Macro Report: How Strong Is Growth and Inflation?

What are the true probabilities of a recession?

HOW To Think About Macro:

Asset markets are fundamentally driven by growth, inflation, and liquidity. These three forces are always moving, expanding or contracting with varying strength and over different timeframes. Because no one knows exactly how these drivers will evolve in the future, markets exist to let participants express their views and obtain the kind of exposure they believe aligns with their goals. Every asset is, in essence, a liquidity solution for a specific belief about how the future will unfold.

But while growth, inflation, and liquidity shape the direction of travel, the road itself is constantly being rebuilt. Markets are made up of companies, consumers, and investors who continuously update their strategies in response to the outcomes they helped create. This feedback loop reshapes the economic landscape in real time, producing new trends, dislocations, and anomalies that traditional equilibrium models often fail to capture. Shifts in policy, regulation, or technology do not just adjust the course, they alter the structure of how capital flows and risk is priced. The economy, in this view, is not a fixed machine but a living system that continuously reinvents itself.

Every price is a reflection of belief. Markets are a constant negotiation over how to interpret the present AND discount the future. But those interpretations rest on assumptions, often unspoken, about how the world works. Mistakes happen at both extremes: some traders sense when the story is wrong but cannot prove it, while others model everything with precision yet miss the regime change that breaks their framework. The ones who thrive are those who fuse measurement with meaning, never forgetting that even the most robust signal is only as useful as the narrative it fits within.

This report is built with that principle in mind. It lays out WHERE we are in the macrocycle and explores the forces shaping WHAT comes next.

Macro Report:

Main Thesis: The US economy is operating in a critical tension where inflation is compressing in a range ABOVE 2% and growth is accelerating. However, this is not creating a Goldilocks scenario where stocks and bonds are rallying because inflation risk has been rising over the last 3 months. This is impacting interest rates and equities as the Fed falls behind the curve in HOW RESTRICTIVE its stance should be.

The Fed:

The Fed continues to use a “data-dependent framework” which functionally means reacting to data and not taking into account path dependency. In other words, the Fed isn’t trying to take an overly restrictive or overly accommodative stance on financial markets. The problem with this stance is that if you are reacting to risks instead of getting in front of them, you will likely overreact when the actual risk materializes.

Since the last FOMC meeting on May 7th, the forward curve went from pricing 75bps of cuts to almost pricing 25bps of cuts (Z5 SOFR contract in the chart below). This is a massive swing in the short end of the curve and one of the main reasons for it is that consensus was laser focused on the probability of a recession due to tariffs.

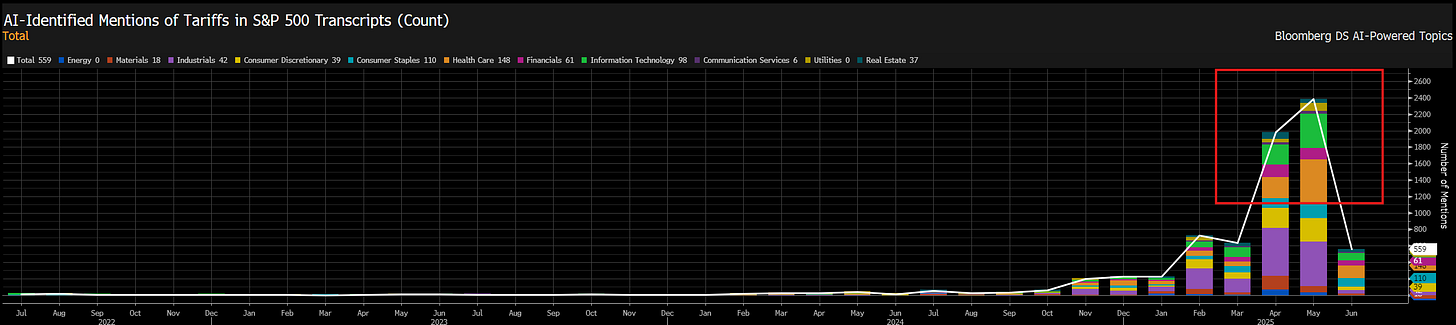

Tariff mentions in earnings transcripts went through the roof:

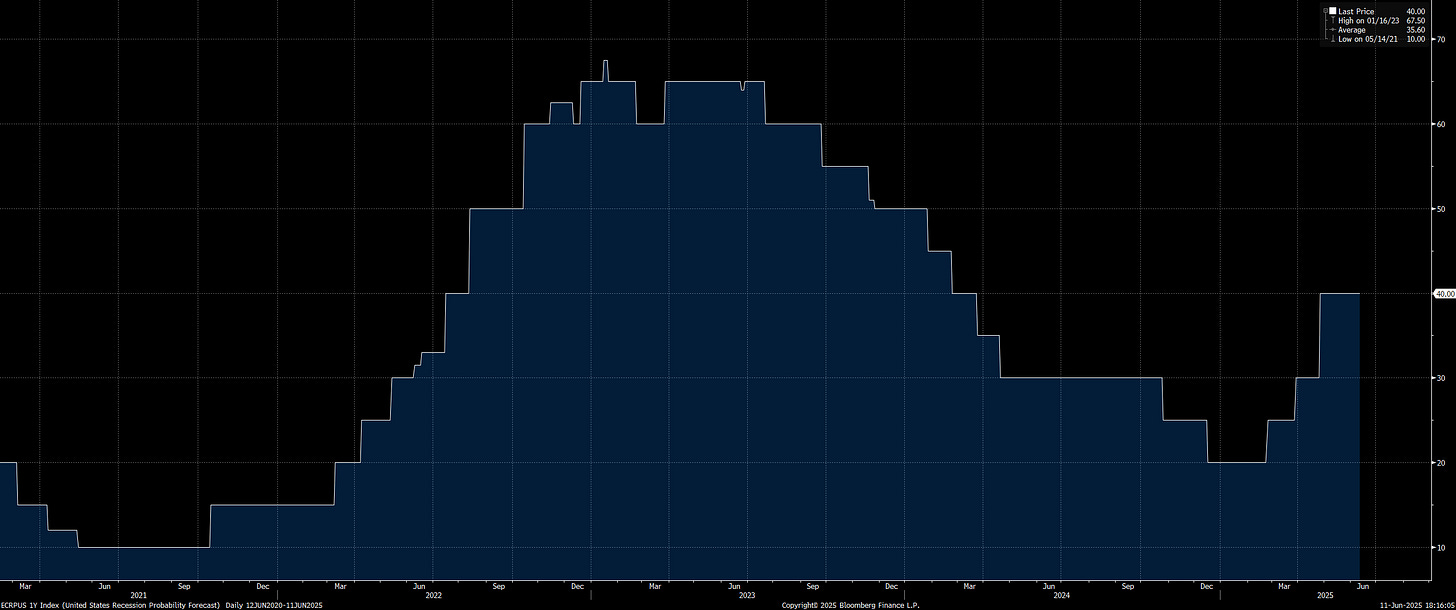

And economists set recession probabilities at 40% (a highly unrealistic projection which hasn’t even been changed yet!):

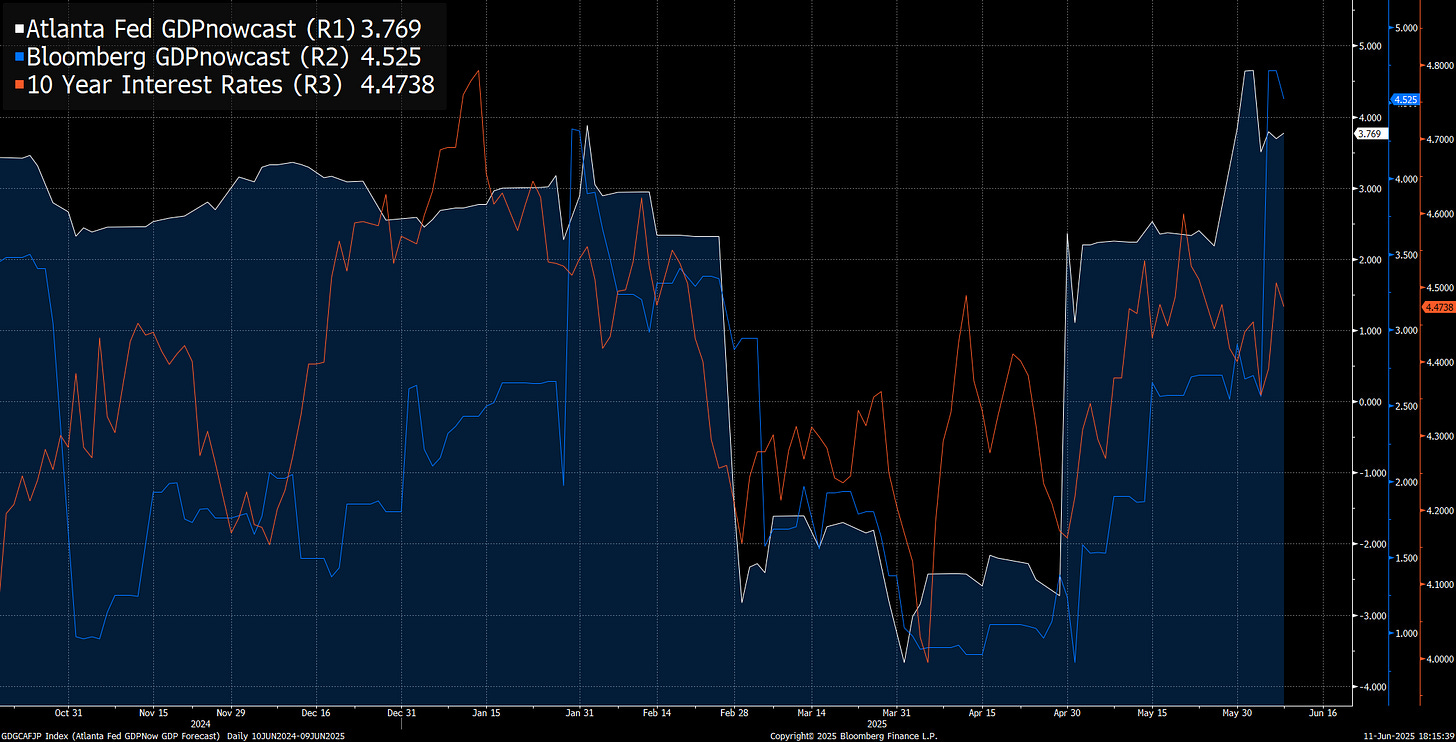

When divergences like this occur it is the clearest signal to get short bonds because as growth accelerates, it is going to push rates HIGHER. The chart below shows that as soon as you had the short term downward move in nowcasts, they almost immediately bounced back up as we went through a regular month of economic data. When growth accelerates, it pushes interest rates and equities UP.

The only way stocks and bonds can rally together during accelerating growth is if inflation is falling fast enough to push rates down more than growth pushes them up (Read the internet rate primer on this: LINK).

Can this happen right now? It is HIGHLY unlikely for two important reasons:

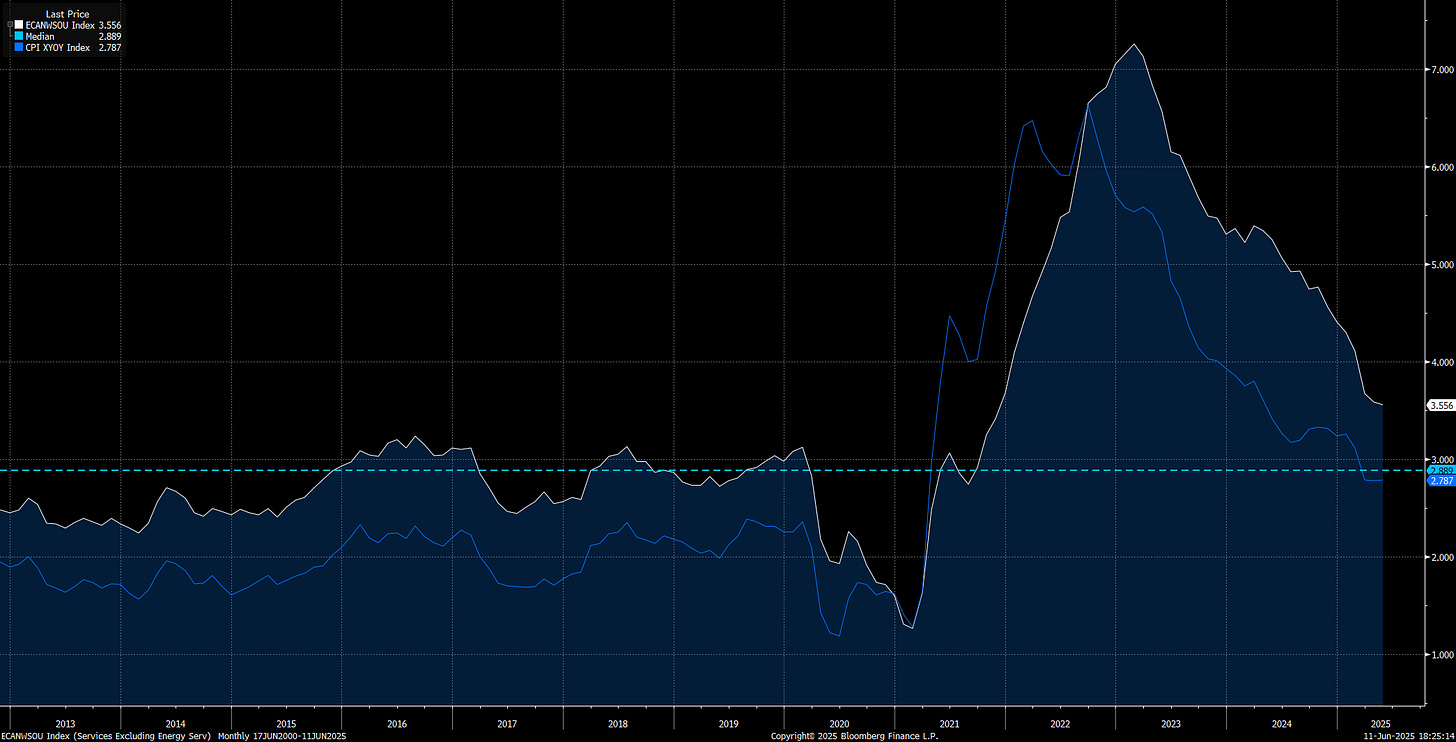

Inflation is still a real risk in the system because Core CPI and service line items of inflation remain ABOVE 2%. Even in the inflation print that came out today, we saw core come in below expectations but it still accelerated marginally. (Chart shows services inflation in white and core CPI in blue)

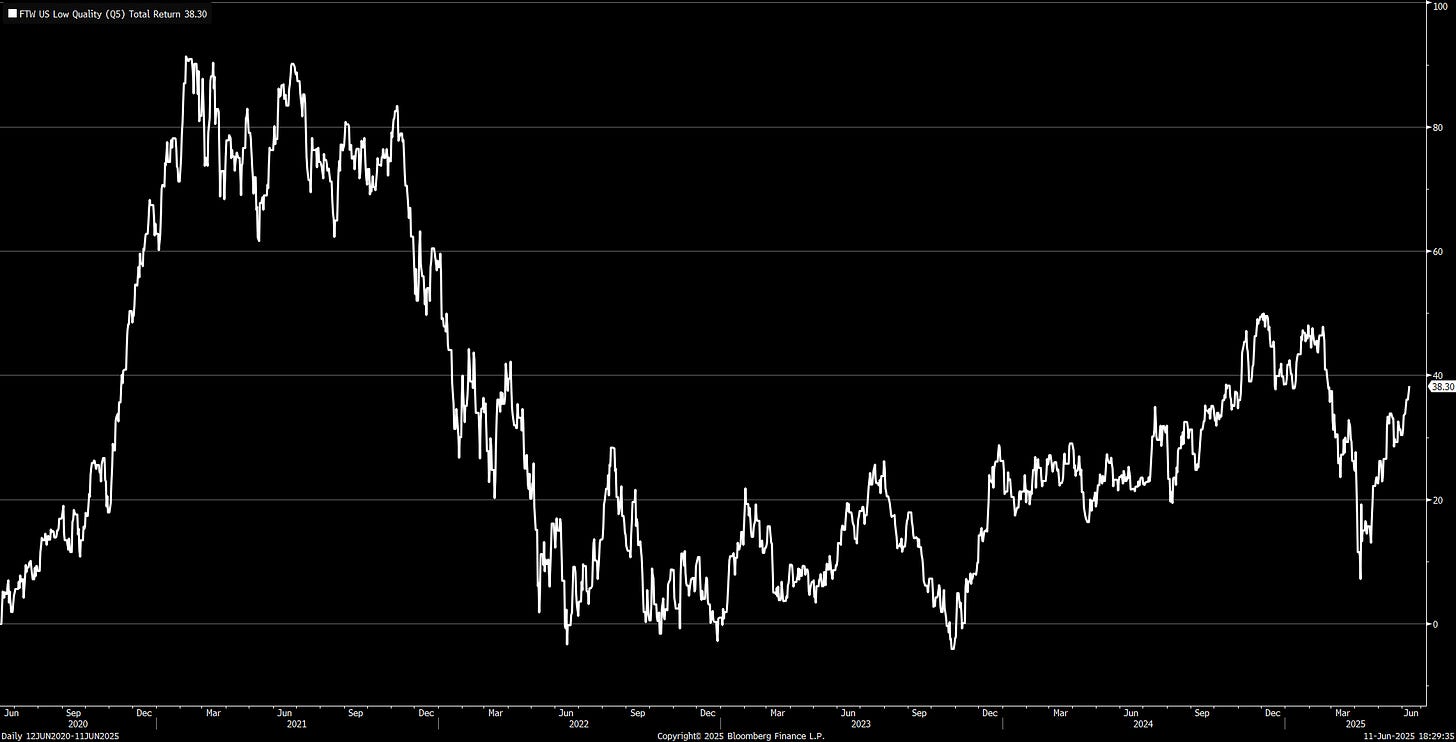

When you have inflation ABOVE the 2% level, any marginal accelerations in growth can slow the downward trend of inflation or even reverse it. So the entire question we need to ask is, HOW STRONG is the trend of growth right now? One of the clearest ways to see how much growth, credit, and liquidity is in the system is by looking at how all of the worst companies are doing. The hurdle to getting a pervasive rise in all major junk companies to rally is very high. In other words, you need VERY strong growth in the economy to lift the worst companies from their lows. We have seen this very thing with the low-quality factor in the United States (basically an index for the highest risk/junk companies) rally aggressively from the lows at the same time GDPnowcasts begin to revise higher.

Bottom line: there are very important tensions in growth to weigh against the compression in inflation. This is directly connected to WHY we have seen long-term rates move up MORE than short-term rates. 30-year interest rates have made a significant divergence away from 2-year rates over the last 2-3 months because the market knows that growth is accelerating and inflation risk is still real.

This is WHY inflation swaps are still showing inflation risk. When short-term inflation swaps are ABOVE long-term inflation swaps (chart below), there is still a real risk in the system. This further illustrates WHERE we are in the macro regime with the points above.

The question becomes, WHERE are we going from here?

Recession and Inflation Probabilities:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.