Macro Regime Tracker: The Credit Cycle

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I did a video breakdown of all my macro views for equities, bonds, and Bitcoin here:

You can find the credit cycle video with the connected primer and TradingView model here:

All of the updated systematic models, tear sheets, and spreadsheets are below. Thanks

Main Developments In Macro

US Domestic Policy & Trade

TRUMP: POSSIBILITY OF 'DIVIDEND' TO AMERICANS FROM TARIFFS

TRUMP TOUTS TARIFF REVENUE

TRUMP: WILL ANNOUNCE CHIPS TARIFFS ALSO

TRUMP: WILL ANNOUNCE PHARMA TARIFFS WITHIN THE NEXT WEEK

TRUMP: PHARMA TARIFF WILL BE SMALL, WILL GO TO 250% EVENTUALLY

TRUMP: TARIFF OF 35% ON EU IF DOESN'T MEET OBLIGATIONS

TRUMP: WORKING OUT STRATEGIES, LANGUAGE ON FOREIGN WORKERS

TRUMP READIES FRESH SANCTIONS AGAINST RUSSIA’S SHADOW FLEET: FT

TRUMP, ASKED ON 100% RUSSIAN OIL TARIFF: 'QUITE A BIT OF THAT'

TRUMP ON RUSSIA TARIFFS: WILL SEE WHAT HAPPENS

TRUMP: XI CALLED FOR A MEETING

TRUMP: I'LL HAVE A MEETING WITH XI IF WE HAVE A DEAL

TRUMP: WE'RE CLOSE TO A CHINA DEAL

US JUNE GOODS EXPORTS TO CHINA RISE 45.4% M/M

US JUNE EXPORTS FALL 0.5% M/M

US JUNE IMPORTS FALL 3.7% M/M

US JUNE TRADE DEFICIT $60.2B; EST. -$61.0B

US CHARGES CHINESE NATIONALS WITH NVIDIA CHIPS EXPORT BREACH

NAVARRO: COPPER TARIFFS GREAT FOR COMPANIES LIKE REVERE COPPER

FCC PROPOSES TO END RATE REGULATION, TARIFFING OBLIGATIONS

FCC TO BEGIN REVIEW OF ITS BUSINESS DATA SERVICES RULES

US TREASURY SETS FOUR-WEEK BILL AUCTION AT RECORD $100 BILLION

Fed Policy and Personnel

TRUMP: FED CHAIR DOWN TO 4 PEOPLE RIGHT NOW

TRUMP ON NEW FED GOVERNOR: HAVE NARROWED TO A COUPLE OF PEOPLE

TRUMP: BOTH KEVINS ARE VERY GOOD, OTHERS ARE ALSO GOOD

TRUMP: WARSH IS VERY GOOD

TRUMP: I LOVE SCOTT, BUT HE WANTS TO STAY AT TREASURY

TRUMP: LABOR STATISTICS ARE VERY POLITICAL

US Foreign Policy & Global Relations

TRUMP TO 'TAKE OVER' GAZA AID EFFORT, US OFFICIALS SAY: AXIOS

TRUMP & WITKOFF DISCUSSED INCREASING US ROLE IN GAZA AID: AXIOS

WITKOFF TO MEET OFFICIALS IN RUSSIA WEDNESDAY FOR TALKS ON WAR

ZELENSKIY SAYS HE DISCUSSED WITH TRUMP RUSSIA'S WAR, ATTACKS

UKRAINE'S ZELENSKIY SPEAKS BY PHONE WITH PRESIDENT TRUMP

RUSSIA SAID TO WEIGH UKRAINE AIR-TRUCE OFFER TO TRUMP ON WAR

NETANYAHU, US HOUSE SPEAKER MET MONDAY IN WEST BANK SETTLEMENT

SHEINBAUM: US-MEXICO SECURITY DEAL IS READY

MEXICO, US SPOKE ABOUT LNG PROJECTS IN TRADE TALKS: SHEINBAUM

CARNEY: CANADA COMMITTED TO USMCA, STILL SEEKING DEAL WITH US

CARNEY SAYS OVER 85% OF CANADA-US TRADE REMAINS TARIFF-FREE

SWISS PRES KELLER-SUTTER, PARMELIN TO TRAVEL TO WASHINGTON

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

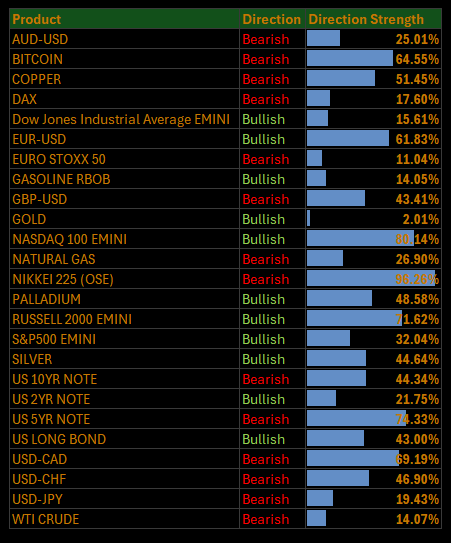

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Services Stall, Tariffs Loom, and Breadth Buckles

The S&P 500 fell another 0.52% on Tuesday, extending its recent slide as macro cracks widened and market leadership faltered. Beneath the surface, the story was clear: Tech, Utilities, and Comm Services led the decline, while cyclicals showed scattered resilience.

The backdrop? A weaker-than-expected ISM Services print, fresh signs of sticky inflation, and escalating tariff risks as Trump’s new trade regime approaches implementation. With market breadth thinning and macro fragilities resurfacing, risk appetite is becoming increasingly selective.

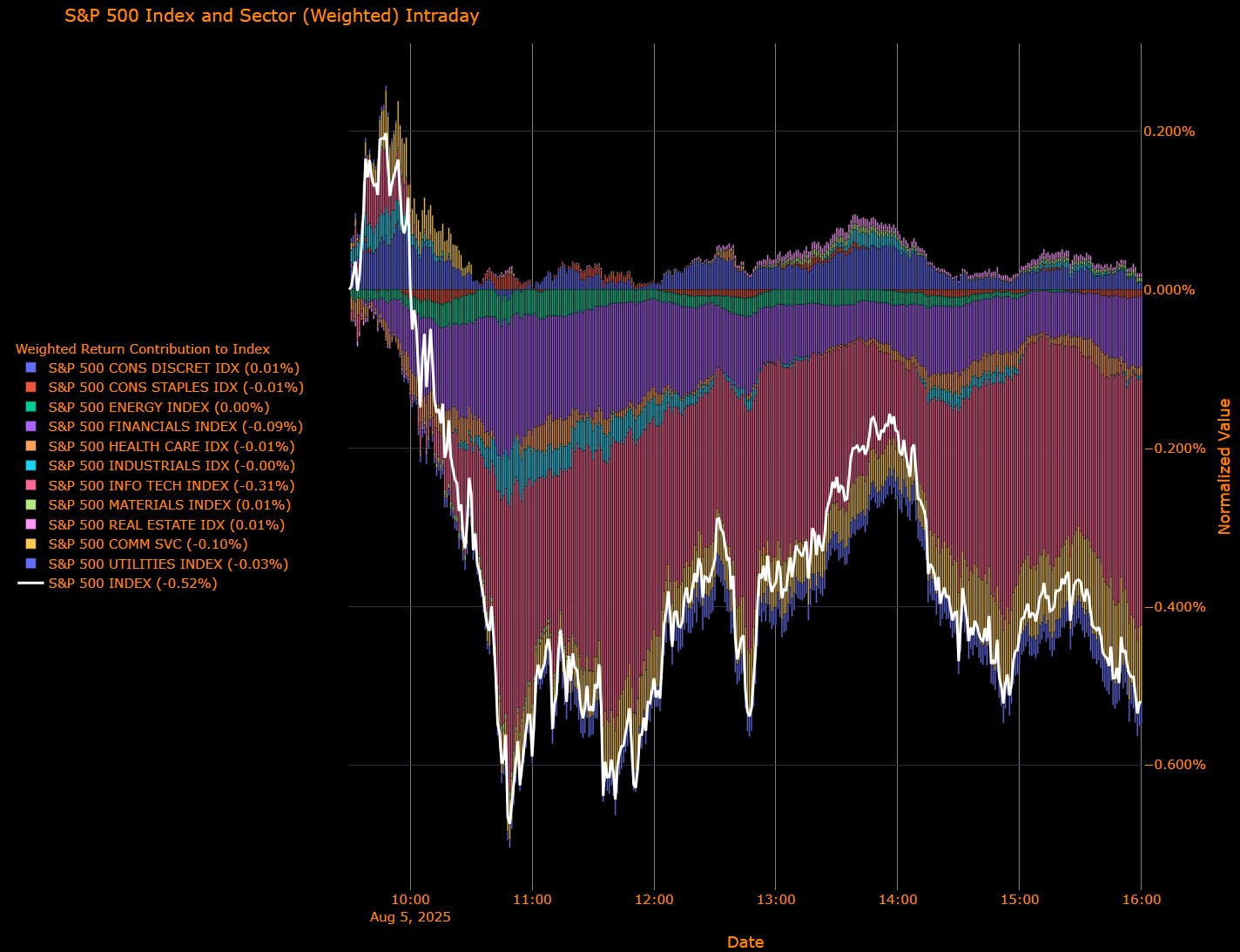

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Top Negative Contributors

Info Tech (–0.31 pp) – Once the market’s cornerstone, Tech cracked again under the weight of tariff fears and guidance disappointments from the likes of AMD and Super Micro. Chip-related headlines and AI profit-taking accelerated the unwind.

Comm Services (–0.10 pp) – Weakness was broad, and AI hype faded for now. Media and streaming names underperformed.

Financials (–0.09 pp) – Rates were mixed, but the curve and credit tightening remain macro headwinds.

Utilities (–0.03 pp) – Surprising downside as yield proxies failed to catch a bid despite stable long-end yields.

Flat to Minor Positives

Energy (0.00 pp) – Stable despite WTI softness, likely aided by positioning.

Materials, Real Estate, Discretionary (each +0.01 pp) – A few green shoots, but not enough to offset broader losses.

Staples, Industrials, Health Care – Slight negative-to-flat contributors.

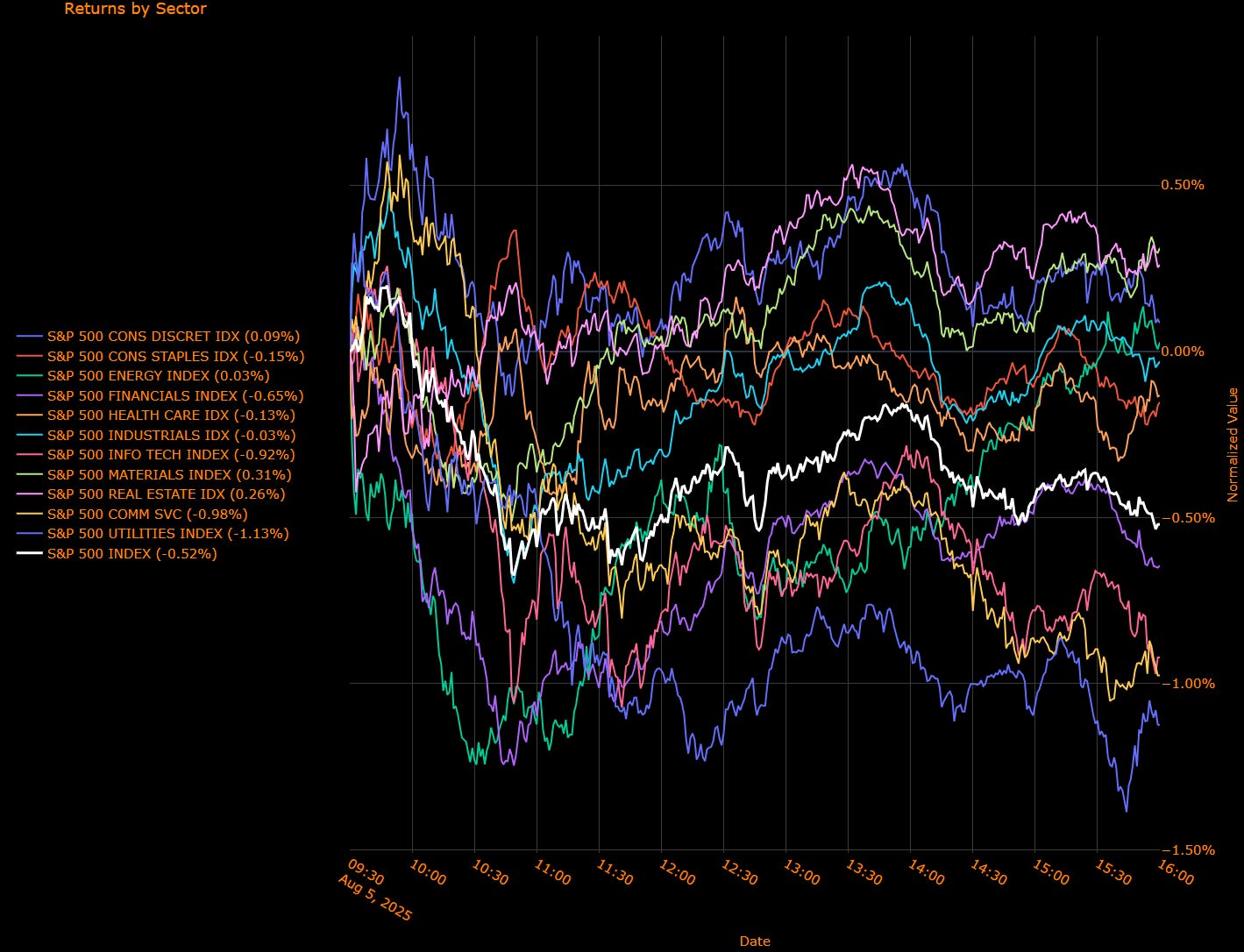

Sector Performance Breakdown

(Unweighted Daily Returns)

Leaders

Materials (+0.31%) – Rotation into commodity plays as traders eyed tariff beneficiaries.

Real Estate (+0.26%) – A rebound despite flat duration. Likely short-covering or mean reversion after recent pain.

Discretionary (+0.09%) – A rare bounce in retailers and autos helped buck the trend.

Laggards

Utilities (–1.13%) – Surprising laggard as flows avoided defensives. A sign of risk-off without the typical rotation.

Comm Services (–0.98%) – Meta and peers pulled back alongside broader AI names.

Info Tech (–0.92%) – The largest drag. Chips, cloud, and hyperscalers came under pressure amid rising China export risks.

Financials (–0.65%) – The bid in front-end rates failed to lift bank sentiment.

Staples (–0.15%), Industrials (–0.03%), Health Care (–0.13%), Energy (+0.03%) – All posted muted or modest losses.

Macro Overlay: Services Slump, Tariff Clock Ticking, and Fed in a Bind

The ISM Services Index dropped to 50.1, a hair’s breadth above contraction and the weakest reading since early 2023. The employment gauge sank to 46.4, its fourth contraction in five months, pointing to a clear hiring slowdown not layoffs, but stalled expansion. Simultaneously, the prices-paid component surged to the highest since October 2022 an inflation red flag.

This “stagflation-lite” setup complicates the Fed’s path. Markets still price in a 90% chance of a September cut, but sticky inflation and political interference muddy the waters. Trump’s tariff agenda is rolling forward semiconductors and pharma imports are next, and the average tariff rate could rise to 15.2% by week’s end. Services firms are already reporting delayed purchases, margin compression, and uncertainty.

Meanwhile, Trump continues to ratchet up political pressure. He’s hinted at replacing Powell, threatened financial institutions, and accused major banks of bias. Even Fed hiring decisions are now political fodder. Kugler’s recent resignation only heightens the stakes.

From Peak Growth to Policy Fog

Markets aren’t just battling valuation concerns they’re navigating a fog of policy instability, inflation confusion, and global trade fragmentation. With breadth narrowing again and mega-cap tech wobbling, even the AI trade is feeling vulnerable.

This is less a panic than a slow burn of uncertainty. Macro tailwinds are losing force. Positioning is tight. And while the Fed may still cut, it will be doing so into a far murkier policy environment than just a month ago.

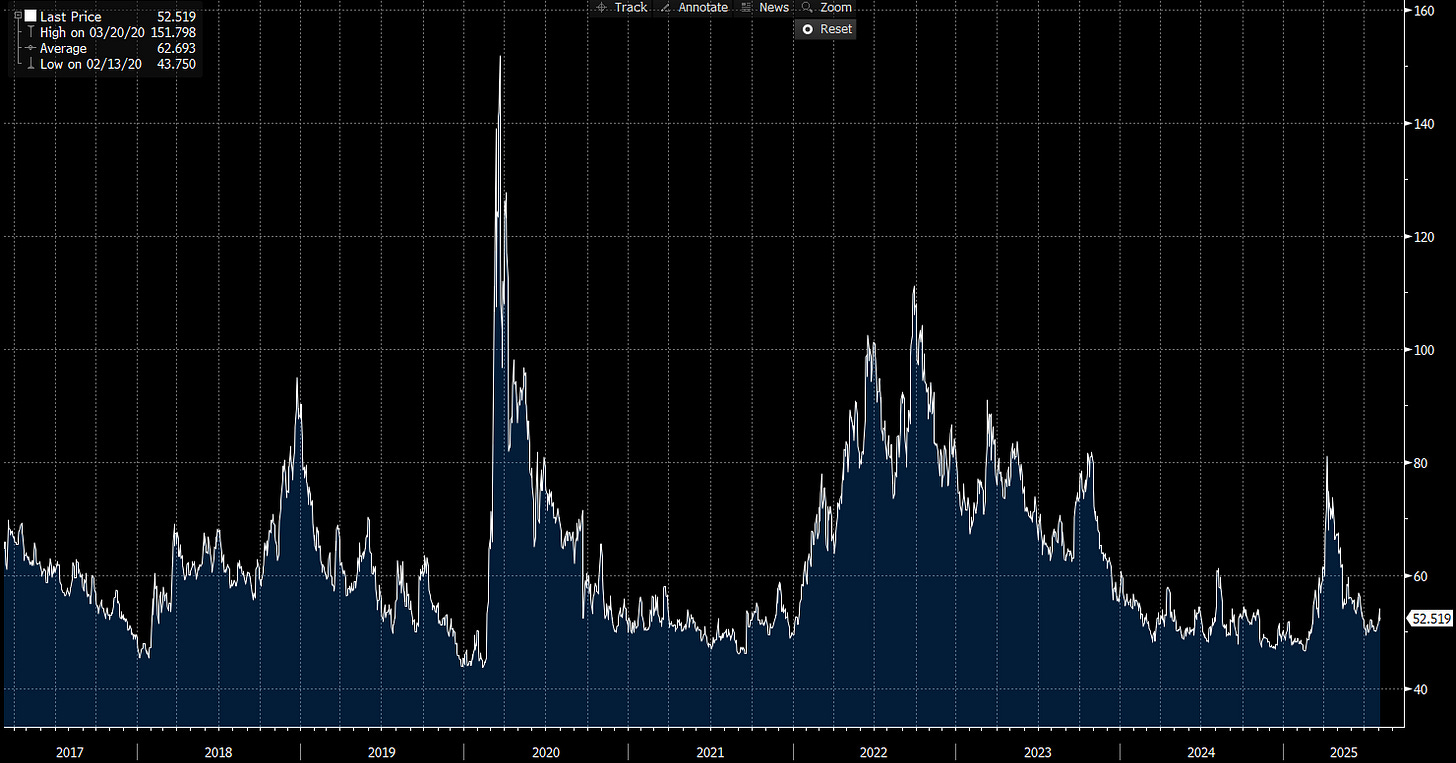

US IG Credit Wrap: Spreads Narrow to 52.52 bp as Services Sag, Tariffs Tick Louder, and Risk Feels Mispriced

Current IG Spread: 52.52 bp

5-Year Avg: 62.69 bp

COVID High: 151.80 bp

Cycle Low: 43.75 bp

Investment-grade credit markets remain steady on the surface, but the foundation is beginning to rumble. Spreads tightened modestly to 52.52 bp still well below average, yet increasingly at odds with a macro narrative that has turned messy, inflationary, and politically volatile.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: Services Sputter, Trump Tariffs Return, and the Market Ignores It All

ISM’s services index fell to 50.1, scraping the edge of contraction, with employment tumbling to 46.4 its fourth drop in five months. The prices-paid component surged to a post-2022 high, painting a worrying picture: inflation is sticky, demand is cooling, and hiring is stalling. That’s not a soft landing; that’s a slow stall.

Add in Trump’s fresh 15.2% average tariff regime with reciprocal duties on semis, pharma, critical minerals, and threats toward India and it’s clear: credit markets are brushing off a materially noisier backdrop.

While equities are chopping and yields drifting, credit seems to be stuck in “autopilot premium compression” and that’s starting to feel dangerously complacent.

Calm, for Now… But Not Anchored

Credit markets are the last to flinch and sometimes that’s a virtue. But sometimes it’s just inertia. The risk-reward in IG at these levels is no longer obvious. In fact, it may be asymmetric… to the downside.

A 52 bp spread with a Fed board in flux, tariffs rolling out, and services stagnating? That’s not “too tight to touch,” but it is “too tight to ignore.”

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

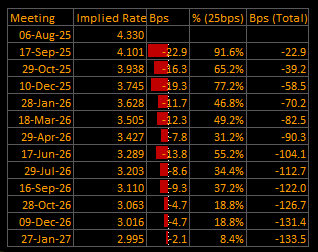

Short-End Rates Wrap: September Cut Cemented as Total Implied Easing Narrows Slightly to –133.5 bp

Cumulative Implied Easing (to Jan 2027): –133.5 bp

Terminal Rate (Jan 2027): 2.995%

September OIS Cut Probability: 91.6% | Implied Rate: 4.101%

The path of policy normalization remains aggressively priced, but Tuesday’s modest repricing reflects a market in pause mode not retreat. The probability of a September cut holds near certainty at 91.6%, but the total easing priced through January 2027 narrowed to –133.5 bp, down from –139.0 bp at the end of last week.

This isn’t about renewed confidence. It’s about short-term recalibration amid political noise, sticky inflation signals, and mounting policy uncertainty.

OIS-Implied Policy Path

Macro Overlay: Political Crosscurrents and Stalling Services

The services sector is barely expanding, with ISM’s headline index falling to 50.1 and the employment gauge contracting sharply to 46.4. Yet inflation remains sticky, with prices-paid hitting the highest since October 2022. This stagflation-lite setup complicates the Fed’s messaging especially with Trump’s pressure campaign intensifying.

Tariff risks are escalating: semiconductor and pharma duties are expected within days, and the average tariff rate will hit 15.2%, up from just 2.3% before Trump took office.

Fed Chair Powell’s grip continues to loosen, with fresh speculation about replacements, as political rhetoric swells.

Data quality is now under scrutiny, following the abrupt removal of the BLS commissioner and public accusations about labor market manipulation.

The Fed’s Margin for Error Is Shrinking

Despite the slight move in rates pricing, the message from markets hasn’t changed:

September is priced in.

A full five cuts are still implied through mid-2026.

The terminal rate has cracked below 3%.

The disinflation narrative is colliding with labor softening and a confidence hit to institutions. That’s not a clean-cut easing cycle, it’s a regime shift.

Politics, Prices, and a Fed on Edge

With inflation stickier than expected and growth visibly weakening, the Fed is being squeezed from both sides. Normally, that would mean caution. But this isn’t a normal cycle it’s increasingly a political one, and markets know it.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.