Macro Report: Credit Cycle Trades

How the current melt up and coming volatility directly informs asymmetrical trades

Macro Report: Credit Cycle Trades

I have laid out the context for WHERE we are on a structural and cyclical basis in the following reports. One of the important things for running risk is correctly stacking knowledge so that you can know the WHAT and WHY across the structural, cyclical, and catalyst calendar that unfolds every week.

What I want to do in today’s piece is update what we are seeing with macro flows and then connect it to HOW I am thinking about specific trades across all major assets.

You can see the most recent livestream I did of macro views here:

Macro Flows:

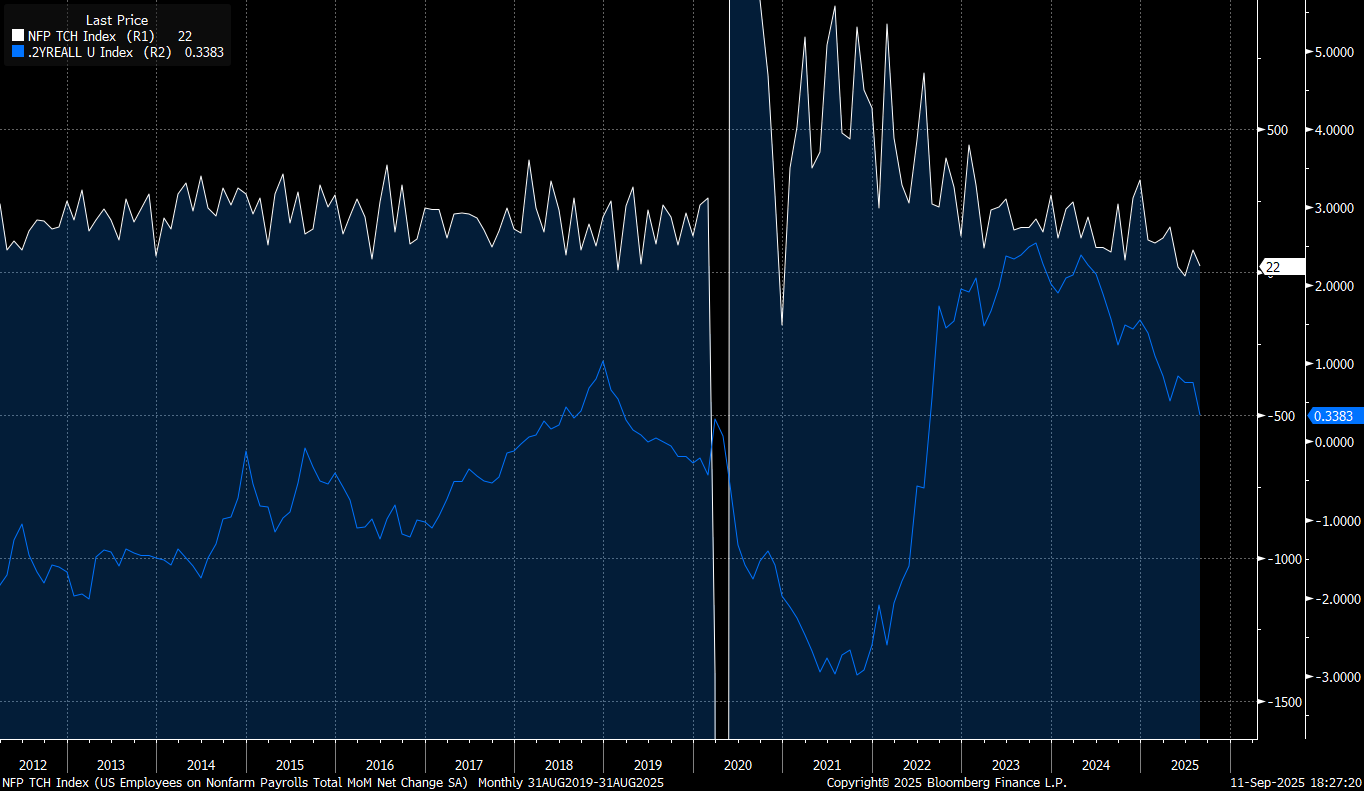

What I want to begin with is the idea of the labor market weakening, particularly through NFP revisions. Since Jackson Hole, the Fed has been overemphasizing the labor market in its rhetoric, which has caused labor market releases to exert a greater influence on interest rates than CPI prints.

Interest rates are constantly balancing the opposing pressures of growth and inflation. When inflation risk dominates, as it did in 2022, inflation prints tend to drive the dominant market impulse more than labor market data. Conversely, when recession risk is elevated, labor market prints carry more weight.

The absolute level of growth and inflation matters because it sets the baseline of economic conditions, while the rate of change indicates whether momentum is building or fading. Together, they frame the probability distribution for where the economy is likely to be over the next 3 to 6 months. This distribution is exactly what the forward curve translates into pricing, embedding premiums or discounts around the likelihood of central bank cuts or hikes. In other words, the market isn’t just reacting to where growth and inflation are, but to how they are evolving—and that evolution drives the pricing of policy expectations.

In simple terms, the LEVEL of growth is important because the HIGHER we are, the longer it would take for us to move into a contraction without an exogenous shock.

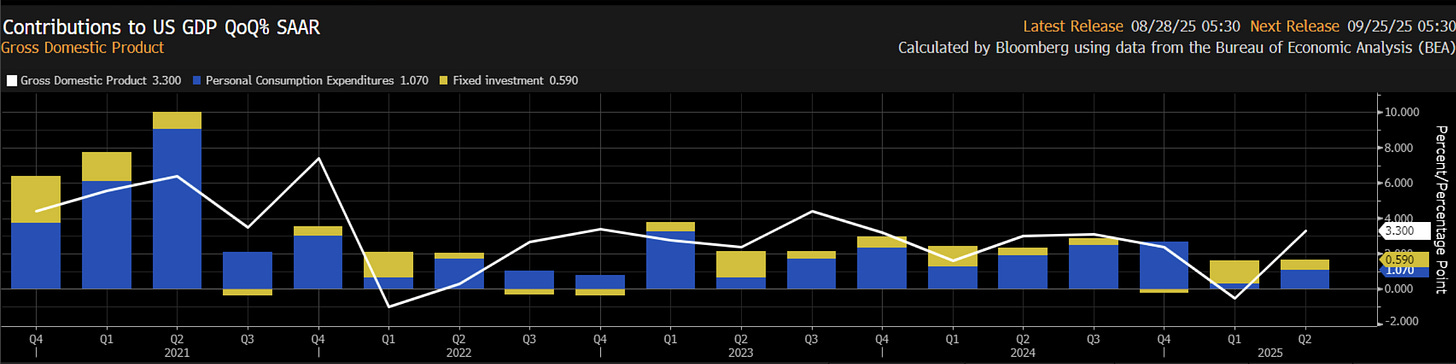

We are currently at a lower LEVEL of growth compared to 2024 in GDP terms:

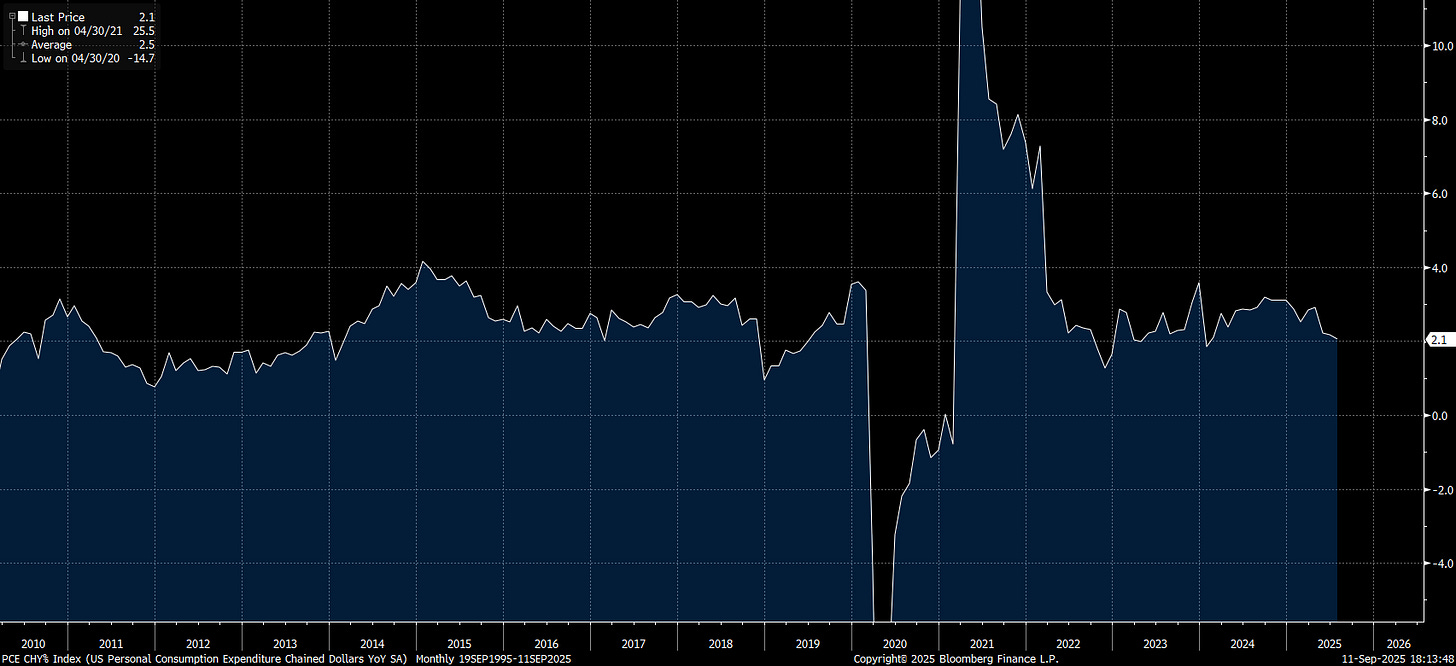

YoY real PCE has shown that the US economy is still growing but at a lower pace compared to the last several years. We are at 2% which is NORMAL.

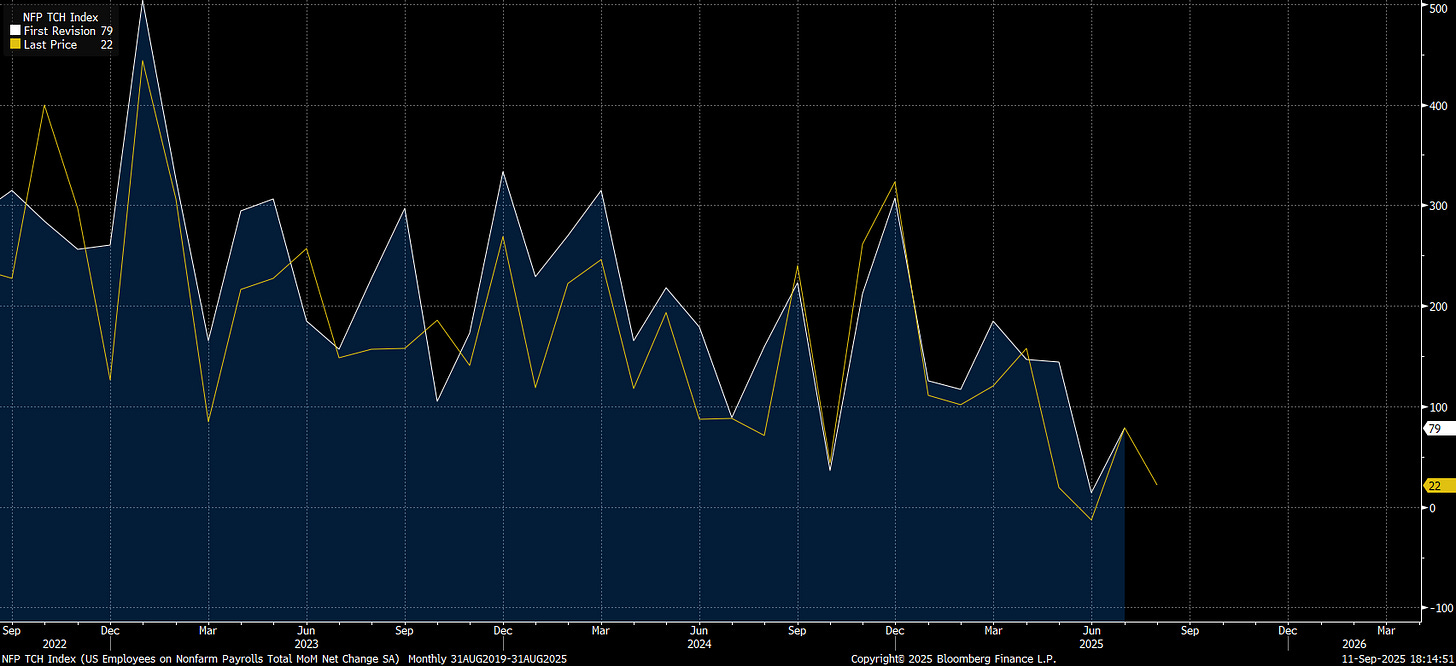

While everyone is laser-focused on the NFP revision as the single reason for recession risk, in reality, the revised numbers are still showing a marginal expansion.

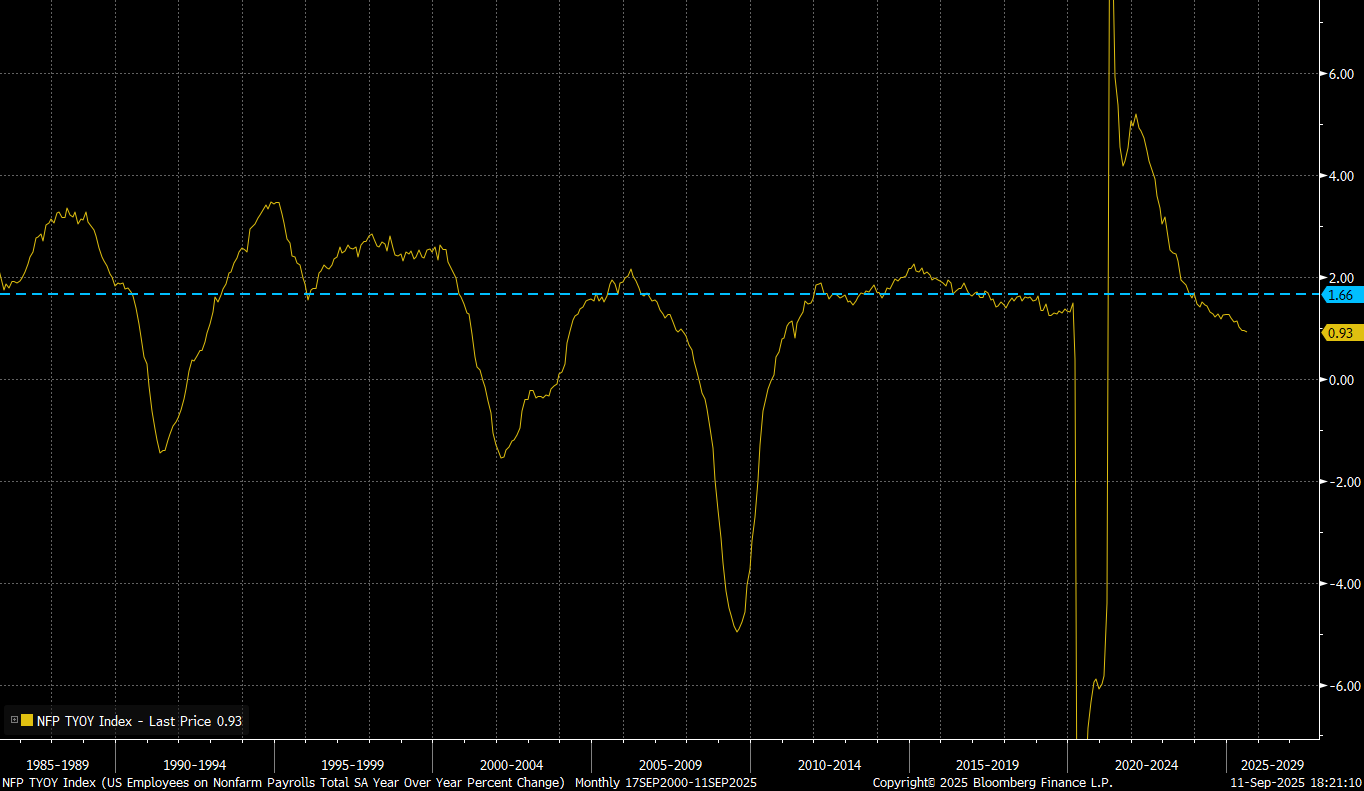

On a YoY basis, we are at a lower level for NFP:

The question is, does this lower level imply a higher probability of a contraction in real GDP that increases recession risk?

One of the most important inputs into where the labor market is likely headed is the sharp decline in real rates as NFP growth has approached lower levels. In 2021, both the level and rate of change in NFP were exceptionally strong while real rates were at historic lows, creating the conditions for an inflation breakout. As real rates rose during the Fed’s hiking cycle, NFP growth moderated. More recently, the decline in real rates has been driven by a combination of rising inflation expectations and the Fed cutting interest rates. This drop in real rates (over the last 12 months), combined with higher public market liquidity, provides a cushion that helps keep NFP from deteriorating more severely.

The recent decline in 2-year real rates reflects a combination of falling nominal rates and rising 2-year inflation swaps. This dynamic signals that the Fed is permitting short-end rates to ease even as inflation expectations move higher.

The combination of labor market resilience and falling real rates has been broadly accommodative for financial markets, reinforcing the view that a recession is unlikely.

The Russell rallying with 10s30s steepening is one of the purest reflections of accelerating nominal GDP as capital moving out the risk curve. This is one of the many reasons why I have not been betting on a recession.

The question from here is HOW are asymmetrical opportunities beginning to unfold in this context?

Credit Cycle Trades:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.