2025 Guide to Interest Rates: Navigating the Price of Money

Understanding Cycles, Policy, and Market Impact

2025 Guide to Interest Rates: Navigating the Price of Money

Recent labor market prints point to normalizing growth, yet inflation remains stubbornly above the Fed’s 2% target. Markets are now pricing in significant rate cuts, raising the question: how do you navigate a world where growth is normalizing but money is still expensive? Interest rates are not an abstract policy lever—they define the cost of credit and touch every part of the economy. From homeowners facing higher mortgage payments to corporations refinancing debt, the ripple effects are everywhere.

The Everyday Impact of the Price of Money

There is ALWAYS a tangible impact on the changes of interest rates across every person in the economy and financial system:

Homeowners — Mortgage costs rise and fall with rates, directly changing affordability.

Renters — Landlord borrowing costs pass through as higher rents.

Corporations — Debt refinancing and capital investment depend on the cost of credit.

Small Business Owners — Access to working capital tightens when rates climb.

Investors — Rates drive bond pricing, equity valuations, and cross-asset flows.

Governments — Servicing sovereign debt gets more expensive as rates rise.

Consumers — Credit cards, auto loans, and student debt all move with policy shifts.

Housing Market Participants — Construction and sales volumes hinge on mortgage affordability.

Retirees / Pension Funds — Rates shape income generation and portfolio stability.

Strategy and Why Interest Rate Regimes Matter

If you are reading this, it is likely because you fall into one of these categories or because you are helping someone manage their interest rate risk within them.

Homeowners

Strategy: Lock mortgages when spreads compress, refinance strategically, and avoid floating-rate loans in tightening cycles.

Why the regime matters: In a falling-rate environment, refinancing can reduce payments substantially. In a rising-rate regime, understanding forward guidance helps avoid unaffordable exposure.

Renters

Strategy: Negotiate longer leases during easing cycles, and time moves when financing costs decline for landlords.

Why the regime matters: Anticipating rate shifts lets renters position ahead of rising rental costs rather than reacting after increases hit.

Corporations (CFOs, Treasurers)

Strategy: Extend maturities in low-rate regimes, hedge exposure to volatility, and delay large borrowing when rates are elevated.

Why the regime matters: Knowing whether rates are peaking or cutting guides whether to lock financing now or wait, directly influencing earnings and shareholder value.

Small Business Owners

Strategy: Maintain liquidity buffers, secure fixed-rate credit during easing, and stagger debt maturity to weather volatility.

Why the regime matters: Rate cycles dictate whether capital access expands or contracts, shaping survival odds in downturns.

Investors

Strategy: Shift allocation between bonds, equities, and alternatives depending on curve shape and rate direction; exploit relative-value opportunities.

Why the regime matters: Rates set the discount rate on all future cash flows—knowing the regime prevents being caught on the wrong side of valuation compressions or expansions.

Governments

Strategy: Smooth debt issuance across maturities, lock funding in low-rate environments, and manage rollover risk during tightening.

Why the regime matters: The interest rate regime dictates fiscal sustainability—misjudging it leads to spiraling deficits.

Consumers

Strategy: Pay down floating-rate debt quickly in rising cycles, refinance fixed obligations in easing cycles, and adjust consumption timing to financing conditions.

Why the regime matters: Understanding where policy rates are headed avoids locking into unfavorable debt structures and maximizes disposable income.

Housing Market Participants (Builders, Realtors)

Strategy: Align construction pipelines with periods of rate easing, offer financing incentives when rates are high, and time sales cycles to affordability trends.

Why the regime matters: Housing demand is hyper-sensitive to mortgage rates; anticipating policy direction avoids misaligned inventory and cash flow crises.

Retirees / Pension Funds

Strategy: Rebalance toward higher-yielding instruments in rising cycles, ladder maturities to smooth returns, and hedge volatility in transition periods.

Why the regime matters: Pension solvency and retirement income streams depend on forward rate paths—misjudging them risks underfunding or eroded purchasing power.

Clarity In The Cycle

If you can understand where we are in the interest rate cycle, you can understand how to adjust exposure. Even if the future cannot be known with certainty, the present can be mapped with precision and that clarity provides the strategy for what to do right now.

MAIN IDEA:

Growth in the U.S. economy remains resilient, with little evidence of significant deterioration in the data. This resilience provides structural support for long-end interest rates, anchoring them at higher levels than in previous cycles. At the same time, inflation risk is not elevated enough to push yields to new highs, keeping upward pressure contained.

The Fed’s willingness to let significant cuts be priced into the forward curve, combined with capital flowing out the risk curve, signals that policy is shifting within a broader regime of structurally higher rates. This means the key question for markets is not whether rates are high, but how the path unfolds in the interim.

If we can establish a clear understanding of that path, we can design a clear strategy for how to adjust exposures and take action as we move into the end of 2025.

This structural reality is tangibly reflected in the longer term ranges we have seen in long end rates

10 year interest structural range:

30 year interest rate structural range:

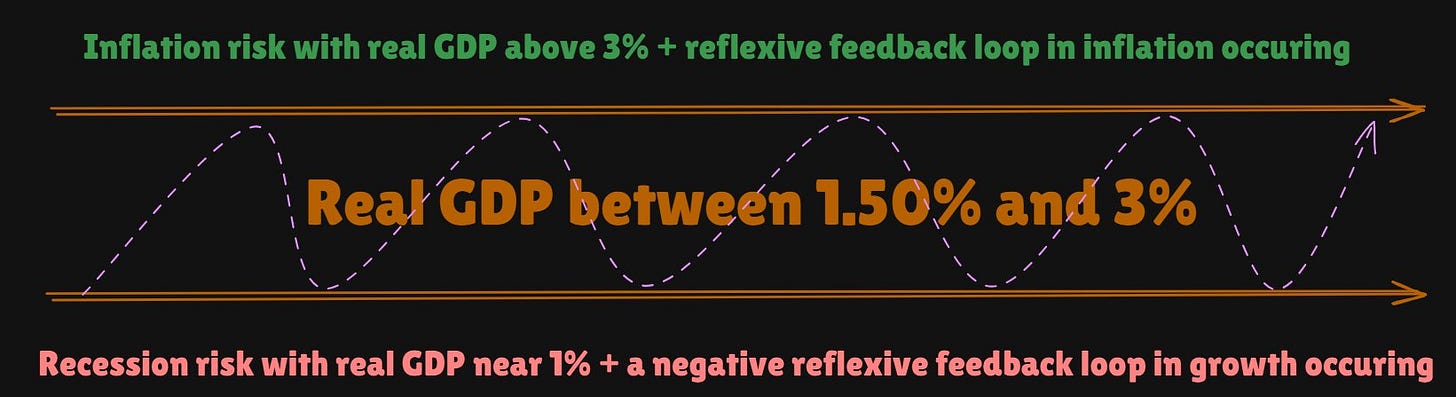

When long-term interest rates push toward the top of their structural range, it reflects temporary inflation risks that fail to develop into a sustained inflationary cycle. Conversely, when rates move toward the bottom of the range, it reflects recession risks that ultimately do not materialize into a full downturn.

Within that backdrop, the path of rates is shaped by short-term catalysts that act as intertemporal markers. These events are not just data releases—they are checkpoints where the market tests whether the current regime is holding or shifting. By mapping these catalysts, we can track how inflation risk and recession risk express themselves inside the broader structural ranges of long-term rates.

September 2025

2025-09-10: PPI Inflation Print

2025-09-11: CPI Inflation Print

2025-09-17: FOMC Rate Decision and Forecasts

2025-09-25: PCE Inflation Print

2025-09-30: JOLTS Labor Report

October 2025

2025-10-01: ADP Employment Report

2025-10-03: Nonfarm Payrolls (NFP)

2025-10-08: FOMC Rate Decision and Forecasts

2025-10-15: CPI Inflation Print

2025-10-16: PPI Inflation Print

2025-10-30: PCE Inflation Print

November 2025

2025-11-04: JOLTS Labor Report

2025-11-05: ADP Employment Report

2025-11-07: Nonfarm Payrolls (NFP)

2025-11-13: CPI Inflation Print

2025-11-14: PPI Inflation Print

2025-11-19: FOMC Rate Decision and Forecasts

2025-11-26: PCE Inflation Print

December 2025

2025-12-02: JOLTS Labor Report

2025-12-03: ADP Employment Report

2025-12-05: Nonfarm Payrolls (NFP)

2025-12-10: CPI Inflation Print

2025-12-10: FOMC Rate Decision and Forecasts

2025-12-11: PPI Inflation Print

2025-12-19: PCE Inflation Print

The Trading Tactical Playbook for actively trading through these types of catalysts is here (all of the other playbooks are linked in the educational primer section below):

Interest Rate Views, Risk Reward, and September FOMC Meeting:

My macro view remains that the credit cycle is in full swing: inflation risk is elevated, real rates are falling, and capital is moving out the risk curve into higher-risk equity sectors. This dynamic will likely continue until the surplus of liquidity becomes unsustainable. The most probable trigger for unsustainability will be either long-end rates blowing out to the upside or cross-border flows selling U.S. assets as the Fed and Treasury continue to undermine the currency. I laid out how this functions in the two most recent macro reports:

Until one of these risks trigger, the primary goal is being long risk assets that benefit from the credit cycle AND managing the path of interest rates within this higher structural range.

The recent labor market prints and rhetoric by the Fed directly connect to specific ranges in the SOFR curve and long duration bonds. I am going to walk you through them and explain HOW to think about WHERE interest rates are likely to move.

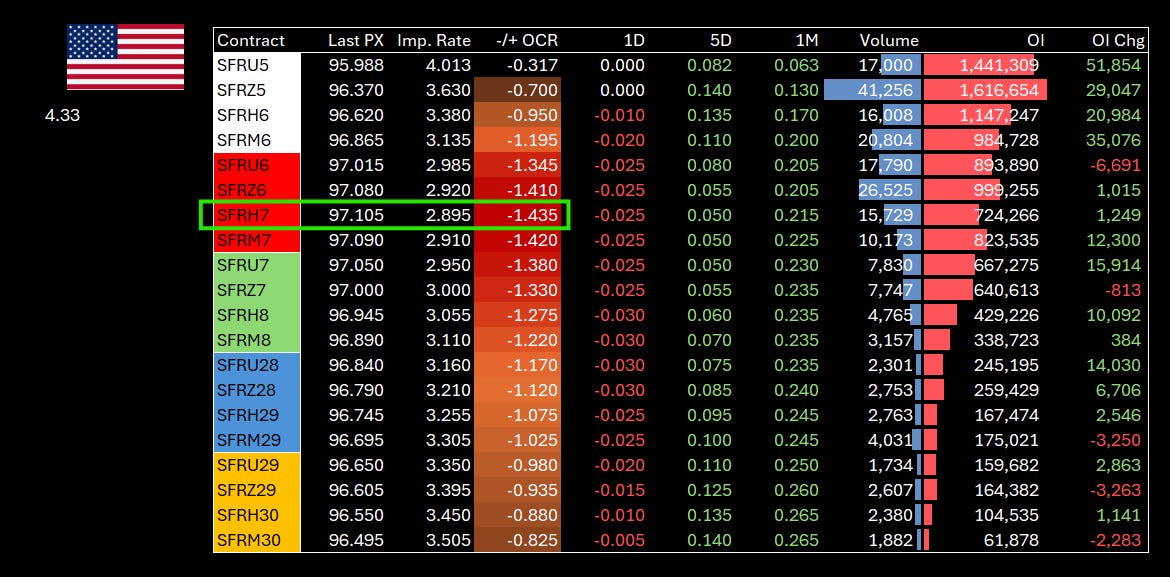

The model below breaks down HOW AGGRESSIVELY the forward curve is pricing cuts. The H7 contract (March 2027) is where the deepest part of the cuts exists in the forward curve. In simple terms, the forward curve is pricing a total of 143bps of cuts between now and March of 2027.

The H7 contract priced the same aggressiveness of rate cuts earlier this year during the tariff drawdown in equities. Since this time, the Fed has allowed the reds (colored SOFR contracts in model above) price more and more rate cuts on the forward curve.

The Fed is simply shifting its stance to overemphasize growth risk vs inflation risk in order to justify cutting interest rates. The most recent NFP prints have caused buying pressure in the short end (ZT in the chart below) but we remain BELOW bid from earlier this year (yellow line). We are likely to remain BELOW this level as we progress into the Sept and Oct FOMC meeting because of how aggressively the 2025 contracts are pricing rate cuts.

Notice that we are actually pricing a little bite more than a 25bps cut in the Sept FOMC meeting!

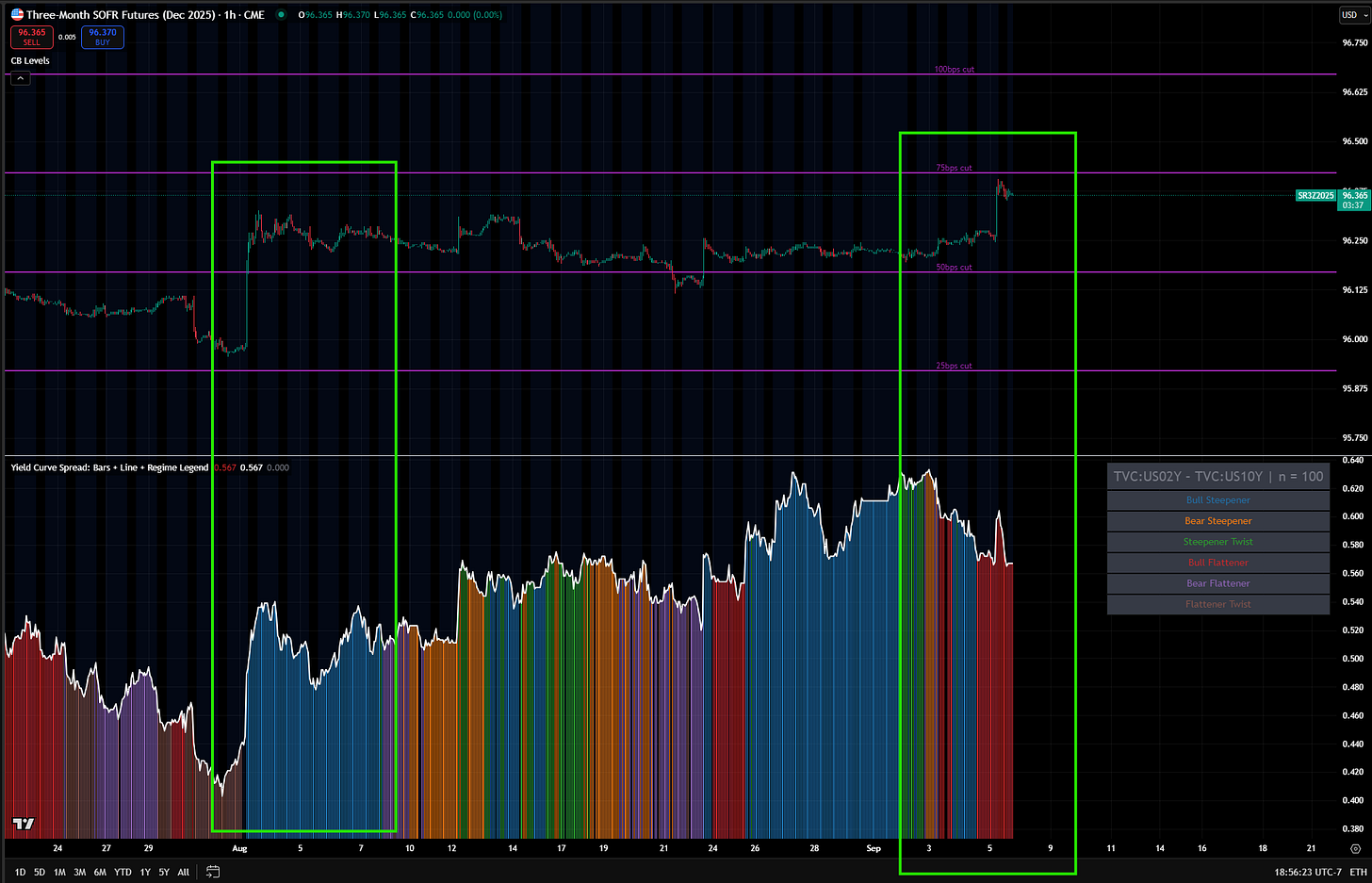

We are almost certainly going to get a 25bps cut at the September FOMC, and it is HIGHLY unlikely that we see a 50bps cut. Given Powell’s shift at Jackson Hole, the recent labor market data, and the fact that 2s10s has not been bear steepening or steepener twisting over the last 3 weeks, a cut at every meeting this year is a very real probability, but it is likely the most dovish outcome.

The implication of this is that there is fuctionally no upside in the Z5 contract if 75bps of cuts are realized for 2025 (which would mean a 25bps cut at the remaining 3 FOMC meetings). As the Z5 and H7 contract have priced more cuts, the 2s10s curve has not bear steepened in a similar manner to 2024 when the Fed cutting immediately caused long end rates to rally.

We are now seeing the 10 year futures contract come back to the level it was at during the drawdown in equities earlier this year. In my view, we are unlikely to move ABOVE this level in ZN before the Sept FOMC meeting and if we continue to have capital move out the risk curve on equity rallies, it further decreases the probability of bonds rallying.

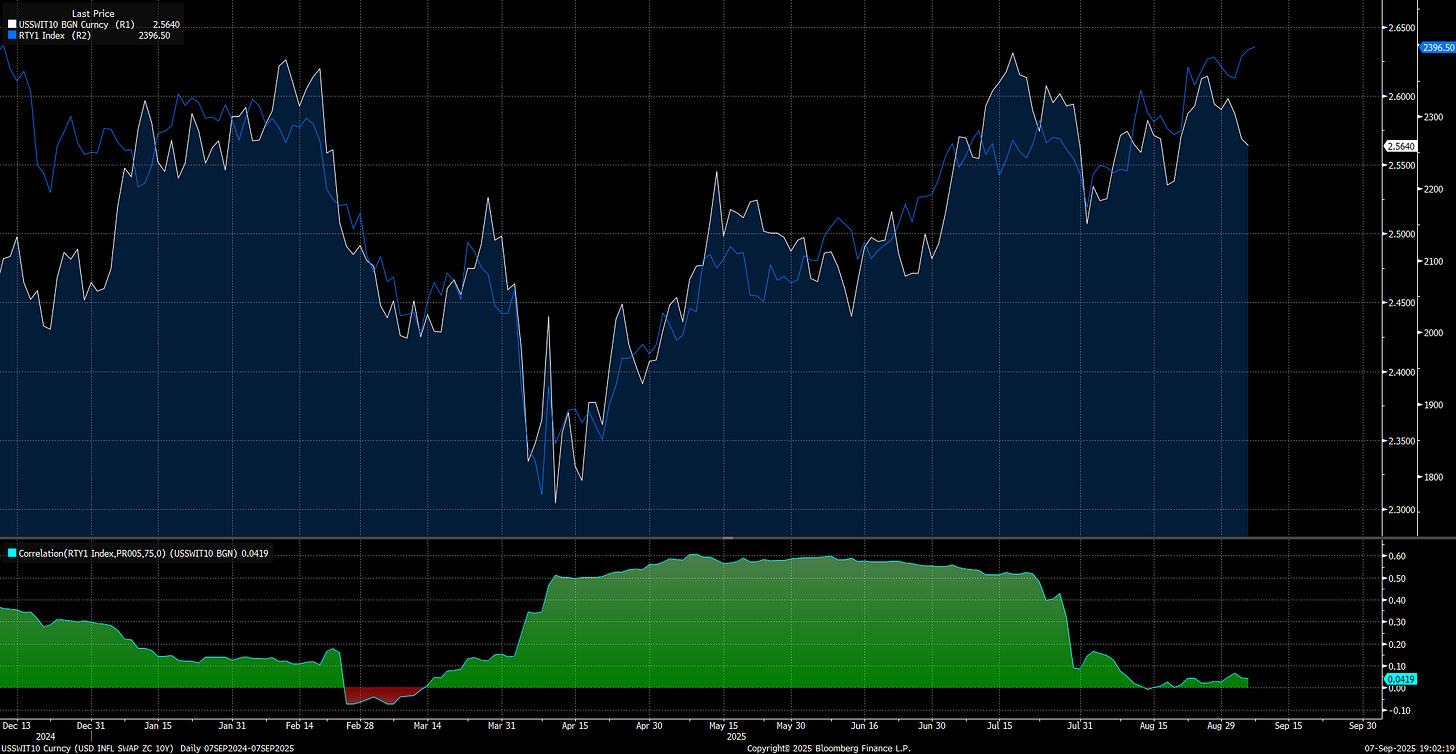

However, the key differntiator for WHERE we are moving with long end rates is how 10 year inflation swaps correlate to the further upside in equities. If 10 year inflation swaps begin to have a negative correlation with things like the Russell (blue line) then we could move into a Goldilocks regime where stocks and bonds rally together. Inversely, if the equity melt up begins to become a larger issue for inflation and drag up 10 year inflation swaps, then this will create significant headwinds for bonds.

Interest Rate Scenario Analysis and Strategy Guide:

The structural reality is clear: long-end rates are anchored in higher ranges by resilient growth, yet capped from breaking higher by muted inflation risk. Within that band, the short-term path is shaped by the catalysts that hit month by month—CPI, PPI, PCE, labor market data, and the FOMC. Each release acts as an intertemporal marker that tests whether markets press the top of the range on temporary inflation scares or the bottom on temporary recession scares.

What matters for strategy is not predicting the exact future, but knowing where we are in the cycle and how to adjust exposure. The scenarios below link the structural regime to cyclical catalysts and provide a clear playbook for households, businesses, investors, and governments to act decisively as we move through the end of 2025.

Structural Frame

Long-end rates trade in higher structural ranges, anchored by resilient growth.

Tops of the range = temporary inflation scares that fade.

Bottoms of the range = temporary recession scares that fade.

Path into year-end is defined by catalysts (FOMC, CPI, PPI, PCE, ADP, JOLTS, NFP).

Scenario 1 — Base Case: Resilient Growth, Contained Inflation

Triggers: CPI/PCE ~0.2–0.25 MoM, NFP 100–175k, JOLTS soft but stable.

Curve: Mild bull steepening, long end mid-range.

Strategy: Stay positioned for stability in higher rates by locking favorable financing, pacing corporate and household balance sheet risk, and using quality duration or credit selectively to capture steady carry.

Scenario 2 — Inflation Flare, Fades (Top-End Test)

Triggers: One or two hot CPI/PCE prints (0.3–0.4), follow-ups cool.

Curve: Bear steepener/twist, fails at top of range.

Strategy: Treat inflation scares as tactical opportunities to fade; hedge exposures in the short term, then re-enter duration or credit once the data confirms the cycle is not breaking higher.

Scenario 3 — Growth Scare, Fades (Bottom-End Test)

Triggers: NFP <100k once, JOLTS openings lower, CPI tame.

Curve: Bull flatten, long end tests bottom of range.

Strategy: Use temporary growth scares as an opportunity to rebalance into equities or credit once data stabilizes, positioning ahead of the unwind of the duration bid while maintaining liquidity discipline.

Scenario 4 — New Inflation Cycle (Upside Breakout)

Triggers: 3+ hot inflation prints, wage growth accelerates.

Curve: Bear steepening, long end breaks above range.

Strategy: Shift aggressively away from duration, front-load financing and borrowing, and reposition toward inflation-linked assets and sectors that can sustain margins in higher rate environments.

Scenario 5 — Hard-Landing Recession (Downside Break)

Triggers: 2–3 weak NFPs (<50k), quits collapse, CPI <0.15 for several months.

Curve: Bull steepening, long end breaks below range.

Strategy: Move defensively by extending duration, prioritizing liquidity and high-quality assets, and reducing cyclical exposure as risk premia reprice across markets.

Contingency Planning is EVERYTHING!

Thanks

As always, a Pepe for the culture:

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

![[FREE] Educational Primers On Every Aspect Of Macro & Markets](https://substackcdn.com/image/fetch/$s_!tfas!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F69c49472-3d63-47f0-9b8c-2a682fa625f1_1024x1024.jpeg)