Macro Report Part 2: Equities to ATH or new lows?

How the macro regime is skewing equities

I laid out Part 1 of the Macro Report here which framed HOW to think about growth and inflation probabilities as they connect with interest rates:

The video breakdown for it can be found here:

And I did a twitter thread on broad equities here: LINK

Equities In The Macro Regime:

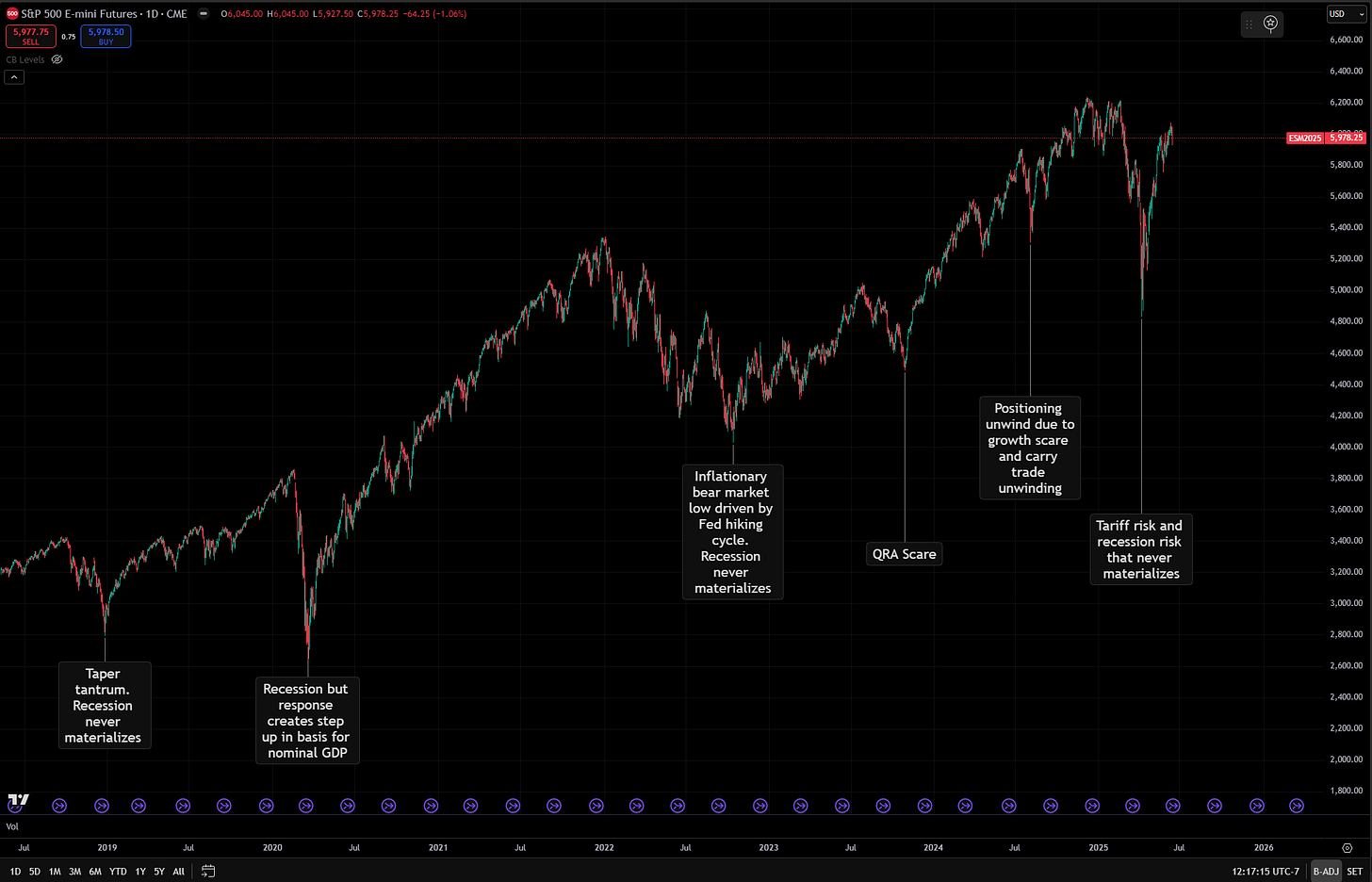

What I want to focus on here is HOW to think about the trend in equities as it relates to the macro regime. What is important to recognize is that growth and liquidity remain firmly squared to the upside right now. Why does this matter? Because it is easy to have a marginal positioning unwind in equities without a durable change in the underlying regime. For example, almost every major drawdown we have seen over the past 7 years has been extrapolated into a recession. The one recession we did get in 2020 was so short-lived because of the nature of the pandemic (lockdowns and reopenings) as well as the fiscal/monetary response.

The implication is NOT that a recession won’t ever happen but its that the current framework that Wall Street/media is using to analyze financial markets is broken.

Equities have continued to rally even as real rates are at decade-high levels. Why is this? It doesn’t have anything to do with dollar devaluation or the changing monetary system:

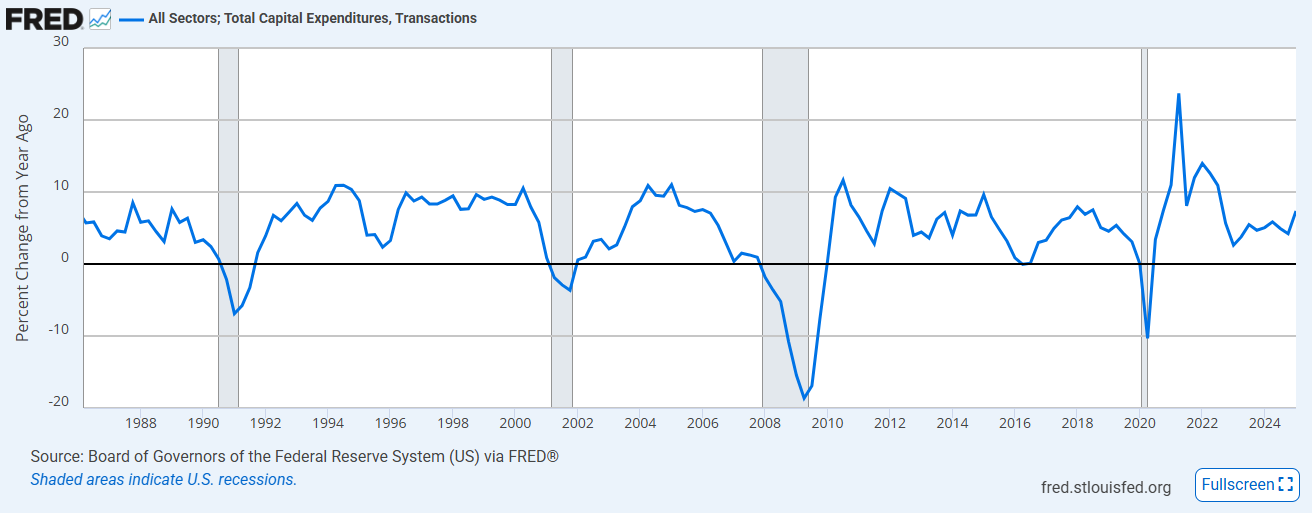

It is the simple factor that underlying growth in the economy is incredibly strong and we don’t have the same asset/liability mismatch as we did moving into the GFC. We are actually seeing so much growth that everyone is realizing they need to invest in order to keep up with the demand. When you are competing against another company, it is a race to whoever can hire, invest, and sell to consumers faster. In the same way that there is panic selling and spending cuts on the downside during recessions, there is panic on the upside to take market share.

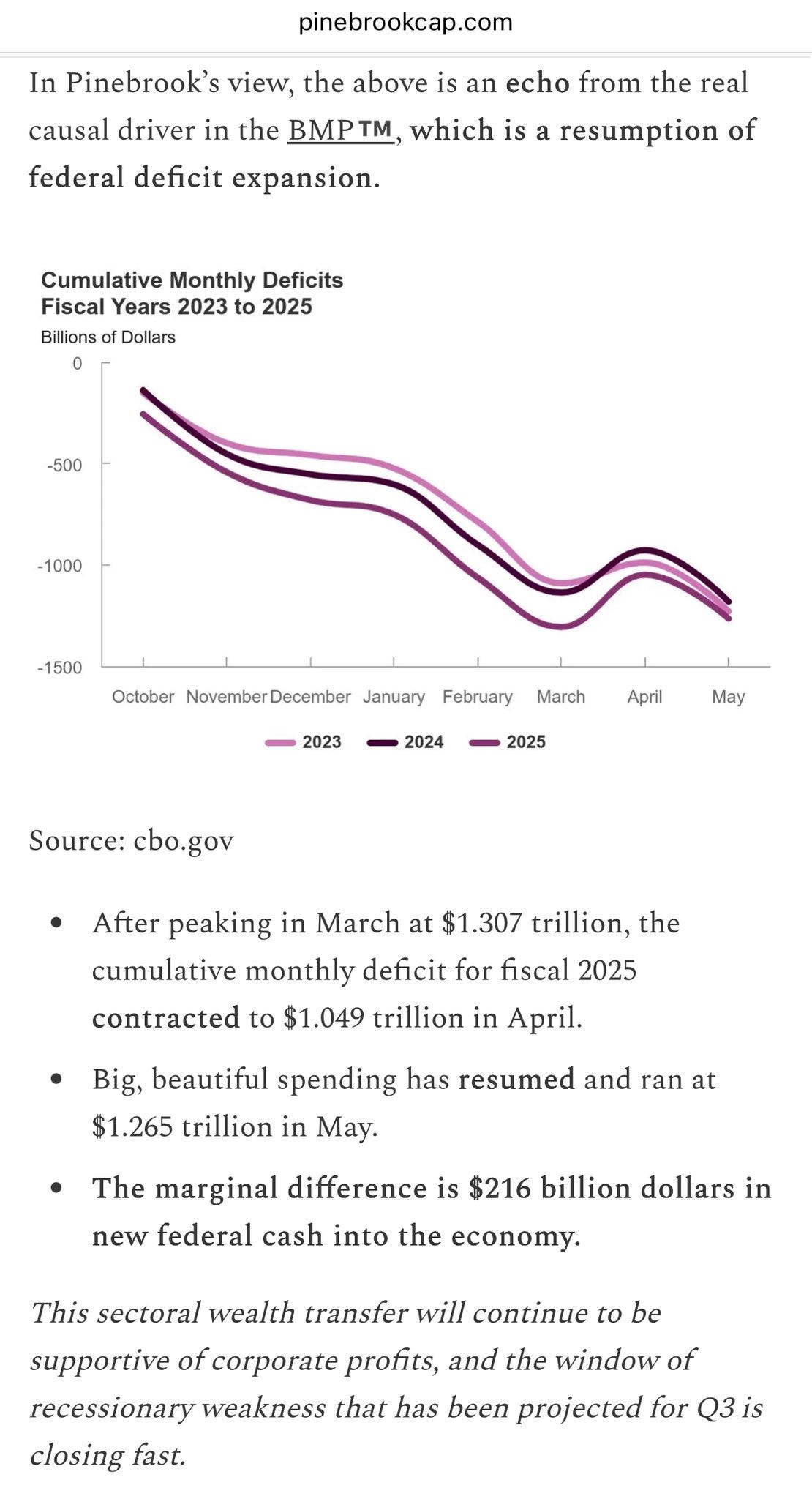

On top of this, the deficit is in full swing. The deficit has an upward impact on long-term yields in so much as it helps boost nominal GDP and adds further fuel to the fire in growth. David Cervantes laid this out in his most recent piece (I would encourage you to follow his work):

Every single thing continues to stack up in the US economy to show that a recession this year is NOT on the table. Honestly, the obsession with a recession is becoming quite strange in the financial industry as if everyone is hoping it happens so we get it out of the way. The system has never worked like this and it never will work like this.

The financial news media has turned into a vicious machine, like algos in markets, finding the most clickbait topics and words that will get you to latch onto them as a source of certainty and information despite the horrendous track record of uninformed analysis.

Geopolitical Risk?

As we ended this past week, the Israel-Iran conflict became the next event that caused short-term selling pressure in equities right before we moved into FOMC. Historically, these types of geopolitical shocks don’t cause prolonged drawdowns in US equities and this is because of the geographic and militaristic stance of the US. However, it can cause inflation like the 2022 invasion.

And don’t forget, we are still down YTD in ES (up a little bit on a total return basis)! My view is as we stabilize after the weekend risk and unwind the FOMC hedges, we will move higher in ES.

The geopolitical risk has a higher probability of making its way into food and energy prices than it does negatively impacting US growth. This is why the week ahead is actually very consequential because if the Fed makes the mistake of confirming the cuts on the forward curve OR even being dovish as a response to the CPI print and geopolitical risk, then we could begin opening some major downside for bonds.

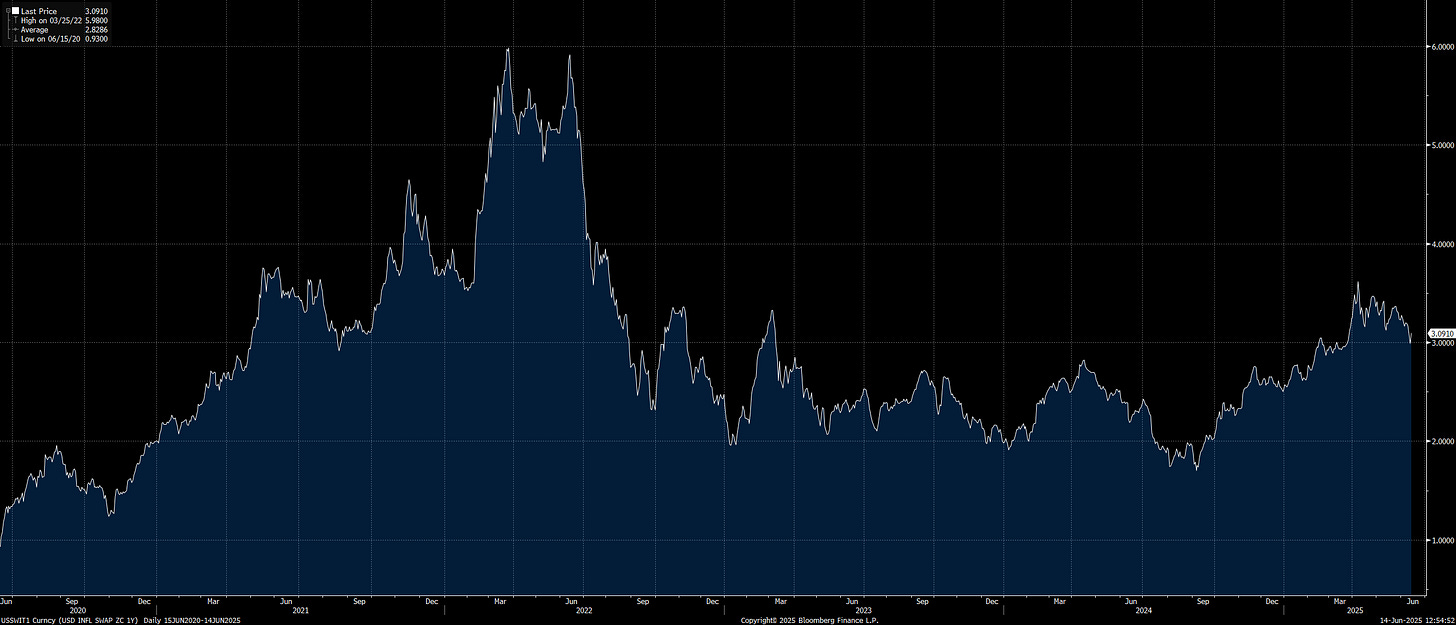

Don’t forget that 1 year inflation swaps are sitting at 3% which means if crude rallies further and a few core CPI prints come in higher for July, this could unhinge the bond market.

The positive thing about this is that we are still in a negative stock-bond correlation regime and NOT seeing equities show much sensitivity to higher rates. The implication is that stocks are likely to move higher and NOT take out their lows. However, bonds remain at risk. See the original macro report I laid out here:

Also see the geopolitical risk video I made here:

Pulling Things Together:

I believe we are coming to a point of ultimatum for the Fed. They need to make a decision about the stance they are going to take because the path they are on leads to another melt-up in equities and downside in bonds. This type of regime could set the stage for a much larger recession in the future but only when things become unsustainable in BOTH the economy and financial market. We aren’t there yet which means we need to operate in the interim tension. I believe the melt up in equities will continue until we have a full TINA effect (like 2021) and people feel stupid that they aren’t long enough. This is what is likely to come and what growth and liquidity are pointing to right now.

As always, a Pepe for the culture:

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Great piece. Thanks for the final pepe, remind me to clean my charts.

Thank you! 📈🫶