Liquidity Tides and Strategic Positioning in Bitcoin and Gold

How Macro Liquidity Is Steering Bitcoin and Gold

Liquidity Tides and Strategic Positioning in Bitcoin and Gold

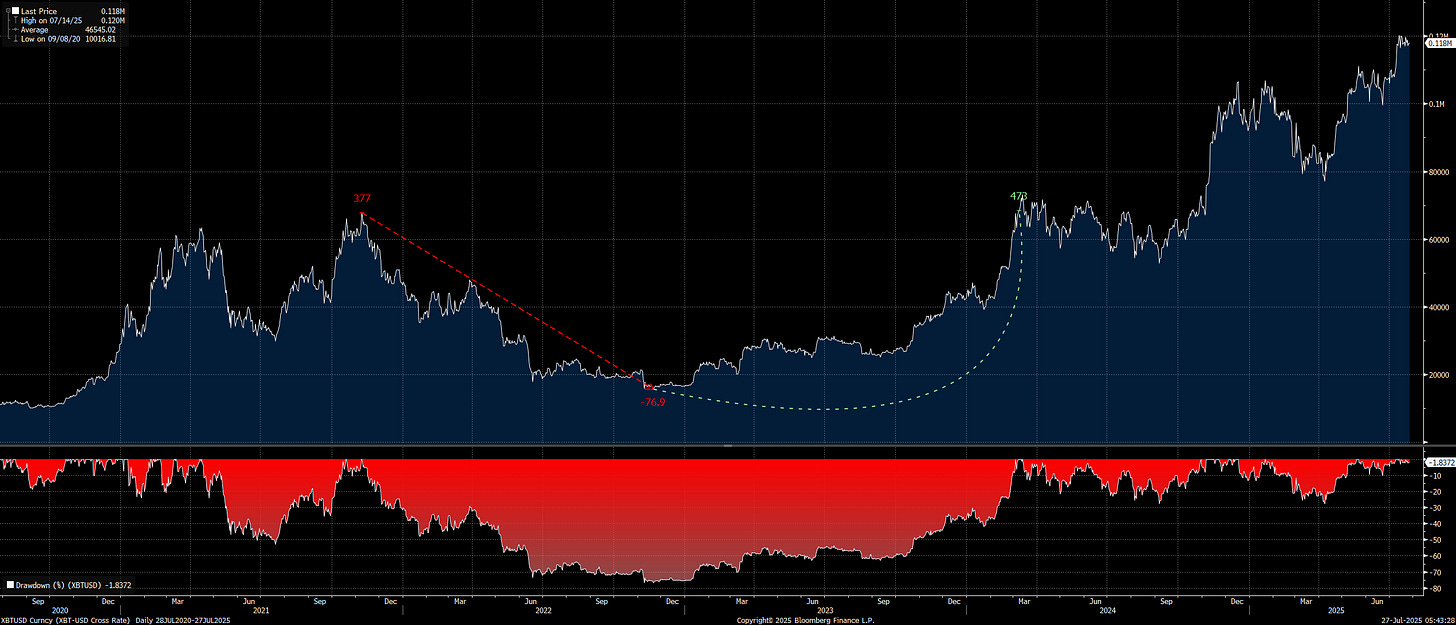

Over the past five years, we’ve witnessed a significant increase in both nominal GDP and macro liquidity. This combination has been the primary driver behind THE rallies in gold and Bitcoin. However, there have also been significant drawdowns along the way. Understanding the moves on both the upside and downside is critical for taking a view on these assets, whether for establishing a long-term cost basis or actively trading.

I believe that holding gold or Bitcoin in a portfolio of assets is a good play over the long term. This doesn’t require a significant informational advantage or any skill, though. My goal in markets is to actively interpret and understand the WHY behind changes in these assets so I can take directional views with leverage and thereby significantly outperform a normal portfolio allocation.

My goal in this report is to break down the drivers of gold and Bitcoin we have been seeing and explain HOW positioning is adjusting to the macro constraints that exist.

If you haven’t already reviewed the playbooks I wrote on Bitcoin, I would encourage you to do it here:

Macro Constraints Changing Money:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.