Macro Regime Tracker: POST FOMC

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

You can find the short livestream I did here after FOMC:

And The Largest Risk To The Credit Cycle video/playbooks here:

As always, all the models and strategies are updated below. The attached spreadsheets have tabs mapping credit cycle indicators you can reference as well. This would be a great time to review them.

Main Developments In Macro

Fed Decision & Policy Outlook

FED RELEASES FOMC STATEMENT IN WASHINGTON

FED CUTS TARGET RANGE FOR BENCHMARK RATE TO 4%-4.25%

FED CUTS IOR TO 4.15%, CUTS DISCOUNT RATE TO 4.25%

FED SAYS GOVERNOR MIRAN DISSENTS IN FAVOR OF HALF-POINT CUT

TRADERS ADD TO BETS ON AT LEAST ONE MORE FED RATE CUT THIS YEAR

FED MEDIAN PROJECTION SHOWS 50 BPS MORE RATE CUTS IN 2025

FED MEDIAN UNEMPLOYMENT PROJECTION 4.5% IN '25, 4.4% IN '26

FED MEDIAN CORE PCE PROJECTION AT 3.1% IN '25, 2.6% IN '26

FED MEDIAN PROJECTION SHOWS RATES AT 3.4% IN '26, 3.1% IN '27

FED MEDIAN PROJECTION SHOWS RATES AT 3.1% BY END OF 2028

ONE OFFICIAL PENCILED IN 150 BPS OF RATE CUTS FOR 2025

TWO OFFICIALS PENCILED IN TWO QUARTER-POINT CUTS FOR 2025

SIX OFFICIALS PENCILED IN ONE QUARTER-POINT CUT FOR 2025

ONE OFFICIAL PENCILED IN NO RATE CUTS FOR 2025

FED MEDIAN LONGER-RUN FUNDS RATE UNCHANGED AT 3%

FED SAYS INFLATION HAS MOVED UP, REMAINS SOMEWHAT ELEVATED

FED SAYS UNEMPLOYMENT HAS EDGED UP BUT REMAINS LOW

FED SAYS DOWNSIDE RISKS TO EMPLOYMENT HAVE RISEN

FED MAINTAINS TREASURY ROLLOFF CAP OF $5B, MBS OF $35B

Powell Commentary

POWELL: RISKS TO LABOR MARKET WERE FOCUS OF TODAY'S DECISION

POWELL: JOB MARKET INDICATORS SUGGEST MEANINGFUL DOWNSIDE RISK

POWELL: REVISED JOBS NUMBERS MEAN LABOR MARKET NO LONGER SOLID

POWELL: LABOR DEMAND COMING DOWN A BIT MORE SHARPLY THAN SUPPLY

POWELL: JOB GAINS HAVE SLOWED, DOWNSIDE EMPLOYMENT RISKS RISEN

FED'S POWELL: UNEMPLOYMENT REMAINS LOW BUT HAS EDGED UP

POWELL: LABOR MARKET IS LESS DYNAMIC AND SOMEWHAT SOFTER

POWELL: JOB GROWTH APPEARS TO BE RUNNING BELOW BREAKEVEN RATE

POWELL: PAYROLLS JUST ONE FACTOR SUGGESTING LABOR MKT COOLING

POWELL: LOW HIRING IS A GROWING CONCERN OVER LAST FEW MONTHS

POWELL: PEOPLE AT JOB-MARKET MARGINS STRUGGLING TO FIND JOBS

POWELL: GOOD PART OF JOBS SLOWING REFLECTS LABOR FORCE DECLINE

POWELL: UNEMPLOYMENT REMAINS LITTLE CHANGED OVER PAST YEAR

POWELL: LABOR DEMAND HAS SOFTENED

POWELL: MODERATION IN GROWTH LARGELY REFLECTS CONSUMER SLOWDOWN

POWELL: DATA THIS WEEK SHOWS CONSUMPTION STRONGER THAN EXPECTED

POWELL: ACTIVITY IN HOUSING SECTOR REMAINS WEAK

POWELL: NEED BIG FED RATE CHANGES TO MATTER FOR HOUSING SECTOR

POWELL: TARIFFS CONTRIBUTING 0.3-0.4 PPTS TO CORE PCE READING

POWELL: EXPECT TARIFF INFLATION IMPACT TO CONTINUE TO BUILD

POWELL: CERTAINLY POSSIBLE TARIFFS ARE IMPACTING LABOR MARKET

POWELL: CASE FOR PERSISTENT TARIFF INFLATION IS LESS

POWELL: DISINFLATION APPEARS TO BE CONTINUING IN SERVICES

POWELL: ESTIMATES INDICATE CORE PCE ROSE 2.9% YOY IN AUGUST

POWELL: ESTIMATES INDICATE PCE INFLATION ROSE 2.7% YOY IN AUG.

POWELL: FINANCIAL STABILITY IS A MIXED PICTURE

POWELL: CONSUMER DEFAULTS TICKING UP, NOT TERRIBLY CONCERNING

POWELL: BALANCE SHEET IS STILL IN ABUNDANT-RESERVES CONDITION

POWELL: FED STRONGLY COMMITTED TO MAINTAINING ITS INDEPENDENCE

POWELL: MARKETS NOT PRICING IN DEBATE OVER FED INDEPENDENCE

POWELL: COMMITTEE REMAINS UNITED IN PURSUING DUAL MANDATE GOALS

POWELL: RISK OF PERSISTENT INFLATION NEEDS TO BE MANAGED

POWELL: YOU CAN THINK OF TODAY'S MOVE AS RISK-MANAGEMENT CUT

POWELL: THERE WASN'T WIDESPREAD SUPPORT FOR 50 BPS CUT TODAY

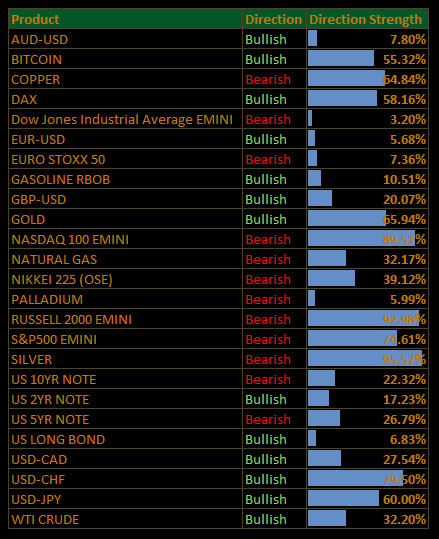

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Fed Delivers, Market Splits; Banks Lift, Tech Drags (S&P –0.17%)

The S&P 500 slipped 0.17% after the Fed’s well-telegraphed 25 bp cut to 4–4.25%, a move framed by Powell as “risk management” in the face of labor softening. The decision came with updated projections pointing to two more cuts this year, keeping easing bias alive but stopping short of a pivot. Market reaction was muted: equities churned, Treasuries cheapened slightly, and the dollar extended its Fed-day winning streak to seven, the longest since 2001.

Breadth fractured sharply. Financials, Energy, and Staples led higher, offset by Tech, Industrials, and Real Estate weakness. Powell’s remarks on tariffs adding to core PCE and continued labor-market deterioration reinforced the sense of “no risk-free path,” balancing inflation vigilance with rising employment downside.

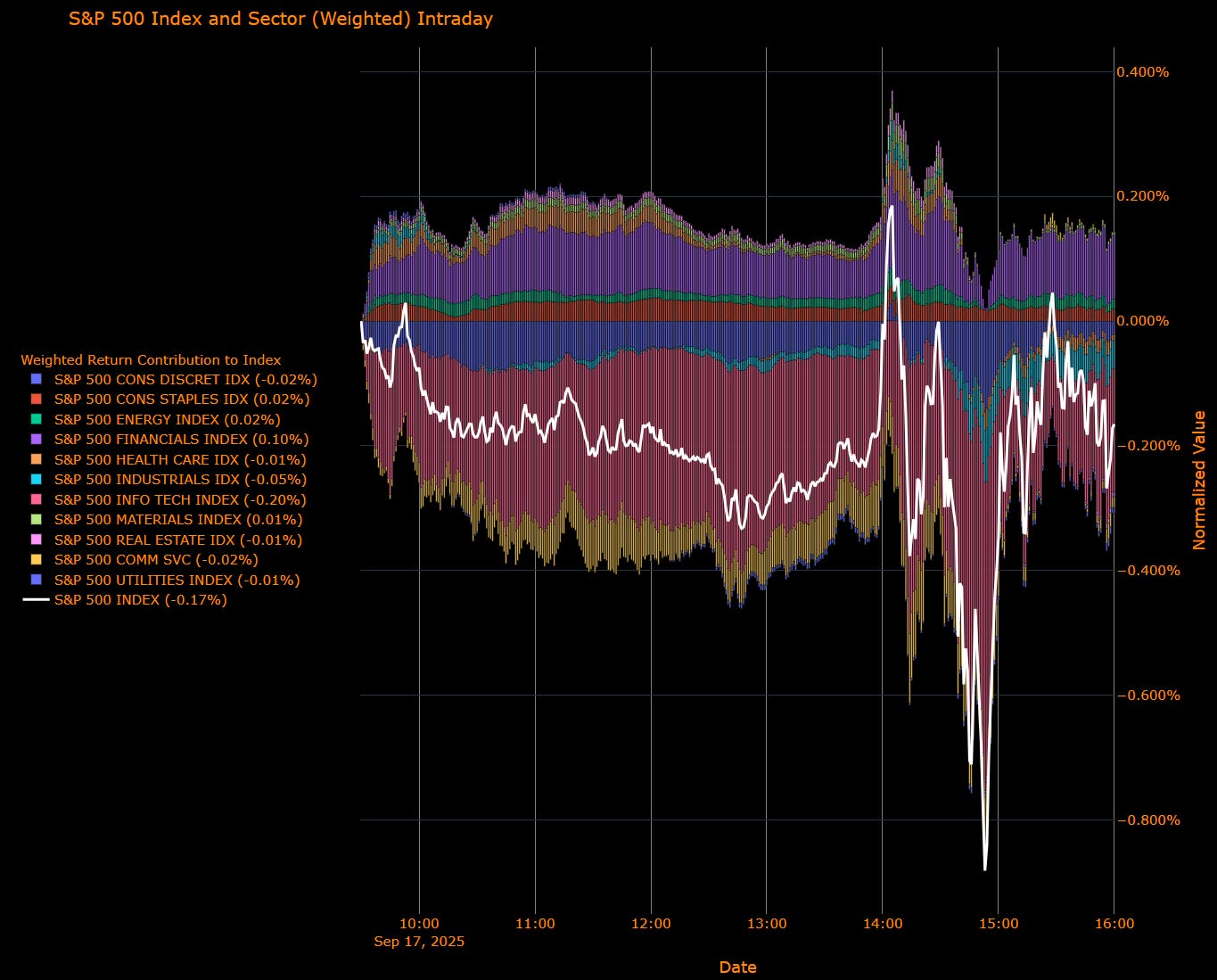

Sector Attribution

Weighted Return Contribution to Index

Biggest drag: Information Technology (–0.20%)

Other negatives: Communication Services (–0.02%), Industrials (–0.05%), Discretionary (–0.02%), Real Estate (–0.01%)

Biggest support: Financials (+0.10%)

Other positives: Energy (+0.02%), Materials (+0.01%)

Net impact: S&P 500 (–0.17%)

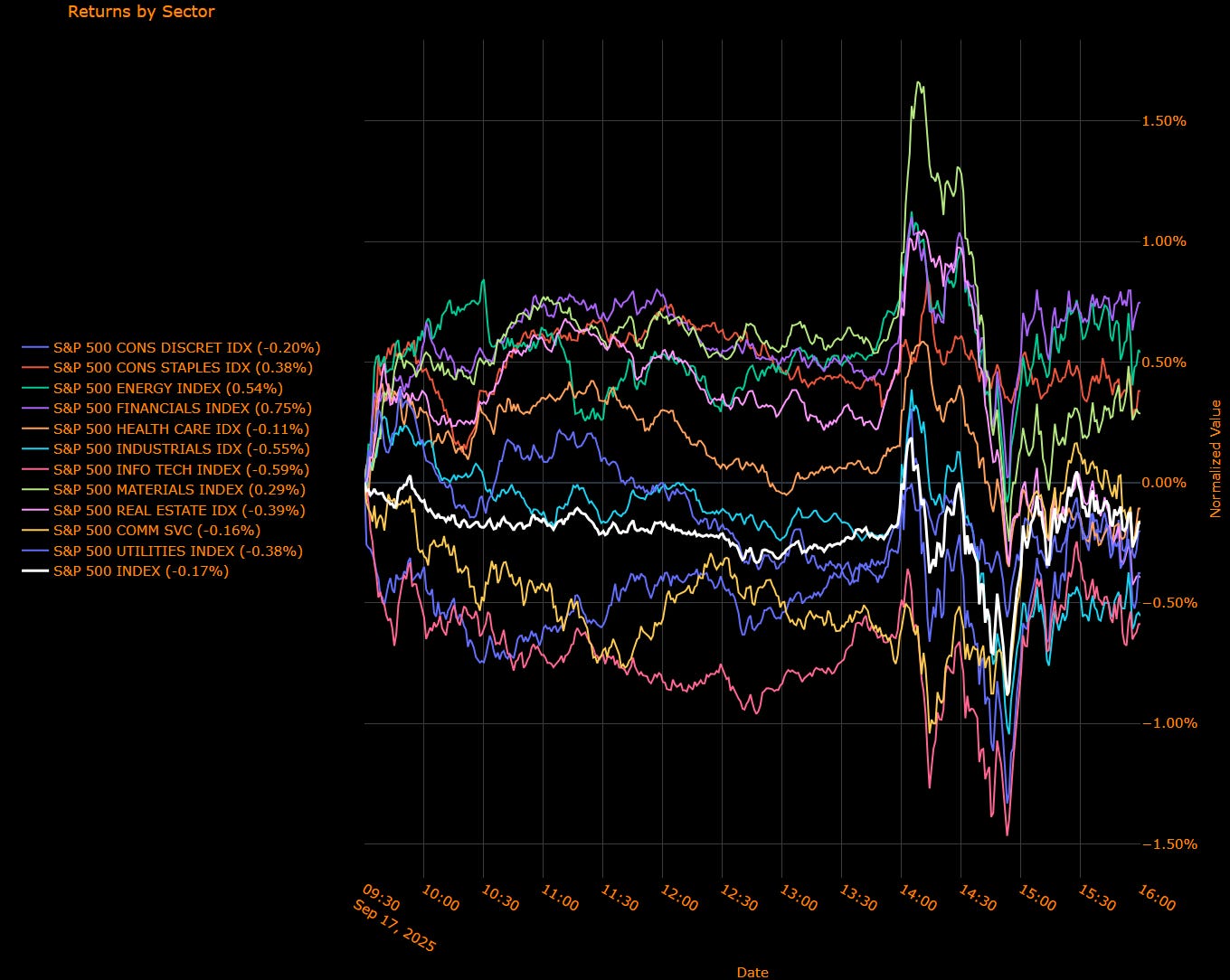

Sector Performance (Unweighted Breadth)

Financials (+0.75%) and Energy (+0.54%) surged, aided by higher yields and crude resilience.

Staples (+0.38%) and Materials (+0.29%) also held firm.

Information Technology (–0.59%) and Industrials (–0.55%) led the downside, joined by Real Estate (–0.39%) and Utilities (–0.38%).

Consumer Discretionary (–0.20%) and Health Care (–0.11%) added to the drag.

S&P 500 Index: –0.17%

Macro Overlay

Fed Posture

The cut was as expected, but the dots revealed a bias toward additional easing in 2025. Powell emphasized the Fed’s independence and highlighted “meaningful downside risks” in labor markets. Tariff pass-through is seen adding ~0.3–0.4 ppt to core PCE, complicating the inflation side of the mandate. Messaging stayed balanced: inflation vigilance intact, but labor softness is pulling policy toward a more dovish stance.

Market Dynamics

The split tape reflects Powell’s “meeting-by-meeting” approach. Banks and cyclicals drew strength from curve steepening bets and higher yields, while tech faltered as the growth/easing trade lost momentum. Real Estate and Utilities continued to struggle under rate-sensitive pressure. The dollar’s resilience, now seven Fed days stronger in a row, underscored skepticism of a deep-cut trajectory.

Rates & Commodities

Treasuries sold off modestly, with 2s up 4 bps to 3.54% and 10s up 3 bps to 4.06%. The curve remains steady but markets are leaning toward October and December cuts. Oil held near $64/bbl despite a build in distillates, while gold eased back below $3,670/oz after Powell stressed inflation risk management.

Market Tone

Muted relief but no breakout. The Fed delivered, but Powell kept optionality alive rather than promising more. Breadth deterioration, tech and real estate lagging while banks and energy carried the tape signals a narrowing market rather than a broad risk-on turn.

The Read-Through

Base Case: Two more cuts in 2025 remain live; Powell stays flexible, labor risks dominate.

Risks: Stickier inflation or higher tariffs could stall the easing path; defensives remain unreliable as hedges.

Positioning Lens: Financials and Energy offer tactical strength; tech requires validation from softer yields; rate-sensitive sectors (REITs, utilities) remain vulnerable.

The Fed gave markets “no curve balls” but also no new tailwind. Leadership has shifted: banks and energy higher, tech cracked, defensives weak. The next catalyst lies in data. inflation and jobs will decide whether easing momentum extends into Q4.

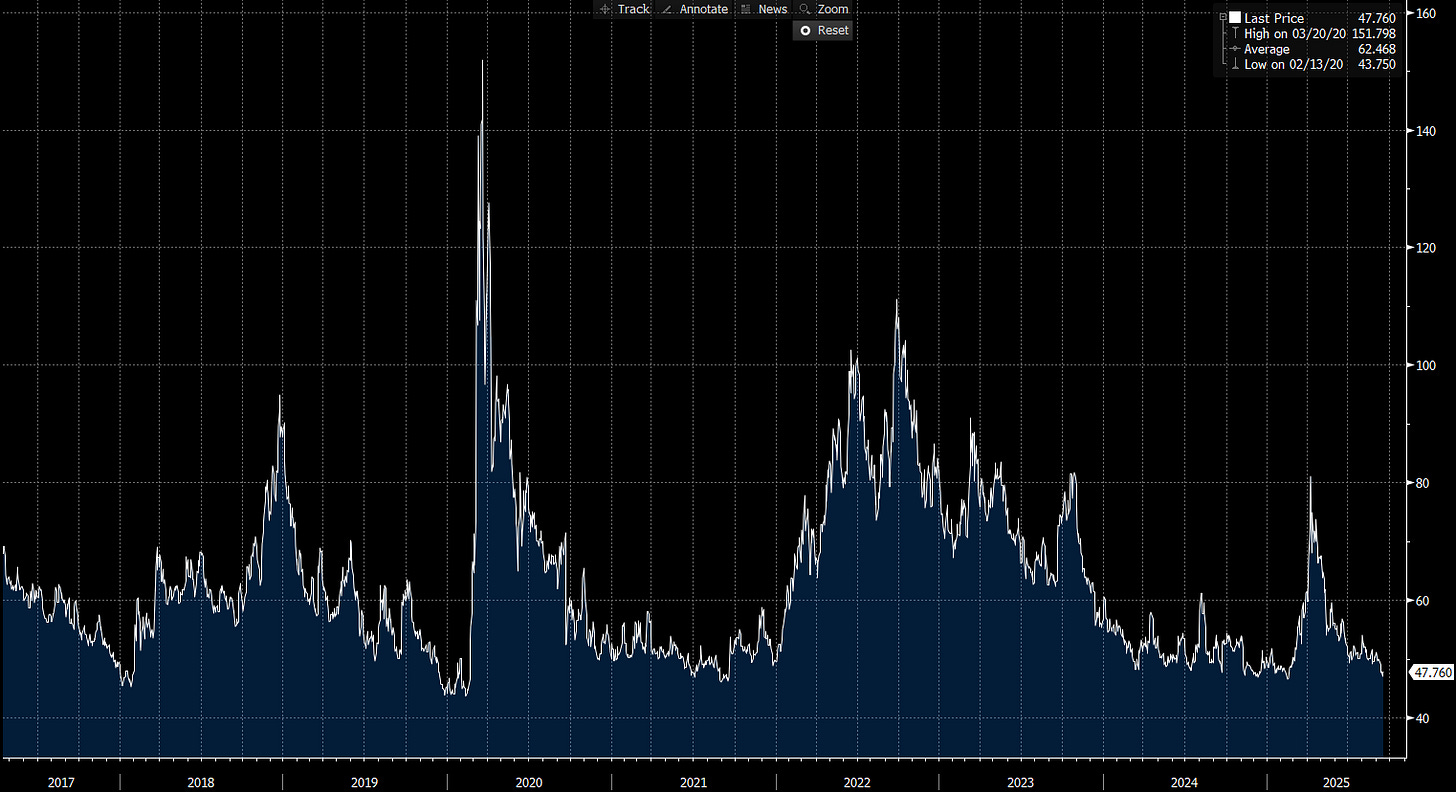

US IG Credit Wrap: Fed Cuts, Spreads Stay Teflon; Carry Still in Charge (IG OAS ~47.8 bp)

IG spreads barely blinked after the Fed’s 25 bp cut to 4%–4.25% and “meeting-by-meeting” guidance. Bloomberg IG OAS closed near 47.8 bp, sitting comfortably inside the carry-sweet spot as equities chopped and Treasury yields edged higher.

Credit Context

IG OAS: ~47.8 bp (chart last: 47.76)

5-yr avg: 62.5 bp → ~15 bp inside

Cycle tights: 43.8 bp → ~4 bp off

COVID peak: 151.8 bp → ~104 bp tighter

Read: spreads are pinned near the floor, consistent with “insurance cuts without crisis.”

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

What Changed Today

Fed: As expected cut; dots leave room for two more this year. Powell balanced labor softness vs. inflation risk (including tariff pass-through), reinforcing optionality rather than a pivot.

Macro tape: Stocks little changed (S&P –0.1%); dollar firmed again on Fed day; USTs cheapened slightly (2s ~3.54%, 10s ~4.06%).

Credit tone: Primary remained orderly with light concessions; secondary two-way but stable. Real-money and ETF demand continued to absorb supply, keeping OAS anchored in the high-40s.

Risks to Watch

Rates vol from data: Hot inflation or re-heating growth could cheapen duration and push OAS +2–5 bp.

Labor air-pocket: Faster deterioration would pressure lower-quality IG and cyclicals.

Curve dynamics: Growth-scare steepening is more threatening to credit than a supply-led back-up.

Calendar/liquidity: Heavy issuance into thin liquidity could stall the grind.

The Read-Through

Carry still rules. At ~48 bp only ~4 bp off tights, return asymmetry is thin but supported by stable macro and the Fed’s gradualism. Barring a data shock, dips look shallow and bought; discipline matters on adds, with a bias to higher-quality beta and intermediate duration.

Final Word

Powell gave no curve balls and credit rewarded him with… nothing. IG spreads remain stuck-in-tight: strong enough to fade fear, too rich to chase. The next move belongs to the data; until then, carry is the game.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.