Macro Regime Tracker: Duration Risk?

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I spent time breaking down the macro watchlist I use, and you can download it for free here:

I also spent time explaining my views on the credit cycle today on this twitter spaces:

https://x.com/Globalflows/status/1983895466585821446

Finally, here is the most recent trade I opened:

As always, all the systematic models and strategies are updated below. Thanks

Main Developments In Macro

US Macro & Policy

SOLOMON SEES NO THREAT TO DOLLAR AS WORLD’S RESERVE CURRENCY

SOLOMON SAYS CHANCE OF A US RECESSION IN NEAR-TERM IS LOW

SOLOMON SAYS PEOPLE ARE WORRIED ABOUT LEVEL OF US DEBT

SOLOMON: WE SHOULD STRIVE FOR CENTRAL BANK INDEPENDENCE

BESSENT: APPLAUD 25 BPS FED CUT, BUT DON’T LIKE LANGUAGE

BESSENT: IMAGINE WE WOULD HAVE FED CHAIR CANDIDATE BY XMAS

BLOOMBERG DOLLAR SPOT INDEX RISES 0.4% TO HIGHEST SINCE AUG. 1

EIA SAYS US NATURAL-GAS STOCKPILES ROSE 74 BCF LAST WEEK

META LOOKS TO RAISE AT LEAST $25 BILLION FROM BOND SALE

FHFA’S PULTE POSTS ON X ABOUT FANNIE MAE LAYOFFS

PULTE: FANNIE MAE EXECUTED LAYOFF OF OVER 62 PEOPLE TODAY

MILLENNIUM RAISING $5 BLN TO TARGET PRIVATE-MARKET BETS

THUNE EXPECTS SHUTDOWN TALKS TO GET ‘EASIER’ AFTER NEXT WEEK

US–China Relations / Global Trade

XI: CHINA, US SHOULD NOT FALL INTO VICIOUS CYCLE OF RETALIATION

XI SAYS CHINA, US SHOULD MAINTAIN COMMUNICATIONS

XI: CHINA, US NEED TO REFINE, FOLLOW UP WORKS ASAP

XI SAYS CHINA, US COULD EXPAND COOPERATION LIST: XINHUA

CHINA TO WORK WITH THE US TO PROPERLY RESOLVE TIKTOK ISSUES

CHINA: US EXTENDS SUSPENSION OF 24% RECIPROCAL TARIFF FOR 1-YR

CHINA TO SUSPEND EXPORT CONTROL ANNOUNCED ON OCT 9 FOR 1 YEAR

CHINA: US TO SUSPEND 50% ENTITY LIST EXPORT CONTROLS FOR A YEAR

TRUMP: CHINA TO BEGIN PROCESS OF PURCHASING AMERCIAN ENERGY

TRUMP: LARGE SCALE DEAL MAY TAKE PLACE ON O&G FROM ALASKA

BESSENT SAYS CHINA TO BUY 12M METRIC TONS OF SOYBEANS THIS YEAR

BESSENT: CHINA DEAL SIGNATURES POSSIBLY NEXT WEEK

Trump–Xi Meeting Receives Skeptical Market Reviews: Macro Squawk

Europe – Inflation, Growth, and ECB Policy

ECB PRESIDENT LAGARDE SPEAKS IN RAI1 INTERVIEW

LAGARDE: ECB IS IN A GOOD PLACE

LAGARDE: INDICATORS OF CORE INFLATION CONSISTENT WITH 2% GOAL

LAGARDE: US TRADE DEAL, CEASE FIRE HAVE MITIGATED DOWNSIDE RISK

LAGARDE: GLOBAL ENVIRONMENT IS LIKELY TO REMAIN A DRAG

LAGARDE: DIVERGENCE OF EXTERNAL, INTERNAL DEMAND TO PERSIST

ECB NOT PRE-COMMITTING TO PARTICULAR RATE PATH

ECB DECISIONS TO BE BASED ON INFLATION OUTLOOK, RISKS AROUND IT

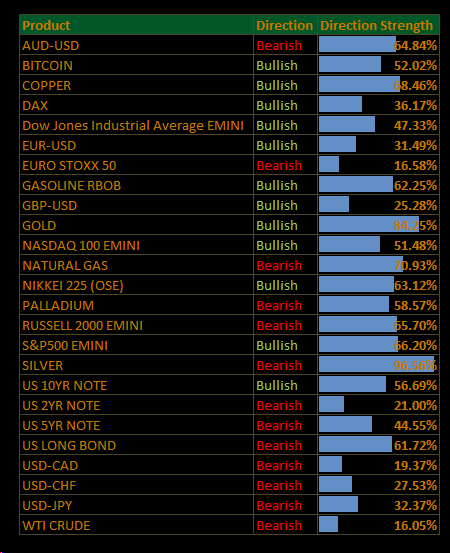

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data,

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

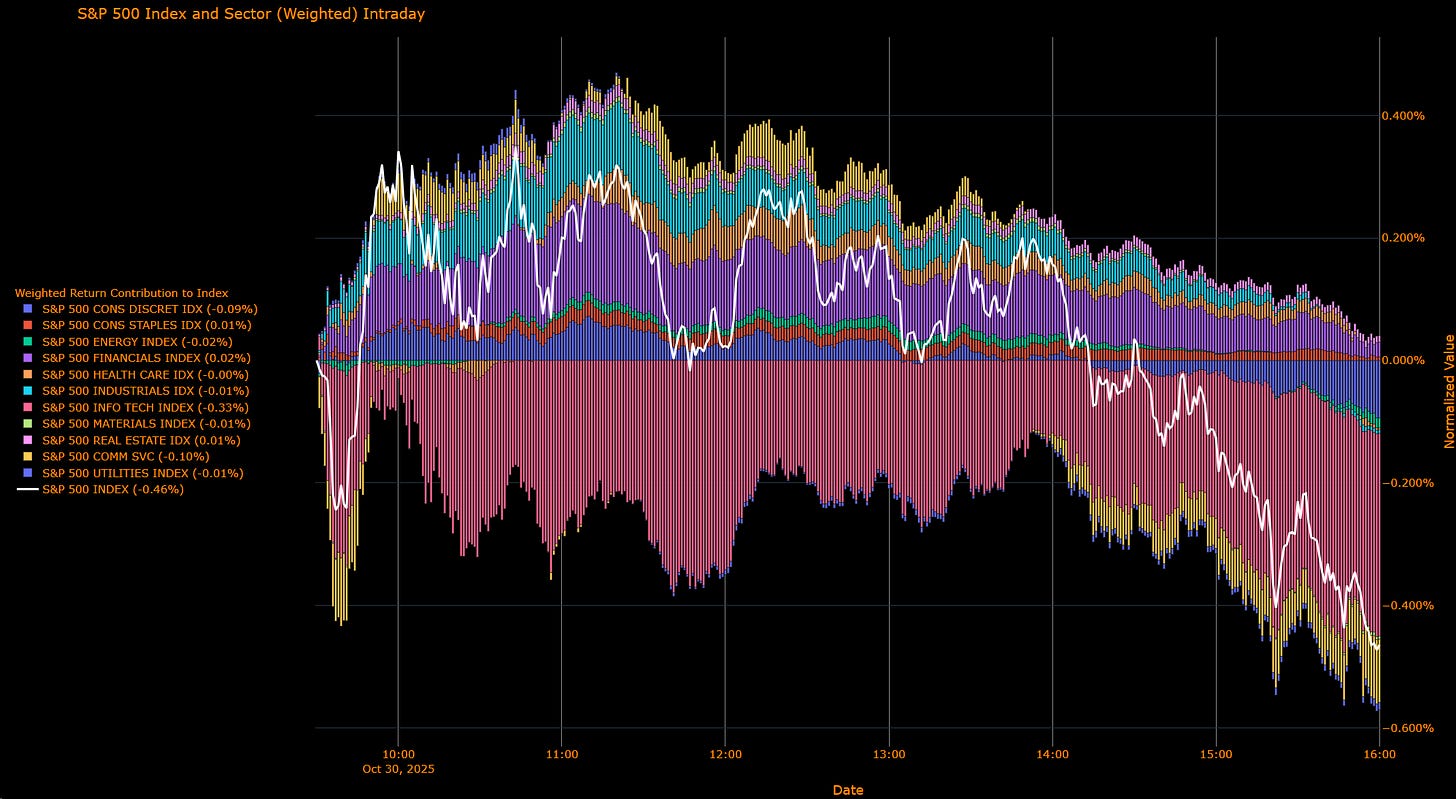

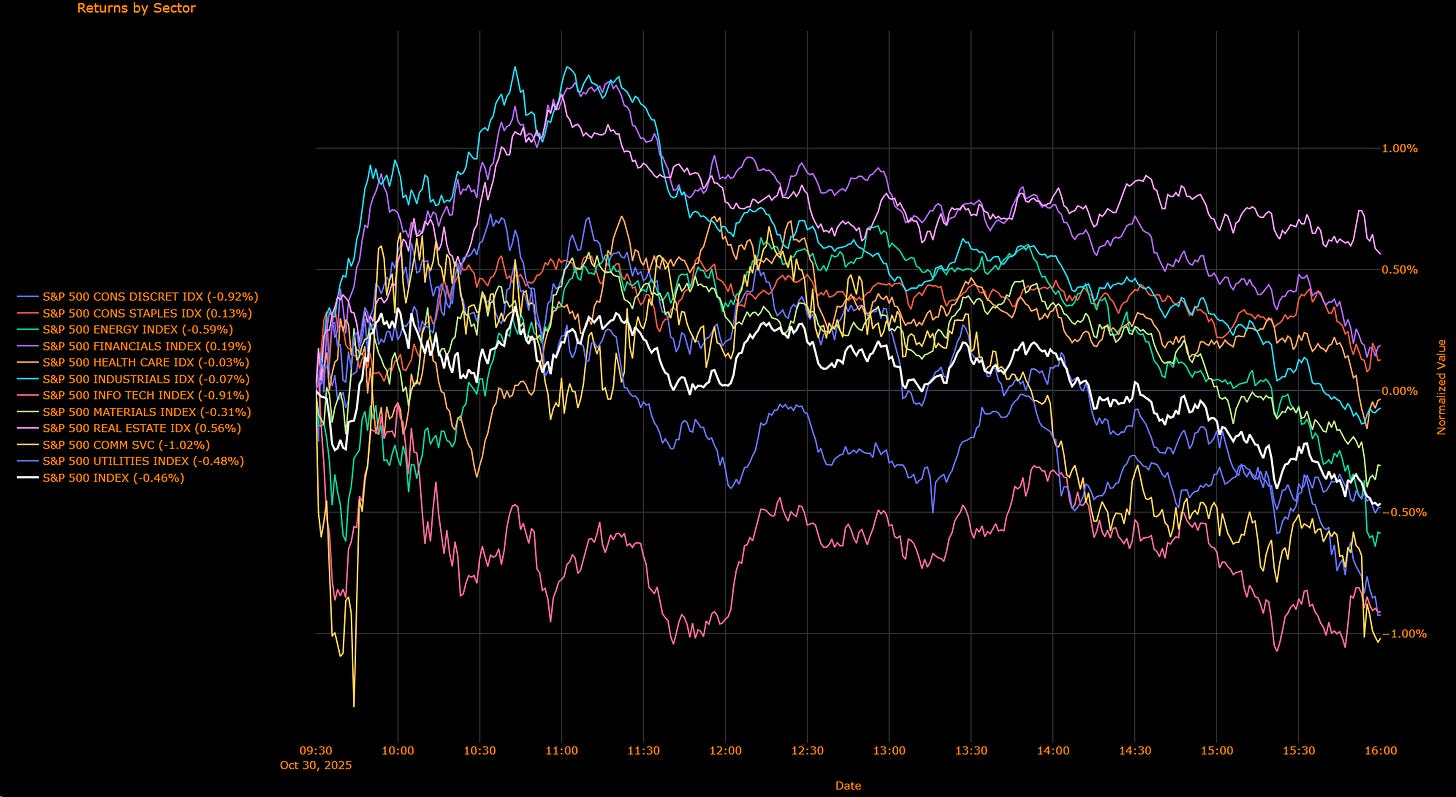

US Market Wrap: Mega-Cap Giveback, Breadth Soft; S&P −0.46%

A tech-led pullback and a firmer dollar knocked the index lower as the Fed’s tone nudged the market toward a slower easing path. AI-capex headlines (Meta) hit leadership, while defensives were mixed and rate-sensitives only partially cushioned the tape.

Sector Attribution

Weighted return contribution (Index −0.46 pp)

Drags: Info Tech −0.33 pp, Comm Svcs −0.10 pp, Cons Disc −0.09 pp, Energy −0.02 pp

Offsets: Financials +0.02 pp, Real Estate +0.01 pp, Staples +0.01 pp

Others ≈ flat to −0.01 pp (Health Care, Industrials, Materials, Utilities)

Unweighted performance (breadth)

Laggards: Comm Svcs −1.02%, Cons Disc −0.92%, Info Tech −0.91%, Materials −0.31%, Energy −0.59%, Utilities −0.48%, Industrials −0.07%

Leaders: Real Estate +0.56%, Financials +0.19%, Staples +0.13%, Health Care −0.03%

The index decline was overwhelmingly a mega-cap Tech/Comm/Discretionary story. Breadth was negative, but REITs/Staples/Financials posted modest gains, consistent with stable rates and a mild quality bid, too small to offset Tech’s drag.

Macro Overlay

Policy/Rates: Powell’s messaging trimmed near-term cut odds; 10y ~4.09%, 2y ~3.61%. The guidance implies slower, not smaller, easing, supportive for credit, neutral-to-headwind for long-duration equities.

FX/Commodities: USD at a 3-month high; WTI ~$60 (soft), helping keep inflation anxiety muted.

Earnings/AI: Capex escalation across Big Tech is testing risk appetite near stretched valuations; flow into AI remains thematic, but leadership concentration raises fragility.

The Read-Through

Leadership risk resurfaced: When Tech stumbles, the index follows, today’s −0.46% came with −0.33 pp from Info Tech alone and further drag from Comm/Disc.

No stress signal from cyclicals/credit: REITs and Financials green on the day and IG spreads steady suggest liquidity remains ample; this is rotation/de-risking, not a funding event.

Macro still Goldilocks-tilted, but narrower: Growth resilient, inflation contained, liquidity OK, yet USD strength + tech capex angst compress participation.

What I’m Watching

Fed speak: Any step toward a December “skip”.

Megacap guidance durability: Cloud/AI monetization vs capex burn, does margin math improve?

Breadth repair: Can Financials/Staples/REITs leadership broaden to Industrials/Materials, or does weakness rotate back into small caps?

Final Word

The tape is pausing, not breaking. With policy gliding toward slow-motion normalization and rate vol contained, the path of least resistance is range-bound with factor churn. Until breadth repairs, the index remains tactically vulnerable to additional mega-cap headlines, but systemic signals (rates, credit, oil) still point to a soft-landing baseline.

Spreads Hold the Line; Carry Still Dominates (IG OAS ≈52.1 bp)

US IG credit stayed calm despite a wobble in mega-cap tech and a firmer dollar. The Bloomberg US IG OAS prints ~52.1 bp, little changed, and remains in the lower quartile of its five-year range. The tape continues to say “carry first, volatility later”: funding is ample, defaults contained, and macro uncertainty is being absorbed without spread stress.

Where We Sit (from today’s chart)

IG OAS: ~52.1 bp (last 52.07)

5-yr average: ~61.9 bp → ~10 bp inside

Cycle tights: ~46.1 bp → ~6 bp above

2022 wides: ~111.2 bp → ~59 bp tighter

Spreads remain comfortably inside the five-year mean and still within touching distance of the cycle tights. That positioning is consistent with normalized liquidity, compression in idiosyncratic risk premia, and a market willing to clip carry while waiting out policy clarity.

Macro & Tape Overlay

Fed/Policy: The Fed’s tone trimmed near-term cut odds and nudged the dollar higher, but the guidance didn’t introduce a credit-negative shock. Slower, not smaller, easing remains the message, which IG can live with.

Equities: A −1% S&P day led by AI capex angst (Meta) hit breadth but not credit; high-quality balance sheets and robust primary reception (jumbo prints clearing) underpin IG resilience.

Rates/FX: 10y UST ~4.09%, 2y ~3.61%, USD at a 3-month high, mildly restrictive but stable; spread beta to these moves remains low as long as vol stays contained.

Commodities: WTI ~$60 keeps inflation anxiety muted and cushions Energy IG; gold firmer is more a rates/FX tell than a credit one.

Mapping to IG Credit

Fair-value band: 50–55 bp remains the “carry equilibrium.”

Path to the 40s: Requires either softer labor + steady disinflation (pulling the first ’26 cuts forward) or another leg down in rate vol.

What widens us: A hawkish “skip” signal into December, a disorderly USD spike, or a sharp oil reversal >$70 that jars inflation expectations.

Risk Markers to Watch

Fed speak & QT hints: A cut without balance-sheet clarity could nudge OAS toward 55–58; explicit QT-endgame talk would likely richen spreads.

Equity breadth: Persistent mega-cap narrowness is fine until it isn’t, credit will care only if it morphs into broad risk-off or funding stress.

Primary market tone: Keep an eye on order multiples and concessions; any slippage there is the earliest, cleanest tell.

Credit’s calm persists. IG OAS ~52 bp says the market still believes in a slow-motion soft landing with plentiful liquidity. Expect sideways-to-grind-tighter price action inside 50–55 bp, with dips toward ~55–58 bp likely to be bought unless the Fed meaningfully re-prices the front end or equities’ pullback turns systemic. Carry remains king.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.