Macro Regime Tracker: GDP Print

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

All of the educational primers are laid out here:

GDP is expected to come out below expectations this week, which the media will extrapolate into a recession. 2025 is shaping up to be another year without a recession (like most years).

Main Developments In Macro

*WILLIAMS: DIDN'T SEE MARKET DYSFUNCTION IN APRIL ON TARIFF NEWS

*WILLIAMS: WE'RE STILL IN A LOW NEUTRAL RATE GLOBALLY

*FED'S WILLIAMS: WANT TO AVOID ALLOWING HIGHLY PERSISTENT INF.

*TRUMP: WORKING ON TAKING FANNIE, FREDDIE PUBLIC

*TRUMP: 'GOLDEN DOME' MISSILE SYSTEM WOULD COST CANADA $61B

*TRUMP: CANADA WANTS TO BE PART OF GOLDEN DOME SYSTEM

*MIRAN: DEREGULATION TO ADD 40 TO 90 BPS TO POTENTIAL GDP GROWTH

*MIRAN: NO MATERIAL DOWNSIDE CONSEQUENCES OF A 10% TARIFF RATE

*MIRAN: 10% TARIFF RATE NOT HUGE ENOUGH FOR ADVERSE ECO. IMPACT

*LANE: ECB TASK TO BRING INFLATION BACK TO 2% MOSTLY COMPLETED

*TRUMP COULD IMPOSE NEW RUSSIA SANCTIONS IN COMING DAYS: CNN

*US PRELIM APRIL DURABLE GOODS ORDERS FALL 6.3% M/M; EST. -7.8%

*US PRELIM APRIL DURABLE GOODS EX-TRANS RISE 0.2% M/M; EST. 0%

*HASSETT: INDIA AMONG DEALS CLOSE TO THE FINISH LINE

*HASSETT: LOWER TARIFFS WOULD BE FOR COUNTRIES WITH GOOD OFFERS

*HASSETT ON TRADE DEALS: WE WILL `PROBABLY' SEE MORE THIS WEEK

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

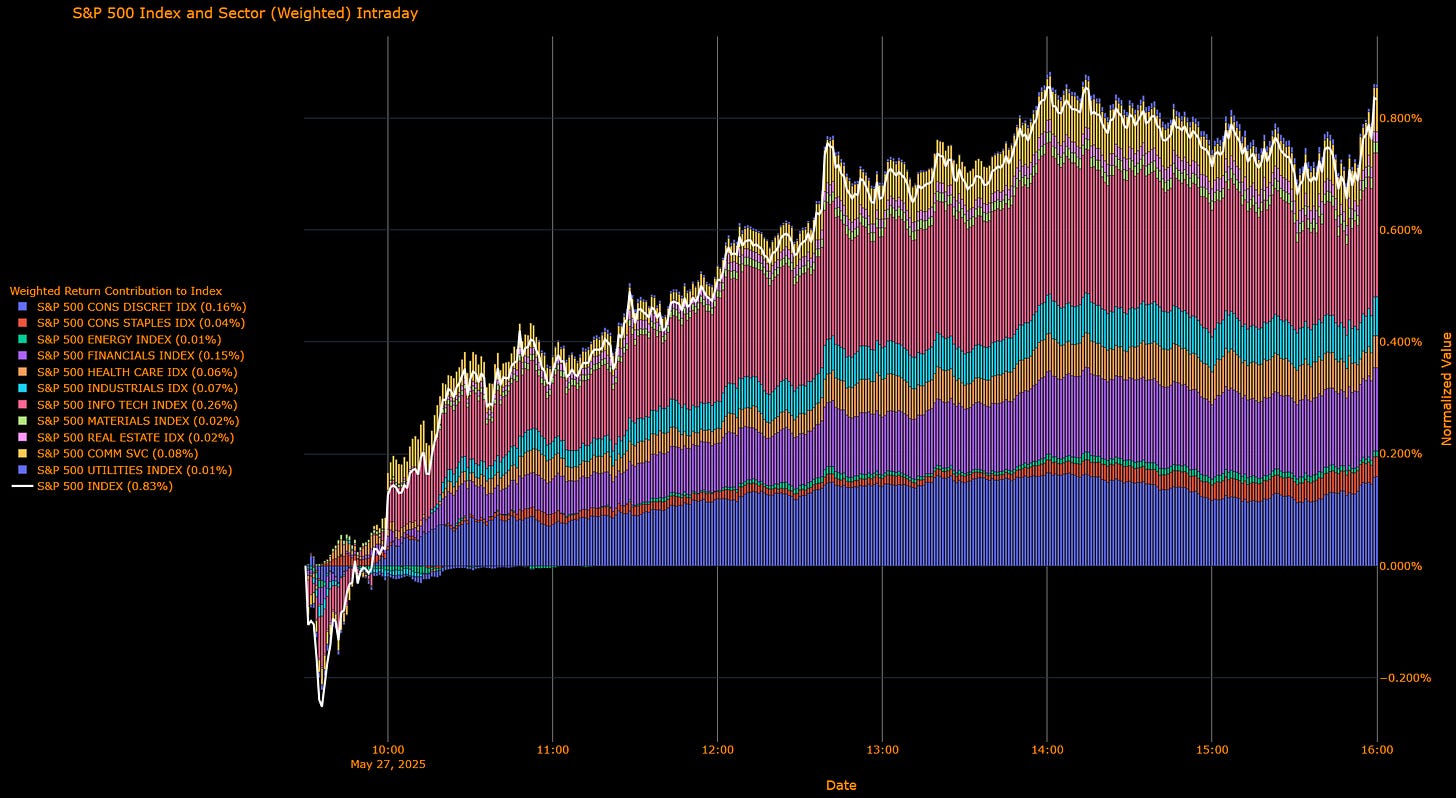

S&P 500 Wrap — Index Advances +0.83% Led by Information Technology and Consumer Discretionary; Utilities and Energy Lag

Sector-by-Sector Contribution Snapshot (Weighted Impact)

Information Technology (+0.26 pp) – Top positive impact, following the delay in EU tariffs which positively influenced technology-related trade flows.

Consumer Discretionary (+0.16 pp) – Significant positive impact, reflecting positive consumer confidence data and potential for increased spending.

Financials (+0.15 pp) – Solid contribution, benefiting from easing Treasury yields and a generally more favorable market environment for financial institutions.

Communication Services (+0.08 pp) – Moderately positive contribution within broader market gains, indicating strength in media and telecom sub-sectors.

Industrials (+0.07 pp) – Positive contribution, supported by easing trade tensions and improved outlooks for manufacturing and transportation.

Health Care (+0.06 pp) – Positive contribution, with consistent demand for services and products.

Consumer Staples (+0.04 pp) – Modest positive contribution, reflecting steady demand for essential goods amidst economic conditions.

Materials (+0.02 pp) – Small positive contribution, reflecting commodity market dynamics and some stability in raw material prices.

Real Estate (+0.02 pp) – Slight positive contribution, as Treasury yields eased providing some relief to interest-rate sensitive real estate assets.

Energy (+0.01 pp) – Marginal positive contribution, with some price stabilization after recent fluctuations.

Utilities (+0.01 pp) – Slight positive contribution, often a defensive sector, showing marginal gains amidst broader market strength.

Sector-by-Sector Performance Snapshot (Unweighted Returns)

Consumer Discretionary (+1.48%) – Strongest unweighted sector, following the rebound in consumer confidence and retail sector strength.

Materials (+0.98%) – Notable gains reflecting commodity market sentiment and demand expectations.

Real Estate (+0.88%) – Strong positive performance, benefiting from easing Treasury yields and a more favorable outlook for property valuations.

Communication Services (+0.83%) – Solid gains, driven by broad strength across its various sub-industries.

Information Technology (+0.81%) – Positive performance, buoyed by the delay in EU tariffs and continued innovation.

Industrials (+0.79%) – Solid gains amid global trade condition expectations and manufacturing activity.

Financials (+1.04%) – Firm performance on yield stability and favorable market conditions for banking and insurance.

Consumer Staples (+0.61%) – Positive performance, indicating steady consumer demand for non-discretionary goods.

Health Care (+0.60%) – Moderate gains, reflecting stable demand for healthcare services and products.

Energy (+0.33%) – Modest gains, potentially influenced by supply-demand dynamics and geopolitical factors.

Utilities (+0.23%) – Positive but relatively subdued gains, consistent with its typically lower volatility profile.

Macro Overlay

Market performance significantly improved following President Trump's decision to delay the 50% tariff on goods from the European Union until July 9. This development, coupled with a stronger-than-expected rebound in U.S. consumer confidence in May, contributed to broad market advancement. While Treasury yields eased, upcoming economic data and fiscal policy developments, including potential regulatory shifts and Federal Reserve commentary on inflation and tariff impacts, remain key economic factors. The easing of trade tensions provided immediate market relief, although underlying macroeconomic uncertainties persist.

Bottom Line

The S&P 500 advanced +0.83%, primarily driven by performance in Information Technology and Consumer Discretionary sectors. The delay in EU tariffs and an increase in consumer confidence were contributing factors. Utilities and Energy sectors exhibited relatively more subdued performance. Despite positive overnight developments, macroeconomic uncertainties and the potential for future tariff risks suggest ongoing market volatility.

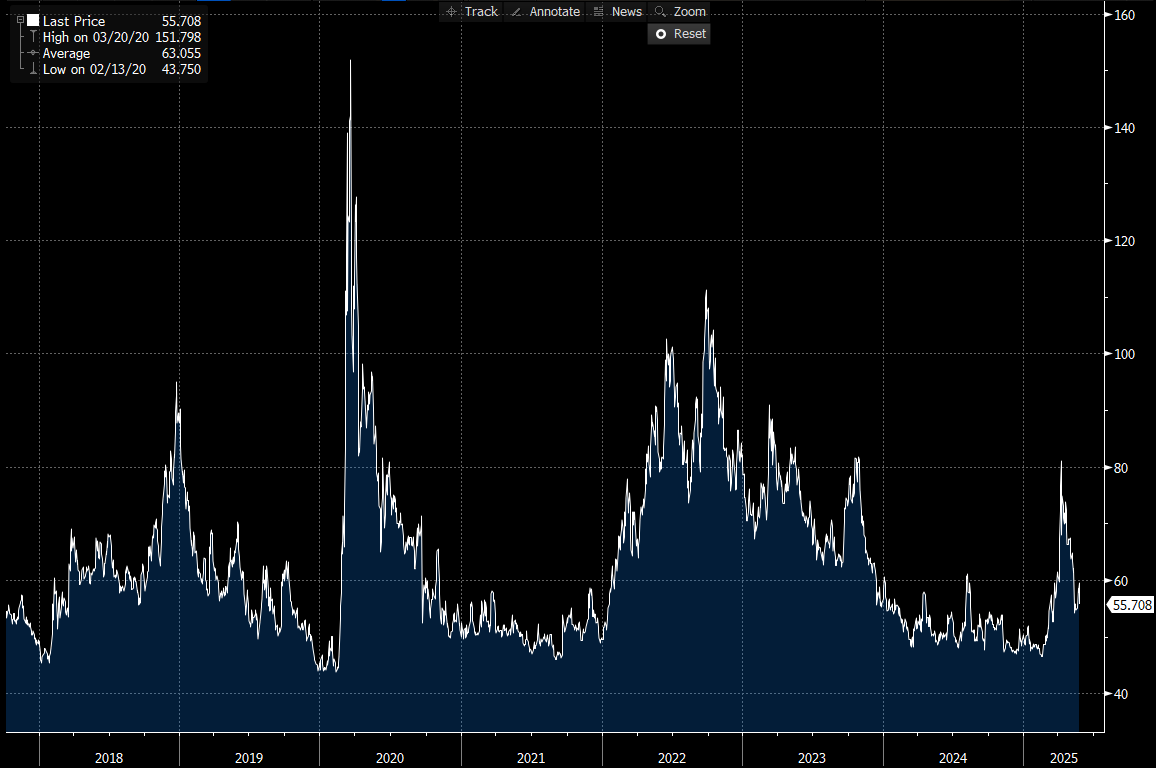

US IG Credit Wrap — Spreads Tighten to 55.7 bp Amid Tariff Delay and Improved Consumer Confidence

Current Spread: 55.7 bp (▼ ~3.8 bp d/d), marking a reversal of recent widening and indicating improved market sentiment. Spreads are now notably below the 5-year historical average (~63 bp), reflecting a more constructive credit environment.

Credit Context

< 60 bp: Pre-tariff escalation range: supportive of duration-heavy buyers (LDI, insurers).

60–70 bp: Tariff and fiscal uncertainty zone: neutral-to-cautious stance warranted.

> 90 bp: Severe stress breakout: still low probability.

Macro Overlay

Market sentiment improved following President Trump's decision to delay a 50% tariff on goods from the European Union until July 9, instead of June 1. This immediate de-escalation of trade tensions reduced a significant source of uncertainty. Further supporting the positive shift, U.S. consumer confidence showed a better-than-expected improvement in May, marking its first increase in six months. Treasury yields also eased during the trading session. While the immediate tariff threat has abated, fiscal uncertainty persists, and Federal Reserve commentary continues to highlight the potential for business uncertainty and inflation risks from trade dynamics.

Bottom Line

IG credit spreads have tightened to 55.7 bp, reflecting reduced immediate trade war concerns and improved macroeconomic data. Near-term volatility risks have decreased from recent highs, influenced by the tariff delay and positive consumer sentiment. Directional bias remains cautiously skewed toward stability or further tightening in the short term, provided no new significant negative catalysts emerge.

Mag7 Model:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.