NOT the market of "truth"

Hey everyone,

Every month or so, I like to take some time to clear my head and write out my thoughts in a longer-form report. I have been doing this long before I started this Substack. There is something about writing your thoughts down that helps clarify and solidify them. Writing helps synthesize the chaos.

This will be a longer form report covering the following topics:

Growth, Inflation, and Liquidity

Bonds

FX

Equities

Crypto

Note to everyone: All future comprehensive macro reports will only be available to paid subscribers moving forward. While there will still be plenty of ideas and materials for free subscribers, the majority of the in-depth analysis will be exclusively reserved for paid subscribers. I deeply appreciate the support from all of you! There are some exciting things on the horizon that I will be sharing soon!

“The market of truth”:

I want to start by addressing a phrase we hear in financial media and the Twitter-sphere: “The bond market is the market of truth.” The idea behind this is that if you really want to know what’s going on, you look at the bond market. It's almost as if every other asset can “lie,” but the bond market will always tell the “truth.”

Well, I have news for you; this idea couldn't be further from the truth. In my estimation, this idea came from the complacency of being in a 40-year bond bull market. So, of course, any ideas you come up with to fit the environment will be thought of as “truth” because nothing is happening to falsify them.

Let me provide two examples that will frame the rest of this report:

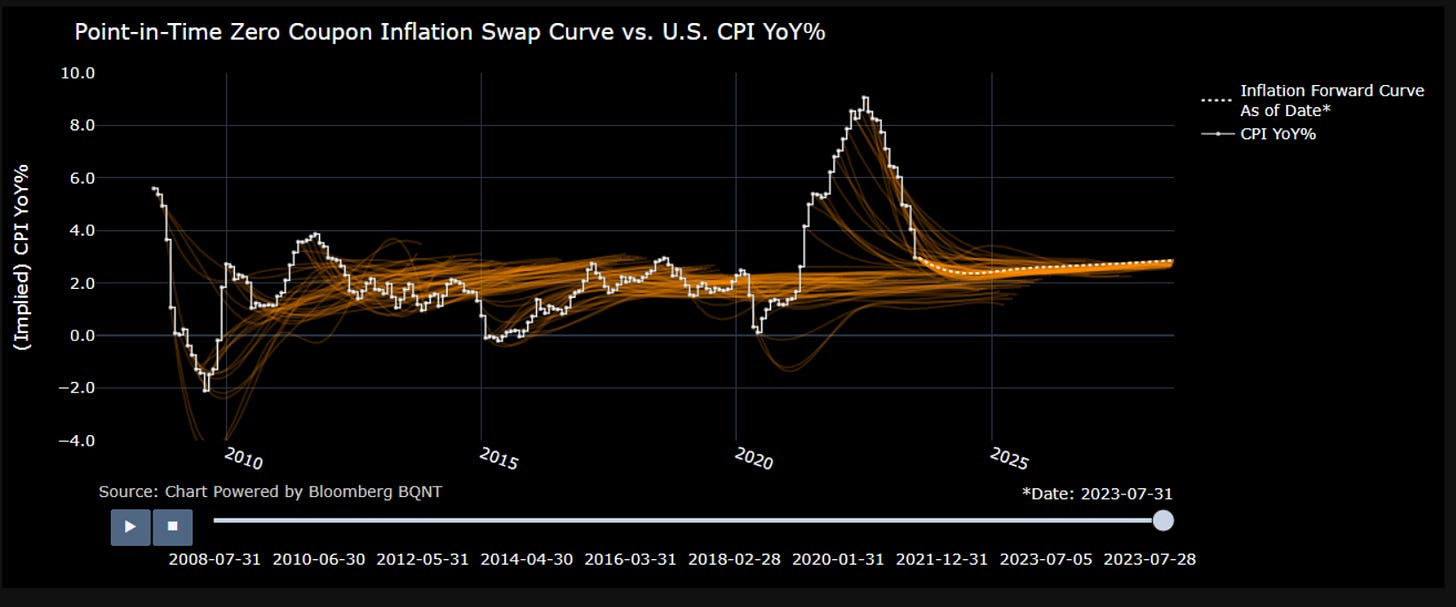

First, here are inflation swaps pricing the market’s expectation of forward inflation. We can observe that inflation swaps continuously priced a downward-sloping path to inflation ALL THE WAY to the most recent peak:

Now, I'm not saying that this is “wrong” or indicates malfunctioning of the market’s pricing mechanism. What I am drawing attention to is that just because the market is pricing a specific path forward in inflation, doesn't imply it will be realized. The bond market doesn’t have any secret powers of seeing into the future that allows it to be “more truthful.”

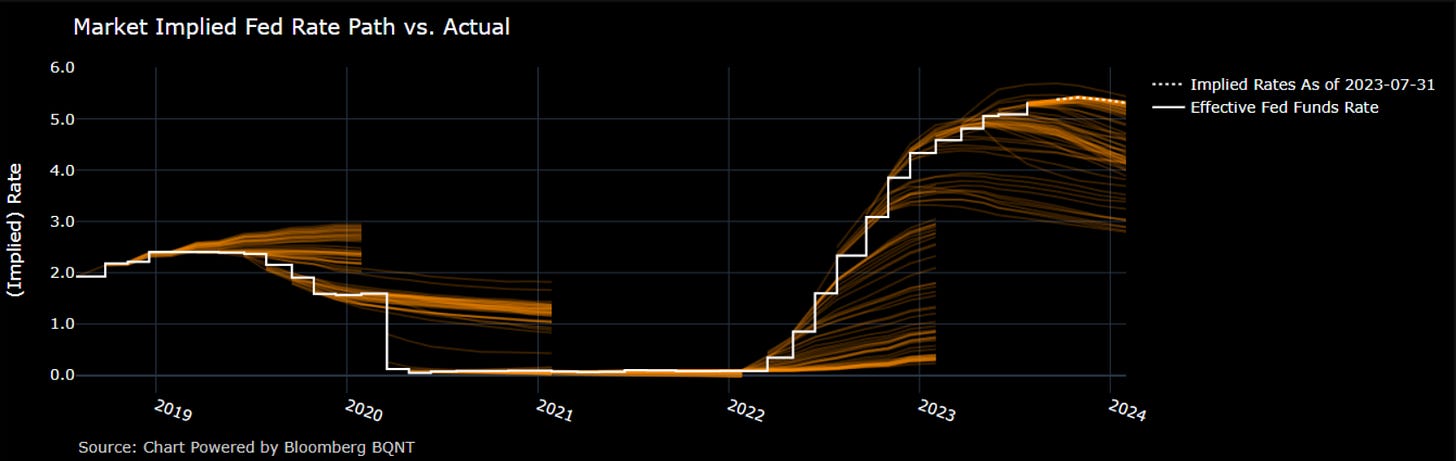

The second example, which is connected to the first, is how the FED funds future curve-priced hikes/cuts in the future and how those were realized. We can see the same dynamic as with inflation swaps:

Let me just say, when the bond market was whipsawing around inflation prints in 2022, nothing was saying to me, “Wow, look at that market of truth.”

Now that we have falsified the idea that the bond market is the “market of truth” and that forward pricing of inflation or FED actions doesn’t necessarily imply the actual path, we can begin to ask the right questions.

What questions do we need to ask? When I think about any asset, I always want to think about it in terms of its DESTINATION and PATH. A lot of this has to do with the timeframe you operate on and how you employ market timing, but fundamentally, we need to analyze the risk-reward of an asset in both its path and destination.

The necessity of analyzing risk-reward in both its path and destination has become explicit over the past six months as inflation has decelerated but nominal rates remain elevated.

Growth, Inflation, Liquidity

The growth and inflation situations are intricately linked when we consider the path and destination dynamic.

Growth: We have seen a surprise upside in growth over the past three months, which creates a challenging environment for a rapid drop in inflation back to 2%.

Inflation: The inflation situation is likely to continue exerting pressure on the FED to keep rates elevated. As real rates remain elevated, growth will continue to feel the pressure of these rates.

The economic surprise index is at its peak right now:

The Atlanta GDP nowcast is running well above 3%:

And real GDP is running at 2.40%:

On top of this, initial claims have actually decelerated over the past couple of prints:

Now, here's the deal. I still think we'll see a contraction in growth, but given the surprise we just witnessed and the level we're at, it will take some time to play out. This relates to the PATH for future inflation. If growth remains marginally resilient, it will be more difficult to achieve a swift return to 2% in core CPI.

To be clear, I think inflation is set up to decelerate, given the skew of the service component:

Mike Green actually just did a great article on this:

The main thing I am focused on is the SPEED at which inflation decelerates into the end of the year.

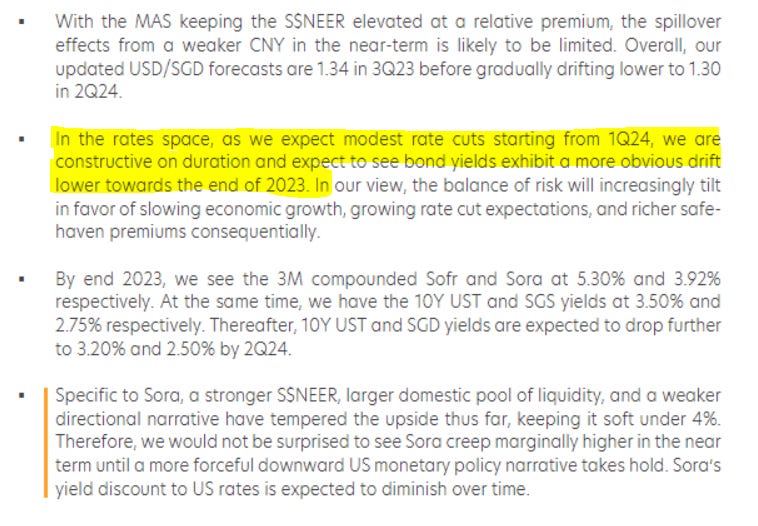

Both inflation swaps and FED fund futures have an immediate downward slope in their pricing as we move into the end of 2023 and into 2024:

Let's run a few theoretical tables on inflation decelerating into the end of the year:

Here's a scenario table showing month-on-month extrapolations of the most recent core CPI print of 4.82%. Now, there are many ways to run these types of projections, and that's exactly what they are - PROJECTIONS! In reality, the speed is constantly changing, but what I like to do is ask, "Okay, for inflation to get back below 3%, what would need to happen?"

I don’t think core CPI gets below 3% by the end. This is unlikely in my opinion, especially given the preconditions we are currently seeing with growth.

Here is a chart visualizing it:

On top of this, the forward curve is pricing cuts in December and through 2024:

Do I think the direction of inflation is to the downside? Yes. I just don’t think it’s as fast as the market is currently pricing.

This is the tension we have been in since the October high in inflation. Core inflation has decelerated from its peak but nominal rates remain in their range:

This is where the pricing of the path forward for inflation becomes important. We need to see more reasonable pricing of the path. Now, this partially brings us to Powell’s most recent comments at the FOMC.

Apart from the poor attempt of one reporter complimenting Powell’s tie (which was a poor choice of tie, by the way), questions were asked about what LEVEL inflation needed to reach before the FED began cutting. This is a key consideration now that the FED funds rate is above inflation. Will Powell cut a little once we get to 3%? Will he wait until we get to 2%? At what speed will he cut?

These are all questions that the market will be trying to price as we move into 2024. However, for the time being, we are dealing with the FED holding rates at an elevated level and the possibility of another rate hike if growth continues surprising to the upside.

Liquidity:

The final note I will make is on liquidity. Prometheus has done a great job of drawing attention to the liquidity situation from a systematic perspective (link):

When I look at both the market signals reflecting liquidity and the economic data, there doesn’t appear to be an imminent contract in liquidity. This could change at any time though.

There has been a “divergence” between equities and the net liquidity gauge people came up with during 2022. This wasn’t surprising since it literally doesn’t take into account major sources of liquidity:

As Prometheus noted above, we are seeing support from private-sector liquidity. We are also seeing a huge issuance in bills which is not taken into account by the “net liquidity indicator”:

I would encourage everyone to follow Concoda for a more in-depth analysis of the plumbing and liquidity dynamics. His most recent article we exceptional!

Let’s pivot (pun intended) to assets from here……….

Bonds:

Since the forward curve (blue) is sloping down, I am primarily watching the aggressiveness and speed of this slope for taking views on bonds:

If we see a higher probability priced to the September or November contracts, we could see a marginal flattening which seems likely. Here is the 3rd SOFR contract minus the 6th SOFR contract:

5s2s looks like it could go back to lows:

30s10s can still hold its range though:

I don't believe we'll see new highs in the 10-year into December unless we see a reacceleration in inflation. If we don't, we are likely to remain range-bound. Here is how I view the range right now:

I don't believe the 2-year will have a durable and sustainable move down until we transition from holding rates at an elevated level to cutting. Unless something unexpected occurs by the end of the year, I wouldn't be betting on cuts just yet:

Big picture, real rates are incredibly elevated which is characteristic of the end of a hiking cycle:

The longer-term chart tells me we are at a cyclical extreme:

Once the path aligns with the destination, the risk-reward will be aligned and more durable move in rates can take place. The question is all about WHEN.

FX:

FX flows have continued to move in lockstep with duration positioning:

The marginal break in the DXY from the 10-year can be explained by how forward curves are pricing cuts in 2024 and by dollar liquidity.

The liquidity situation has been reflected in both FX implied vol…..

And cross-currency basis swaps:

The official definition of cross-currency basis swaps from the CFA handbook:

Several additional things to watch for FX:

We are likely to see monetary policy differentials be the primary driver of FX price action until negative growth becomes the dominant impulse in markets. We also had an adjustment in policy by the BoJ which will be important to monitor moving forward:

Here is more of the bullish bond view which is still important to keep in mind. Knowing all the scenarios is key so that you can easily adapt on the fly:

Keep in mind that if the September and November contracts price higher probabilities of hikes, this is likely to cause a bid in the dollar.

Equities:

In terms of equities, we continue to see the accommodative liquidity push up risk assets:

We have seen the current SPX earnings yield diverge considerably from the risk-free rate as valuations have expanded:

I think we are a bit overextended but I am more focused on identifying a change in any of the liquidity drivers.

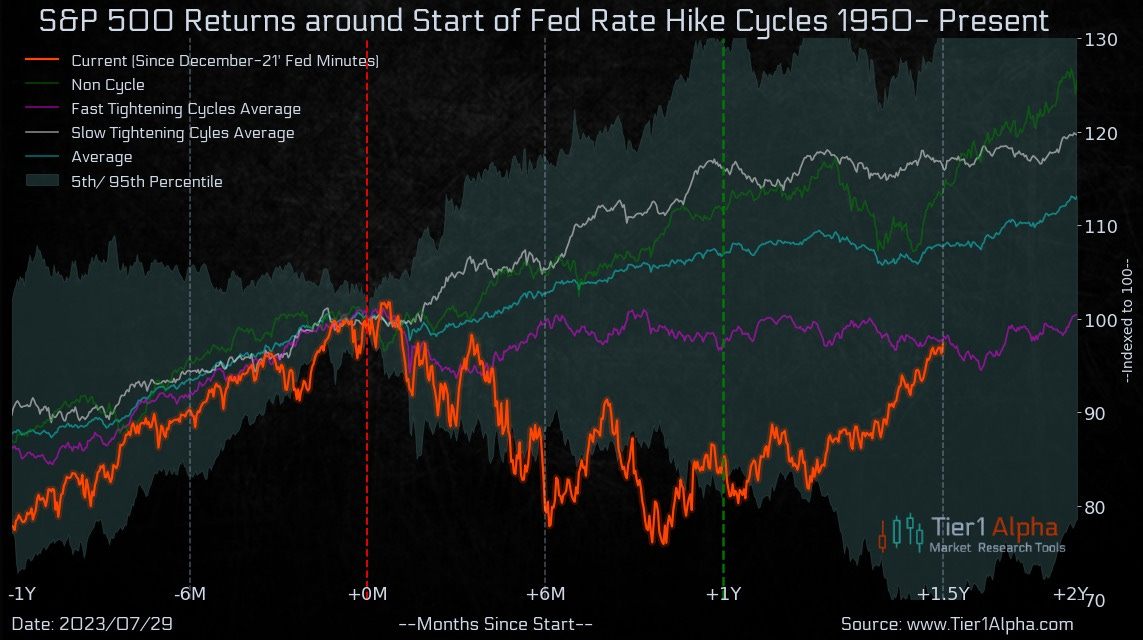

T1Alpha has provided some exceptional charts on returns around these types of cycles:

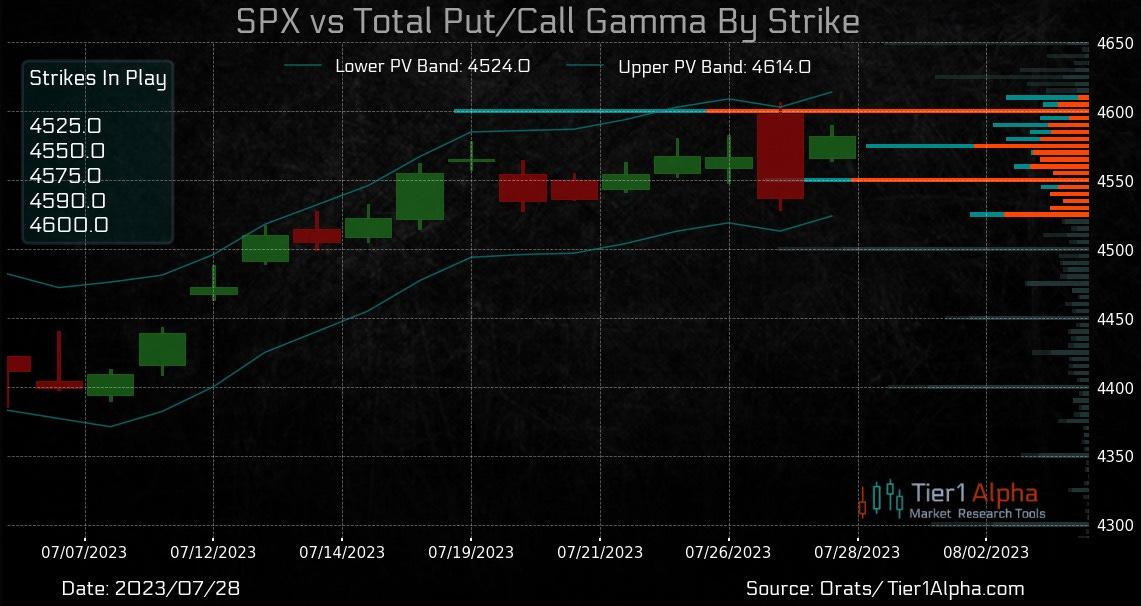

And also SPX levels:

I am watching for a close above or below these levels in connection with some volatility models I am running:

Implied volatility for equities continues to be incredibly low, which has caused positioning to increase long exposure considerably. In my mind, any type of VIX move is likely to have durability if we also see FX-implied volatility and credit risk rise as well. Until then, I am in no way bearish on ES.

Crypto:

I have shared how I view the risk-reward of Bitcoin multiple times. It continues to move down:

I also shared how I view the Solana risk reward. Also moving down:

Here is how I am thinking about crypto here: We just had a monstrous rally in equities, extremely loose liquidity, short squeezes across small-cap junk names, and cross-currency basis swaps making huge moves to the upside. All of that happened, and Bitcoin STILL couldn't break out. What do you think happens when something actually bearish occurs?

Even the news that pushed XRP up over 100% intraday couldn't cause Bitcoin to break out to new cycle highs:

It all biases the risk-reward to the downside for the time being.

Conclusion:

I believe there are a ton of opportunities out there for active management in this environment. There is so much volatility and time lags in growth, inflation, and liquidity that simple target date funds or 60/40 type portfolios can't maintain the same type of returns they did in the past.

Nimbleness and adaptability are crucial in this environment, as there are so many idiosyncratic moves with new drivers. I always want to understand the distribution of probabilities in both the likely destination and paths as they dynamically change through time. From this foundation, I can allow the market to present me with opportunities instead of chasing based on deterministic views.

Enjoy the ride……..

Thanks for reading!

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

Great report. Thank you. Regarding the topic about will the fed start cutting only once inflation gets to 2%, do you think the Fed gives any credence to the real time data from Truflation?

And what do you think about Truflation?

What's the prompt for the chatgpt model on CPI