Macro Regime Tracker: Post FOMC Models

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

You can find the most recent report on equities and Bitcoin here:

Main Developments In Macro

Federal Reserve (FOMC) & Monetary Policy

FOMC Decision & Press Conference Highlights:

FED HOLDS BENCHMARK RATE IN 4.25%-4.5% TARGET RANGE

FED: INFLATION REMAINS SOMEWHAT ELEVATED

FED: ECONOMIC GROWTH MODERATED IN FIRST HALF OF YEAR

FED: LABOR MARKET CONDITIONS REMAIN SOLID

FED: UNCERTAINTY ABOUT ECONOMIC OUTLOOK REMAINS ELEVATED

FED REMOVES LANGUAGE SAYING UNCERTAINTY HAS DIMINISHED

FED GOVERNORS WALLER, BOWMAN DISSENTED IN FAVOR OF RATE CUT

FED CHAIR JEROME POWELL ENDS PRESS CONFERENCE IN WASHINGTON

POWELL: HAVE MADE NO DECISIONS ABOUT SEPTEMBER MEETING

POWELL: TARIFFS ARE STARTING TO SHOW IN CONSUMER PRICES

POWELL: CORE PCE LIKELY ROSE 2.7% YEAR OVER YEAR IN JUNE

POWELL: INFLATION IS MOST OF THE WAY BACK TO 2%

POWELL: REASONABLE BASE CASE IS SHORT-LIVED TARIFF INFL. IMPACT

POWELL: WOULD CHARACTERIZE POLICY AS MODESTLY RESTRICTIVE

POWELL: DON'T SEE FISCAL BILL AS PARTICULARLY STIMULATIVE

POWELL: CURRENT STANCE OF POLICY LEAVES US WELL POSITIONED

POWELL: LONGER-TERM INFLATION EXPECTATIONS CONSISTENT WITH 2%

POWELL: DOLLAR HASN’T BEEN TOPIC OF MAJOR DISCUSSION AT THE FED

POWELL: WE’RE STILL A WAYS AWAY FROM SEEING WHERE THINGS SETTLE

POWELL: DEMAND AND SUPPLY FOR WORKERS DECLINING AT SAME PACE

POWELL: LABOR MARKET CONDITIONS ARE BROADLY IN BALANCE

POWELL: GROWTH MODERATION LARGELY REFLECTS CONSUMER SLOWDOWN

Trade Policy & Tariffs

Tariff Developments:

US SAYS NEW TARIFF ON BRAZIL IMPORTS TAKES EFFECT IN 7 DAYS

TRUMP SIGNS PROCLAMATION ON COPPER IMPORTS

TRUMP: OTHER COUNTRIES ARE MAKING OFFERS FOR TARIFF REDUCTION

TRUMP: TARIFFS ARE PUSHING UP SOME GOODS PRICES

POWELL: POSSIBLE INFLATIONARY EFFECTS COULD BE MORE PERSISTENT

POWELL: CAN’T SEPARATE OUT TARIFF EFFECTS ON INFLATION

POWELL: IT'S STILL EARLY DAYS ON INFLATION IMPACT OF TARIFFS

Geopolitical Trade Headlines:

TRUMP: FULL AND COMPLETE TRADE DEAL WITH THE REPUBLIC OF KOREA

TRUMP: CONCLUDED DEAL WITH PAKISTAN TO DEVELOP OIL RESERVES

TRUMP: WE’LL KNOW AT END OF WEEK ON INDIA TARIFFS

TRUMP: INDIA TARIFF IS OVER BRICS, TRADE DEFICIT

TRUMP: TOUTS EU, JAPAN TRADE DEALS

TRUMP: NEGOTIATING WITH OTHER COUNTRIES

TRUMP: HIGH INTEREST RATES HURTING PEOPLE TRYING TO BUY HOUSES

Labor Market & Inflation

POWELL: YOU DON'T SEE A WEAKENING IN THE LABOR MARKET

POWELL: UNEMPLOYMENT RATE REMAINS LOW

POWELL: DOWNSIDE RISKS TO LABOR MARKET ARE CERTAINLY APPARENT

POWELL: BY MANY STATISTICS, LABOR MARKET IS STILL IN BALANCE

Energy & Commodities

TRUMP SIGNS PROCLAMATION ON COPPER IMPORTS

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

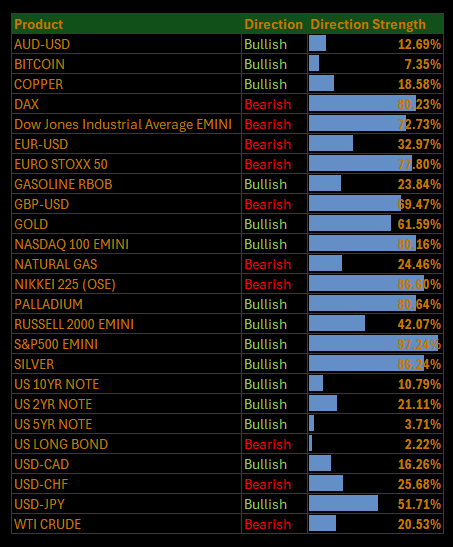

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Tech Holds the Line as Broader Market Buckles Post-Fed, Tariff Anxiety Creeps Back In

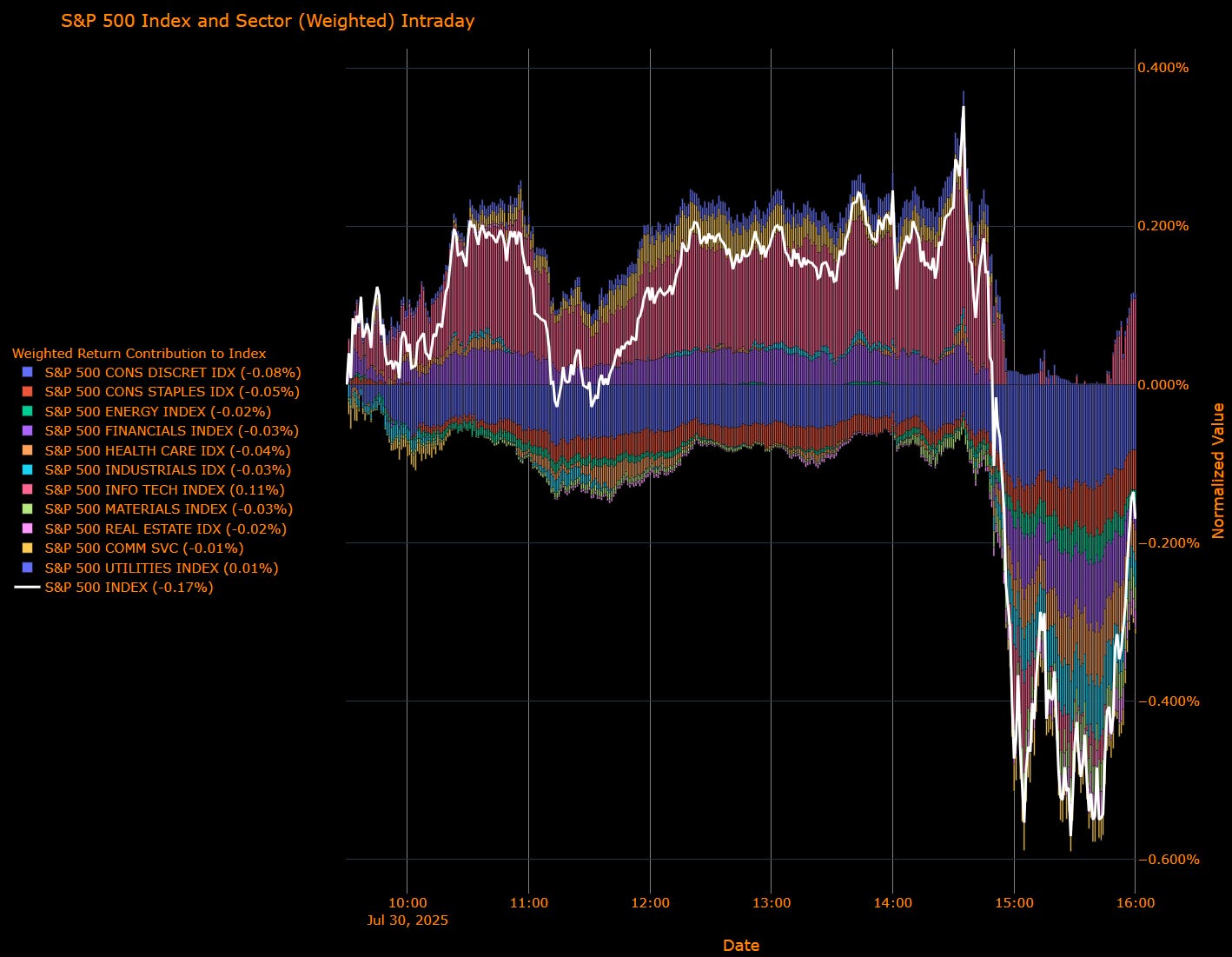

The S&P 500 slipped 0.17% on Wednesday, masking a much messier session beneath the surface. A sharp sector divergence saw Tech prop up the index thanks to strong earnings from Microsoft and Meta, but nearly every other sector traded lower, as risk appetite faltered into a triple threat of Fed, tariffs, and softening demand signals.

Breadth weakened further, defensive sectors cracked, and duration-sensitive segments took a fresh hit. The day’s tape carried a familiar message: this market remains dangerously narrow, and macro uncertainty is beginning to crowd out the soft landing narrative.

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Top Positive Contributor:

Info Tech (+0.11 pp) — Led by Microsoft and Meta, with strong cloud and ad revenue driving upside surprises. Big Tech continued to deliver, even as the broader market sagged.

Marginal Positives:

Utilities (+0.01 pp) — Modest bid for yield proxies despite rising Treasury yields. Possibly a rotation into defensive yield as macro jitters return.

Top Negative Contributors:

Consumer Discretionary (–0.08 pp) — Pulled lower by rate-sensitive segments like autos and housing, alongside weakness in retailers.

Consumer Staples (–0.05 pp) — Defensives saw no safe haven bid. The Staples breakdown suggests rotation out of low-beta into cash or Tech.

Health Care (–0.04 pp) — A steady bleed with no clear leadership, though pharma names underperformed modestly.

Financials / Industrials / Materials (–0.03 pp each) — All flagged soft macro tone: Industrials suffered from growth concerns, Financials struggled with curve flattening and reduced cut expectations, and Materials sank alongside copper and tariff headlines.

Real Estate (–0.02 pp) — Duration exposure continued to weigh on the sector as yields pushed higher.

Sector Performance Breakdown

(Unweighted Daily Returns)

Strongest Sectors:

Info Tech (+0.32%) — The only true bright spot. Mega-cap resilience continues to distort index optics.

Utilities (+0.27%) — A modest gain despite curve moves, highlighting appetite for perceived defensive exposure.

Broad Decliners:

Materials (–1.58%) — Worst performer on the day. Copper collapse and fresh Trump tariffs targeting Brazil drove the unwind.

Real Estate (–1.17%) — Long-duration pain intensified as Fed commentary cooled expectations for imminent easing.

Consumer Staples (–0.96%) — Rare defensives lag. Possibly reflects portfolio de-risking into cash rather than classic shelter sectors.

Consumer Discretionary (–0.80%) — Weighed by higher rates and fading sentiment. Autos and retail were key underperformers.

Energy (–0.60%) — Reversal from recent strength. Oil’s sideways grind and less tariff tailwind likely hurt the flow.

Health Care (–0.43%), Industrials (–0.38%), Financials (–0.23%) — Core cyclicals remain fragile, pricing in a slower second-half narrative.

Comm Services (–0.07%) — Flat overall, though Meta’s earnings buoyed the group marginally.

Macro Overlay: Tariffs, Tech, and Powell’s Patience Test Market Nerves

The Fed held rates steady, as expected, but Chair Powell’s tone dampened hopes for a near-term pivot. He emphasized tariff-related inflation risks, reiterated that the labor market remains in “solid shape,” and gave no signal that September easing was a done deal. The result? Markets pared back cuts, Treasury yields rose, and the dollar surged to a two-month high.

GDP surprised to the upside at 3.0%, but composition told a less bullish story. Final sales to private domestic purchasers rose just 1.2%, the weakest since late 2022, and consumer spending remains tepid. Inventories and trade largely distorted by tariff front-loading flattered the top-line.

Meanwhile, Trump’s return to the tariff stage added new uncertainty. India now faces a 25% levy, Brazil’s copper exports are under fire, and a newly announced deal with South Korea formalizes 15% tariffs. Markets are beginning to price in more persistent trade friction even if inflation impact remains ambiguous for now.

Narrow Leadership, Fragile Foundations

Wednesday’s session reinforced the market’s reliance on mega-cap tech. Strip away Info Tech and a whisper of Utilities, and the S&P 500 would have faced a material decline.

The macro backdrop is deteriorating just enough to erode broad participation but not enough (yet) to secure a Fed pivot. Add in trade uncertainty and weakening consumer demand, and the rally is increasingly hard to justify outside of AI-led euphoria.

With breadth buckling and leadership narrowing, the market is walking a tightrope. Tech alone can’t carry the load forever and this week’s remaining data and tariff developments could be the tipping point.

US IG Credit Wrap: Spreads Edge Lower to 50.84 bp as Earnings Buoy Risk, but Tariff and Fed Signals Blur the Path Forward

Current IG Spread: 50.84 bp | 5-Year Avg: 62.74 bp | COVID High: 151.80 bp | Cycle Low: 43.75 bp

Investment-grade spreads nudged tighter to 50.84 bp on Wednesday, clinging to the lower bound of their multi-year range despite a muddled macro picture. Strong earnings from Big Tech helped stabilize broader risk sentiment, but Powell’s pushback on September rate cut hopes and the re-escalation of tariff threats inject fresh uncertainty into the outlook. Credit continues to trade with composure but that steadiness increasingly masks fragile conviction.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: Mixed Signals, Muted Reaction

Powell Holds, But Credibility Frays at the Margins

The Fed held rates as expected and downplayed urgency around cuts, with Powell stating the labor market remains “solid” and that inflation, while cooling, is not yet at target. Traders shaved September cut odds to below 50%, a notable shift from earlier in the day. While the press conference was not overtly hawkish, it lacked the conviction bulls had hoped for.

For credit, this reopens the question: is the Fed’s glidepath really friendly enough to sustain ultra-tight spreads? The answer, so far, appears to be “yes” but only if growth and earnings stay resilient.

GDP Headline Strong, Core Demand Less So

Q2 GDP printed +3.0%, well above the +2.6% consensus. But under the hood, final sales to private domestic purchasers rose just +1.2% the weakest since 2022. That soft demand signal matters for credit, particularly for capital goods and cyclical industrial issuers, where earnings quality depends on real end-market strength, not just trade distortions or inventory rebalancing.

Capex is clearly fading, and credit desks will be watching Q3 guidance from corporates closely. Slowing internal growth and tariff-linked volatility could soon challenge the notion of "investment-grade durability."

Tariff Rhetoric Is No Longer Bluff

Trump’s 25% tariff on Indian exports kicks in Friday. Brazil’s copper shipments face fresh levies. South Korea signed onto a 15% export deal. This is no longer trial balloon diplomacy. And while spreads haven’t reacted, the cumulative drag on margins and trade certainty could soon register particularly for IG corporates with global exposure and modest pricing power.

The key risk: a sudden repricing of forward earnings, not because of credit downgrades, but because of margin compression.

Credit Markets Are Still Standing… But Are They Still Thinking?

There was no panic in spreads today but also very little new information priced in. The earnings beat from Tech helped keep risk on the rails. But the Treasury curve steepened, equities chopped sideways, and macro tension from tariffs and Fed uncertainty was met with near-silence from credit.

That may be complacency or it may be conditioning. But in either case, it suggests spreads are increasingly lagging macro volatility, rather than preempting it.

Tighter and Tighter, Thinner and Thinner

Spreads are tighter than average. But so is liquidity. So is conviction. And so is the margin of error.

Credit has weathered rate volatility, fiscal headlines, and global trade recalibration with surprising calm. But the cracks are no longer hypothetical:

Growth is softening under the surface.

Tariff friction is no longer just a market tail-risk… it’s policy.

Powell’s grip on the narrative is slipping, just as dissents mount.

This isn’t a moment for fear. But it is a moment for discipline. The tighter credit gets, the less room there is for macro surprises. And right now, the list of surprises is growing.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Short-End Rates Wrap: Curve Holds Soft Bias as Total Implied Easing Settles at –113.7 bp, Fed Patience Meets Market Persistence

Cumulative Implied Easing (to Jan 2027): –113.7 bp

Terminal Rate (Jan 2027): 3.193%

September OIS Cut Probability: 44.8% | Implied Rate: 4.218%

After Powell’s latest press conference and a strong GDP headline, the front-end remains resolutely dovish, though not aggressively so. The total implied rate cuts through January 2027 have edged only slightly firmer, holding at –113.7 bp from a previous –116.7 bp. The market has modestly trimmed odds for a September cut (now 44.8%), but the easing path beyond remains largely intact.

Despite the Fed’s attempt at narrative control, traders continue to price an eventual descent in policy rates—steady, gradual, and layered beneath headline resilience.

OIS-Implied Policy Path

Macro Overlay: Expectations Trimmed, but Not Torn Down

Fed Plays for Optionality, Market Prices Glidepath Anyway

Chair Powell gave little ground to doves this week, emphasizing “solid” labor market conditions and lingering inflation risks. But his refusal to slam the door on easing was enough to keep the front-end from repricing higher. September cut odds dropped below 50%, but the market’s conviction in 4–5 cuts by early 2027 remains intact.

This is not a market buying panic it’s a market buying time.

GDP Beats, But Composition Weakens Case for Prolonged Hold

The Q2 GDP print (+3.0%) beat expectations, but traders saw through the headline. Nearly all of the strength came from trade distortions and inventory effects, while final sales to private domestic purchasers a cleaner signal of demand grew just 1.2%. That tells a different story: one of cooling core demand and corporate caution.

The result: macro data is no longer strong enough to delay cuts indefinitely, but not weak enough to accelerate them. The curve is priced for slow-motion easing. And Powell didn’t dispute that.

Tariff Risks Still Lurking, But Market Shrugs (For Now)

The curve assumes a managed tariff path—deals with South Korea, exemptions on copper, and delayed action on Japan and Canada. That narrative has held for now. But with over 200 trade-related notices due in coming days, there is back-loaded risk to the soft-landing pricing regime. If inflation surprises reemerge or trade disruptions deepen, the front end will not have much cushion.

Persistent Descent, Not a Panic Drop

The short-end isn’t rushing anywhere. But it is grinding lower.

The September cut is no longer priced as probable, but 2026 still ends below 3.2%.

The market no longer needs Powell to deliver a cut. It just needs him not to fight the drift.

Every macro input durables, job openings, business investment is bending gently downward. Enough to justify a gentle glidepath, not forceful easing.

This is a market priced not for collapse, but for convergence: a Fed that waits until conditions deteriorate just enough, and a front-end that quietly walks there first.

The risk now isn’t a blow-up. It’s a break in the narrative. Tariffs. A sharp payroll miss. Or Powell blinking too late.

The easing curve is intact. But the story propping it up is getting heavier.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.