Macro Regime Tracker: Post CPI Analysis

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

The CPI print today showed inflation coming in ABOVE expectations and the market is beginning to converge to the view I have been laying out. The main idea is that inflation is NOT just tariff driven but actually a fuction of growth. This is why core services accelerated in the print today.

I covered this and Q&A in the live stream today. The recording can be found here:

Bottom line, we remain in the same regime where stocks and Bitcoin are skewed to the upside and bonds face headwinds. We saw yields in Germany make new highs today, which is the first warning shot about the global nature of the duration risk we are seeing.

You can find the twitter thread I wrote on this here: LINK

As always, all of the updated models and strategies are updated below. Thanks

Main Developments In Macro

Federal Reserve Commentary & Policy

Trump Officials Mull Philip Jefferson for Fed Chair: Politico

Bessent: Want to Find Someone Who Can 'Revamp' the Fed

Bessent: Trump Has an 'Open Mind' on Fed Chair Pick

Bessent: Fed Could Have Cut in June if Given Accurate Data

Miran: Can't Comment on Current Interest Rate Policy

Fed's Schmid: Restrictive Policy Is Appropriate for Time Being

Fed's Schmid: Growth Remains Solid, Inflation Remains Too High

Schmid: Policy Is Modestly Restrictive, Not Very Restrictive

Fed's Barkin Says Balance of Jobs, Inflation Risk Still Unclear

Barkin: If Consumer Draws the Line, Employment Could Take a Hit

Barkin: Spending Solid, but Consumers Tiring of Higher Prices

Barkin: Pullback Must Be More Serious to Cause Economy to Falter

Tariffs, Trade, and Policy Direction

Lula: We Are Considering Reciprocity Against US Tariffs

Bessent: Will Immediately Enjoin if Court Rules Against Tariffs

Bessent: Need Sustained Progress Before Tariffs Come Down

Trump: Tariffs Have Not Caused Inflation

Miran on CPI: 'No Evidence' of Tariff-Induced Inflation

Miran: Tariffs 'Will Be Borne' by Foreign Countries

Schmid: Cooling Job Market Working Against Tariff Pass-Through

Labor Market Data & Reporting Changes

WSJ Cites White House Officials on Jobs Data Changes

Trump Told Advisers He Doesn't Want Big Data Revisions: WSJ

Trump Advisers Consider Changes to Jobs Data Collection: WSJ

EJ Antoni Suggests Suspending Monthly Jobs Report: Fox Business

Leavitt: Plan Is for BLS to Continue to Put Out Jobs Reports

Political & Fiscal Developments Impacting Macro

Trump: Powell Must Now Lower the Rate

Trump: Considering Allowing a Major Lawsuit Against Powell

Trump: Would Sue Powell Over Construction of Fed Buildings

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Record Highs on CPI Relief, September Cut Odds Surge

The S&P 500 rose 0.68% on Tuesday, closing at a fresh record alongside the Nasdaq 100 as an in-line July CPI print bolstered expectations the Federal Reserve will cut rates in September. While services inflation accelerated, goods prices especially tariff-exposed categories came in softer than feared, easing concerns of a broader inflation flare-up.

Money markets now price in nearly a 90% probability of a September cut, with some traders openly debating the potential for a 50 bp move. Two-year Treasury yields fell 4 bps to 3.73% before paring gains, and the dollar weakened 0.4%.

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Top Contributors

Info Tech (+0.31 pp) – Mega-cap tech extended its leadership, with semis and cloud names outperforming.

Comm Services (+0.10 pp) – Gains in media and streaming drove the sector higher.

Financials (+0.10 pp) – Banks benefited from curve steepening optimism as rate-cut odds rose.

Moderate Contributors

Health Care (+0.05 pp) – Outperformed on a mix of managed care strength and biotech rebounds.

Industrials (+0.06 pp) – Transport and aerospace names firmed on cyclical sentiment.

Smaller Contributions

Consumer Discretionary (+0.02 pp), Materials (+0.02 pp), Energy (+0.01 pp), Utilities (+0.01 pp) – All positive, though gains were incremental.

Real Estate (0.00 pp), Consumer Staples (0.00 pp) – Largely flat.

Sector Performance Breakdown

(Unweighted Daily Returns)

Leaders

Comm Services (+1.02%) – Led by internet platforms and ad-tech.

Materials (+0.93%) – Metals and chemicals rallied on China stimulus chatter.

Info Tech (+0.90%) – Broad-based strength, semiconductors outperforming.

Financials (+0.75%), Industrials (+0.73%), Health Care (+0.61%) – Cyclicals and defensives alike joined the advance.

Laggards

Energy (+0.36%) – Oil names lagged despite crude stability.

Consumer Staples (+0.07%), Real Estate (+0.07%), Utilities (+0.22%) – Defensive sectors rose modestly.

Macro Overlay: CPI Relief, Fed Cut Momentum, Fiscal Undercurrents

Inflation Data – Core CPI rose 0.3% MoM, the strongest since January, driven by services (airfares, medical care, recreation), while goods inflation stayed subdued. Tariff-sensitive categories like toys, furnishings, and sporting goods saw only mild price gains. YoY core CPI printed at 3.1%, just above expectations.

Fed Policy Shift – The print reinforced market conviction in a September cut. Treasury Secretary Scott Bessent floated the idea of a 50 bp reduction, while Richmond Fed’s Tom Barkin kept an open stance pending more data. Kansas City Fed’s Jeff Schmid struck a more cautious note, preferring to hold rates unless demand weakens materially.

Tariff & Fiscal Dynamics – July tariff revenue hit a record $28B, up 273% YoY, yet the budget deficit widened to $291B. Bessent hinted full-year tariff revenues could exceed 1% of GDP, even as fiscal deficits remain on a worsening trajectory post-tax cuts.

Final Word: Inflation Relief Sets the Stage for Fed Debate

Tuesday’s CPI release removed one major risk from the near-term outlook, tariffs have yet to feed meaningfully into broad inflation. The market’s rally reflects confidence that the Fed will prioritize labor market softness over the recent services inflation uptick. The next pivot point is Friday’s retail sales report, which will determine whether consumption resilience reinforces the case for a gentler easing pace or emboldens those pushing for an aggressive half-point cut in September.

US IG Credit Wrap: Spreads Grind Tighter on “OK” CPI, Carry Still in Charge

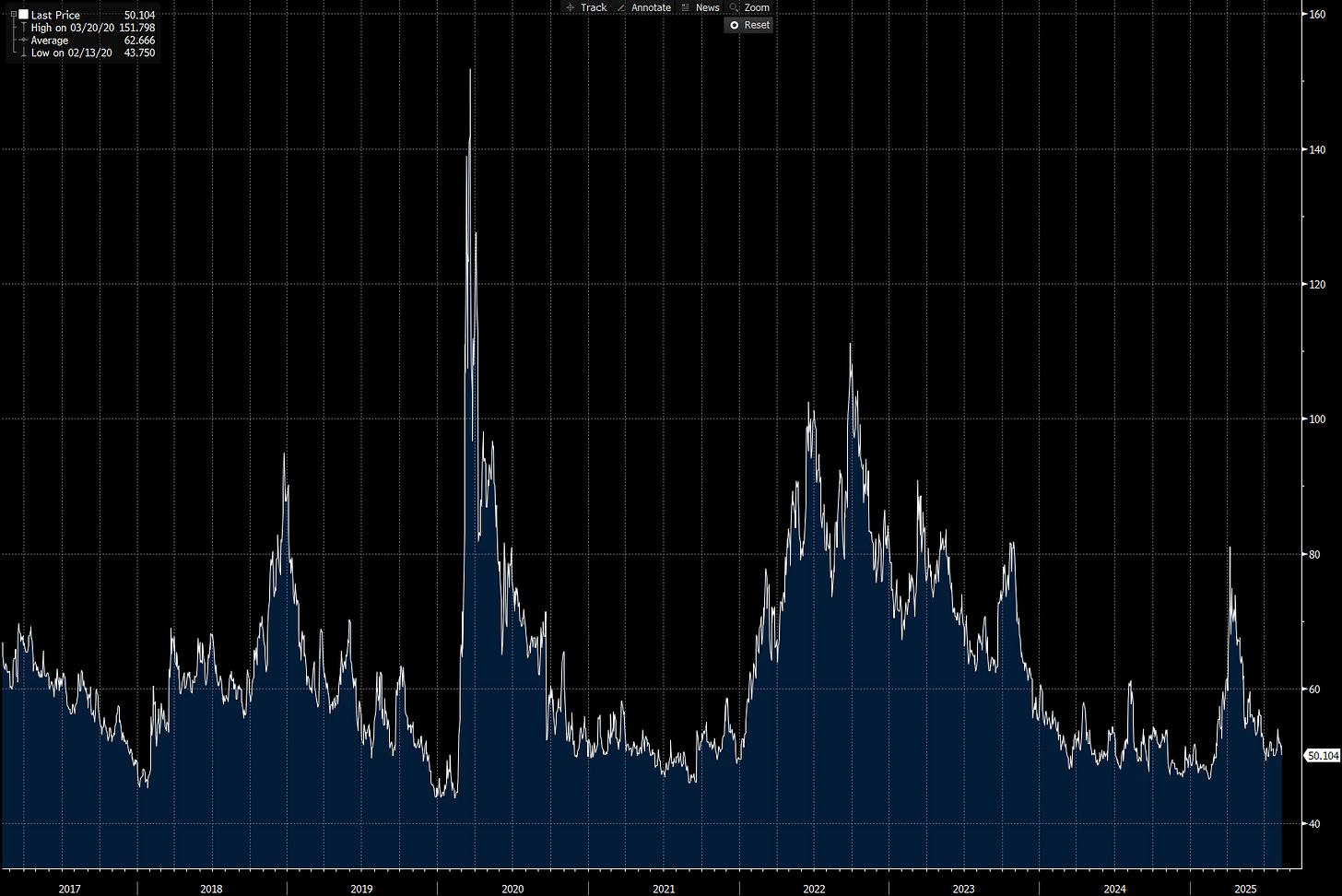

IG OAS: 50.10 bp • 5-yr avg: 62.67 bp • Cycle low: 43.75 bp • COVID high: 151.80 bp

10y UST: softer post-print • Equity tape: risk-on, new highs • Dollar: lower

Investment-grade spreads ticked ~1 bp tighter to ~50 bp, back near the floor of the post-COVID range as July CPI landed in line (core +0.3% m/m). Services inflation re-accelerated but goods/tariff-exposed categories stayed tame, reinforcing the consensus that the first move is in rates, not credit risk. Money markets hold ~90% odds of a September cut, and Treasury Secretary Bessent even floated 50 bp; Fed speakers split (Barkin open-minded, Schmid cautious), but none of it changed the carry-comfort tone in IG.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro overlay that matters for IG

Inflation/Cuts: CPI keeps a September cut in play; the debate shifts to 25 vs 50 bp. For IG, front-end rate relief > credit shock: lower all-in yields extend demand from total-return and yield targets.

Tariffs/Fiscal: Record monthly tariff receipts lift near-term revenues but don’t close the widening budget gap duration, not spread, is where fiscal risk bites first (long-end term premium).

Labor: Softer payroll backdrop argues the Fed skews to employment, another reason spreads hug the floor barring a growth air-pocket.

Good enough…

IG remains priced for “good-enough” macro and an easing Fed. Unless upcoming growth data surprise on the hot side, the path of least resistance is carry and roll with OAS anchored ~50–55 bp. The next meaningful spread catalyst is not CPI it’s whether consumption blinks or the Fed blinks bigger in September.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Short-End Rates Wrap: September Cut All-But-Closed, Path Edges to –131 bp; Terminal ~3.02%

Cumulative Implied Easing (to Jan 2027): –131.3 bp

Terminal Rate (Jan 2027): 3.017%

September OIS Cut Probability: 96.8% | Implied Rate: 4.088%

Markets pushed the easing path a touch lower after an in-line CPI: the September cut is essentially priced, with ~24 bp of reduction implied on the day and ~97% odds of at least 25 bp. Beyond September, the curve added a few basis points of easing, taking the terminal to ~3.02% and total cuts to –131 bp by Jan ’27.

OIS-Implied Policy Path

Macro Overlay: CPI Looms, Politics and Tariff Pause in Focus

Inflation: Core CPI +0.3% m/m (strongest since January) but goods inflation stayed subdued, muting fears of broad tariff pass-through.

Policy rhetoric: Treasury Sec. Bessent floated the option of 50 bp in September; Fed’s Barkin stayed flexible while Schmid leaned toward holding unless demand weakens. Odds for a September move ~90% in money markets remain intact, with debate shifting to 25 vs. 50.

Macro tape: Equities at new highs, 2-yr ~3.73% (softer), dollar lower—conditions that keep front-end easing bias in place.

Next….

The market just nudged the glidepath lower: September is done in all but name, and the terminal slides to ~3.02%. Next catalysts—Retail Sales, PPI→PCE inputs, and Fed speak—will decide whether we debate how much in September, not if.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.