Macro Regime Tracker: Equity Risk Into Jackson Hole

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

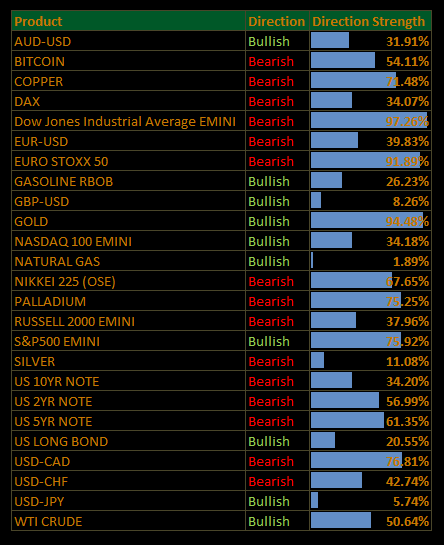

Macro Regime Tracker Index:

I explained the equity setup in a video today here: (connected Twitter thread here: LINK)

And the live stream from today:

We are seeing some marginal derisking of equities into Jackson Hole. I expect to remain above the CPI level in ES and then begin to make a short-term bottom to rally higher into Sept.

All the playbooks for the credit cycle and educational primers are linked here:

Bitcoin Indicator From Tradingview: LINK

Yield Curve Indicator: LINK

If you make a copy of the charts above, you will be able to use the indicators with your own inputs.

As always, see all of the systematic models and strategies below.

Main Developments In Macro

US Rates / Fed

*TRUMP: EVERY SIGN IS POINTING TO A MAJOR RATE CUT

*TRUMP: POWELL IS HURTING THE HOUSING INDUSTRY VERY BADLY

*BOWMAN CONCLUDES INTERVIEW ON BTV

*BOWMAN: REG PROPOSALS WON'T CHANGE UNDER NEXT FED CHAIR

*BOWMAN: BASEL 3 WILL COME LAST AMONG CAPITAL PROPOSALS

*FED'S BOWMAN COMMENTS ON BLOOMBERG TV

*FED'S BOWMAN SAYS DEBANKING IS A PROBLEM IN FINANCIAL SYSTEM

US Trade / Industrial Policy / Tech

*MEXICO TO PROPOSE JOINT STEEL COMMITTEE WITH US TO BOLSTER TIES

*LUTNICK: CANNOT RELY ON TAIWAN TO MAKE OUR CHIPS

*LUTNICK: US COULD CONVERT INTEL FUNDING INTO EQUITY STAKE

*LUTNICK: HOPEFUL INTEL CAN MAKE US PARTICIPANT IN CHIP SPACE

*LUTNICK: WE WILL FIX INFRASTRUCTURE THAT CHINA 'COMPETED AWAY'

*LUTNICK: WE'RE 'WEEKS AWAY' FOR THE JAPAN AND KOREA DEAL MODELS

*LUTNICK: DOCUMENTS ON RECENT DEALS 'WEEKS AWAY'

*BESSENT: THERE'S NO TALK OF FORCING COMPANIES TO BUY FROM INTEL

*BESSENT: PLAN TO UP TARIFFS ON INDIA OVER RUSSIAN OIL BUYING

*NVIDIA PREPS NEW MORE POWERFUL CHIP FOR CHINA: REUTERS

*APPLE EXPANDS INDIA IPHONE PRODUCTION FOR US-BOUND NEW MODELS

*CONTACTS BETWEEN EU'S SEFCOVIC, US'S GREER, LUTNICK ONGOING

US–Ukraine / Geopolitics (US-led talks & security)

*TRUMP: I JUST WANT TO SEE WHAT HAPPENS AT RUSSIA, UKRAINE BILAT

*TRUMP:IF NEEDED I'LL GO TO PUTIN-ZELENSKIY MEETING AND CLOSE IT

*TRUMP: I THINK WE HAVE A GOOD SHOT AT STOPPING WAR IN UKRAINE

*TRUMP: THOUGHT RESOLVING RUSSIA-UKRAINE WAR WOULD BE EASIER

*TRUMP: YOU HAVE TO BE A LITTLE OPTIMISTIC ABOUT RUSSIA, UKRAINE

*CORRECT: GERMANY, UK, FRANCE REPS TO JOIN DC UKRAINE TALKS: FOX

*JOINT CHIEFS CHAIR CAINE TO HOST HIS EUROPEAN COUNTERPARTS: FOX

*US, EURO MILITARY REPS TO MEET THIS WEEK IN DC ON UKRAINE: FOX

*LEAVITT: TRUMP EXPECTS PUTIN, ZELENSKIY MEETING TO HAPPEN

*LEAVITT: ACCOMMODATIONS FOR PUTIN, ZELENSKIY MEETING UNDERWAY

*WHITE HOUSE EYES BUDAPEST FOR ZELENSKIY-PUTIN MEETING: POLITICO

*KELLOGG: RUBIO-LED GROUP PREPPING UKRAINE OPTIONS FOR TRUMP

*MARTIN: TRUMP-ZELENSKIY MEETING GIVES REASONS FOR OPTIMISM

*TRUMP ON POSSIBLE US SECURITY GUARANTEES: POSSIBLY BY AIR

*TRUMP: IT'S POSSIBLE PUTIN DOESN'T WANT TO MAKE A DEAL

*TRUMP: UKRAINE WON'T BE A PART OF NATO

*TRUMP: SETTING UP MEETING WITH PUTIN AND ZELENSKIY

*TRUMP: PUTIN-ZELENSKIY GETTING ALONG BETTER THAN EXPECTED

*TRUMP: ZELENSKIY HAS TO SHOW FLEXIBILITY ALSO

*TRUMP: HOPE PUTIN WILL BE GOOD, IF NOT, A ROUGH SITUATION

*TRUMP ON PUTIN-ZELENSKIY MEETING: WE'LL LET THEM MEET FIRST

*TRUMP: EUROPEANS WANT TO END THE WAR WITH UKRAINE AND RUSSIA

*US, EUROPE GUARANTEES TO FOCUS ON BOOSTING UKRAINE ARMED FORCES

*US, ALLIES TO START IMMEDIATELY ON UKRAINE SECURITY PLAN

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.