Macro Regime Tracker: NVDA and Credit Flows

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I laid out all of the macro views and trade write ups in a video today that can be found here:

as always you can find all the systematic models and strategies updated below

Main Developments In Macro

US MONETARY POLICY & FED

*VANCE IMPLIES TRUMP WOULD WORK W/ CONGRESS ON FED: USA TODAY

*VANCE SAYS TRUMP CAN LEGALLY FIRE FED'S COOK: USA TODAY

*NAVARRO: APPEARS TO BE SLAM DUNK CASE AGAINST FED'S COOK

*NEC DIRECTOR HASSETT SPEAKS ABOUT LISA COOK TO REPORTERS

*HASSETT: HONORABLE THING TO DO WOULD BE TO TAKE LEAVE

*FED'S WILLIAMS: PRETTY OPTIMISTIC ON WHERE THE ECONOMY IS

*WILLIAMS: DEFINITELY EVERY MEETING IS 'LIVE' FOR ME

*WILLIAMS: IF NEUTRAL IS 1% OR BIT BELOW, WE ARE RESTRICTIVE NOW

*WILLIAMS: PUTTING 'LITTLE BIT' DOWNWARD PRESSURE ON ECONOMY NOW

*WILLIAMS: JOB, PRICE RISKS GETTING CLOSER TO BALANCE

*WILLIAMS: GOT TO SEE WHERE BALANCE OF RISKS ARE

*WILLIAMS: AT SOME POINT, APPROPRIATE TO MOVE RATES DOWN IN TIME

*WILLIAMS: DEFINITELY SEE A SLOWDOWN IN PACE OF HIRING

*WILLIAMS: THIS IS A SLOWING ECONOMY, NOT A STALLING ECONOMY

*WILLIAMS: GDP GROWTH HAS SLOWED, EXPECT THAT TO CONTINUE

*WILLIAMS: CENTRAL BANK INDEPENDENCE IS VERY IMPORTANT

*FED'S WILLIAMS: NOTHING TO ADD ON LISA COOK ALLEGATIONS

US RATES / TREASURY MARKET

*TREASURY WI 5Y YIELD 3.717% BEFORE $70 BILLION AUCTION

*US FIVE-YEAR NOTES DRAW 3.724%; ALLOTTED AT HIGH 84.43%

*US 5Y NOTES DRAW 3.724% VS 3.717% PRE-SALE WHEN-ISSUED YIELD

*US FIVE-YEAR NOTES BID/COVER RATIO 2.36 VS. 2.31 PREVIOUS AUCTION

*US AWARDS 60.5% OF FIVE-YEAR NOTES TO INDIRECT BIDDERS

*US AWARDS 30.7% OF FIVE-YEAR NOTES TO DIRECT BIDDERS

*US AWARDS 8.8% OF FIVE-YEAR NOTES TO PRIMARY DEALERS

*US 1YR 11MO FRNS DISCOUNT MARGIN AT 0.195%

*US 1YR 11MO FRNS ALLOTTED AT HIGH 77.45%

*US 1YR 11MO FRNS BID/COVER RATIO 3.22 VS. 2.81 PREVIOUS AUCTION

*TREASURIES PARE LOSSES; 2- TO 5-YEAR YIELDS FALL TO DAY'S LOWS

US ENERGY / COMMODITIES

*RUSSIA TO EXTEND FULL GASOLINE EXPORT BAN THROUGH SEPT.

US TRADE & FOREIGN POLICY

*TRUMP TO LEAD WHITE HOUSE MEETING ON ENDING GAZA WAR: WSJ

*ZELENSKIY SAYS HIS OFFICIALS TO MEET TRUMP'S TEAM IN US FRIDAY

*HADDAD: BRAZIL WILL CHALLENGE TARIFFS IN US JUDICIARY

*EU TO PROPOSE CUTTING US TARIFFS THIS WEEK TO MEET TRUMP DEMAND

*TRUMP'S DOUBLING OF INDIA TARIFFS TO 50% TAKES EFFECT

*AKAZAWA: URGE US TO ISSUE ORDER TO CUT AUTO TARIFFS ON JAPAN

*AKAZAWA: URGE US TO END STACKING OF TARIFFS VIA EXECUTIVE ORDER

*AKAZAWA: WILL VISIT US ON AUG. 28-30 FOR TRADE TALKS

*CORRECT: JAPAN'S AKAZAWA PLANS TO VISIT US AUGUST 28: ASAHI

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

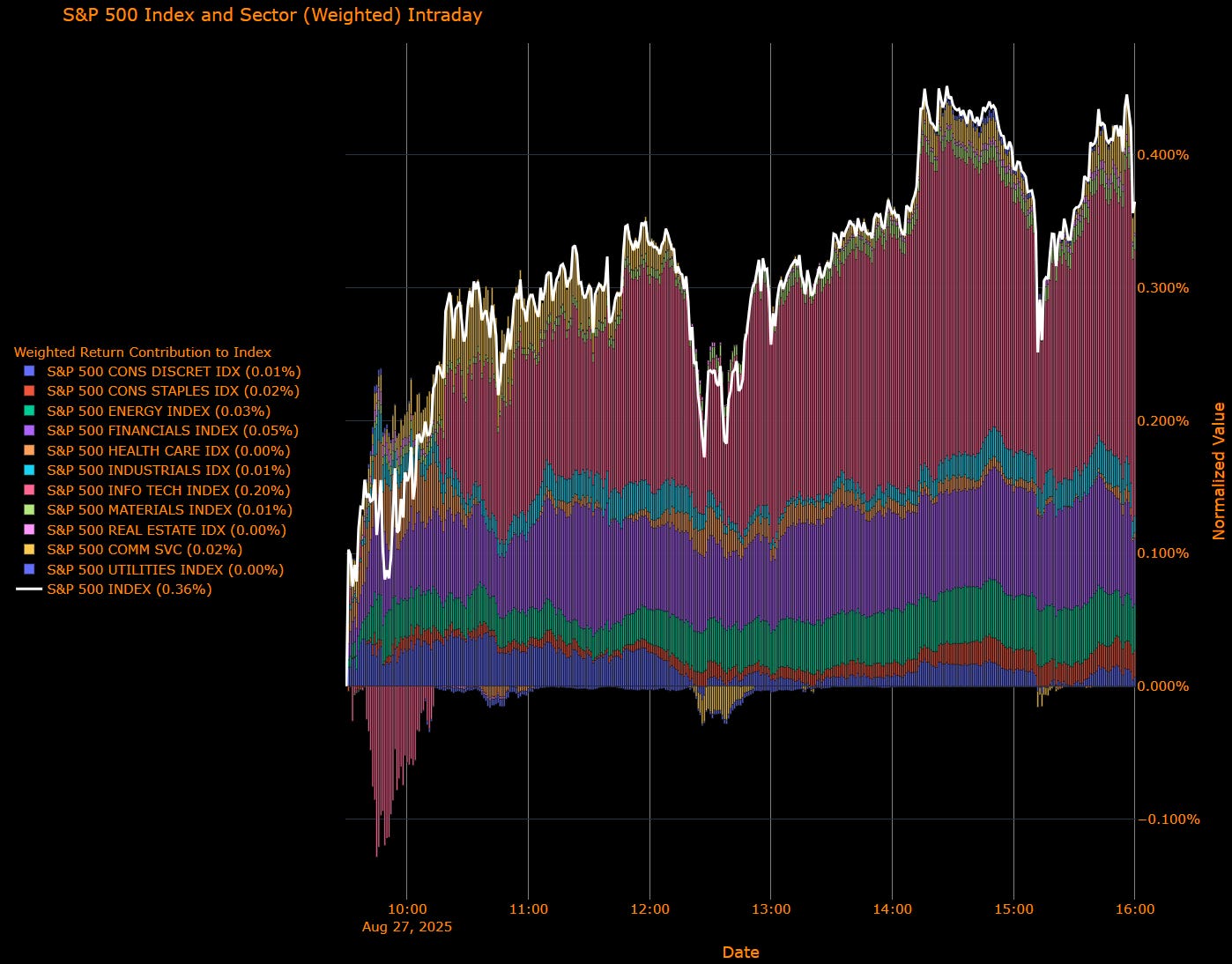

US Market Wrap: NVDA Guide Wobbles After Hours; Front-End Bid, Energy + Tech Lead (S&P +0.36%)

A constructive cash session gave way to softer futures after Nvidia’s revenue outlook ($54B ±2%) undershot lofty whispers and excluded China data-center sales. The S&P finished +0.36% in regular hours with Energy and Tech carrying the tape, while short-dated Treasuries stayed bid on easier-policy bets. Fed-independence headlines linger (Cook saga), with Treasury Sec. Bessent again urging an internal Fed review and signaling Powell-succession interviews after Labor Day. Oil eased, the dollar was little changed.

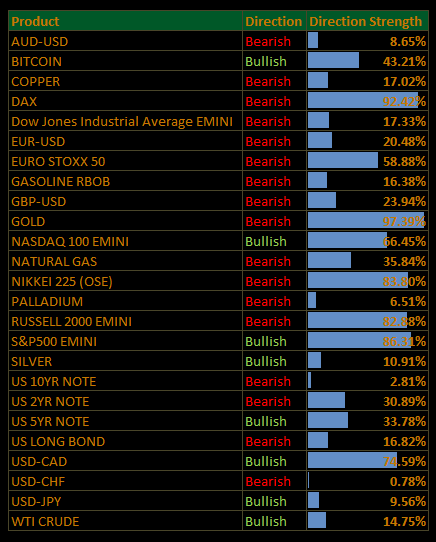

Sector Contribution (weighted to index move)

Offsets: Information Technology (+0.20%), Financials (+0.05%), Energy (+0.03%), Communication Services (+0.02%), Consumer Staples (+0.02%), Industrials (+0.01%), Consumer Discretionary (+0.01%), Materials (+0.01%).

Detractors/flat: Health Care (0.00%), Real Estate (0.00%), Utilities (0.00%).

Index: S&P 500 (+0.36%).

Sector Performance (unweighted breadth)

Leaders: Energy (+1.17%), Information Technology (+0.59%), Materials (+0.54%), Consumer Staples (+0.38%), Financials (+0.36%), Communication Services (+0.21%), Industrials (+0.15%).

Laggards: Real Estate (+0.12%), Consumer Discretionary (+0.07%), Health Care (+0.04%), Utilities (+0.04%).

Index: S&P 500 (+0.36%).

Macro Overlay

NVDA: Guide shy of the whisper and no China DC revenue in the forecast stoked “AI spend decel” fears; stock fell after hours and NDX futures slipped. Watch commentary on the GB300 transition and any China-compliant SKUs.

Rates/auctions: Front end firmed (prices up) as easing expectations persist. The 5-yr auction cleared a touch above WI with solid demand (bid/cover ~2.36, strong indirects ~60.5%), keeping funding conditions orderly.

Fed independence/politics: Cook removal attempt keeps a term-premium/steepening overhang even if day-to-day impact is modest; Bessent pushes for an internal review and starts the Powell-successor process post-Labor Day.

Trade policy drift: Secondary tariffs in focus (India), Mexico signaling higher China tariffs another small nudge toward stickier goods prices/supply-chain rerouting.

Cross-asset tone: WTI ~−0.6% on the day, gold flat, dollar little changed; vol remains subdued, leaving the tape sensitive to an earnings or policy headline.

Looking Forward

Cash session strength was broad and cyclical enough to keep the “growth-without-panic” vibe alive, but the AI leader now has to re-earn the multiple. Base case: September 25 bp cut remains the market’s anchor; political noise sustains a mild steepening bias. Near-term pivots: Friday’s core PCE, and 5s30s behavior into quarter-end.

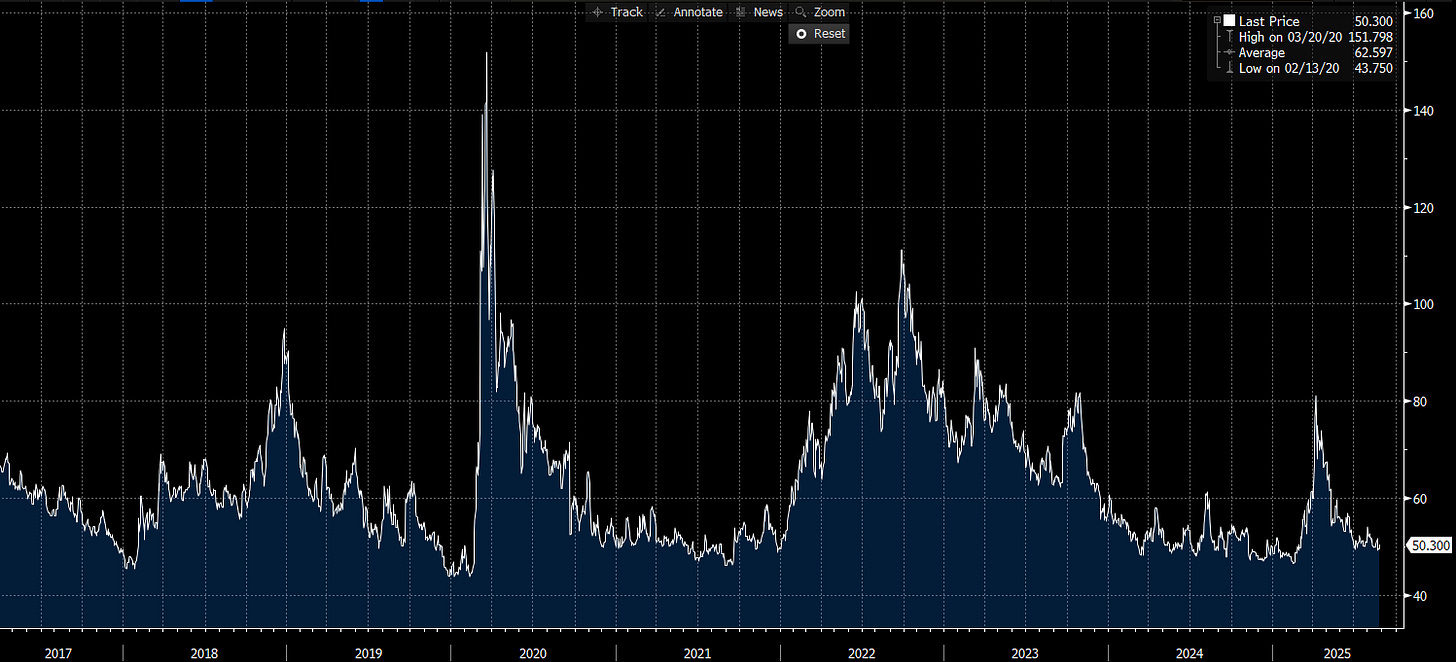

US IG Credit Wrap: Low-50s Hold; NVDA Guide Wobbles, Front-End Bid (S&P futs softer)

IG OAS: 50.30 bp • 5-yr avg: 62.60 bp (~12.3 bp inside) • Cycle low: 43.75 bp (~6.6 bp off tights) • COVID high: 151.80 bp (~101.5 bp tighter)

Spreads ticked ~0.6 bp wider but stayed in the “low-50s” comfort zone while rates did the heavy lifting. Cash equities were constructive, then futures faded after Nvidia’s revenue outlook ($54B ±2%) underwhelmed and excluded China data-center sales. Short-dated Treasuries stayed bid on easing expectations; the 5-yr auction cleared just above WI with solid demand (bid/cover ~2.36, indirects ~60.5%), keeping funding conditions orderly. Fed-governance noise lingered (Bessent urging an internal review; Powell-successor interviews after Labor Day), a mild term-premium overhang rather than a credit event.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay for IG

Earnings/AI: NVDA guide shy of whispers and no China DC revenue feeds the “AI spend decel” worry, but capex leaders still anchor sentiment unless guidance cuts spread.

Rates & curve: Front-end bid with cut odds intact; steepening risk persists from politics/term premium, but moves in spreads remain smaller than moves in rates.

Fed independence: Cook saga = headline risk; markets still price an independent Fed. Any escalation hits the long end first before IG beta.

Trade policy drift: India secondary tariffs/Mexico’s talk on China tariffs add a small goods-price tailwind; not spread-moving yet.

Primary/flows: New issue calendar stays selective into core PCE; concessions disciplined, carry doing most of the work.

What to Watch

Core PCE, NVDA call color on GB300/China-compliant SKUs, and 5s30s behavior into month-/quarter-end. Base case: sub-51 holds near term; carry beats beta while rates set the tone.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

Today is the last day that all the Interest Rate Sensitivity Models will be free. This would be a great time to do a free trial so you can review everything. Free Trial LINK.

Launch video for these models is here: LINK

Equity Indices:

Equity Sectors:

Bitcoin:

Gold, Silver, and Crude:

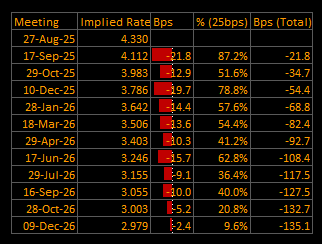

US Short-End Rates Wrap: Sept 25 bp Base Case (86.0%); Path Deepens to –138.9 bp, Terminal ~2.94%

Cumulative Implied Easing (to Dec 2026): –138.9 bp

Terminal Rate (Dec 2026): 2.941% (~2.94%)

September OIS Cut Probability: 86.0% — Implied Rate 4.115% | Implied Move –21.5 bp (~0.86×25)

Versus yesterday, the path is a touch deeper and the terminal a few bps lower (–138.9 vs –135.1; ~2.94% vs ~2.98%), while September odds ease slightly (86% vs 87.2%) but remain a 25 bp base case.

OIS-Implied Policy Path

Macro overlay

NVDA wobble: A softer revenue guide ($54B ±2%, no China DC revenue) dented post-close risk appetite, but doesn’t change the front-end anchor unless it broadens into capex cuts.

Rates/auctions: Front-end remains bid on easing expectations; the 5-yr cleared just above WI with solid demand (strong indirects), keeping funding orderly.

Fed governance: Cook saga lingers; Bessent urged an internal Fed review and starts Powell-successor interviews after Labor Day — a term-premium/steepening overhang, not a front-end event (yet).

Trade noise: Secondary tariffs (India) and Mexico’s talk of higher China tariffs = mild goods-price tailwind; watch for services stickiness in Friday’s core PCE.

What it says

Base case is a calibration cut in September, followed by measured trims through mid-’26; today’s glidepath is a few bps deeper with the terminal nudged below 3%.

Risks to the path

Hot core PCE / sticky services: slows cadence; terminal biased higher.

Benign PCE + softer labor: re-deepens the path toward the mid-140s bp by late ’26.

Governance escalation: pressures the long end/term premium first; spreads follow only if equities/flows crack.

Destination…

Destination remains lower; speed is the variable. Into core PCE, front-end P&L is rates-led: hot prints shave 1H’26 cuts; benign prints restore the step-down with terminal just under 3%.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.