Macro Regime Tracker: Equities Making Their Run

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

I have been laying out the bullish view of equities for some time now. We are now seeing the realization of it as ES is almost at an all time high and the Russell outperforms today. See the original report here:

The most up-to-date views on bonds are here:

Market participants were extrapolating the downside in equities so much on short term geopolitical that they forgot how much money is in the actual system. As I have said, when the ARKK ETF is rallying, you know that there is money in the system. Cathie Wood always buys the highest risk consensus bets on the far end of the risk curve.

The GDP print today came in negative but you will notice that personal consumption remain positive with prices aceelerating marginally.

Now consensus is expecting core PCE to come in at 2.6% tomorrow. This is the first stage of inflation beginning to reflect the lack of Fed restrictiveness.

Main Developments In Macro

Federal Reserve Commentary & Policy Direction

Powell:

“Tariff-driven inflation remains a big question”

“It’s hard to predict how tariffs will show up in inflation”

“We’re in a strong economy — no need to rush rate cuts”

“We won’t save money by ending interest payments to banks”

“Discount-window modernization is under review”

Collins (Boston Fed):

“July probably too early for rate cut”

“Fed has time to carefully assess incoming data”

Daly (San Francisco Fed):

“The fall looks promising for a rate cut”

“Tariffs will have temporary inflation impact”

“Focused on inflation reaching 2%”

“Labor market remains solid”

Goolsbee (Chicago Fed):

“Need more clarity that tariff inflation won’t be lasting”

“Job market steady, full employment seen over past year”

“Recent inflation readings have been encouraging”

Barkin (Richmond Fed):

“Little upside to Fed moving too fast”

“Tariffs may pressure employment and inflation”

Barr (Fed Governor):

“Monetary policy is well positioned, Fed can afford to wait”

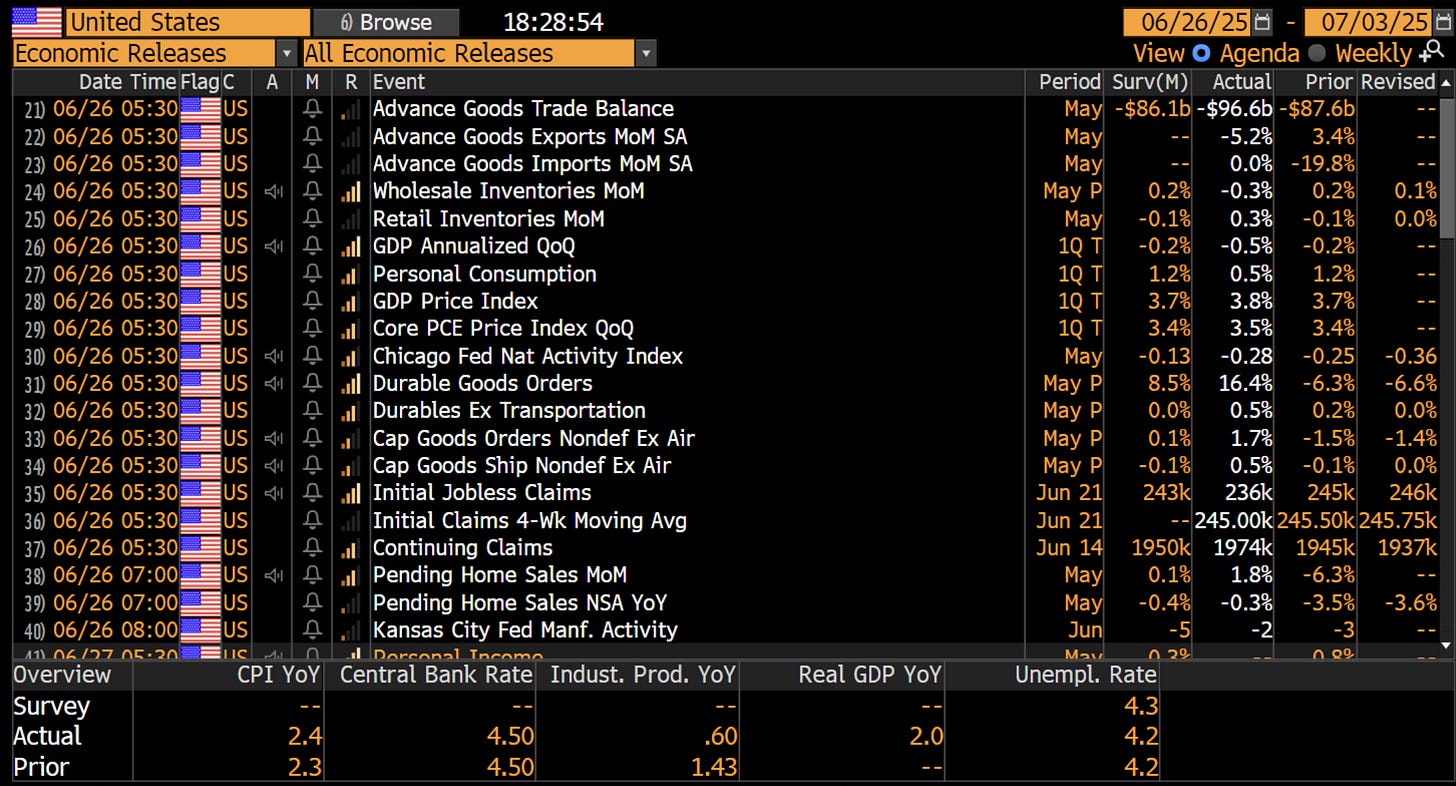

US Macro Data

GDP (Q1): –0.5% QoQ annualized (vs est. –0.2%)

Core PCE (Q1): +3.5% QoQ (vs est. +3.4%)

Jobless Claims (week of Jun 21): 236K (vs est. 243K)

Continuing Claims (Jun 14): 1.974M (vs est. 1.950M)

May Pending Home Sales:

MoM: +1.8% (vs est. +0.1%)

YoY: –0.3%

Durable Goods Ex-Trans (May prelim): +0.5% MoM (vs est. 0%)

Chicago Fed National Activity Index (May): –0.28

US Trade & Tariffs (Global Impact)

US-China:

Rare earth export deal signed; US to lift trade limits once shipment confirmed (Lutnick)

US to remove ethane export curbs after Chinese delivery

China deal signed and sealed two days ago

Nike to reduce China production and raise prices to mitigate tariff risk

US-EU:

Macron: EU will respond if US imposes 10% tariff

Von der Leyen: EU ready for a deal but assessing latest US offer

EU weighing lower tariffs to secure deal with Trump (WSJ)

Trump pressuring EU on climate rule rollbacks as part of trade talks

US-India:

Trump: “Possible deal soon”

Lutnick: “We’re near finish line”

US Domestic Tariff/Tax Policy:

Tax bill expected on Trump’s desk by July 4

Section 899 expected to be removed

July 9 flagged as soft deadline for reciprocal tariff decisions

Lawmakers to remove Section 899 from tax bill

Collins: Tariff-induced price increases already showing up

Geopolitics & US Strategic Outlook

Middle East:

US-Iran backchannel engagement reported (CNN)

Trump says uranium not moved in Iran; no talks yet scheduled

Ceasefire holds; US destroyed nuclear capabilities (Leavitt)

NATO/Defense:

Trump touts NATO defense spending deal

Leavitt: US remains firm on deterrence credibility

Trump: Strategic Petroleum Reserve refill decision pending

Trump: Major investment coming from Texas Instruments

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.