Macro Regime Tracker: Red

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I have laid out my view on equities here:

As always, all the systematic models and strategies are updated below. I will be publishing another important report later today so keep an eye out for that.

Main Developments In Macro

Federal Reserve / Monetary Policy

FED: REPORT IS DELAYED, NEED DATA FROM OTHER GOVT. AGENCIES

FED: INDUSTRIAL PRODUCTION REPORT WON’T BE RELEASED OCT. 17

FEDERAL WORKER UNIONS SEEK IMMEDIATE HALT TO SHUTDOWN LAYOFFS

FEDERAL LAYOFFS HIT INTERIOR, TREASURY, COMMERCE DEPT: POLITICO

FEDERAL LAYOFFS ARE SUBSTANTIAL: PUNCHBOWL

FEDERAL LAYOFFS WON’T HIT EVERY AGENCY: PUNCHBOWL

BLS WILL PUBLISH SEPTEMBER CPI REPORT ON OCT 24 AT 8:30AM ET

Fed Speakers:

MUSALEM: NEED TO CONTINUE LEANING AGAINST INFLATION PERSISTENCE

MUSALEM: LIMITED ROOM FOR CUTS BEFORE WE’RE TOO ACCOMMODATIVE

MUSALEM: I’M OPEN-MINDED ABOUT POTENTIAL FURTHER RATE REDUCTION

MUSALEM: I EXPECT LABOR MARKET TO SOFTEN SOME, IN ORDERLY WAY

MUSALEM: INFLATION IS MATERIALLY ABOVE OUR TARGET

FED’S MUSALEM: RIGHT NOW, MANDATES SEEM LIKE THEY’RE IN TENSION

WALLER: OPEN TO QUARTER-POINT CUTS AT COMING MEETINGS

WALLER: SEES NEED FOR RATE CUTS, BUT SHOULD BE CAUTIOUS

WALLER: US LABOR MARKET IS NOT DOING GREAT

WALLER: FED CAN USE ALTERNATIVE DATA DURING GOVERNMENT SHUTDOWN

US Macro Data

UMICH PRELIM OCT. CONSUMER SENTIMENT FALLS TO 55; EST. 54

UMICH PRELIM OCT. CONSUMER SENTIMENT WEAKEST READING SINCE MAY

MICHIGAN OCT. CURRENT CONDITIONS RISES TO 61.0 VS 60.4

MICHIGAN PRELIM. OCT. EXPECTATIONS INDEX FALLS TO 51.2 VS 51.7

UMICH 1-YR INFLATION EXPECTATIONS FALL TO 4.6% VS 4.7%

MICHIGAN 5–10 YR INFLATION EXPECTATIONS UNCHANGED AT 3.7%

Trade, Geopolitics, and Policy

TRUMP THREATENS ‘MASSIVE INCREASE’ OF TARIFFS ON CHINESE GOODS

TRUMP: MIGHT BE FORCED TO FINANCIALLY COUNTER CHINA’S MOVE

TRUMP: MANY COUNTERMEASURES UNDER CONSIDERATION ON CHINA

TRUMP: CHINA MADE A SINISTER MOVE WITH RARE EARTH CONTROLS

TRUMP: CALCULATING INCREASED TARIFFS ON CHINESE PRODUCTS

TRUMP: THERE SEEMS TO BE NO REASON TO MEET XI IN S. KOREA

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

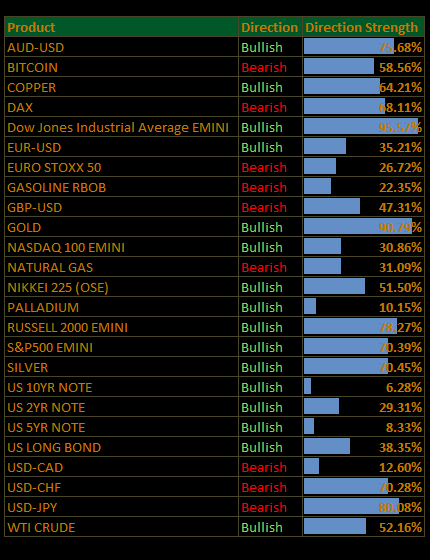

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

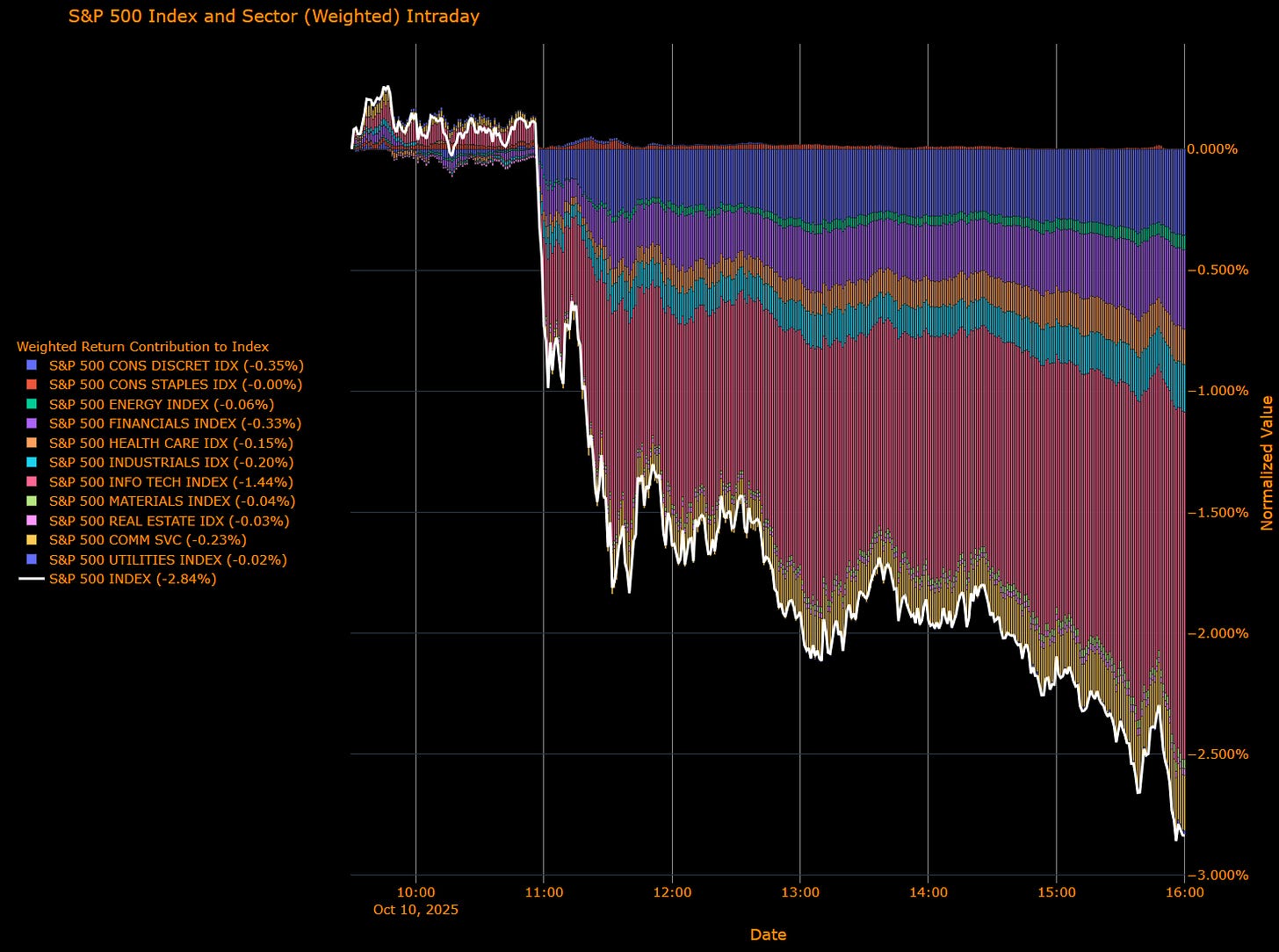

US Market Wrap: Tariff Shock Flattens Risk, Tech Leads Drawdown (S&P −2.84%)

A blunt re-pricing on renewed US–China tariff threats hit every cyclical lever at once: equities slid, oil and copper tumbled, and Treasuries rallied in a classic flight-to-quality. Leadership inverted mega-cap growth and high-beta groups bore the brunt while defensives cushioned but couldn’t offset the blow. Fed speak stayed balanced (Musalem/Waller) and the data vacuum persists, keeping markets hypersensitive to headlines and high-frequency proxies.

Sector Attribution

Unweighted Performance (Breadth)

Leaders (least negative): Consumer Staples (−0.02%), Utilities (−0.66%), Real Estate (−1.43%), Health Care (−1.60%)

Laggards: Information Technology (−4.11%), Consumer Discretionary (−3.44%), Industrials (−2.38%), Communication Services (−2.28%), Materials (−2.16%), Financials (−2.45%), Energy (−2.15%)

Read on Contribution (qualitative): With Tech (−4.11%) and Discretionary (−3.44%) both heavy weights, the index drawdown was dominated by growth/AI and consumer-beta, with Comm Services and Financials reinforcing the downside. Defensives (Staples/Utilities) outperformed but remained too small to stabilize the tape.

S&P 500 (cap-weighted): −2.84%

Macro Overlay

Catalyst & tape: The tariff headline shattered complacency, rotating flows out of equity risk into duration. Cross-asset confirmed: oil −4%+, copper −~3%, crypto lower, while the VIX popped and China-sensitive equity baskets slumped.

Rates: Treasuries rallied in bull-flattening fashion (10y ~4.06%, ~−8 bp; 2y ~3.52%, ~−7 bp). The 5y fell ~10 bp to ~3.64%, consistent with a growth scare rather than an inflation impulse.

FX & commodities: Dollar eased into the close despite its strong week; JPY firmed ~1% as the risk-off hedge. WTI slipped below $60; gold caught a safe-haven bid back above ~$4,000/oz.

Fed & data: Musalem underscored inflation vigilance and limited room to cut; Waller stayed open to gradual easing but cautious. With several government releases delayed, BLS set CPI for Oct 24, making earnings and alt-data the near-term anchors.

The Read-Through

This was a positioning shock layered on a valuation shock: expensive growth + crowded AI met a fresh policy risk that directly targets supply chains. The bull-flattening, stronger yen, and commodity slump together flag growth-uncertainty more than tightening fear. Breadth damage was wide, but not disorderly; defensives worked and rates absorbed stress.

Takeaways & Tactics

Bias: Neutral tactically into event risk; constructive medium term if policy rhetoric cools and earnings hold margins.

Overlays / pairs:

On tariff-headline days: long duration vs. cyclicals; quality/Staples over Consumer Discretionary; Utilities/REITs as ballast.

What flips the script: De-escalation on tariffs + steady labor/inflation prints would quickly re-enable growth leadership; escalation that bleeds into guidance could extend breadth deterioration and push the curve flatter.

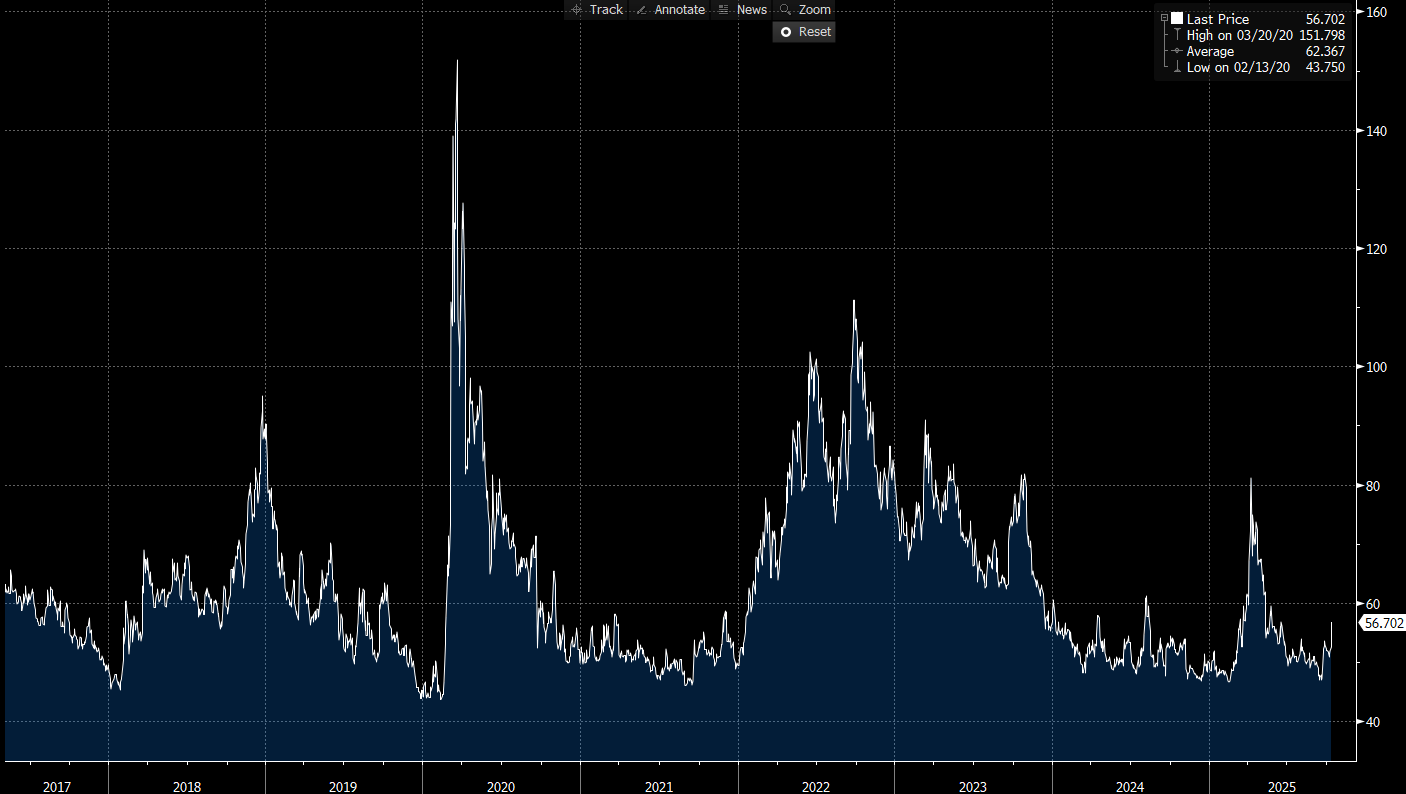

US IG Credit Wrap: Tariff Shock Pops OAS Into Mid-50s; Carry Still Intact, Beta Bleeds (IG OAS ~56.7 bp)

IG spreads gapped wider with the risk-off move tied to renewed US–China tariff threats. Bloomberg US IG OAS closed around 56.7 bp (≈ +4.1 bp d/d), a mechanical widening consistent with the equity drawdown, commodity slump, and a bull-flattening rally in Treasuries. The move lifts OAS back toward the top of the recent carry channel, but not into stress territory. Tone = sideways-to-slightly-wider, dispersion > direction.

Where we sit (from the chart)

IG OAS: ~56.7 bp

5-yr avg: ~62.4 bp → ~5.7 bp inside

Cycle tights: 43.8 bp → ~12.9 bp off

Pandemic wides: 151.8 bp → ~95 bp tighter

(Chart stats: Last ~56.7 | High 151.8 on 03/20/20 | Avg 62.37 | Low 43.75 on 02/13/20.)

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro overlay

Equities: Broad risk-off; Tech/Discretionary lead declines; defensives outperform but can’t offset.

Rates: USTs rally bull-flattening (10y ~4.06%, 2y ~3.52%); price action signals growth anxiety rather than an inflation scare.

FX/Commodities: USD eased into the close; JPY firmer; oil −4%+, copper softer; gold bid.

Fed/data: Speakers balanced (vigilant on inflation, open to gradual easing). Data delays keep the tape headline-sensitive; CPI due Oct 24 remains the near-term macro pivot.

Mapping to IG

Carry > convexity (still): Even at ~56–57 bp, high-quality carry remains the dominant P&L driver; today’s widening is orderly and consistent with beta de-risking.

Duration cushion: The long end’s rally supports A/AA long-duration demand; liability buyers likely to add on weakness.

Dispersion watch: Expect BBB cyclicals (Energy/Industrials/Materials, China-sensitive supply chains) to underperform; idiosyncratic moves will hinge on guidance and tariff-path commentary.

Primary market: Expect lighter issuance and modestly wider concessions until volatility cools; no sign of funding stress.

The read-through

Base case shifts from “low-50s grind” to “mid-50s with headline beta”: policy optionality and duration demand keep a lid on systemic widening, but tariff rhetoric and equity volatility argue for two-way spread risk near term.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Equity Indices:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.