Macro Regime Tracker: Gold Unwind

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

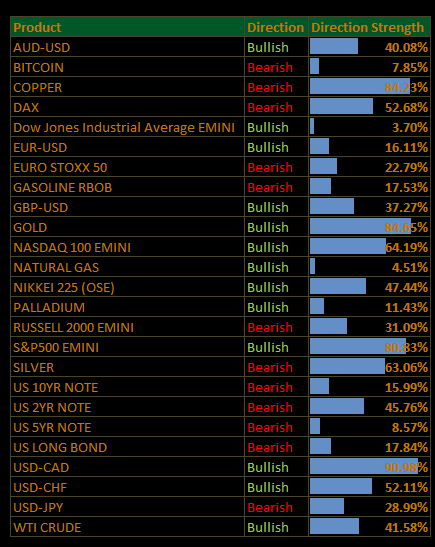

We remain in the same regime I have been laying out since April: The credit cycle is in full swing, inflation is not coming in above expectations yet, the Fed is cutting, and capital is moving out the risk curve. All of these factors are systematically constraining capital because the market is always pricing the REAL purchasing power of money.

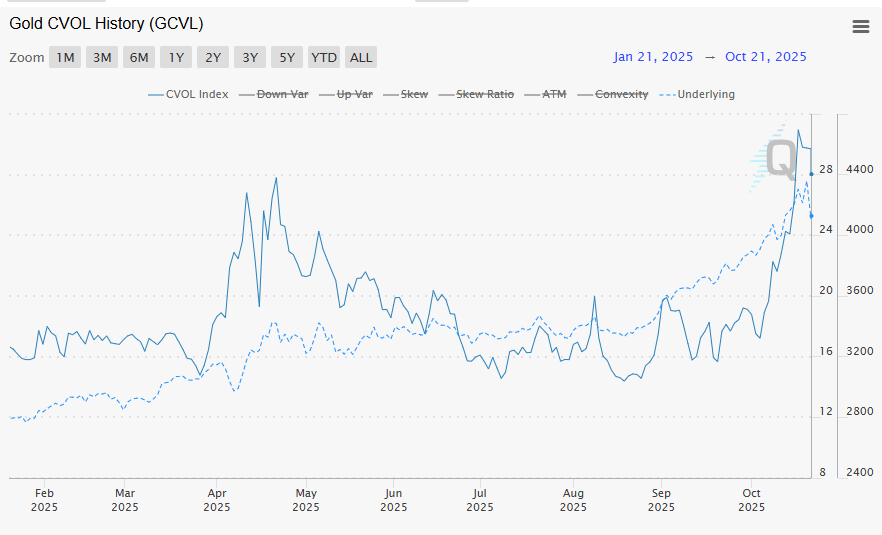

Today, gold and silver sold off marginally but this was primarily driven by positioning as opposed to a fundamental macro shift. Notice that implied vol has blown out in gold as traders are paying a massive premium for calls. In simple terms, short-term positioning is paying a massive premium, so the 5% pullback today was not incredibly surprising after being up almost 60% YTD:

My view on gold that I shared in the chat earlier:

I laid out the macro picture for everything into FOMC in this video:

As always, all the systematic models and strategies are laid out below. Thanks

Main Developments In Macro

U.S. Policy, Trade, and Geopolitics

HASSETT: HIGH CONFIDENCE TRUMP, XI WILL COME TO AGREEMENT

HASSETT: AI PRODUCTIVITY BOOM IS TOTALLY IN THE DATA

TRUMP: I WANT XI TO HAVE A GOOD DEAL FOR CHINA

TRUMP: CHINA, JAPAN USED TARIFFS AGAINST US FOR MANY YEARS

TRUMP: WE CAN START PAYING DOWN OUR DEBT WITH TARIFFS

TRUMP: SHOULD WIN TARIFF LEGAL CASE

TRUMP: CHINA WANTS TO DISCUSS TARIFFS

TRUMP: WILL SEE PRESIDENT XI IN TWO WEEKS IN SOUTH KOREA

TRUMP ADMIN BACKS EFFORT FOR US-KAZAKHSTAN TUNGSTEN MINE DEAL

SCHUMER: URGED TRUMP TO SIT DOWN AND NEGOTIATE WITH US

SCHUMER: REACHED OUT TO TRUMP TODAY

THUNE: HOPEFUL THIS WILL BE THE WEEK SHUTDOWN ENDS

US SHUTDOWN MAY FORCE STATCAN TO POSTPONE NOV. 4 TRADE RELEASE

STATCAN SAYS IT HASN’T RECEIVED US IMPORT DATA DUE TO SHUTDOWN

US TO BUY 1 MILLION BARRELS FOR STRATEGIC PETROLEUM RESERVE

US OFFICIAL SAYS NO PLANS FOR TRUMP-PUTIN MEETING SOON: CBS

RUSSIA EFFECTIVELY REJECTED TRUMP UKRAINE PLAN ON WEEKEND: RTRS

NATO’S RUTTE SET TO MEET WITH TRUMP TOMORROW: WH OFFICIAL

VANCE: HAMAS WILL ‘BE OBLITERATED’ IF IT DOES NOT COOPERATE

VANCE: PAST WEEK GIVES ME ‘GREAT OPTIMISM’ CEASEFIRE WILL HOLD

VANCE: THERE’S A ROLE FOR THE TURKS TO PLAY IN GAZA DEAL

US VICE PRESIDENT VANCE SPEAKS IN ISRAEL

VANCE: THINGS ARE GOING BETTER THAN I EXPECTED

KUSHNER: RECONSTRUCTION FUNDS WON’T GO TO AREAS HAMAS CONTROLS

TRUMP: AN END TO HAMAS WILL BE ‘FAST, FURIOUS, & BRUTAL’ IF NOT

Central Banks, Inflation & Macro Conditions

FED’S WALLER ASKED STAFF TO EXPLORE IDEA OF ‘PAYMENT ACCOUNT’

MANN: WE ARE ENTERING ENVIRONMENT OF INCREASED SUPPLY SHOCKS

MANN: CLEAR UK BEHAVIOR STILL AFFECTED BY INFLATION CONCERNS

MANN: INFLATION VOLATILITY MORE DIFFICULT THAN INFLATION RATE

MANN: UK INFLATION EXPECTATIONS HAVE DRIFTED FROM 2% TARGET

MANN: SCARRING FROM INFLATION IN UK MORE SIGNIFICANT THAN US

MANN SAYS SHE PLAYS CLOSE ATTENTION TO INFLATION STICKINESS

BANK OF ENGLAND RATE-SETTER CATHERINE MANN SAYS AT LAZARD EVENT

REEVES WANTS TO SEE INTEREST RATES COME DOWN FURTHER: FT

REEVES SAYS TO BE TARGETED ACTION IN BUDGET AROUND PRICES: FT

REEVES TO TAKE STEPS IN BUDGET TO CUT HOUSEHOLD BILLS: FT

CANADA INFLATION QUICKENS TO 2.4% Y/Y IN SEPT, EST. 2.2%

CANADA SEPT. CORE CPI TRIM RISES 3.1% Y/Y

US OCT. PHILADELPHIA FED NON-MANUFACTURING INDEX -22.2

KGANYAGO: TERMS OF TRADE IMPORTANT VARIABLE FOR S. AFRICA, RAND

Global Macro & Trade

ARGENTINA’S CENTRAL BANK SOLD DOLLARS TO SUPPORT PESO

ARGENTINE CENTRAL BANK RESERVES TODAY AT $40.54B

LULA GOVT PLANS TAXES ON BANKS, BETTING TO EASE FISCAL WOES

CHINA OFFICIAL SAYS EXPORT CONTROLS TARGET WORLD STABILITY

EUROPE, UKRAINE SAID TO READY 12-POINT PLAN TO END RUSSIA’S WAR

TAKAICHI: US-JAPAN ALLIANCE IS FOUNDATION OF JAPAN’S DIPLOMACY

TAKAICHI: WILL TAKE JAPAN-US RELATIONS TO NEW HIGH

TAKAICHI: WILL DO ALL NEEDED TO COUNTER IMPACT OF TRUMP TARIFFS

TAKAICHI: ORDERED CABINET TO COMPILE NEW ECONOMIC PACKAGE

TAKAICHI: WILL COOPERATE DEEPLY WITH LIKE-MINDED COUNTRIES

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

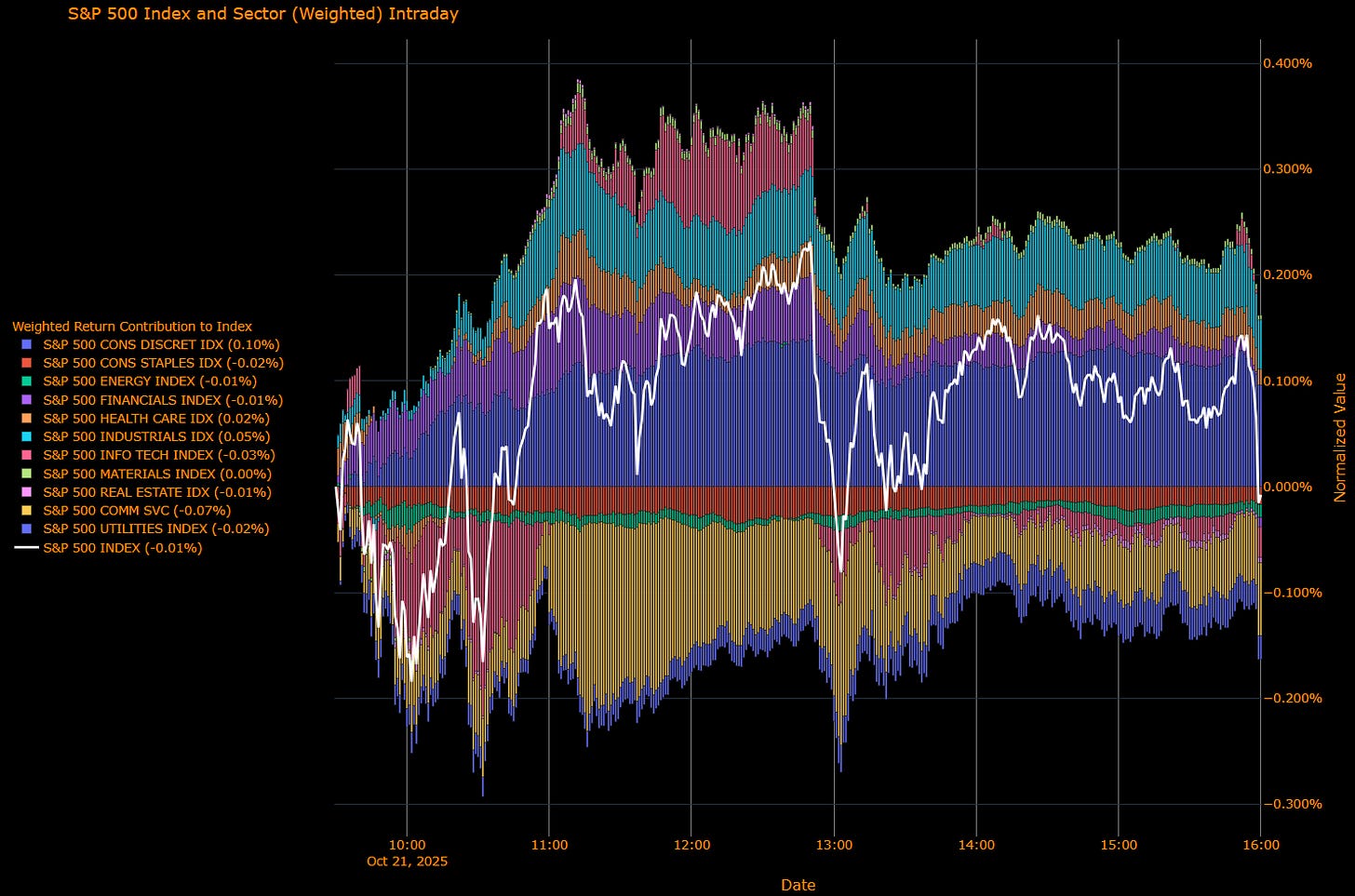

US Market Wrap: Pause at the Highs, Gold Buckles; Mixed Breadth With Defensives Heavy (S&P −0.01%)

The tape cooled after a strong run, with buyer fatigue and a firmer dollar clipping risk appetite. The S&P 500 finished basically flat (−0.01%) while the Dow notched a record on upbeat industrial guidance. Precious metals cracked lower as gold/silver saw their biggest slide in years. Rates stayed friendly (10-yr −2 bps to ~3.96%) but leadership rotated and participation narrowed.

Sector Attribution

Weighted Return Contribution (S&P −0.01%)

Leaders: Consumer Discretionary (+0.10%), Industrials (+0.05%), Health Care (+0.02%).

Drags: Communication Services (−0.07%), Information Tech (−0.03%), Utilities (−0.02%), Staples (−0.02%), Real Estate (−0.01%), Energy (−0.01%), Financials (−0.01%); Materials (0.00%).

Unweighted Performance (Breadth)

Leaders: Consumer Discretionary (+0.92%), Industrials (+0.56%), Materials (+0.25%), Health Care (+0.16%).

Laggards: Utilities (−0.91%), Communication Services (−0.68%), Real Estate (−0.27%), Energy (−0.43%), Staples (−0.34%), Financials (−0.07%), Info Tech (−0.08%).

Read: The index held up on cyclical Discretionary/Industrials while classic defensives (Utilities/Staples/REITs) and Comm Services weighed; Tech slipped at the margin. Breadth was positive in pro-growth pockets but defensives were a clear headwind.

Macro Overlay

Catalysts / Tape Feel

A rally at record-adjacent levels wavered as “breather” calls grew; exposure among macro and long-only cohorts remains elevated, making dips choppier.

Gold’s sharp unwind (profit-taking + stronger USD + stretched positioning) stole the macro spotlight; volatility gap vs. equities widened.

Earnings flow turned more mixed at the edges (e.g., TXN tepid guide; NFLX tax noise), though Dow strength was supported by upbeat industrial commentary.

Policy / Rates / FX

USTs firmed (10-yr ~3.96%, −2 bps); energy’s drift lower keeps the “disinflation assist” narrative alive.

USD firmer, contributing to metals pressure; Bitcoin bounced.

US-China: talks remain on track, keeping tariff tail-risk on simmer rather than boil. Shutdown maintains a data vacuum, elevating single-print sensitivity.

The Read-Through

Late-cycle, not risk-off: Defensives underperformed even as the index stalled, this looks more like fatigue at highs than a duration scare.

Cyclicals doing the holding: Discretionary/Industrials leadership with Tech soft says “growth/animal spirits” > pure rates beta on the day.

Gold’s reset is a positioning/FX/rates cocktail, not (yet) a macro regime turn; watch whether dip buyers re-engage quickly.

What to Watch Next

CPI (Fri) in a data-thin week: a benign 0.3% core would preserve the soft-landing glide and keep 10-yr yields anchored; a 0.4–0.5% re-tests risk appetite.

Breadth follow-through: Do Discretionary/Industrials keep carrying while Utilities/Staples/REITs lag? That’s the durability tell.

Metals vs. USD/rates: If the dollar stays bid and real yields hold, gold’s bounce attempts may be shallow; a quick recapture would signal the bull trend’s resilience.

Earnings micro: Watch capex/AI monetization tone from mega-caps and the guidance bar for semis/industrial beta, key for whether this pause is consolidation or handoff lower.

US IG Credit Wrap: Flat Equities, Hard Gold Reset; OAS Holds the Groove, Carry Still in Charge (IG OAS ~52.9 bp)

IG held firm while the equity tape paused near highs and metals cracked lower. With 10-yr USTs a touch richer (~3.96%, −2 bp) and USD firmer, spreads were steady in the low-50s, classic “carry regime” behavior despite noisier cross-asset headlines.

Where We Sit (from the chart)

IG OAS: ~52.9 bp (last 52.85)

5-yr avg: ~61.9 bp → ~9 bp inside

Cycle tights: ~46.1 bp → ~6–7 bp above

2022 wides: ~111.2 bp → ~58 bp tighter

Tape & Macro Overlay

Equities: S&P little changed; Dow record on upbeat industrial guidance; positioning elevated, calls for a breather growing.

Metals/FX: Gold & silver slumped on stronger USD/positioning; volatility spiked in metals, not in credit.

Rates: Mild bull tone; oil drift keeps the “disinflation assist” narrative alive.

Earnings: Still supportive overall, though semis/hardware guidance (e.g., TXN) turned more mixed; idiosyncratic, not systemic.

Mapping to IG

Base case: The 50–60 bp corral remains the center of gravity. With rates contained and earnings broadly fine, grind-tighter bias persists toward the high-40s only if macro stays calm.

Banks: Senior IG stable; equity jitters around isolated events haven’t propagated. Funding windows open, terming out continues.

Cyclicals (Energy/Materials/Industrials): Two-way to commodities and tariffs, but quality BBB/A compression continues on constructive guidance.

Defensives (Staples/HC/REIT IG): Rich, steady carry dominates unless duration rally accelerates materially.

Tech/Comms: Headlines are micro; large-cap balance sheets remain spread-supportive.

Risk Markers to Watch

CPI (Fri): A 0.3% core keeps the grind; 0.4–0.5% risks a brief duration tantrum and a pause in tightening.

USD & real yields vs. metals: Sustained USD firmness/real-rate stability keeps gold in reset mode, credit insensitive unless it snowballs into broader risk-off.

US–China tape: De-escalation keeps beta door open; fresh tariff shock would cap further compression.

Regional-bank disclosures: Any shift from idiosyncratic to systemic would show up first as a clean break back above ~60 bp.

With equities pausing but not breaking and rates friendly, carry is doing the work. Barring a hot CPI or shock headline, IG OAS hugs the low-50s and grinds.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.