Macro Regime Tracker: Big Macro Bet

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I laid out the main macro bets I am taking right now here:

As always, all the systematic models and strategies are updated below. Thanks.

Main Developments In Macro

U.S. Policy, Trade & Foreign Relations

USTR GREER TO MEET WITH CHINA COUNTERPART ON TRADE

DEMOCRATS URGE ADMIN TO ACT AGAINST CHINA SANCTIONS EVASION

BESSENT TO DISCUSS TRADE WITH CHINA’S HE LIFENG

BESSENT TO TRAVEL TO MALAYSIA, JAPAN, AND SOUTH KOREA

TRUMP TO MEET WITH XI JINPING NEXT THURSDAY

LEAVITT: NEXT THURSDAY HAVE MEETING WITH XI

LEAVITT: TRUMP TO HAVE BILATERAL MEETING WITH JAPAN PM

US TO PROBE CHINA’S COMPLIANCE WITH 2020 TRADE DEAL: NYT

CARNEY HOPES TO MEET CHINA’S XI NEXT WEEK: CANADA OFFICIAL

MACRON SAYS CHINA RARE EARTH CURBS ARE ECONOMIC COERCION

FORD CEO: TARIFF IMPACT NOW AT ‘A MORE REASONABLE LEVEL’

GM, STELLANTIS TO LOSE PART OF CANADA TARIFF EXEMPTION

BOE’S DHINGRA: TARIFFS WILL PUT DOWNWARD PRESSURE ON PRICES

Energy, Commodities & Industrial Policy

TRUMP PLANS TO OPEN ALMOST ALL OF US COAST TO OFFSHORE DRILLING

TRUMP ADMINISTRATION OPENS ALASKA COASTAL PLAIN TO OIL DRILLING

PUTIN: REDUCTION OF RUSSIAN OIL WILL LEAD TO HIGHER PRICES:TASS

RUSSIA MAY RAISE OIL TRANSIT FROM KAZAKHSTAN TO GERMANY: TASS

TURKEY CUTS ONE-WEEK REPO RATE BY 100BPS TO 39.5%; EST. 39.50%

AKAZAWA: CHANGING ENERGY SOURCES MAY PUT PRESSURE ON JAPAN ECON

Global Geopolitics & Security

PUTIN: RUSSIA SUPPORTS DIALOG WITH US

PUTIN: NEW SANCTIONS WON’T AFFECT RUSSIAN ECONOMY: TASS

PUTIN: US SANCTIONS HARM RELATIONS WITH RUSSIA: IFX

PUTIN ABOUT SANCTIONS: IT’S AN ATTEMPT TO PUT PRESSURE: IFX

PUTIN: US PROPOSED BUDAPEST AS PLACE FOR MEETING: IFX

PUTIN: TRUMP MADE A DECISION TO POSTPONE MEETING: IFX

EU LEADERS DEFER RUSSIA FROZEN ASSET PLAN DECISION TO DECEMBER

LEAVITT: SANCTIONS PUT A LOT OF PRESSURE ON RUSSIA

LEAVITT: RUSSIA HAS SHOWN NOT ENOUGH INTEREST IN PEACE

ZELENSKIY: CHINA IS NOT INTERESTED IN UKRAINE’S VICTORY

ZELENSKIY: DISCUSSED AIR DEFENSE, ENERGY RESILIENCE WITH MACRON

UKRAINIAN PRESIDENT ZELENSKIY MEETS FRENCH PRESIDENT MACRON

ZELENSKIY, MERZ DISCUSS UKRAINE’S AIR DEFENSE, ENERGY

Market/Trade-Relevant Political Notes

TRUMP: THINK WE’RE GONNA COME OUT VERY WELL ON XI MEETING

TRUMP PARDONED BINANCE FOUNDER CHANGPENG ZHAO ON WEDNESDAY: WSJ

TRUMP TO MAKE AN ANNOUNCEMENT AT 3PM IN WASHINGTON

TRUMP: WE’RE NOT HAPPY WITH VENEZUELA

TRUMP DENIES REPORT THAT US FLEW B-1 BOMBERS NEAR VENEZUELA

TRUMP: DID NOT SEND B-1 BOMBERS NEAR VENEZUELA

US FLEW AIR FORCE B-1 BOMBERS NEAR VENEZUELA: WSJ

TRUMP: ‘LAND DRUGS’ WILL BE TARGETED NEXT

LEAVITT: TRUMP INCREASINGLY FRUSTRATED WITH UKRAINE, RUSSIA

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data,

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Tech Lifts, CPI Looms — Risk Appetite Returns (S&P +0.51%)

Wall Street shook off the recent wobble and pushed higher into the CPI print, led once again by Big Tech and cyclical pockets. The S&P 500 rose +0.51%, approaching its all-time highs as hopes of de-escalation in US-China trade tensions boosted risk sentiment. President Trump confirmed he’ll meet Xi Jinping on Oct 30, while oil surged on fresh sanctions against Russian producers, a reminder that the inflation fight isn’t over. Bonds sold off modestly (10-yr +6 bp to 4.00%) as traders priced in another Fed cut next week despite lingering price pressures.

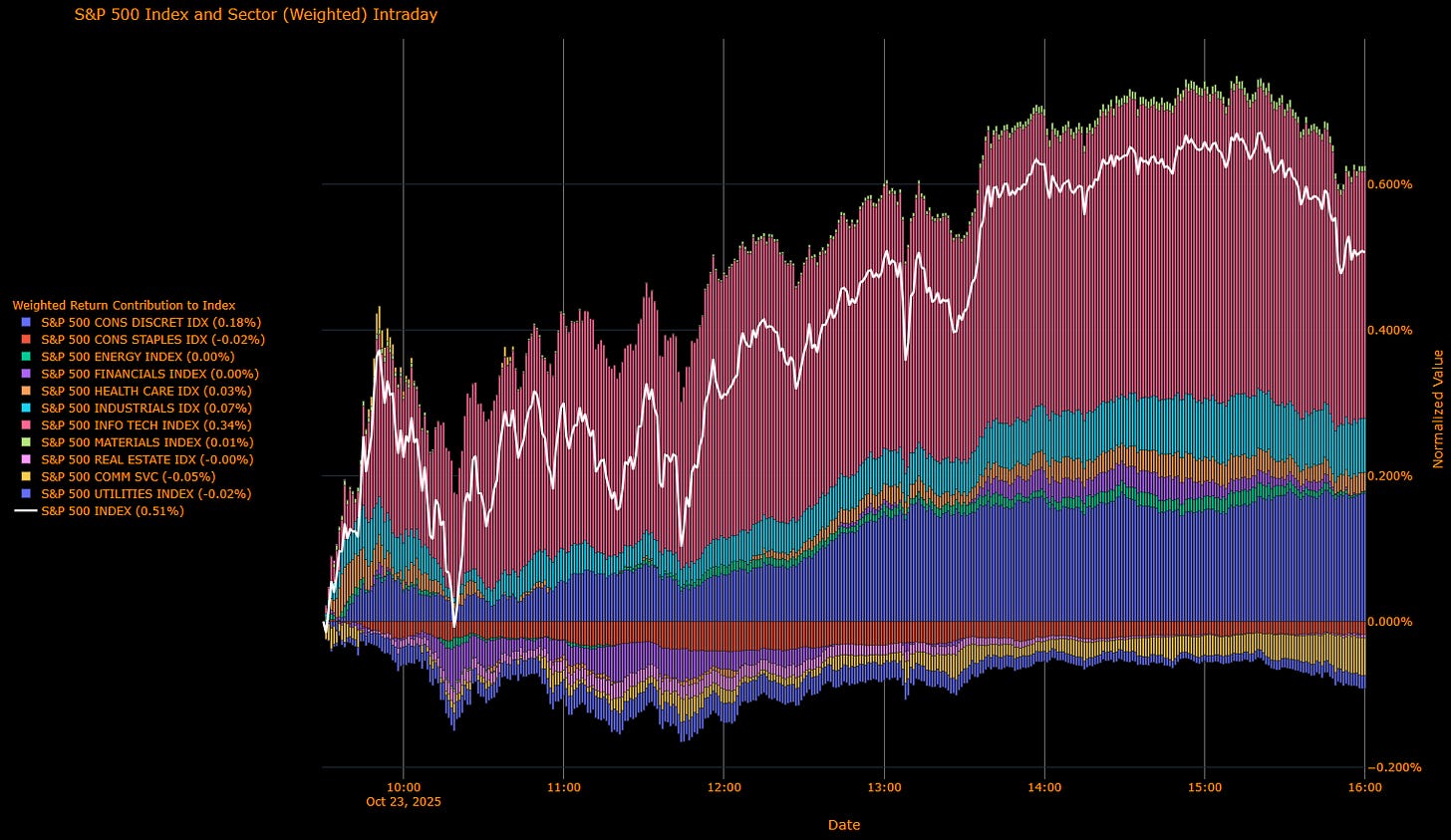

Sector Attribution

Weighted Return Contribution (S&P +0.51%)

Leaders: Info Tech (+0.34%), Discretionary (+0.18%), Industrials (+0.07%), Health Care (+0.03%).

Drags: Comm Services (−0.05%), Staples (−0.02%), Utilities (−0.02%); Energy and Financials flat.

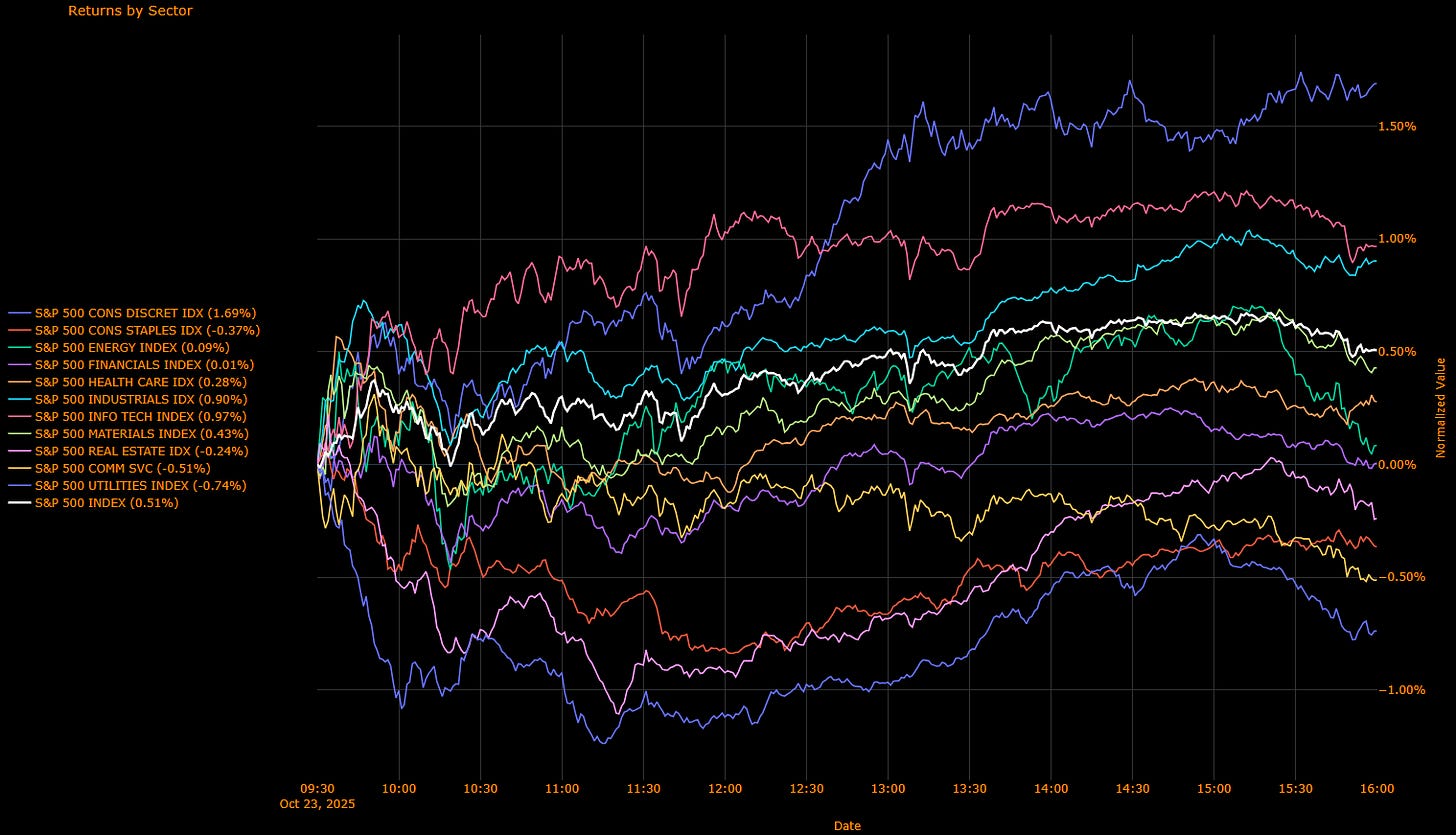

Unweighted Performance (Breadth)

Leaders: Discretionary (+1.69%), Info Tech (+0.97%), Industrials (+0.90%), Materials (+0.43%), Health Care (+0.28%).

Laggards: Utilities (−0.74%), Comm Services (−0.51%), Staples (−0.37%), Real Estate (−0.24%).

Read: Momentum and cyclicals drove the tape — Tech, Industrials, and Discretionary carried the load while defensives were unwound. The index advance was broad enough to offset small-cap softness and commodity volatility, suggesting positioning clean-up rather than fresh risk aversion.

Macro Overlay

Catalysts / Tape Feel

The mood brightened as trade diplomacy headlines broke — confirmation of a Trump-Xi meeting and early signs of thaw in US-China tensions. The quantum-computing “arms race” narrative added to optimism in AI-linked names. Oil’s +5% spike on Russian sanctions sparked a fleeting inflation scare but failed to derail the risk bid; investors leaned into cyclical growth themes ahead of CPI.

Policy / Rates / FX

Treasuries softened with 10-yr yields touching 4.00% and 2-yr +5 bp to 3.49%. Markets still price two Fed cuts this year (Oct + Dec), with inflation seen as a bump not a barrier. The USD held firm while gold stabilized and crypto extended gains. The easing bias narrative remains intact, but higher oil clouds the timing of additional rate cuts.

Cross-Asset Pulse

Oil +5.4% (WTI ≈ $61.6), Gold +0.5%, Bitcoin +2.3%, Ether +1.9%. The rotation back into energy and AI shows traders are comfortable fading last week’s de-risking — at least until CPI confirms that the inflation impulse is contained.

The Read-Through

Re-risking ahead of CPI: Traders stepped back into Tech and Discretionary leadership on optimism over Fed easing and trade progress.

Energy & inflation risk: Crude’s spike adds short-term inflation risk, but the market’s calm response shows confidence the Fed will look through it.

Defensives under pressure: Staples, Utilities, and Comm Services lagged as yields rose and duration proxies lost appeal.

Momentum rebuild: Breadth improved, suggesting last week’s correction may have reset positioning rather than ended the cycle.

What to Watch Next

CPI (Friday): Core 0.3% keeps the soft-landing script alive; 0.4% or higher revives “higher for longer” fears.

Fed path: Focus shifts to how the Fed communicates easing under political pressure, Bessent/Waller commentary in view.

Oil vs Equities: If crude holds > $60, watch for renewed inflation-hedge flows into Energy vs. Tech rotation.

China Trade Tone: Any follow-through from the Trump-Xi meeting could anchor risk sentiment into month-end.

US IG Credit Wrap: Risk-On Into CPI, Oil Pops; OAS Still Glued to Low-50s (IG OAS ≈52.1 bp)

IG spreads held firm as equities rallied, oil spiked on Russia sanctions, and rates cheapened ahead of CPI. Despite the macro noise, the index OAS remains classic carry, anchored in the low-50s and refusing to chase cross-asset volatility.

Where We Sit (from today’s chart)

IG OAS: ~52.1 bp (last 52.08)

5-yr avg: ~61.9 bp → ~10 bp inside

Cycle tights: ~46.1 bp → ~6 bp above

2022 wides: ~111.2 bp → ~59 bp tighter

Read: Still mid-channel between cycle tights and the 5-yr mean—comfortably “normal,” not stretched.

Tape & Macro Overlay

Equities: Risk appetite rebuilt (S&P +0.6%) on cooling US-China tension and confirmation of a Trump–Xi meeting; Big Tech led.

Rates/FX: USTs sold off modestly (10-yr ~4.00%, +6 bp; 2-yr ~3.49%, +5 bp). USD steady; gold stabilized.

Commodities: WTI +5.4% (~$61.6) on sanction headlines; inflation optics worsened but didn’t dent credit.

Policy: Market still leans toward two Fed cuts this year (Oct & Dec); CPI Friday is the near-term arbiter.

Positioning feel: Vol spikes are being faded; drawdowns treated as add-risk windows, constructive for primary and secondaries.

Mapping to IG

Base case: The 50–60 bp corral remains the center of gravity. A calm CPI keeps the grind-tighter bias toward high-40s; a hot print likely just pauses the grind rather than triggers disorder.

Financials: Senior hold firm; friendlier capital-rules chatter offsets the rate backup. Supply windows open, new issues well-absorbed.

Cyclicals (Energy/Materials/Industrials): Oil pop is credit-positive for Energy; broader cyclicals two-way with tariff/export-tech noise, but BBB/A compression persists.

Defensives (Staples/HC/REIT IG): Rich but stable carry dominates unless rates rally hard.

Tech/Comms: Equity headlines noisy, balance-sheet strength keeps spreads insulated.

Risk Markers to Watch

CPI (Fri): Core 0.3% = carry on. 0.4–0.5% risks a brief rates tantrum and stalls tightening momentum.

Oil path: Sustained >$60 with product draws nudges breakevens up; watch beta sleeves for any cheapening.

China/trade tone: Follow-through on Trump–Xi could underpin risk and reopen Asia-linked issuance.

Regional-bank vibe: A decisive break back above ~60 bp OAS would be the early systemic tell, low probability near term.

Even with stocks higher, oil spiking, and yields up, US IG is still in carry mode. Barring a hot CPI or policy shock, expect OAS to hug the low-50s and grind, with any risk-off widening shallow and fadeable.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.