Macro Regime Tracker: Long End Rates Making The Move

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I recorded a livestream today explaining the setup for long-end rates from here:

And then recorded a video breaking down the forward curve as we move into Jackson Hole tomorrow:

As always, you can find all the updated systematic strategies and models below. I will be sending out some special updates in the next 24 hours, so keep an eye out for them!

Main Developments In Macro

Federal Reserve & US Monetary Policy

*FED'S COLLINS SPEAKS IN INTERVIEW TO WSJ

*COLLINS: RATE CUT MAY BE SUITABLE IF JOBS OUTLOOK WORSENS: WSJ

*GOOLSBEE: CURRENT TARIFFS DON'T LOOK 'ONE AND DONE'

*GOOLSBEE: INDEPENDENCE FROM POLITICAL INTERFERENCE IS CRITICAL

*GOOLSBEE: RISE IN SERVICES INFLATION A 'DANGEROUS' DATA POINT

*GOOLSBEE: US ECONOMIC DATA SENDING MIXED MESSAGES

*FED'S GOOLSBEE SEPTEMBER FOMC IS A 'LIVE MEETING'

*HAMMACK: LABOR MARKET COULD STILL BE IN BALANCE DESPITE SLOWING

*HAMMACK: LABOR DEMAND MAY BE COMING DOWN BUT SO IS LABOR SUPPLY

*HAMMACK: BIGGEST CONCERN IS INFLATION TOO HIGH, TRENDING UP

*HAMMACK: ECONOMIC THEORY ON ONE-TIME TARIFF IMPACT MAY NOT HOLD

*HAMMACK: NOT GOING TO SEE FULL TARIFF EFFECT UNTIL NEXT YEAR

*HAMMACK: IT'S JUST NOW THAT WE'RE STARTING TO SEE TARIFF IMPACT

*HAMMACK: WHOLESALE COSTS GOING UP, NOT NECESSARILY BEING PASSED

*HAMMACK: IMPORTANT WE MAINTAIN MODESTLY RESTRICTIVE POLICY

*FED'S HAMMACK: BOTH SIDES OF DUAL MANDATE ARE UNDER PRESSURE

*BOSTIC: RIGHT NOW I THINK WE'RE MARGINALLY RESTRICTIVE

*BOSTIC: SHOULD BE ABLE TO BRING POLICY CLOSER TO NEUTRAL IN '26

*BOSTIC: ONE RATE CUT FOR THIS YEAR IS KIND OF STILL WHERE I AM

*BOSTIC: EMPLOYMENT TRAJECTORY IS POTENTIALLY TROUBLING

*SCHMID SAYS OFFICIALS WILL BE WATCHING AUG, SEPT INFLATION DATA

*FED'S SCHMID SAYS POLICY IS MODESTLY RESTRICTIVE, APPROPRIATE

*BULLARD: `I DO THINK THEY'LL CUT IN SEPTEMBER,' MINUTES STALE

*BULLARD: RATES ARE HIGH RIGHT NOW, CAN CUT 100 BPS INTO 2026

US Policy: Trade, Industrial, Energy, Immigration

*TRUMP: WE'RE GOING BACK TO FOSSIL FUELS, BACK TO WHAT WORKS

*TRUMP: WE HAVE TO INCREASE ELECTRICITY CAPACITY TO LEAD AI

*TRUMP: WE'RE LEADING THE ARTIFICIAL INTELLIGENCE RACE

*US PLAN WOULD REALLOCATE FUNDS FOR CRITICAL MINERALS: REUTERS

*US WEIGHS PLAN TO REALLOCATE $2B IN CHIPS ACT FUNDS: REUTERS

*US REVIEWING ALL US VISA-HOLDERS FOR DEPORTABLE VIOLATIONS: AP

*US MILITARY SEEKS TO STOCKPILE COBALT FOR FIRST TIME IN DECADES

*TRUMP AIMS TO GIVE LUTNICK GREATER OVERSIGHT OF MINERALS: RTRS

*NAVARRO ON EU: MAINTAIN TARIFFS ON STEEL, ALUMINUM

*NAVARRO ON EU: WILL IMPOSE 15% TARIFF ON AUTOS, DROP FROM 25%

*NAVARRO: NO DEAL MORE IMPORTANT THAN WITH EUROPEAN UNION

*EU, US REACH AGREEMENT ON JOINT STATEMENT OUTLINING TRADE DEAL

*US TARIFF ON EU AUTOS COULD BE LOWERED IN WEEKS: US OFFICIAL

*TRUMP AND CARNEY DISCUSSED TRADE TODAY, WHITE HOUSE CONFIRMS

*CARNEY, TRUMP AGREED TO RECONVENE SHORTLY

*CARNEY, TRUMP DISCUSSED TRADE CHALLENGES, OPPORTUNITIES

US Housing & Agencies

*PULTE ON FANNIE, FREDDIE: TRUMP VERY INTERESTED IN THIS ISSUE

*PULTE: FANNIE, FREDDIE IPO TIMING UP TO TRUMP ENTIRELY

*PULTE: FANNIE, FREDDIE NOW WORTH NORTH OF $500B

*PULTE ON FANNIE, FREDDIE: INTERESTING TO SEE WHAT TRUMP DOES

Fed Governance / Legal

*DOJ OFFICIAL REMARKS IN LETTER TO FED CHAIR JEROME POWELL

*DOJ: COOK CRIMINAL REFERRAL REQUIRES FURTHER EXAMINATION

*DOJ'S MARTIN SAYS HE INTENDS TO INVESIGATE COOK OVER MORTGAGES

*DOJ OFFICIAL URGES FED'S POWELL TO REMOVE GOVERNOR LISA COOK

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Flat Close, Cyclicals Lead; Powell Still the Hinge

The S&P 500 finished essentially unchanged at +0.05% as traders trimmed September-cut odds into Jackson Hole on firmer PMIs and hawkish Fed chatter. Yields backed up, the dollar firmed, and leadership flipped toward Energy/Materials while classic defensives lagged.

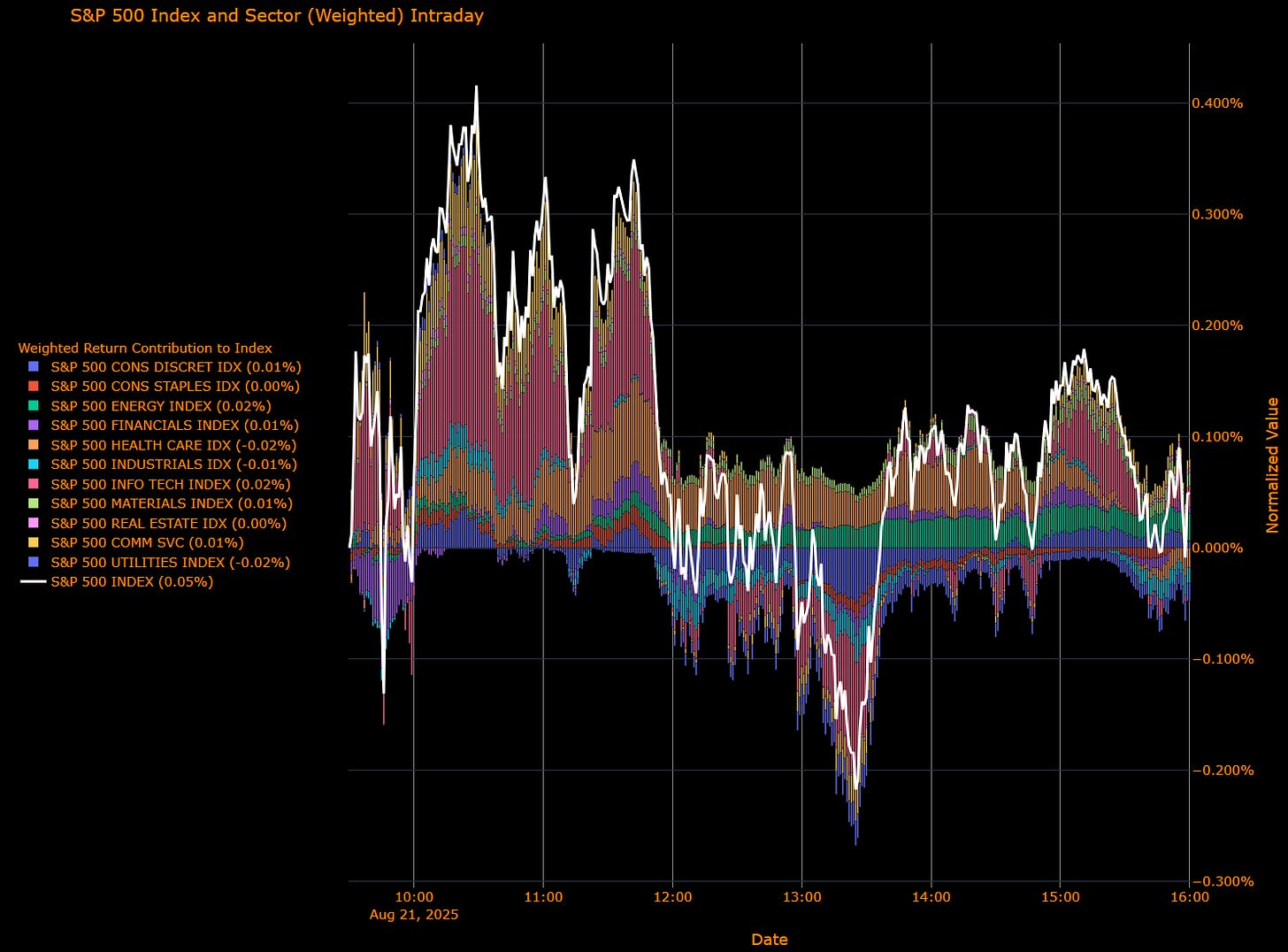

Sector Contribution (weighted to index move)

What actually drove the +0.05% on the day:

Offsets: Energy (+0.02%), Information Technology (+0.02%), Financials (+0.01%), Materials (+0.01%), Consumer Discretionary (+0.01%), Communication Services (+0.01%), Consumer Staples (0.00%), Real Estate (0.00%).

Detractors: Health Care (–0.02%), Utilities (–0.02%), Industrials (–0.01%).

Index: S&P 500 (+0.05%).

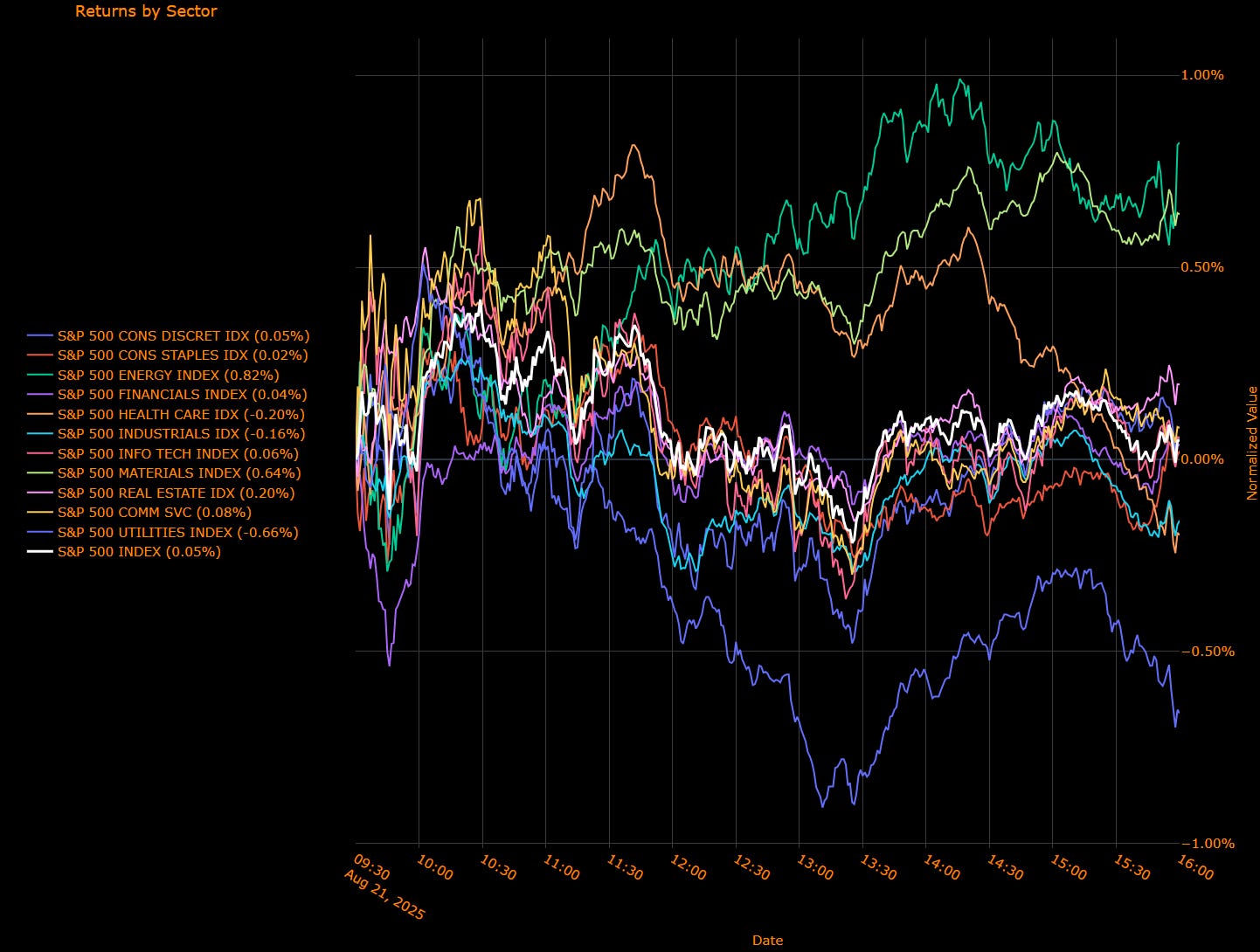

Sector Performance (unweighted breadth)

Leaders: Energy (+0.82%), Materials (+0.64%), Real Estate (+0.20%), Communication Services (+0.08%), Information Technology (+0.06%), Consumer Discretionary (+0.05%), Financials (+0.04%), Consumer Staples (+0.02%).

Laggards: Health Care (–0.20%), Industrials (–0.16%), Utilities (–0.66%).

Index: S&P 500 (+0.05%).

Macro Overlay: What mattered

Data pulse: US manufacturing PMI jumped to 53.3 (fastest since 2022), lifting the composite to this year’s high; services prices stayed hot. Claims rose but not enough to offset the growth signal.

Policy tone: Fed speakers leaned cautious Hammack wouldn’t support easing “if deciding tomorrow,” Bostic still sees one cut this year, Schmid called policy modestly restrictive. Markets trimmed September cut odds toward ~70% from >90% last week.

Cross-asset tells: Higher yields pressured rate-sensitives (Utilities, parts of Health Care) while cyclicals tied to real-activity (Energy/Materials) outperformed; USD firmer.

Final Word

Positioning reset rather than trend change: a growth-positive, price-sticky mix pushed leadership to cyclicals and clipped defensives. Powell’s message on reaction function tomorrow is the fulcrum anything that downplays pre-commitment and stresses inflation risk keeps front-end sensitivity elevated and favors this “cyclicals > defensives” skew unless services inflation cools.

US IG Credit Wrap: Hovering at ~51.6 bp; Rates Back Up on Hotter PMIs, Powell Friday

IG OAS: 51.59 bp • 5-yr avg 62.60 bp (~11.01 bp inside) • Cycle low 43.75 bp (~7.84 bp off tights) • COVID high 151.80 bp (~100.21 bp tighter)

Spreads held the low-50s despite a rates backup—classic carry regime. Credit beta stayed orderly even as equities slipped and the dollar firmed.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Context

Growth pulse: S&P Global mfg PMI jumped to 53.3 (fastest since 2022); composite at a YTD high. Pricing power remains sticky on tariffs/services.

Fed tone: Hammack wouldn’t back easing “if deciding tomorrow,” Bostic still at one cut this year, Schmid says policy is moderately restrictive. Goolsbee called the services-inflation pop “dangerous” but hopes it’s a blip. Odds of a September cut ~70% (down from >90% last week).

Cross-asset: Treasury yields higher, USD firmer; oil little changed. Equity weakness hasn’t bled into IG—another sign spreads are anchored by coupon/roll.

Macro overlay for IG

Powell’s reaction-function is the hinge. A message that re-emphasizes inflation risk and eschews pre-commitment likely lifts rates vol first; spreads follow only if it persists or equities wobble more materially. With OAS ~51–52, the path of least resistance remains carry and modest roll, bounded by fair-value talk in the mid-50s.

Rates Are the Risk

IG is trading as a rates-sensitive carry asset into Jackson Hole. If Powell leans hawkish, expect the first pain in duration (Treasury vol, curve beta); a sustained move toward 55–60 bp would likely require a combination of firmer services-price data and tighter financial conditions not just a one-day rates jump.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

US Short-End Rates Wrap: Sept 25 bp Still Base Case; Path Trims to –128.0 bp, Terminal ~3.05%

Cumulative Implied Easing (to Jan 2027): –128.0 bp

Terminal Rate (Jan 2027): 3.050% (~3.05%)

September OIS Cut Probability: 75.6% — Implied Rate 4.141% | Implied Move: –18.9 bp (~0.76×25)

The front end nudged shallower versus yesterday: the total path eases to –128.0 bp (from –130.5 bp) and the terminal ticks up +2½ bp. September remains a 25 bp base case but with softer odds (~76% vs low-80s). By 10-Dec-25 the curve embeds –48.6 bp, reaches –95.7 bp by 17-Jun-26, and finishes –128.0 bp by 27-Jan-27. Cadence still reads “step-downs through 1H26, then lighter trims into late-26/early-27.”

OIS-Implied Policy Path

Macro overlay

Growth pulse: Flash manufacturing PMI 53.3 (fastest since 2022) lifts the composite to a YTD high; pricing power sticky on services/tariff pass-through.

Fed tone: Hammack wouldn’t back easing “if deciding tomorrow”; Bostic still at one cut this year; Goolsbee called the pop in services inflation “dangerous,” hoping it’s a blip. Odds of a September cut have slipped toward ~70s from >90% last week.

Read-through: Destination (total easing) barely changed; pace is the swing factor into Powell.

Final word

Same layout, a touch shallower: ~25 bp in September, ~two cuts by year-end, terminal around 3.05%. Unless Powell leans hard against speed, the carryable glide remains intact; front-end P&L is about pace rhetoric more than the end-point.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.