Macro Regime Tracker: EURUSD and Tariff Clearing Event

Macro regime and risk assets qualified clearly

Macro Regime Tracker:

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning and cross-asset data, it identifies macro changes and their impact on market positioning.

The launch video for the Macro Regime Tracker is here: Link

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth and Inflation Regime Tracker

Fixed Income and Credit Model

Equity Sector Model

Machine Learning Strategies and Models

Macro Regime Context:

I laid out the view for EURUSD in the Alpha Report here:

I am not going to restate everything in the report, so please read the Alpha Report for context: We have seen call skew in EURUSD fall over the last 24 hours and Z5 move to the top of its range.

This dynamic in the Euro has overlapped perfectly with some of the buying pressure we saw in ES over the last 2 trading sessions.

We are likely to see some short-term downside in the Euro and a bounce in equities. This is how I view the short-term risk reward (with the caveat that Trump doesn’t throw a curve ball out of left field tomorrow)

Implied correlation has been significantly elevated for a prolonged period of time and likely just made a lower high.

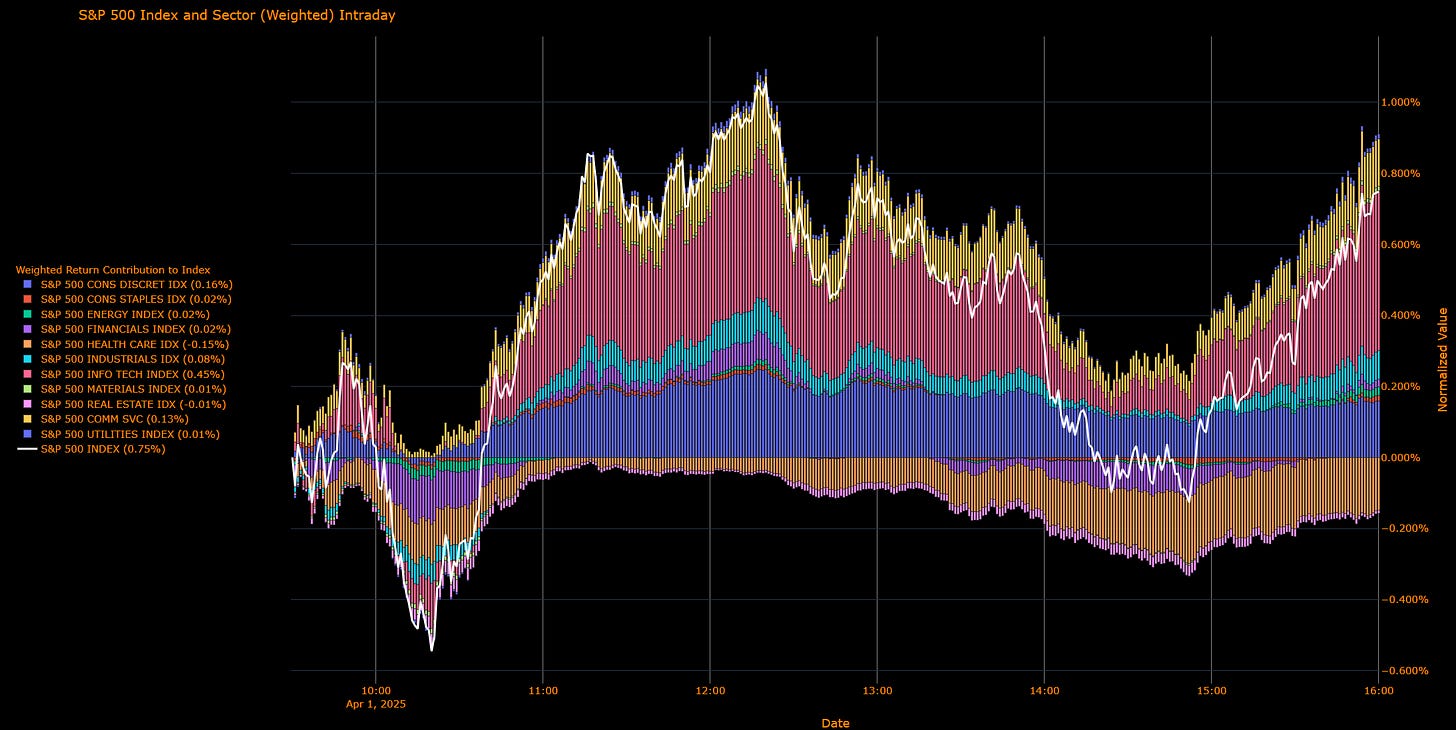

While the macro risks still exist, we know that tech continues to contribute the largest portion of returns on a weighted average basis. In other words, everything comes down to tech here.

Tomorrow, being Liberation Day, is likely to be a clearing event in some capacity, but in truth, Trump is probably just playing the market. While I am not taking any major swings at the moment, I think we will move marginally lower in EURUSD and likely bounce in ES.

On a higher timeframe, we continue to see persistent selling pressure with some confirmation from macro drivers in US equities.

In terms of an international view of equities: Higher Eurostoxx and DAX is a higher probability in my view, given the growth differentials between the US and Eurozone. In terms of equity beta, Mag7 is likely to have headwinds as international and domestic factor rotations take place. Here is how I view the short term risk reward of Eurostoxx.

We have seen a little bit of a pullback in Eurostoxx against ES ,but we are likely to push higher, in my view:

Again, moving into tomorrow, I am cautious taking any large swings because I don’t even think Trump knows what he is going to say. There are just so many wild cards that can be thrown out, and none of us know exactly what will happen.

Tomorrow will be a special day for the Capital Flows Substack, so stay tuned for an announcement!

Main Developments In Macro

*FED'S GOOLSBEE SAYS TARIFFS COULD BE TRANSITORY `IN THEORY'

*GOOLSBEE SAYS HARD DATA IS STRONG, SOFT DATA `ALMOST CRATERING'

*CONGRESS AIMS TO PASS TRUMP TAX PACKAGE NO LATER THAN AUGUST

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth and Inflation Regime Tracker:

The Macro Regime Model first provides a real-time view of growth and inflation dynamics, then directly connects these insights to upcoming catalysts and the statistical measures that gauge their impact on asset prices.

(If you are new and would like to do a free trial to review the full macro regime tracker with the connected ES strategy, a link to a free trial is available here: Link).

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.