Macro Regime Tracker: Macro Liquidity

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

I recorded a video today explaining WHERE we are in the macro regime (referenced video on twitter with threads: LINK): I want to dig into a few additional things

First, all of the major companies that are “Buy Now, Pay Later” (BNLP) are seeing massive growth. The implication of this is that there is unlikely some secret risk “under the surface” of either the economy or labor market that is beginning to create an imminent recession.

When consumers take out debt, there is no implication that it will eventually end poorly for them. This is possible but it needs to be taken in context with all macro data. The larger issue is if their income goes offline or wages begin to have less purchasing power.

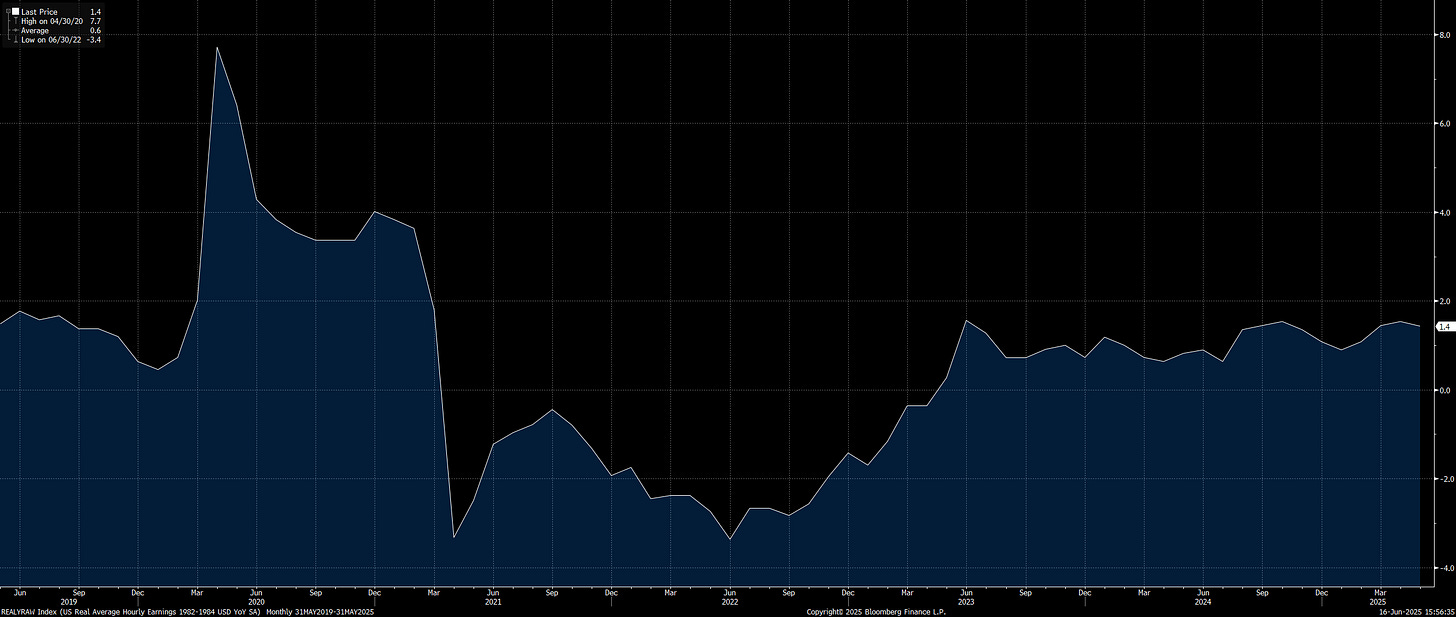

Right now, real wages are positive and well above 2022 levels:

I will be publishing a report tonight further breaking down these factors and explaining how they connect with both interest rates and assets on the far end of the risk curve so be on the look out for that.

Main Developments In Macro

Senate Republicans Release Their Version of Tax Bill

Senate GOP Tax Bill Ends EV Tax Credit 180 Days After Enactment

Senate Bill Proposes Max 8% University Endowment Tax

Senate Bill Makes Three Business Tax Breaks Permanent

Senate Bill Keeps 3.5% Remittance Tax

Senate Bill Delays Section 899 ‘Revenge Tax’ to Dec 31, 2026

Senate Bill Kills IRS Direct File Program

Senate Bill Includes No Tax on Tips, Overtime

Senate Tax Bill Lowers Medicaid Provider Tax to 3.5%: Politico

Senate Tax Bill to Omit Proposed Cuts to Medicare Advantage

Senate GOP Tax Bill Would Raise US Debt Ceiling by $5 Trillion

Trump: We Just Signed Document With UK

Trump Speaks at G-7 Meeting With UK PM Starmer

Trump Meeting With Von Der Leyen, White House Says

Trump and Japan PM Ishiba Met on Sidelines of G7 Summit

Trump on Iran: Will ‘Do Something’ After Leaving G-7

Trump: A Deal Will Be Signed or 'Something Will Happen'

Trump: Iran Would Be Foolish Not to Sign a Deal With Israel

Trump: We Just Signed Document, It’s Done

Trump: Throwing Russia Out of G-7 Was a Mistake

Trump: Good Relationship With Carney

Trump: We Will Accomplish a Lot, Mainly Focus on Trade With Canada

Trump Supports China Joining G-7 Talks

Trump Reiterates Support for Israel

Trump Will Not Sign the G7 Statement on Israel-Iran: CBS

Trump, Asked About Possible Sanctions on Russia: Could Happen

Israel’s Strategic Affairs Minister Ron Dermer Speaks on BTV

Dermer: Iran Needs to Halt Pursuit of Nuclear Weapons

Dermer: Iran in Violation of International Law

Dermer: Not Looking to Occupy Iran, No Territorial Conflict

Dermer: 'Our Greatest Ally in the World' Is the US

Dermer: American Pilots in Air Knocking Down Drones From Iran

Dermer: US Has Been ‘Tremendous’ in Supporting Israel

Dermer: Israel Has ‘Clear Plan’ to Set Iran Back Several Years

Dermer: Israel Started Ops to Address Nuclear, Ballistic Threats

Dermer: Israel Has Already Dismantled Natanz Site

Dermer: Israel Taking Out Iran’s Missile Production Factories

Dermer: Israel Wants to Remove the Ballistic Threat

Dermer: Iran Is Losing the War

IDF: Identified Missiles Launched From Iran Toward Israel

IDF: Air Force Continuing to Strike Targets in Central Iran

IDF Tells Some Tehran Residents to Leave Before Attack

USS Nimitz Carrier Strike Group on Way to Middle East: Fox News

US Military Moves Refueling Tanker Airplanes to Europe: Reuters

Iran Ready to Deliver 'Major Blow' to Israel: Semi-Official Mehr

Iran Retaliation Against Israel to Persist ‘As Long As Needed’

Iran: Latest Attacks on Israel to Continue Until Dawn: State TV

Iran Air Defense Activated in West, East, South of Tehran: Mehr

Iran’s Fars News Cites Foreign Minister Abbas Araghchi

Iran Asked Qatar, Saudi Arabia, Oman to Urge Trump: Reuters

Iran Seeks Trump to Press Israel for Immediate Ceasefire: Reuters

Iran to Offer Trump Flexibility in Nuclear Talks: Reuters

Macron, Trump Discussed Tariffs, Middle East, Ukraine at G-7

Japanese PM Ishiba Urged Trump to Rethink Tariffs: Nikkei

Rubio, French FM Discussed Middle East Conflict in Phone Call

EU Faces Struggle to Cut Russia Oil Price Cap on Mideast Risk

Trump, Starmer to Have Bilateral Meeting at G-7 Today: Official

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

S&P 500 Climbs 0.29%, Led by Tech and Comm Services Amid War Jitters and Central Bank Watch

Despite heightened geopolitical risks, the S&P 500 eked out a 0.29% gain, with investors selectively rotating back into growth sectors as signs emerged that the Israel-Iran conflict might remain contained. Traders focused squarely on this week’s central bank bonanza — with the Fed, BoE, BoJ, and SNB all due — while keeping one eye on the oil tape and another on missile headlines.

Sector Contribution Breakdown (Weighted Impact to Index)

Information Technology (+0.18 pp) – Dominant driver of the day's gain, with the AI complex and semis rebounding as valuations stabilized and dip buyers returned.

Communication Services (+0.05 pp) – Netflix, Meta and telco names staged a recovery, tracking lower rates and better ad demand expectations.

Financials (+0.05 pp) – Mild bounce despite higher long-end yields as traders leaned into big banks ahead of Fed commentary.

Consumer Discretionary (+0.04 pp) – Continued leadership as domestic consumption sentiment improved, especially in retail.

Energy (+0.01 pp) – Small contribution despite oil volatility, with traders reluctant to chase.

Industrials (+0.01 pp) – Marginal positive as capex optimism offset defense sector fatigue.

Materials (+0.01 pp) – Stabilized after recent pullback as commodity tape firmed.

Utilities (–0.02 pp) – Slight drag, reflecting profit-taking in havens.

Health Care (–0.03 pp) – Defensive sector lagged despite volatility.

Real Estate (–0.01 pp) – Underperformed as rates stayed firm.

Consumer Staples (–0.00 pp) – Flat; not participating in broader recovery.

Sector Performance Breakdown (Unweighted Returns)

Communication Services (+0.49%) – Top performer, with bounce in media and large-cap tech-adjacent names.

Information Technology (+0.56%) – Strong comeback in semis and software after valuation reset.

Financials (+0.36%) – Banks firmed despite curve pressure; traders look ahead to Fed tone.

Consumer Discretionary (+0.35%) – Ongoing rotation into cyclical names with retail strength.

Materials (+0.28%) – Rebounded with metals and chemicals catching a bid.

Energy (+0.27%) – Crude volatility kept energy names supported, if not exuberant.

Industrials (+0.10%) – Light gains led by logistics and capex plays.

Health Care (–0.35%) – Gave back recent gains amid gene therapy headline risks and sector rotation.

Real Estate (–0.24%) – Remained heavy as duration-exposed names suffered.

Consumer Staples (–0.05%) – Modestly lower on sector rotation out of defensives.

Utilities (–0.86%) – Biggest laggard, with broad unwind of defensive positioning.

Macro Overlay: Markets Walk the Tightrope

Geopolitics: The Israel-Iran conflict continues but hasn’t escalated beyond military tit-for-tat. Markets cheered signals that Tehran may be open to resuming nuclear talks, sparking hopes of de-escalation.

Oil: Brent erased an early 5.5% spike, closing near $72.6 as fears of a Strait of Hormuz disruption faded. Options flow still shows upside tail risk hedging.

Fed Outlook: Powell speaks Wednesday, with rates expected to remain on hold. The energy shock complicates the inflation picture, even as PPI data softened.

Bond Market: 10Y Treasury yields rose 2.6 bps to 4.42% as long-end weakness persisted, with Japan’s JGB dynamics now in global focus.

US IG Credit Wrap — Spreads Tighten to 55.89 bp Amid Soft Inflation and Strong Treasury Demand

Current Spread: 54.28 bp

5-Year Average: 62.92 bp

Status: Lowest level since early April — decisively inside the stable pre-pandemic range, suggesting market confidence in macro and policy containment.

Credit Context

< 60 bp: Stable, duration-friendly range supporting insurance and liability-driven investment (LDI) strategies.

60–70 bp: Neutral-to-cautious positioning recommended amid tariff uncertainties and macroeconomic volatility.

> 90 bp: Significant market distress—currently unlikely without a major escalation in geopolitical or macroeconomic shocks.

Macro Overlay

Treasury Market Support

A well-covered $22B long bond auction helped anchor long-end rates. Demand strength at the back end is key for credit markets, limiting volatility in real yields and supporting fixed income allocations.Inflation Cooling

Both CPI and PPI came in below expectations. Markets are now pricing in a ~65% chance of a rate cut by September, offering a policy backstop that encourages further credit spread compression.Geopolitics Absorbed

Despite Israel-Iran tensions and hundreds of missiles exchanged, spreads narrowed. The conflict has not disrupted energy infrastructure nor caused a broader market unwind. Risk sentiment has recalibrated on signs that Tehran may engage in nuclear diplomacy through Oman.Policy Week Ahead

With the Fed, BoE, BoJ, and SNB all setting policy this week, macro attention turns to global rate expectations. Most central banks are expected to remain on hold, but dovish signals could fuel further inflows into IG credit.

Bottom Line

Investment-grade credit is behaving predictably: ignoring headline volatility and taking its cues from real yields and inflation surprises. At 54.28 bp, spreads are nearly 9 bp through the 5-year average and well inside the post-COVID equilibrium zone.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Short-End Rates Wrap — Cumulative Easing Deepens to –104.0 bp; Market Conviction Builds for a September Start

Key Takeaways (Latest OIS-Implied Pricing)

First-Cut Timing:

18-Jun-25: Virtually unchanged (–0.2 bp), with just a 0.8% probability of a cut — confirms no live risk.

30-Jul-25: Mild easing expectations re-emerge, with a 12.0% probability of a 25 bp cut (–3.0 bp). Still not a firm base case.

17-Sep-25: This is where conviction builds — a 57.2% chance of a 25 bp cut is now priced (–14.5 bp), making September the most likely liftoff point.

Front-Loaded Easing Path (2025)

10-Dec-25: Implied rate at 3.860%, equating to a total of –47.0 bp of expected cuts between now and year-end.

Full-Year 2025: Markets currently expect just under two full cuts (–47.0 bp), reflecting a modest pace of normalization once easing begins.

Longer-Term Easing Expectations (2026)

28-Oct-26: Terminal rate implied at 3.290%, down –104.0 bp from today’s 4.33%. This suggests:

Roughly 4 full cuts (16 x 25 bp)

With the majority of action expected in H1 2026, including 3 cuts between Jan and July

Macro Context

Inflation Cooling:

Last week’s CPI and PPI both surprised to the downside, with May PPI up just +0.1% m/m. The data reinforced the Fed’s ability to wait for clearer trends without the pressure of an inflation overshoot.

Treasury Strength:

A robust $22B long bond auction and firm demand across the curve have helped anchor front-end pricing, even amid modest curve steepening.

Geopolitical Volatility Contained (For Now):

Despite escalating Israel-Iran tensions — with direct missile exchanges and oil volatility — rate markets are looking through the noise. Brent briefly topped $80 before fading, and no durable risk premium has taken hold in STIR pricing.

Fed in Focus:

As the June FOMC looms, Powell is expected to hold firm but may nod to softening inflation. Markets are comfortable pricing a gradual, low-volatility path lower, beginning in September and extending into late 2026.

Bottom Line

Markets remain anchored to a "September start" easing cycle, with just under two cuts now priced for 2025 and a cumulative –104.0 bp of easing priced through October 2026. The forward curve embeds a measured, quarterly cutting cycle, not an aggressive reversal.

Unless we see a sharp oil rebound or sticky core inflation in the July/August data, the bar for delaying a September cut continues to fall.

The Fed is unlikely to pre-commit — but the market already has.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.