Macro Regime Tracker: Inflation and Equity Beta

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

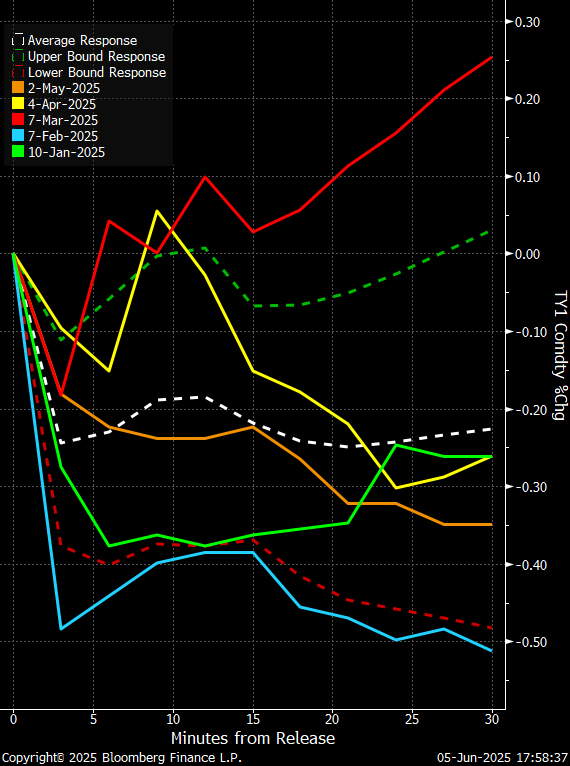

I want to cover several ideas post-market close as we head into NFP. You can see the bond views here:

First, the selling in the index today occurred with the Russell outperforming. Why? Because TSLA and the indexation effect helped drag down ES.

Second, Russell outperforming against the Dow (green), crude, and inflation swaps have been moving in lockstep. This is a key relationship to note because if the Russell does outperform marginally from here then it is a confirmation about inflation expectations.

Third, the distribution for NFP is below. We are ending a week after the hawkish comments from Lagarde. I would not be surprised to see some hedges unwind and put a bottom in BTC since it has been deviating from equities on a short-term basis.

Main Developments In Macro

TESLA SHARES EXTEND DROP TO 10% AFTER TRUMP, MUSK TRADE ATTACKS

SCHMID: TARIFFS LIKELY TO DRIVE UP PRICES, UNCLEAR HOW MUCH

SCHMID: OPTIMISTIC THAT ECONOMIC ACTIVITY CAN BE SUSTAINED

SCHMID: POLICY NEEDS TO BE NIMBLE AS FED BALANCES DUAL MANDATE

KANSAS CITY FED PRESIDENT JEFF SCHMID COMMENTS IN SPEECH

HARKER: MUST WAIT FOR MORE DETAIL OF TARIFF IMPACT ON ECONOMY

HARKER GIVES LAST PUBLIC REMARKS AS PHILADELPHIA FED PRESIDENT

FED'S SCHMID: INFLATION, EMPLOYMENT DATA ARE CLOSE TO MANDATE

HARKER: POSSIBLE, NOT CERTAIN FED TO FACE HIGHER PRICES, UNEMP.

HARKER: CRITICAL MONETARY POLICY BE FREE OF EXTERNAL INFLUENCE

HARKER: US ECONOMY REMAINS RESILIENT, BUT SEE SOME STRESSORS

LUTNICK TESTIMONY TO HOUSE PANEL ENDS

KUGLER: MAJ. OF FED OFFICIALS WORRIED ABOUT INF. BEFORE GROWTH

KUGLER: PREMATURE TO EXPECT BIG JOB LOSSES FROM AI

KUGLER: IMMIGRATION FLOWS DOWN, MAY MAKE LABOR MARKET TIGHTER

KUGLER: UNEMPLOYMENT STILL AT HISTORICALLY VERY LOW RATE

KUGLER: OVERALL TAX BILL MORE STIMULATIVE THAN CONTRACTIONARY

LUTNICK REITERATES JULY 9 DEADLINE FOR TRADE DEALS

LUTNICK: EXPECT NO TARIFFS ON THINGS WE CAN'T MAKE IN US

KUGLER: NOT CLEAR TARIFFS WILL HAVE ONE-TIME INFLATION IMPACT

FED'S KUGLER SAYS HER FOCUS NOW IS ON INFLATION

FED GOVERNOR ADRIANA KUGLER COMMENTS IN Q&A FOLLOWING SPEECH

TRUMP: CONGRESS WAITING FOR ME TO DECIDE ON RUSSIA SANCTIONS

TRUMP: HAVEN'T LOOKED AT RUSSIA SANCTIONS BILL

TRUMP PRAISES MODI, SAYS TRADE DEAL IN WORKS

TRUMP: PUTIN TOLD ME RUSSIA HAS NO CHOICE BUT TO ATTACK

TRUMP: THERE'S MORE FIGHTING IN STORE IN RUSSIA-UKRAINE WAR

TRUMP: COULD BE TOUGH ON BOTH RUSSIA AND UKRAINE IF DEAL FAILS

TRUMP: IF DEAL WITH RUSSIA FAILS, WE'LL BE VERY TOUGH

TRUMP SAYS MUSK HANGUP ON BILL ONLY BECAUSE OF EV TAX CREDITS

TRUMP: 'ALL OF A SUDDEN' MUSK HAD A PROBLEM WITH TAX BILL

TRUMP: DISAPPOINTED BECAUSE MUSK KNEW INNER WORKINGS OF BILL

TRUMP: YOU DON'T WANT TO HAVE ZERO INFLATION

TRUMP: WE HAVE ALMOST PERFECT INFLATION

KUGLER: SEE INFL. RISKS NOW, EMPLOYMENT RISKS DOWN THE ROAD

KUGLER: IF HIGH TARIFFS STAY, MAY SEE LARGER INF. EFFECTS SOON

KUGLER: CURRENT POLICY WELL-POSITIONED FOR ECONOMIC CHANGES

TRUMP ON MUSK REACTION TO BILL: I WAS VERY SURPRISED

TRUMP: I'D RATHER ELON CRITICIZE ME THAN THE BILL

TRUMP SAYS HE WILL BE GOING TO CHINA

TRUMP: WILL DISCUSS POTENTIAL EU TRADE DEAL WITH MERZ

LUTNICK: NEED TO RETHINK US-MEXICO RELATIONSHIP

LUTNICK: MEXICO SHOULD BE IN MINING, REFINING BUSINESSES

GOLDMAN NOW SEES FINAL ECB CUT IN SEPTEMBER RATHER THAN JULY

TRUMP REITERATES CALL WITH XI WENT 'VERY WELL'

TRUMP SPEAKS AT THE WHITE HOUSE AS HE GREETS GERMANY'S MERZ

LUTNICK: TRUMP WANTS FULL CHIP SUPPLY CHAIN IN THE US

TRUMP CRITICIZES CBO FOR NOT STATING TARIFF CALCULATION SOONER

LUTNICK REITERATES DESIRE FOR WEATHER CLOUD INFRASTRUCTURE

XI SAYS US SHOULD DEAL WITH TAIWAN CAUTIOUSLY: CCTV

XI TELLS TRUMP US SHOULD REMOVE 'NEGATIVE' MEASURES ON CHINA

XI SAYS TRUMP IS WELCOME TO VISIT CHINA AGAIN: XINHUA

XI TELLS TRUMP CHINA IMPLEMENTED GENEVA AGREEMENT: CCTV

XI SAYS US SHOULD REMOVE 'NEGATIVE' MEASURES ON CHINA: CCTV

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income and Currencies

You can find the educational primer and video explanation of these models here: LINK

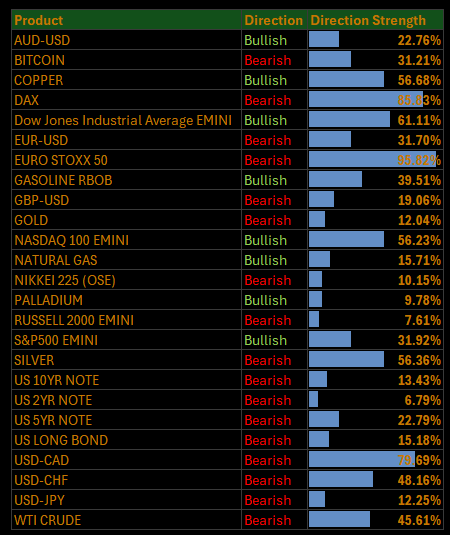

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

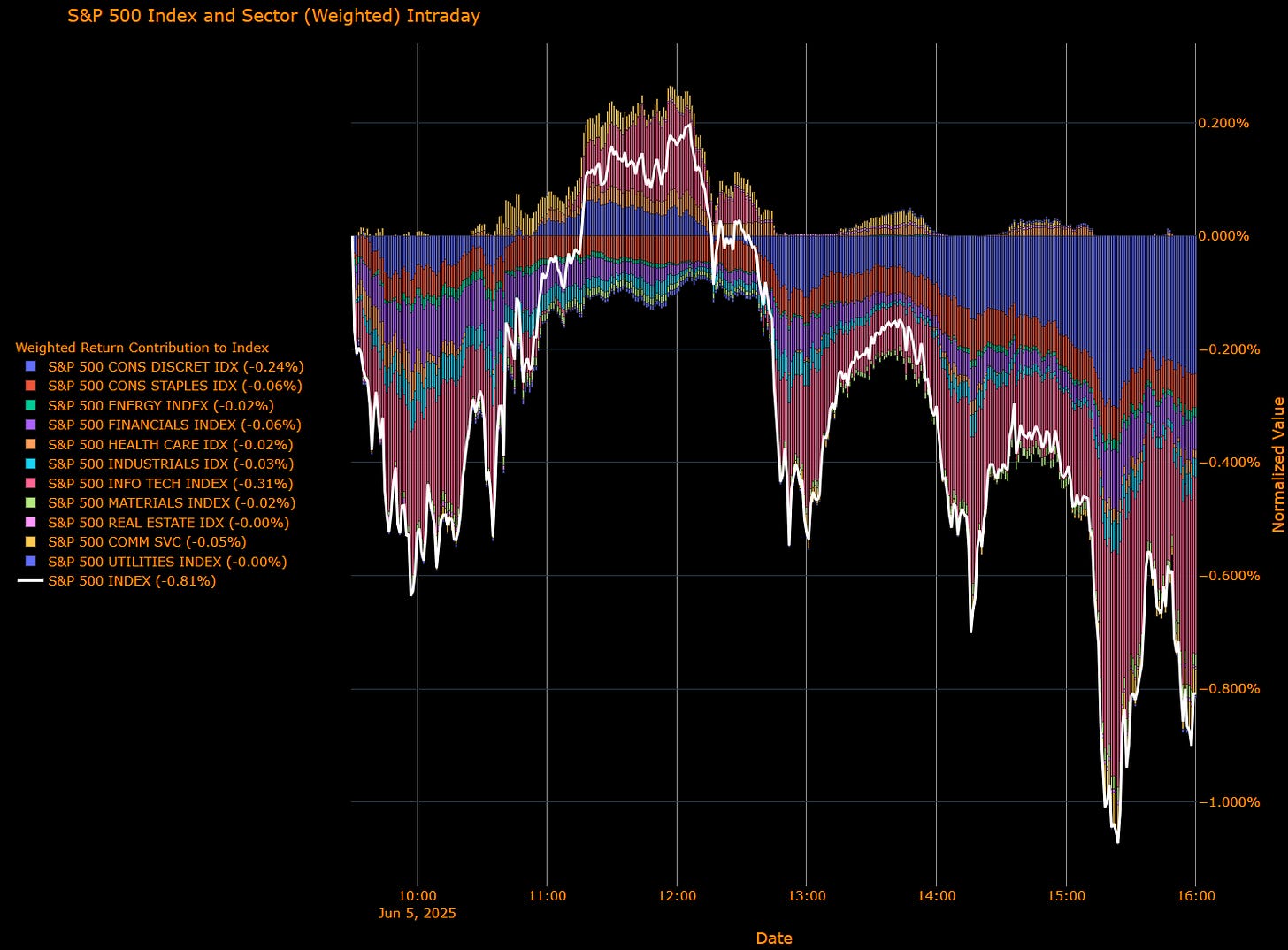

S&P 500 Declines -0.81%, Led by Technology and Consumer Discretionary Amid Trump-Musk Dispute and Economic Caution

Sector-by-Sector Contribution Snapshot (Weighted Impact)

Information Technology (-0.31 pp) – Largest negative contributor, significantly impacted by a steep decline in Tesla shares (-14%), following intensified disputes between Trump and Elon Musk over subsidies and tax policies.

Consumer Discretionary (-0.24 pp) – Major drag due to heightened investor caution around consumer spending amid tariff uncertainty and declining consumer sentiment.

Consumer Staples (-0.06 pp) – Modest negative contribution, reflecting cautious market sentiment despite the sector’s traditionally defensive stance.

Financials (-0.06 pp) – Negatively impacted by falling bond yields and rising economic uncertainties following softer employment data and tariff-induced inflation concerns.

Communication Services (-0.05 pp) – Contributed negatively, despite earlier strength, weighed down by general market anxiety and tariff-related uncertainties.

Industrials (-0.03 pp) – Mildly negative impact, as investors reacted cautiously to weaker manufacturing data and ongoing tariff disruptions.

Energy (-0.02 pp) – Slight negative contributor, pressured by concerns over global economic growth and uncertain energy demand outlook.

Materials (-0.02 pp) – Marginally negative, impacted by tariff concerns and ongoing economic uncertainty despite stable commodity prices.

Real Estate (-0.00 pp) – Virtually flat, as yield-oriented appeal was offset by broader market caution and interest rate uncertainty.

Utilities (-0.00 pp) – Minimal impact, despite typically defensive positioning, as investors showed broad caution amid uncertain economic conditions.

Health Care (-0.02 pp) – Slight negative impact, reflecting modest investor caution amid mixed economic signals and trade tensions.

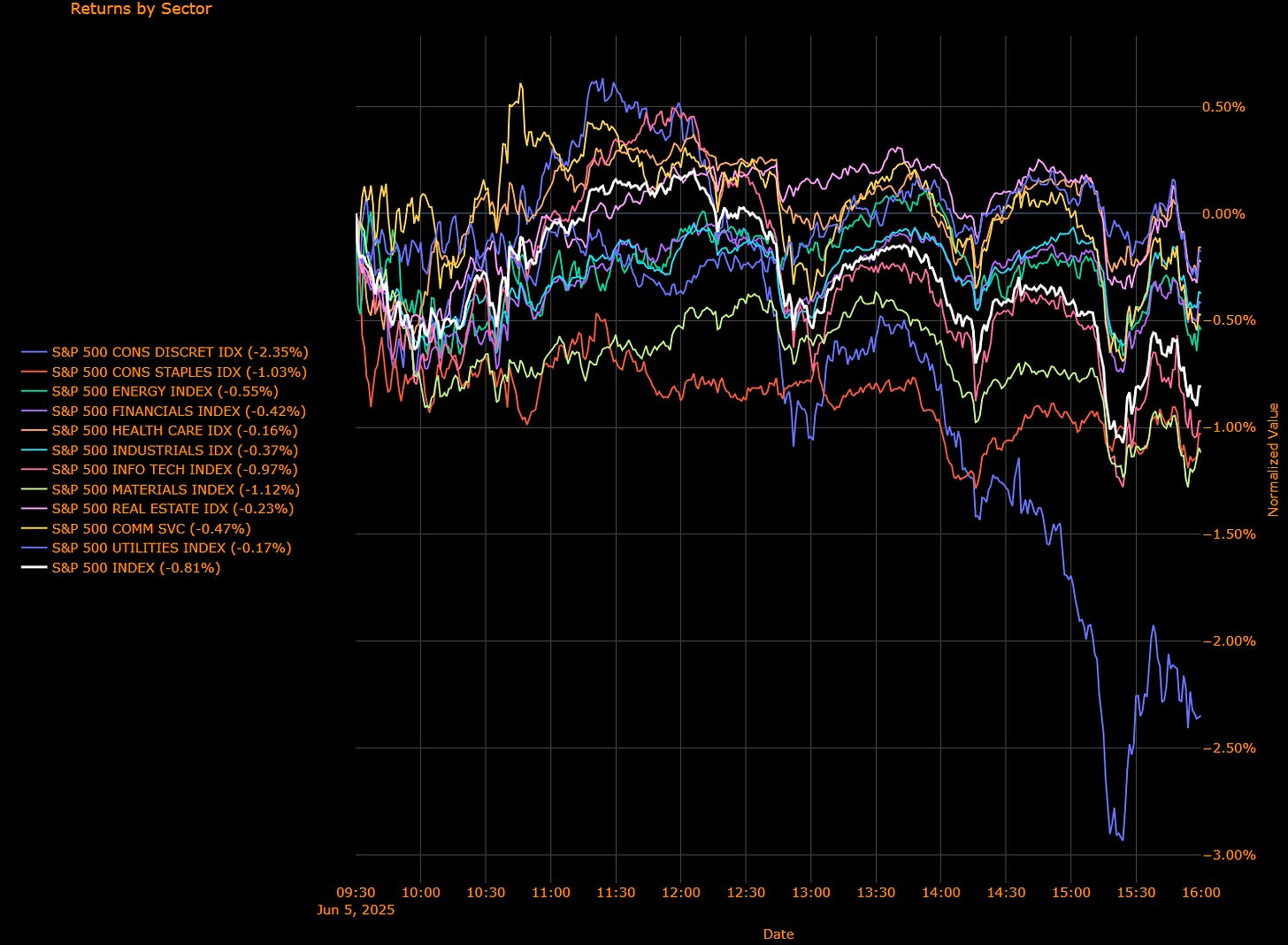

Sector-by-Sector Performance Snapshot (Unweighted Returns)

Energy (-0.29%) – Negative returns due to ongoing worries about global economic growth prospects.

Consumer Discretionary (-0.24%) – Weakened significantly, affected by concerns around consumer spending amid intensified tariff uncertainties and broader economic caution.

Consumer Staples (-0.06%) – Slightly lower, reflecting cautious investor sentiment despite the sector's defensive attributes.

Financials (-0.06%) – Dragged down by declining yields and economic growth concerns heightened by tariff impacts.

Health Care (-0.02%) – Modestly negative, influenced by cautious investor positioning.

Industrials (-0.03%) – Slightly weaker amid manufacturing softness and ongoing tariff-related supply chain issues.

Information Technology (-0.31%) – Significantly lower, driven by Tesla's sharp drop amid Musk-Trump tensions and broader tech caution.

Materials (-0.02%) – Marginal decline as investors navigated tariff uncertainty and moderate commodity outlook.

Real Estate (-0.00%) – Flat performance as investor caution balanced against yield attractiveness.

Communication Services (-0.05%) – Modest decline, reflecting broader market anxiety despite earlier defensive interest.

Utilities (-0.00%) – Unchanged, despite investor rotation typically benefiting defensive sectors.

Macro Overlay

The S&P 500 declined -0.81%, heavily influenced by significant weakness in Information Technology—particularly Tesla, following a high-profile dispute between Trump and Musk. Concurrently, broader market sentiment deteriorated amid weaker-than-expected employment data, rising unemployment claims, and escalating tariff-related inflation concerns highlighted by Fed officials including Adriana Kugler and Jeff Schmid. These developments fueled speculation about potential Fed rate cuts, intensifying caution in markets.

Bottom Line

The S&P 500 experienced a pronounced drop of -0.81%, primarily pressured by sharp declines in Technology and Consumer Discretionary sectors amidst heightened political tensions, weak economic indicators, and escalating tariff uncertainty. Wise to maintain vigilant regarding upcoming economic data releases, Federal Reserve signals, and developments in trade policy, preparing for continued market volatility.

US IG Credit Wrap — Spreads Widen to 55.66 bp Amid Rising Economic Concerns and Tariff Impacts

Current Spread: 55.66 bp (▲ ~0.5 bp d/d), marking a modest increase in spreads. Though still below the 5-year historical average (~63 bp), the current widening reflects increasing investor caution in response to recent disappointing economic data and heightened tariff-related uncertainties.

Credit Context

< 60 bp: Stable, duration-friendly range supporting insurance and liability-driven investment (LDI) strategies.

60–70 bp: Neutral-to-cautious positioning recommended amid tariff uncertainties and macroeconomic volatility.

> 90 bp: Significant market distress—currently unlikely without a major escalation in geopolitical or macroeconomic shocks.

Macro Overlay

Today's modest widening in IG credit spreads to 55.66 bp aligns with increased market caution stemming from recent soft economic indicators, sentiment has been negatively impacted by elevated uncertainty surrounding tariffs, reinforced by cautious commentary from Federal Reserve officials including Governor Adriana Kugler and Kansas City Fed President Jeff Schmid, who underscored inflation risks and potential economic drag from persistent tariffs.

Treasury yields declined amid these concerns, bolstering market expectations of potential rate cuts by the Federal Reserve later this year, somewhat tempering broader credit market risks.

Markets remain cautiously optimistic about further trade negotiations between President Trump and Chinese President Xi Jinping but continue to closely monitor developments for any tangible resolutions.

Bottom Line

US IG credit spreads have widened slightly to 55.66 bp, underscoring increased investor caution amid weakening economic data and ongoing tariff uncertainties. Keep a good eye on upcoming economic releases, Federal Reserve communications, and developments in trade talks to inform positioning and risk management strategies.

Mag7 Model:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.