Macro Regime Tracker: More Downside?

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

All of the macro views are linked here in the recent video I recorded for paid subscribers. The main question is, HOW MUCH risk is left in equities?

As always, see all of the systematic models and strategies updated below. Thanks

Main Developments In Macro

U.S. Monetary Policy and Fed Commentary

FED’S POWELL: ECONOMIC ACTIVITY DATA HAVE BEEN SURPRISING TO UPSIDE

POWELL: THERE ARE LESS GOOD SUBSTITUTES FOR GOVT INFLATION DATA

POWELL: LABOR DEMAND IS MOVING A LITTLE FASTER THAN SUPPLY

POWELL: LABOR MARKET SHOWS PRETTY SIGNIFICANT DOWNSIDE RISKS

POWELL: PERSISTENT TARIFF INFLATION IS CERTAINLY A RISK

FED’S COLLINS: INFLATION CERTAINLY CONTINUES TO BE TOP OF MIND

COLLINS: DOWNSIDE RISKS TO LABOR MARKET HAVE LIKELY RISEN

COLLINS: EXPECT RELATIVELY MODEST FURTHER RISE IN UNEMPLOYMENT

COLLINS: INFLATION RISK SOMEWHAT LESS THAN PREVIOUSLY THOUGHT

COLLINS: POLICY WOULD REMAIN RESTRICTIVE EVEN WITH MORE EASING

FED’S COLLINS: PRUDENT TO NORMALIZE RATES A BIT FURTHER IN 2025

BOWMAN: CONTINUE TO SEE TWO MORE RATE CUTS BEFORE END OF YEAR

FED’S BOWMAN SAYS SUPERVISION SHOULD FOCUS ON MATERIAL RISK

BOWMAN: FED SEEKING INPUT ON REQUIREMENTS FOR STABLECOIN RULES

BOWMAN: OFFERING MORE STRESS TEST PLANS IN NEXT WEEK OR SO

U.S. Politics, Fiscal, and Trade

WHITE HOUSE BUDGET OFFICE SAYS WILL ‘RIDE OUT’ SHUTDOWN

WHITE HOUSE BUDGET OFFICE SAYS WILL CONTINUE LAYOFFS

WHITE HOUSE BUDGET OFFICE POSTS ON X ABOUT LAYOFFS, SHUTDOWN

HOUSE SPEAKER MIKE JOHNSON SPEAKS TO REPORTERS AT THE CAPITOL

JOHNSON: TRUMP ADMIN HAS THE RIGHT TO MOVE FUNDS TO PAY TROOPS

JEFFRIES: THERE HAS TO BE GOP WILLINGNESS TO TALK ON SHUTDOWN

JEFFRIES: HOUSE DEMOCRATS ON DUTY IN DC READY TO OPEN GOVT

MINORITY LEADER HAKEEM JEFFRIES SPEAKS TO REPORTERS

Trump and Trade / Geopolitics

TRUMP: CONSIDERING TRADE MEASURES TOWARD CHINA AS RETRIBUTION

TRUMP: CHINA NOT BUYING US SOYBEANS IS ECONOMICALLY HOSTILE ACT

TRUMP: HAVE TO BE CAREFUL WITH CHINA

TRUMP: GREAT RELATIONSHIP WITH XI, SOMETIMES IT GETS TESTY

TRUMP: THINK RELATIONSHIP WITH CHINA WILL BE FINE

TRUMP: BRICS WAS AN ATTACK ON THE US DOLLAR

TRUMP: I LIKE THE DOLLAR, VERY STRONG ON THE DOLLAR

TRUMP PRAISES CURRENT OIL, GASOLINE PRICES

TRUMP: TRADE AGREEMENT WITH ARGENTINA WILL BE POSSIBLE

TRUMP: MILEI IS ON THE VERGE OF ECONOMIC SUCCESS

TRUMP SAYS HE WILL ENDORSE MILEI

TRUMP: WANT TO SEE ARGENTINA SUCCEED, VERY IMPORTANT COUNTRY

TRUMP: RUSSIAN ECONOMY IS GOING TO COLLAPSE

TRUMP: PUTIN DOESN’T WANT TO END WAR

TRUMP: PROBABLY STILL HAVE GOOD RELATIONSHIP WITH PUTIN

TRUMP: IF HAMAS DOES NOT DISARM, WE WILL DISARM THEM

GREER: CHINA TARIFF COULD HAPPEN SOONER, AS TRUMP SAID

GREER: 100% CHINA TARIFF DEPENDS ON WHAT CHINESE DO

GREER: CHINESE REALIZE THEY OVERSTEPPED

GREER: CHINA RARE EARTHS MEASURE IS DISPROPORTIONATE

GREER: HAVE HAD CONSTRUCTIVE TALKS WITH CHINA OVER PAST 6 MOS

US TRADE REPRESENTATIVE JAMIESON GREER SPEAKS ON CNBC

Europe

LAGARDE: RISKS TO ECONOMIC OUTLOOK ARE MORE BALANCED

LAGARDE: MONETARY POLICY IN EUROPE HAS DONE ITS JOB

LAGARDE: ECB WELL-POSITIONED TO RESPOND TO POTENTIAL SHOCKS

LAGARDE: WOULD NEVER SAY ECB IS DONE CUTTING RATES

ECB’S LAGARDE: ECONOMY HAS BEEN RELATIVELY RESILIENT TO TARIFFS

ECB GOVERNING COUNCIL MEMBER MAKHLOUF SPEAKS IN WASHINGTON

MAKHLOUF: EUROPEAN ECONOMY IS SHOWING RESILIENCE

MAKHLOUF: ECB IN GOOD PLACE WITH DISINFLATIONARY PROCESS OVER

ECB’S MAKHLOUF: INFLATION IS WHERE WE WANT IT TO BE

Broader Global Context

BESSENT: EUROPE NEEDS TO RATCHET UP PRESSURE ON RUSSIA

BESSENT: HAPPY WITH THE CURRENCY ARRANGEMENT WITH ARGENTINA

BESSENT: US AID TO ARGENTINA NOT CONDITIONED TO CHINA SWAP END

BESSENT COMMITED TO WORKING WITH G7 PARTNERS TO PRESS RUSSIA

WHITAKER: EXPECT ‘BIG’ UKRAINE WEAPONS ANNOUNCEMENTS TOMORROW

WHITAKER: NO CARVE-OUTS FROM NATO DEFENSE SPENDING

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

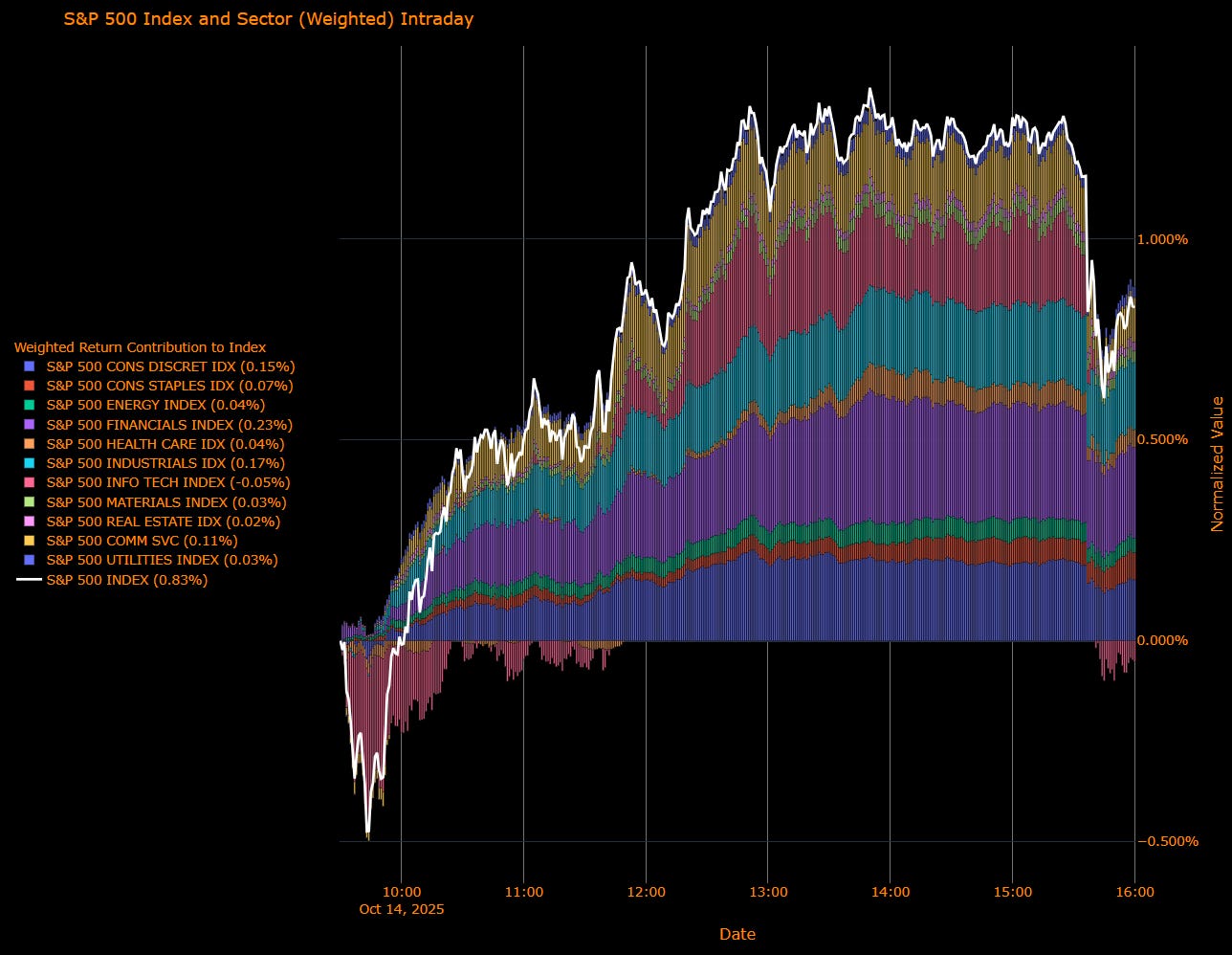

US Market Wrap: Trade Friction Tempers Fed Relief — Cyclicals Lead as AI Euphoria Fades (S&P +0.83%)

Markets struggled to reconcile Fed reassurance with resurgent trade tension after President Trump’s remarks reignited friction with China. The S&P 500 clawed out a modest +0.83% gain, sustained by rotation into cyclicals and banks, but under the surface the mood turned fragile. Powell’s speech at the NABE conference affirmed an October rate cut and hinted that quantitative tightening could end soon, but traders were distracted as Trump threatened new restrictions on Chinese cooking-oil trade, pulling risk appetite back to neutral.

Sector Attribution

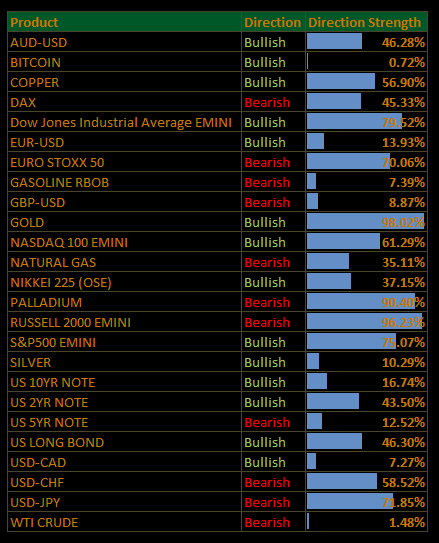

Weighted Return Contribution (S&P +0.83%)

Leadership came from Financials (+0.23%), Industrials (+0.17%), and Consumer Discretionary (+0.15%), together accounting for roughly two-thirds of the index’s move. Communication Services (+0.11%) added follow-through momentum, while Energy, Health Care, and Staples each chipped in modestly (~ +0.04–0.07%). Technology lagged slightly (–0.05%) as the AI trade paused for breath.

Unweighted Performance (Breadth)

Breadth was surprisingly healthy despite the macro noise. Industrials (+2.02%) and Financials (+1.68%) topped the table, followed by Materials (+1.63%) and Consumer Discretionary (+1.47%), underscoring rotation into real-economy cyclicals. Energy (+1.27%) and Staples (+1.35%) also advanced, hinting that investors remain anchored to quality earnings and pricing power. Tech (–0.15%) fell for a second session as talk of an AI bubble grew louder, reflecting fatigue rather than fundamental reversal.

Macro Overlay

Catalyst & Tape:

The day began with optimism after Powell signaled that the Fed is firmly on track to deliver another quarter-point cut in October and may halt QT to preserve liquidity. Two-year yields hovered near 3.47%, their lowest since 2022, reinforcing the “policy-easing but data-dependent” narrative. Yet any dovish tailwind was blunted by renewed U.S.–China trade tension, reminding investors that geopolitical risk still trumps policy comfort.

Rates & FX:

Treasuries flattened at the front end; the 10-year yield slipped to 4.02%. The dollar eased (–0.1%) as haven demand supported the yen (+0.4%) and euro (+0.3%). Markets continue to price ~125 bps of cumulative Fed cuts by end-2026 with a terminal near 3%.

Commodities & Crypto:

Oil retraced (–1.7% WTI to $58.47) on concern that weaker global trade could sap demand, while gold rose (+0.8% to $4,144/oz) as traders sought protection against policy uncertainty. Bitcoin (–2.6%) and Ether (–4.1%) fell sharply, mirroring fading risk appetite in tech.

Corporate & Credit:

Earnings season unofficially kicked off on a strong note, Goldman and Citi beat estimates across divisions, JPMorgan flagged credit vigilance but solid trading income, and Wells Fargo raised profitability guidance. BlackRock reported $205bn inflows as private-credit exposure expanded. Yet the AI theme wobbled: Citigroup’s CFO warned of “frothiness” in valuations, and AMD slipped after reports of a slower chip-order pipeline.

The Read-Through

This was a rotation day, not a breakout. The index advance masked internal divergence: cyclicals outperformed as defensives and tech decoupled. Powell’s assurance of imminent cuts soothed rate fears, but Trump’s tariff rhetoric revived growth anxiety. a reminder that liquidity and policy support can’t fully offset political shocks. The AI trade looks stretched, while bank strength hints at stabilizing credit conditions. For now, markets are balancing between easing expectations and external risk; breadth says “risk is alive,” but leadership says “it’s tired.”

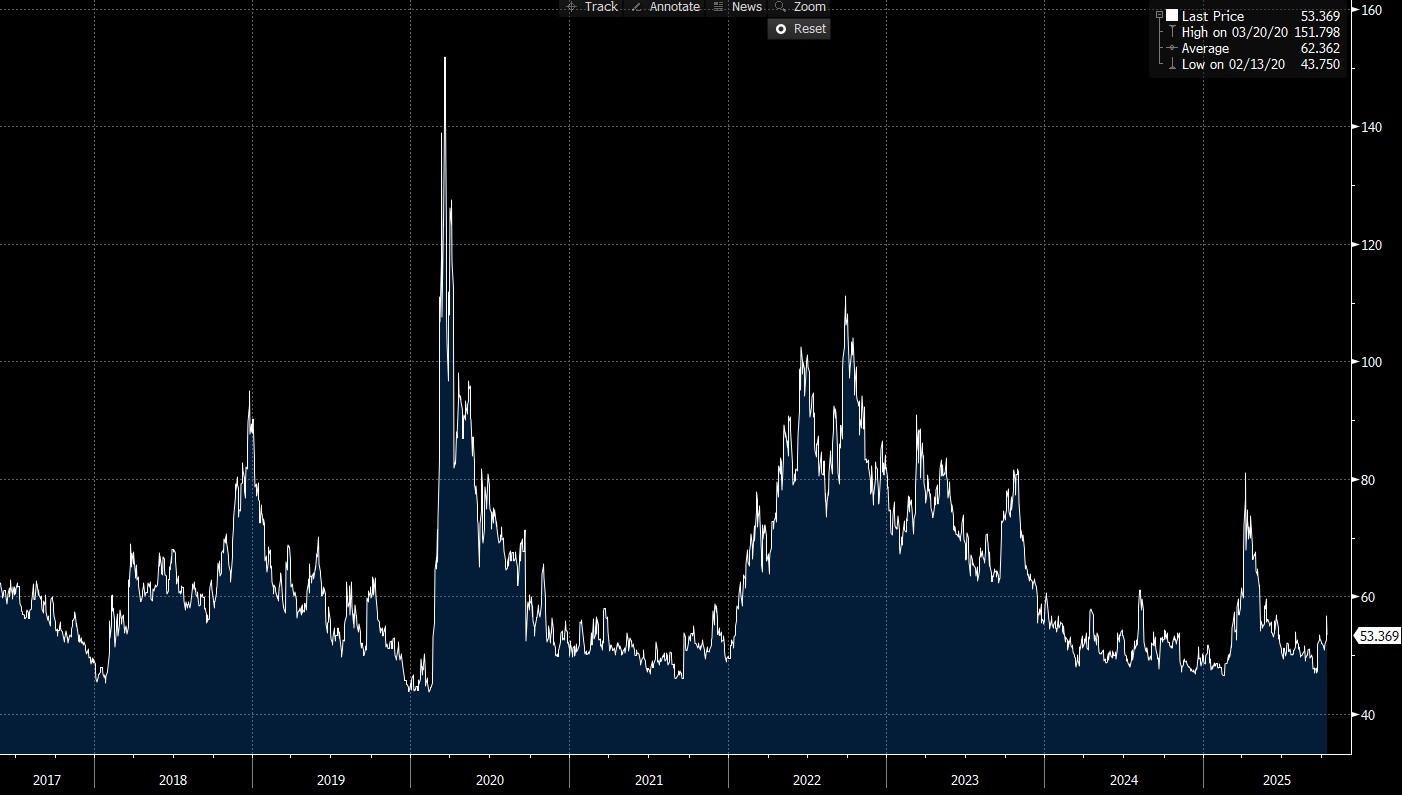

US IG Credit Wrap: Trade Friction Tests Nerves, Fed Dovish Tilt Keeps OAS Anchored (IG OAS ~53.4 bp)

A fresh bout of U.S.–China tension knocked equities and oil, while haven bids supported gold and the front-end. Credit held its ground: IG OAS stayed pinned in the low-to-mid-50s as Powell reaffirmed an October cut and hinted QT may end soon, both supportive for liquidity and swap spreads. The message from spreads is “uneasy but intact carry.”

Where We Sit (from the chart)

IG OAS: ~53.4 bp

5-yr avg: ~62.4 bp → ~9 bp inside

Cycle tights: 43.8 bp → ~9.6 bp above

Pandemic wides: 151.8 bp → ~98 bp tighter

(Chart stats: Last ~53.37 | High 151.8 on 03/20/20 | Avg 62.36 | Low 43.75 on 02/13/20.)

Credit Context

<55–60 bp: Carry-positive, duration-friendly zone for insurers/pensions; room to oscillate without breaking trend.

60–70 bp: Noise band where tariff or growth scares can push beta wider temporarily.

>90 bp: Requires a genuine macro shock—still a low-probability tail given the policy backdrop.

Tape & Macro Overlay

Equities: Soft risk tone as tariff rhetoric re-emerged; AI leadership wobbled, banks resilient into earnings.

Rates/FX: 2y ~3.47% (cycle lows), 10y ~4.02%; easing expectations sticky (Oct cut priced, Dec likely). QT pause talk = supportive for spreads via funding/swap-spread channel.

Commodities/Crypto: WTI –1.7% (demand anxiety), gold +0.8% (hedging bid). Crypto heavy alongside tech fatigue.

Mapping to IG

Beta: With rates stable-to-softer and QT pause on the table, base case is a grind within 50–60 bp.

Sector color: Cyclical sleeves (Energy/Materials/Industrials) are two-way with tariff headlines; banks benefit from earnings clarity and a friendlier funding backdrop.

Primary/flows: Expect constructive reception for high-quality supply while volatility stays contained; liability-driven accounts keep clipping carry.

The Read-Through

We shift from “holiday-quiet mid-50s” to “headline-tested but anchored”. Powell’s dovish tilt caps downside in credit even as trade noise caps upside. Path of least resistance: 50–60 bp channel with a slight grind-tighter bias if earnings stay constructive and tariff escalation cools. Upside risk to OAS (wider) is a sharp growth scare; downside (tighter) needs a clean risk tape plus a live rates bid.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.