Macro Regime Tracker: Crude Risk

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

We are seeing fairly significant geopolitical risk get priced into markets. I posted a redundancy plan breakdown for crude in the chat earlier today:

Here is the original pdf if you want to review it now:

Main Developments In Macro

US told Israel it won't participate in an Iran strike – Axios

Trump: Entire admin has been directed to negotiate with Iran

Lutnick: Had 25,000 sign-ups for Gold Card website in 15 hours

Lutnick: China tariff pause likely won't be extended

Lutnick: Launched Gold Card Visa website last night

Lutnick: As magnets flow, we'll drop our countermeasures

Greer: London agreement limited to current situation

Greer: Found way for China to expedite magnets to US

US Trade Representative Jamieson Greer speaks on Fox News

Bessent says 'we'll see' if China tariff pause ends in August

Trump: Israeli strike could 'blow it'

Trump: Don't want Israel going into Iran

Trump: Told US staff to leave in case something happens

Trump: Pakistan coming to negotiate next week

Trump: Israeli strike not imminent but looks like it could happen

Trump implies action if other cities 'gearing up'

Treasury’s Bessent says he doesn't think tariffs are taxes

Bessent says EU has been 'very intractable' in trade talks

Trump: Might go up with tariff in not too distant future

Trump on China: It's going to happen fairly soon

Trump: Xi and I had a long talk about it

Trump: China deal will open China up

Trump: Love China, respect Xi a lot

Trump: China is very strong on electric

Trump: If China's using coal, we should use coal

Bessent: My view is that over 10 years the deficit will decrease

Bessent: There's varying scoring on tax bill deficit impact

Trump: Told Powell to raise rates if there's inflation in 1 year

Trump: All Powell has to do is lower it

Trump: If lower by two points, pay less

Trump: If we lower by one point, pay one point less

Trump: I like long-term cheap debt

Trump: Would like to get interest rates lowered

Trump: Not going to fire Powell

Trump: Don't like oil prices have gone up

Trump: Oil prices have gone up a little bit

Hegseth: Marines in LA are not authorized to fire warning shots

Trump: Terminating California EV mandate

Trump: Signing bill on California auto regulation

Bessent: International economic system failed American worker

Bessent: Signed two more Iran sanction orders this morning

Bessent: US has implemented 'maximum' pressure strategy on Iran

Bessent: 'Quite satisfied' with tax bill healthcare portions

Bessent: Business chiefs tell me capex ready to go post-Tax Act

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income and Currencies

You can find the educational primer and video explanation of these models here: LINK

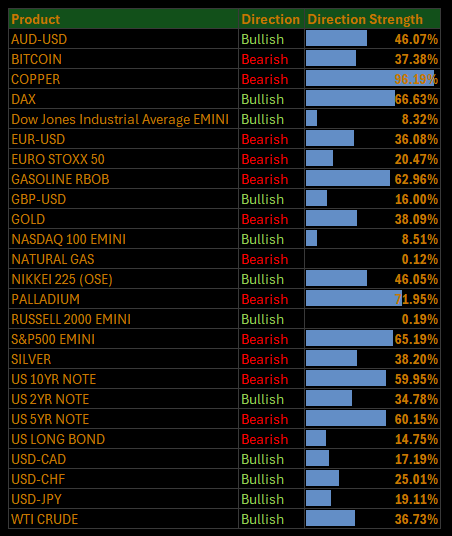

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

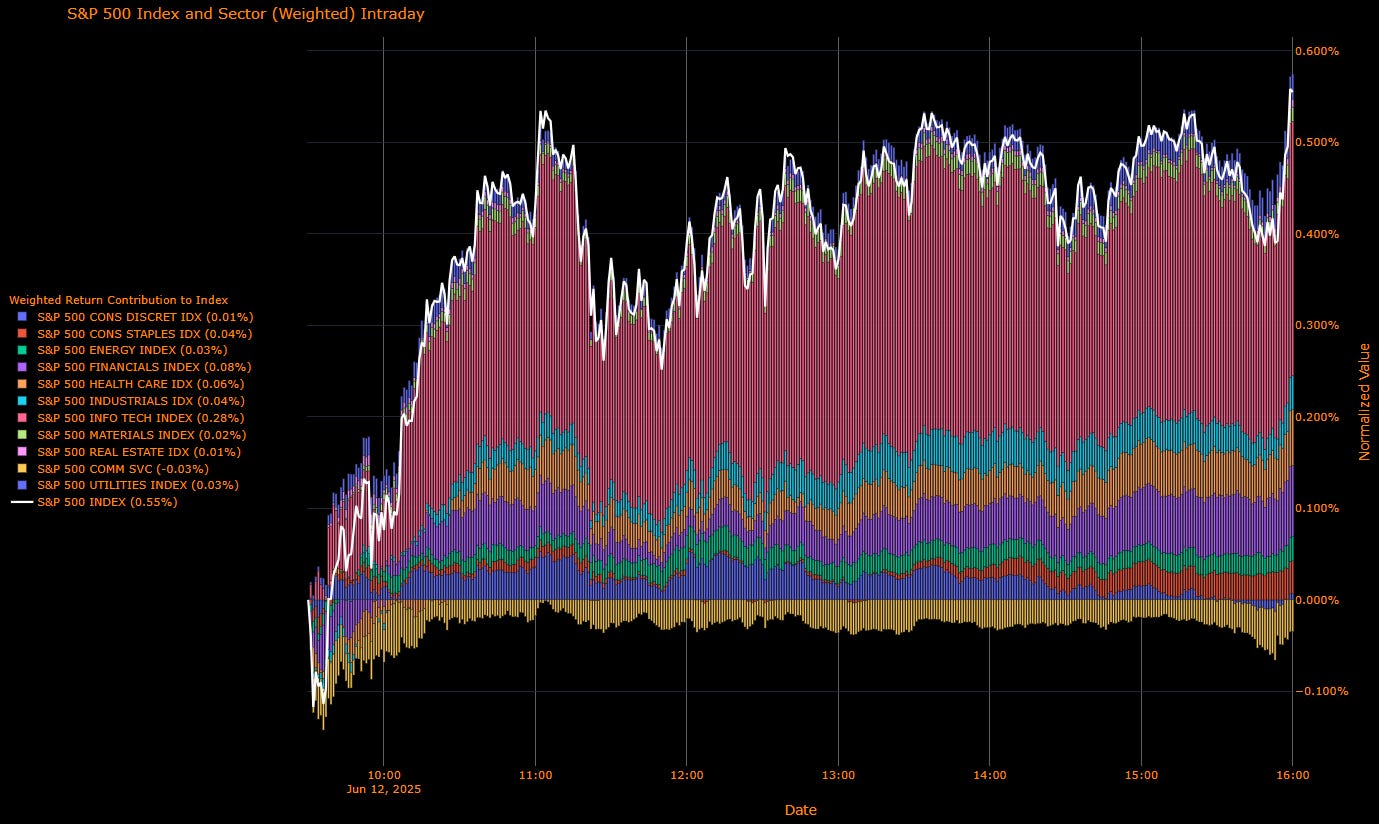

S&P 500 Rises 0.55%, Led by Tech and Financials While Communications Lags

Sector-by-Sector Contribution Snapshot (Weighted Impact to Index)

Information Technology (+0.28 pp) – Top contributor as optimism in AI and cloud-related earnings (e.g., Oracle) lifted sentiment.

Financials (+0.08 pp) – Boosted by easing rate pressures and strong Treasury demand.

Health Care (+0.06 pp) – Steady contributor amid stable inflation outlook and improving capex sentiment.

Industrials (+0.04 pp) – Gained modestly, benefiting from soft inflation and rising capital investment narratives.

Consumer Staples (+0.04 pp) – Defensive bid continued despite broader risk-on tone.

Energy (+0.03 pp) – Supported by oil volatility and renewed geopolitical tension.

Utilities (+0.03 pp) – Defensive flows persist, though trailing broader gains.

Materials (+0.02 pp) – Lifted slightly by easing dollar and sentiment tied to China trade.

Consumer Discretionary (+0.01 pp) – Flat-to-positive, as traders rotate out of cyclicals cautiously.

Real Estate (+0.01 pp) – Minor contribution amid bond yield compression.

Communication Services (–0.03 pp) – Only drag on the index, led lower by risk-off positioning in select media and telecom names.

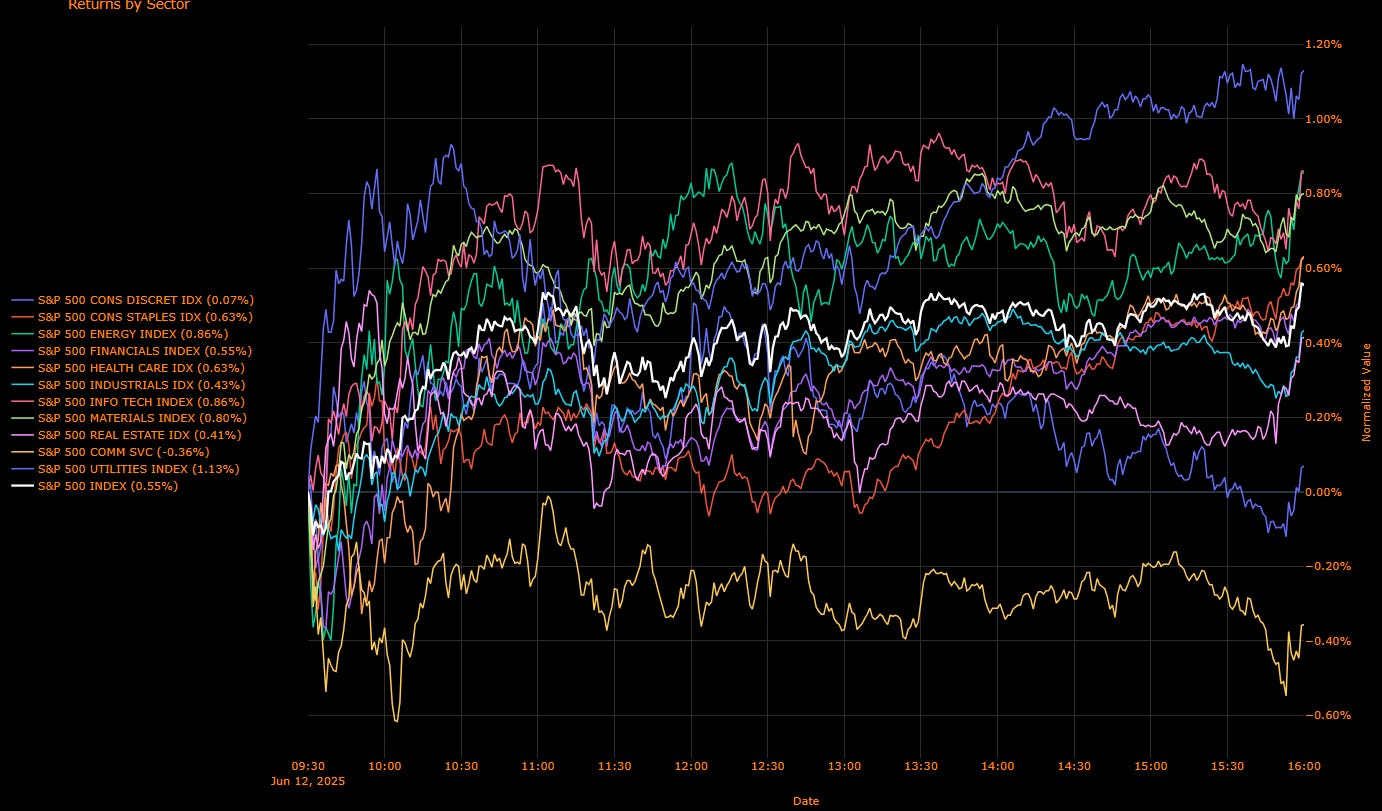

Sector-by-Sector Performance Snapshot (Unweighted Returns)

Utilities (+1.13%) – Top performer as investors embraced rate-sensitive, high-yielding sectors.

Energy (+0.86%) – Traded higher as Mideast risks intensified and long-end yields retreated.

Information Technology (+0.86%) – Solid earnings momentum (e.g., Oracle) pushed sector leadership.

Consumer Staples (+0.63%) – Broad gains on defensive positioning and stable consumer margins.

Health Care (+0.63%) – Benefited from strong managed care performance and capex optimism.

Financials (+0.55%) – Supported by bond rally and soft inflation encouraging easier Fed stance.

Industrials (+0.43%) – Helped by improved forward capex expectations and declining input costs.

Materials (+0.41%) – Stronger alongside weaker USD and trade détente hopes.

Real Estate (+0.41%) – Rally continued with falling yields and sticky rent pricing.

Consumer Discretionary (+0.07%) – Underperformed broader move as retailers remain cautious.

Communication Services (–0.36%) – Only declining group, dragged by weak streaming/media sentiment.

Macro Overlay

The S&P 500 closed up 0.55%, marking its highest finish since February 20. Gains were broad-based but led by Information Technology and Utilities, as markets absorbed soft inflation data and a blockbuster $22B long-end (30yr) Treasury auction. The muted May PPI print (+0.1%) reinforced expectations that the Fed can afford to remain on hold or cut if necessary.

President Trump’s repeated calls for lower rates, paired with dovish positioning and a falling equity risk premium, boosted rate-sensitive sectors. Meanwhile, geopolitical tensions escalated in the Middle East with the US evacuating non-essential embassy personnel amid Iran-Israel risks, lending support to Energy stocks.

Sentiment also benefited from strong corporate updates, with Oracle hitting record highs and renewed corporate capex signals from firms like Meta and Micron. However, insider selling reached levels last seen in November, suggesting some caution near the market’s highs.

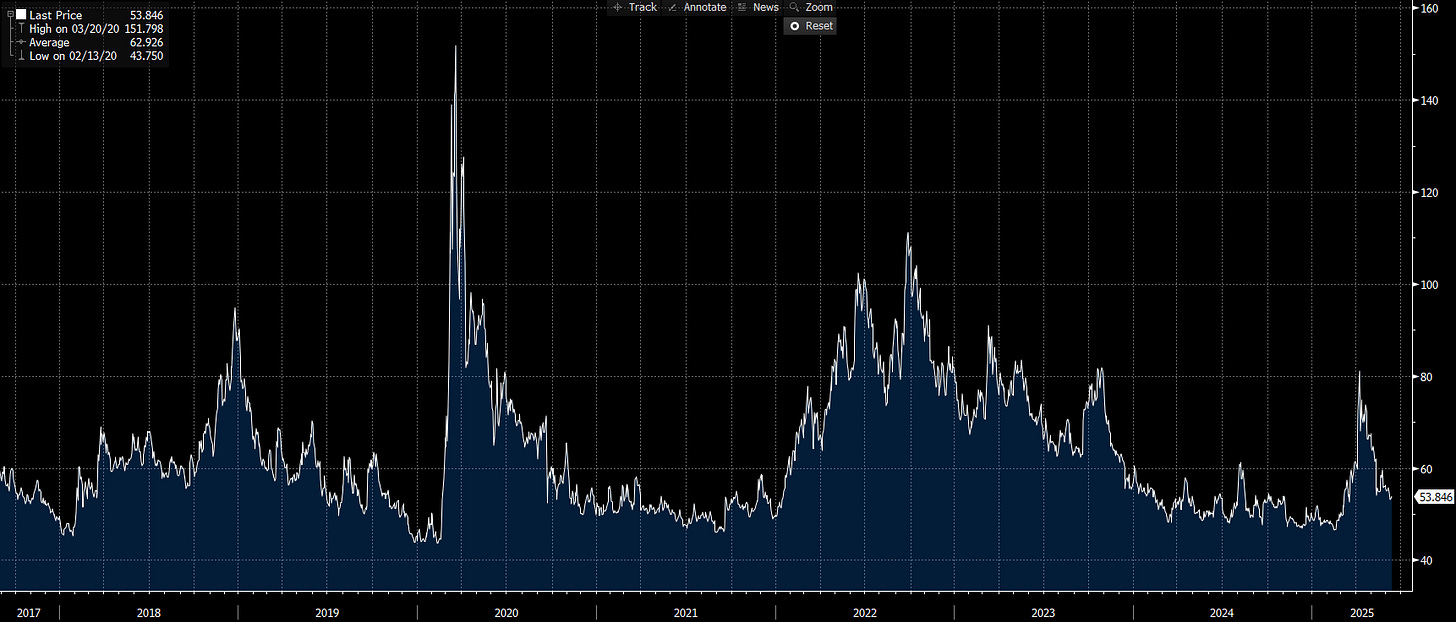

US IG Credit Wrap — Spreads Tighten to 53.85 bp Amid Soft Inflation and Strong Treasury Demand

Current Spread: 53.85 bp (▼ modest tightening), below the 5-year average of ~62.93 bp. Levels remain within a historically stable zone, signaling continued investor comfort despite persistent macro and geopolitical noise.

Credit Context

< 60 bp: Stable, duration-friendly range supporting insurance and liability-driven investment (LDI) strategies.

60–70 bp: Neutral-to-cautious positioning recommended amid tariff uncertainties and macroeconomic volatility.

> 90 bp: Significant market distress—currently unlikely without a major escalation in geopolitical or macroeconomic shocks.

Macro Overlay

Treasury strength: A strong $22B long-bond auction eased concerns about fiscal crowding out. Yields at the long end declined sharply, reinforcing the duration bid.

Inflation still tame: May’s PPI rose just 0.1%, undershooting expectations and underscoring a multi-month stretch of soft inflation. This keeps the Fed on hold—and the door open to easing if needed.

Fed policy inertia: With both CPI and PPI prints coming in below forecast, markets are increasingly pricing in at least one rate cut later this year. This has provided a backstop to duration-heavy credit.

Geopolitical risk: Middle East tensions remain elevated, but have yet to materially impact credit pricing. Market focus remains on Oman-hosted US–Iran nuclear talks this weekend.

Bottom Line

Credit markets continue to lean cautiously optimistic, with IG spreads tightening to 53.85 bp—the lowest levels since early April. The move reflects a benign inflation backdrop, robust Treasury demand, and resilient equity sentiment. Despite geopolitical flare-ups and active insider selling in equities, credit remains well-behaved.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Short-End Rates Wrap — Cumulative Easing Deepens to ≈ –108.5 bp; Market Now Sees Three Cuts by Year-End

Key Takeaways (Latest OIS-Implied Pricing)

First-Cut Timing:

18-Jun-25: All but ruled out, with only a 0.4% probability for a 25 bp cut.

30-Jul-25: Market pricing 22.4% probability for the first cut — still cautious.

17-Sep-25: Conviction building, now 69.2%, suggesting markets see this as the likely policy pivot point.

Front-Loaded Easing Path (2025):

10-Dec-25: Implied rate at 3.807%, suggesting –52.3 bp of cumulative easing (~2 cuts).

Full-Year 2025: Market now pricing ~2 full cuts between July and December.

Longer-Term Easing Expectations (2026):

28-Oct-26: Implied rate at 3.245%, signaling cumulative cuts of –108.5 bp from the current effective rate of 4.33%.

Pricing reflects ~4 full 25 bp cuts by Q4 2026, with terminal rate expectations drifting lower as inflation cools and policy patience extends.

Macro Context

Markets continue to lean dovish amid:

Soft inflation prints: May PPI came in at just +0.1% m/m, following a similarly tame CPI earlier this week. There’s growing confidence the Fed can sit tight or begin easing later this year.

Strong Treasury demand: A well-bid $22B long bond auction helped anchor front-end volatility and reinforce confidence in US duration, even amid deficit concerns.

Geopolitical backdrop: Elevated tension in the Middle East (US–Iran–Israel dynamic) hasn’t yet destabilized rate markets, though it's contributing to mild bid into duration and gold.

Fed outlook: Trump reiterated frustration with the pace of Fed cuts but also confirmed he won’t fire Chair Powell. Meanwhile, swap markets are pricing ~50–55 bp of cuts by year-end 2025, and nearly 110 bp by end-2026.

Bottom Line

OIS pricing reflects growing confidence in easing, with the first meaningful cut now firmly expected by September, and ~2 full cuts priced by December. Beyond that, markets expect a measured, extended easing cycle through 2026. The combination of benign inflation, constructive Treasury flows, and subdued front-end volatility is keeping rate expectations anchored.

Tactical Portfolio

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.