Macro Regime Tracker: FOMC Set Up

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

The most recent trade write up with my views into FOMC is here:

And the update on crypto treasury companies is here:

As always, all the systematic models and strategies are updated below. Thanks.

Main Developments In Macro

US Macro & Markets

HASSETT: 10-YEAR BOND RATE HAS COME DOWN ENORMOUSLY

HASSETT: LOOKING AT 'WAY NORTH' OF 3% GROWTH

NASDAQ 100 FALLS, SNAPPING NINE-SESSION WINNING STREAK

S&P 500 CLOSES 0.1% LOWER, NASDAQ 100 DOWN 0.1%

US 20Y BONDS DRAW 4.613% VS 4.615% PRE-SALE WHEN-ISSUED YIELD

US OIL HITS INTRADAY HIGH AMID RUSSIA, MIDEAST SUPPLY RISKS

SPOT GOLD RISES ABOVE $3,700 AN OUNCE FOR THE FIRST TIME

USD/JPY FALLS 0.5% TO 146.66

US SEPT. HOMEBUILDER INDEX UNCHANGED AT 32; EST. 33

US JULY BUSINESS INVENTORIES RISE 0.2% M/M; EST. +0.2%

US AUG. INDUSTRIAL PRODUCTION RISES 0.1% M/M; EST. -0.1%

US AUG. CAPACITY UTILIZATION 77.4%; EST. 77.4%

US AUG. RETAIL 'CONTROL GROUP' SALES RISE 0.7% M/M; EST. +0.4%

US AUG. RETAIL SALES EX-AUTO RISE 0.7% M/M; EST. +0.4%

US AUG. RETAIL SALES EX AUTOS, GAS RISE 0.7% M/M; EST. +0.4%

US AUG. RETAIL SALES RISE 0.6% M/M; EST. +0.2%

US AUG. IMPORT PRICES RISE 0.3% M/M; EST. -0.2%

Policy, Trade & Geopolitics (US-related)

HOUSE GOP RELEASES DRAFT BILL TO FUND GOVERNMENT

JOHNSON SAYS HE EXPECTS VOTE ON STOPGAP BILL BY FRIDAY

HOUSE TO VOTE ON A SEVEN-WEEK FUNDING BILL FRIDAY: PUNCHBOWL

WHITE HOUSE TO APPEAL COURT RULING ON FED'S COOK: REUTERS

DOJ TO CHALLENGE RULING ON FED'S COOK SOON AT SCOTUS: NYT

US CONSIDERS NEW NATIONAL SECURITY TARIFFS ON AUTO PARTS: RTRS

US MULLS IMPOSING NEW TARIFFS ON IMPORTED AUTO PARTS: REUTERS

US IN TALKS TO SET UP $5 BILLION FUND FOR MINERALS DEALS

USTR: TIKTOK DEAL TERMS PROTECT AMERICANS' DATA, IP

TIKTOK'S US CONSORTIUM WOULD INCLUDE ORACLE: WSJ

TIKTOK'S US WOULD BE CONTROLLED BY AN INVESTOR CONSORTIUM: WSJ

TIKTOK DEAL WOULD CREATE A NEW US ENTITY: WSJ

US, UK FINANCE FIRMS TO ANNOUNCE INVESTMENTS DURING TRUMP VISIT

UK, US SET TO ANNOUNCE CLOSER CO-OPERATION ON CRYPTO: FT

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

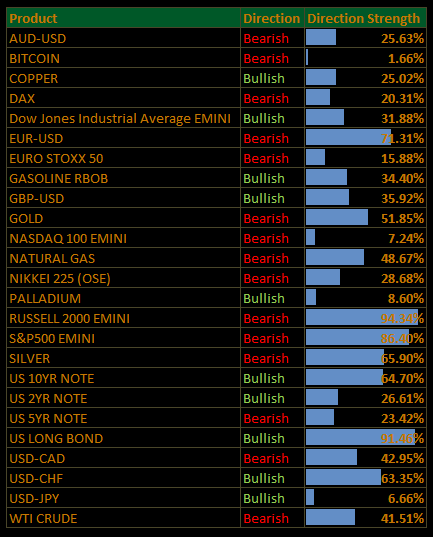

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Fed Countdown Freezes Flows; Energy Pops, Utilities Sink (S&P –0.25%)

The S&P 500 slipped 0.25%, snapping the Nasdaq 100’s nine-day winning streak, as investors paused ahead of Wednesday’s Fed decision. Treasuries stayed firm with 20-year supply absorbed smoothly, the dollar weakened further, and gold briefly topped $3,700/oz. Solid retail-sales data underscored consumer resilience, but only sharpened debate over the pace of policy easing.

Breadth narrowed meaningfully: tech leadership faded, cyclicals underperformed, and defensives failed to provide shelter as utilities plunged. Energy stood out as the lone bright spot, with crude buoyed by geopolitical risks and supply pressure.

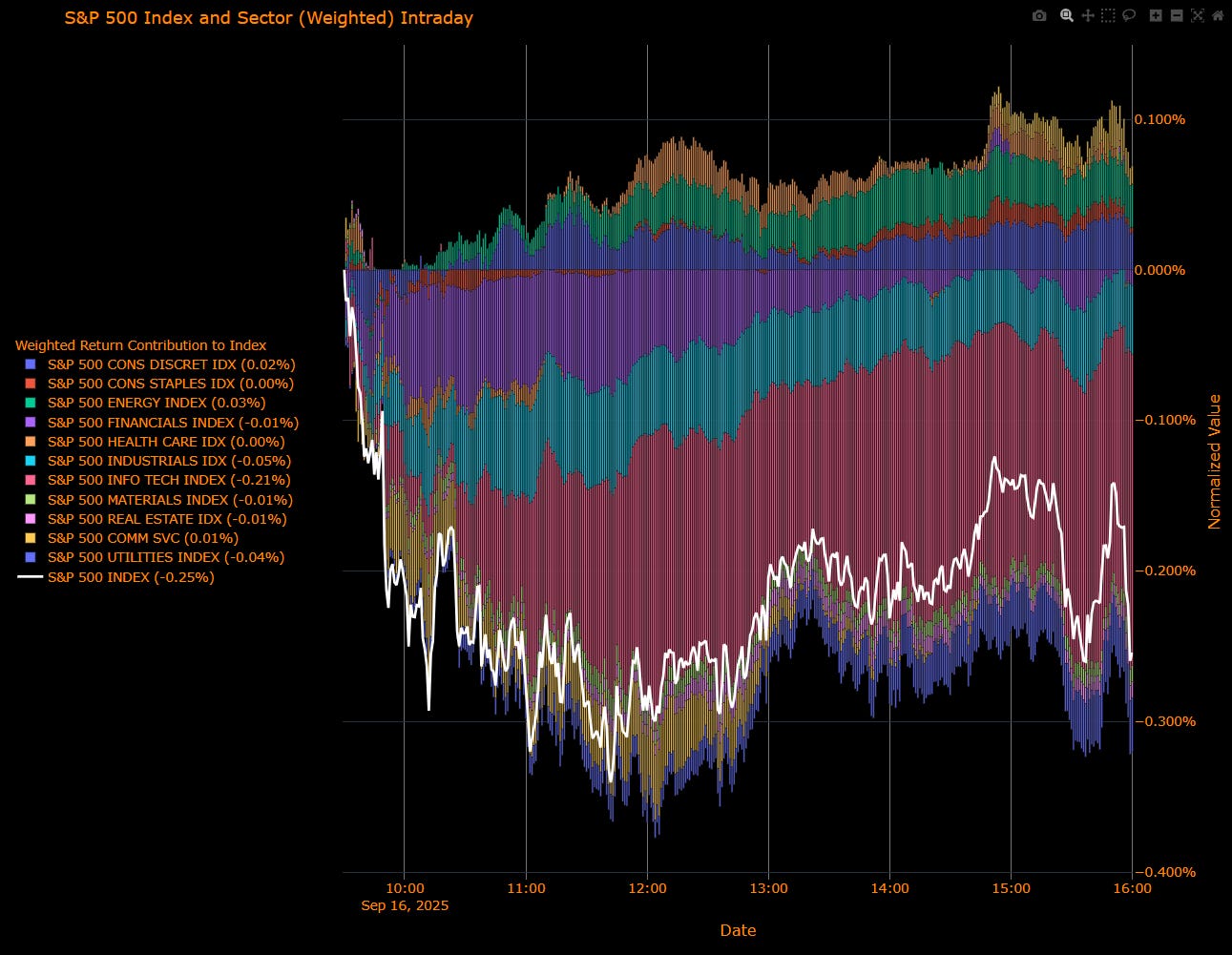

Sector Attribution

Weighted Return Contribution to Index

Biggest drag: Information Technology (–0.21%)

Other negatives: Industrials (–0.05%), Utilities (–0.04%), Financials (–0.01%), Materials (–0.01%), Real Estate (–0.01%)

Positives: Energy (+0.03%), Consumer Discretionary (+0.02%), Communication Services (+0.01%)

Net impact: S&P 500 (–0.25%)

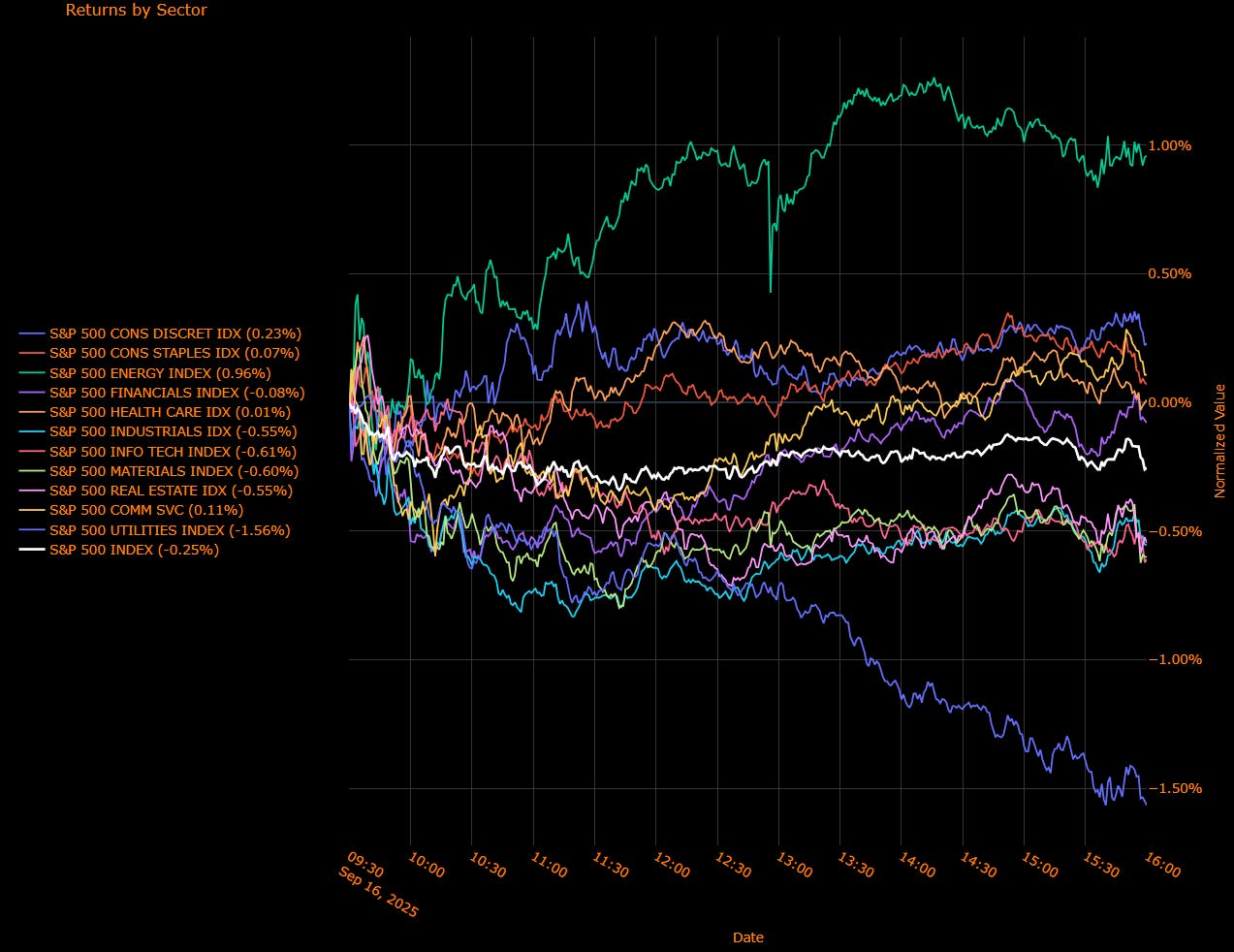

Sector Performance (Unweighted Breadth)

Energy (+0.96%) surged, extending crude’s rebound.

Consumer Discretionary (+0.23%), Staples (+0.07%), and Communication Services (+0.11%) posted modest gains.

Information Technology (–0.61%) and Materials (–0.60%) led declines.

Industrials (–0.55%) and Real Estate (–0.55%) were also weak.

Utilities (–1.56%) saw sharp underperformance, dragging defensives lower.

S&P 500 Index: –0.25%

Macro Overlay

Fed Countdown

Markets remain fully priced for a 25 bp cut on Wednesday. Strong retail-sales data (+0.6% headline, +0.7% control group) confirmed consumer momentum, dampening hopes for an aggressive dovish turn. Powell’s statement and the dot plot are the focus: the balance will be between cushioning labor-market softness and avoiding a “stimulus now, regret later” narrative.

Flows & Positioning

Unlike yesterday’s tech-led strength, growth leadership faltered, and no broad rotation filled the gap. Utilities’ collapse signals little demand for traditional defensives, while energy was the standout beneficiary of both supply tension and hedging flows. The market tone has shifted toward “waiting mode” rather than chasing highs.

Rates & Commodities

Treasuries held gains, with the 2-year at 3.51% and the curve steady. The dollar touched multi-week lows, the euro climbed to its strongest since 2021, and yen strengthened. Gold pierced $3,700/oz, reflecting both easing bets and geopolitical hedging. Oil extended gains amid Russia/Mideast risks.

Market Tone

The market is locked in before the Fed. Breadth has deteriorated: energy is the only real outperformer, while utilities and tech leadership cracked. Consumer resilience keeps the macro backdrop constructive but complicates the dovish story. The stage is set for Powell: reassure without overcommitting, or risk a “sell the news” pullback.

The Read-Through

Base Case: 25 bp cut delivered, Powell emphasizes optionality and data dependence.

Risks: Hawkish dots or cautious tone could stall equities; consumer strength may limit future cuts.

Positioning Lens: Energy offers tactical outperformance; growth sectors need Powell to validate easing. Utilities’ collapse highlights fragility in defensives.

The tape is stalling at the top, leadership narrowing. Tomorrow’s Fed decision is the hinge: the outcome will dictate whether the rally broadens or fragments further.

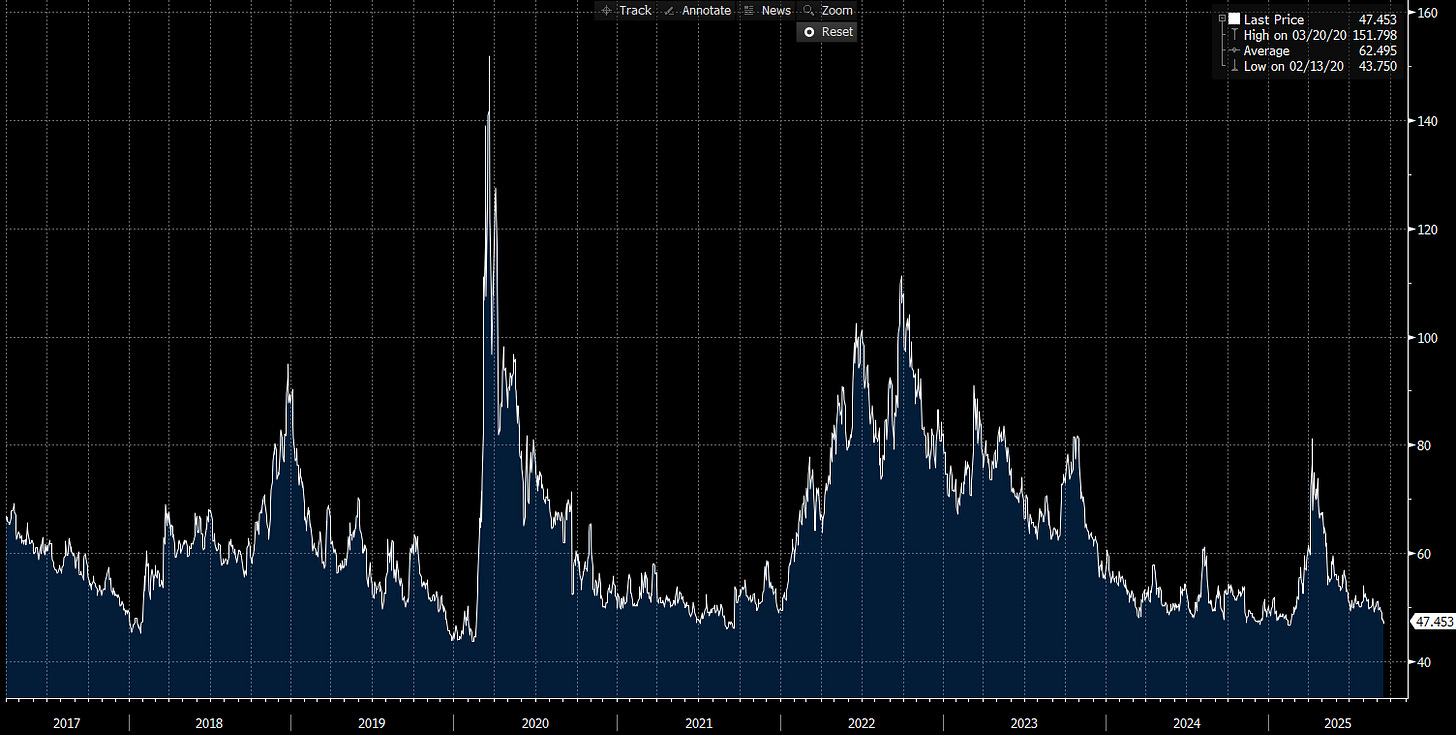

US IG Credit Wrap: Spreads Hold Ahead of Fed; Carry Still Anchors (IG OAS ~47.5 bp)

Investment-grade credit remains steady into the Fed decision, with Bloomberg IG OAS closing near 47.5 bp. That leaves spreads ~15 bp inside the five-year average (62.5 bp) and only ~3.7 bp off the cycle tights. The stability underscores how strongly carry continues to dominate positioning, even as equity momentum wobbles and rates volatility looms ahead of Powell’s remarks.

Credit Context

IG OAS: ~47.5 bp (chart last: 47.453)

5-yr average: 62.5 bp → ~15 bp inside

Cycle low: 43.8 bp → ~3.7 bp off tights

COVID peak: 151.8 bp → ~105 bp tighter

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

What Changed Today

Macro tape: Equities eased (S&P –0.25%, Nasdaq ended a nine-day streak) shifting fully into “waiting mode.” Retail sales beat expectations (+0.6% headline, +0.7% control group), reinforcing consumer resilience but complicating the case for aggressive dovish guidance.

Policy path: A 25 bp cut tomorrow is fully priced. The debate is over Powell’s tone and the dot plot: markets want a cushion for labor but not a signal of crisis.

Rates/backdrop: Treasuries remained well-bid, with 2s at 3.51% and 20-year supply smoothly absorbed. Dollar drifted lower, euro and yen stronger, gold pierced $3,700/oz, and oil extended gains on geopolitical risk.

Credit tone: Primary issuance was well absorbed with light concessions; secondary markets saw two-way flow but balanced demand. ETF inflows and real-money buyers continue to anchor spreads near the mid-40s.

Risks to Watch

Fed tone: A cautious Powell or hawkish dots could spark rates vol and widen OAS 2–5 bp.

Labor prints: A sharper deterioration would pressure lower-tier IG and cyclical sectors.

Curve dynamics: Growth-scare steepening is a bigger credit risk than supply-led back-up.

Liquidity: Heavy primary calendars into thin conditions could stall the grind.

Read-Through

Credit is still pricing “insurance cuts without crisis.” At ~47.5 bp, the next 5–10 bp move hinges less on micro fundamentals and more on Fed communication and rates volatility. Unless labor cracks faster or inflation re-accelerates, dips are likely shallow and bought, but valuations demand discipline.

Final Word

IG spreads remain pinned in the high-40s, granting Powell the benefit of the doubt. If he threads the needle; cutting, stressing optionality, avoiding promises of a sequence, credit can stay anchored. If he surprises hawkish or the data crack, the first move is in rates vol; credit follows, but from a position of strength.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Equity Indices:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.