Macro Regime Tracker: The Divergence In Flows

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

As we approach FOMC, understanding the drivers of the credit cycle and the melt up will be absolutely critical.

One of the key things to understand right now is the divergence that is building between stocks and bonds. I laid this out in a video here:

As always, the systematic models, strategies, and tear sheets are linked below. I am in the process of writing an in depth report explaining positioning further for paid subscribers to be on the look out for that.

Main Developments In Macro

US Macro, Fed Policy & Political Commentary

US JUNE LEADING INDICATOR FALLS 0.3% M/M; EST. -0.3%

FED, FDIC AND OCC ISSUE JOINT STATEMENT ON REGULATORY REVIEW

REGULATORS SEEK PUBLIC INPUT ON BANK OPERATION, CAPITAL RULES

TRUMP TAX LAW WILL ADD $3.4T TO DEFICITS OVER DECADE, CBO SAYS

LEAVITT: FED CHAIR NEEDS TO LOWER INTEREST RATES

LEAVITT: TRUMP HAS NO PLANS TO FIRE FED CHAIR

TRUMP ADMINISTRATION WANTS TO VISIT FED THIS WEEK: SEMAFOR

SENATOR TIM SCOTT IN TALKS TO ATTEND FED VISIT AS WELL: SEMAFOR

THUNE SAID FIRING POWELL DIDN'T COME UP WITH TRUMP: SEMAFOR

THUNE SAID FED RENOVATIONS REQUIRE MORE OVERSIGHT: SEMAFOR

WARREN QUESTIONS PULTE OVER SOCIAL MEDIA POSTS ABOUT POWELL

WARREN REQUESTS COPY OF PULTE'S SCHEDULE

WARREN CRITICIZES PULTE FOR 'ABNORMAL' BEHAVIOR ON SOCIAL MEDIA

Inflation, Productivity, and Business Expectations

BESSENT: ON CUSP OF PRODUCTIVITY BOOM AMID AI DEVELOPMENTS

BESSENT: IF INFLATION NUMBERS LOW, SHOULD BE CUTTING RATES

BOC SURVEY SHOWS CONSUMER INFLATION EXPECTATIONS ELEVATED

BOC: CONSUMERS SEE AUTO INFLATION SPIKING AMID TARIFF THREATS

BOC: FIRMS' NEAR-TERM INFLATION EXPECTATIONS NORMALIZING

BOC: RECORD 14% OF FIRMS GIVE NO RESPONSE FOR INFLATION OUTLOOK

BOC: WEAKER DEMAND, COMPETITION LIMITING TARIFF PASS THROUGH

Tariffs, Trade & Supply Chain

LEAVITT: YOU COULD SEE MORE TARIFF LETTERS BEFORE AUG. 1

LEAVITT: TRUMP CONTINUES TO BE ENGAGED OVER TRADE AGREEMENTS

BOC: TARIFFS, UNCERTAINTY WEIGHING ON BUSINESS OUTLOOK

BOC SAYS MOST EXPORTERS IN SURVEY AREN'T YET HIT BY TARIFFS

BOC: CONSUMERS SEE TARIFFS HINDERING BOC'S INFLATION CONTROL

BESSENT: TRADE TALKS WITH CHINA ARE IN A 'GOOD PLACE'

BESSENT: TRADE TALKS ARE 'MOVING ALONG'

BESSENT: IF BACK AT APRIL 2 TARIFFS, SEE PRESSURE ON PARTNERS

BESSENT: NOT GOING TO RUSH FOR SAKE OF DEALS, WANT HIGH QUALITY

BESSENT: INDONESIA KEPT COMING BACK WITH A BETTER DEAL

BESSENT: PROBLEM WITH STORIES LIKE WSJ WAS PARTIAL INFORMATION

BESSENT: TRUMP SOLICITS RANGE OF OPINIONS AS INPUTS

Geopolitical & Defense

US, GERMANY NEAR DEAL TO SEND AIR-DEFENSE SYSTEMS TO UKRAINE

US-GERMANY DEAL INVOLVES SENDING TWO PATRIOT SYSTEMS TO KYIV

ZELENSKIY: UKRAINE PROPOSES NEW MEETING WITH RUSSIA IN TURKEY

RUSSIA, UKRAINE MAY HOLD TALKS JULY 24-25 IN TURKEY: TASS

PESKOV: PUTIN, TRUMP MEETING IN CHINA IN SEPT. POSSIBLE: TASS

ISRAEL STRIKING HOUTHI TARGETS IN YEMEN'S HODEIDAH PORT: KATZ

IRAN FOREIGN MINISTRY: NO PLANS FOR TALKS WITH US AT THE MOMENT

IRAN SAYS TO DISCUSS NUCLEAR ISSUE WITH RUSSIA, CHINA TUESDAY

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: S&P 500 Edges Lower as Defensive Lift Fades, Tariff Anxiety Builds

The S&P 500 slipped 0.09% on Monday, reversing its early climb to settle slightly in the red despite briefly notching a record close above 6,300. Beneath the surface, the rally narrowed further propped up almost entirely by Communication Services, while Energy, Industrials, and Financials bore the brunt of risk-off rotation. Bond yields fell and the dollar softened broadly, driven by a dovish tilt in global fixed income markets and some flight to safety as traders reassess earnings resilience and the mounting tariff threat ahead of the August 1 deadline.

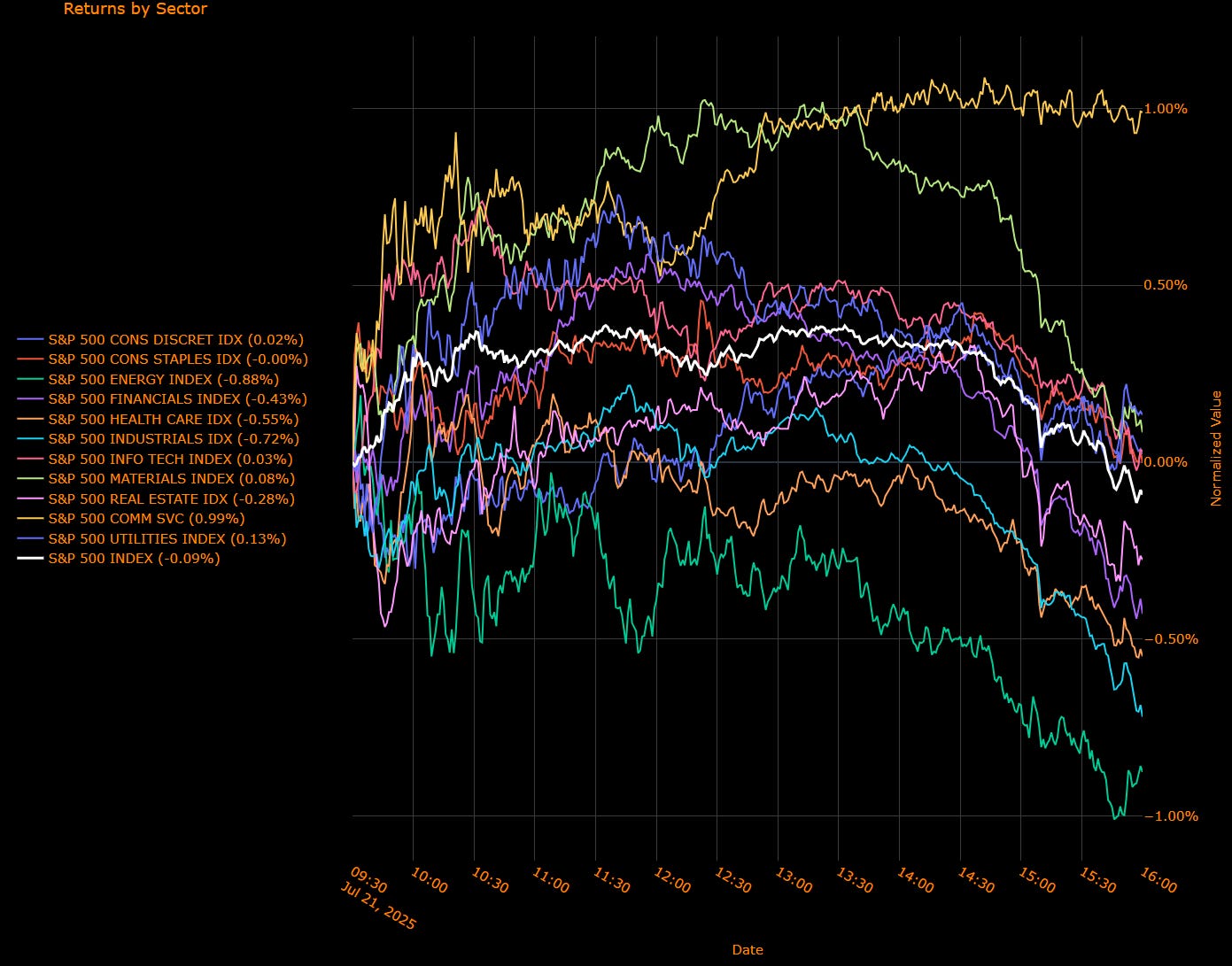

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Comm Services (+0.10 pp) – Sole major support to the index. Strength in streaming and digital platforms, possibly fueled by AI-driven optimism and investor anticipation ahead of Alphabet’s earnings, carried the group.

Info Tech (+0.01 pp) – Marginal lift from chipmakers and cloud platforms, though Nvidia softened late in the session. Earnings hopes kept a floor under the group.

Energy (–0.03 pp) – Pulled lower as oil-linked names slumped on demand concerns and geopolitical uncertainty despite WTI holding near $67.

Financials & Industrials (–0.06 pp each) – Twin drags reflecting broad rotation out of cyclicals. Bank earnings tailwinds faded while industrials digested softer guidance and trade worries.

Health Care (–0.05 pp) – Reversal from Friday’s leadership. Pharma and services names gave back prior gains, partially on valuation pressure.

Real Estate (–0.01 pp) – Slightly negative amid uncertainty around rate volatility and tax policy risk.

All Other Sectors – Flat. Discretionary, Staples, Utilities, and Materials posted zero or negligible contributions, highlighting the narrow leadership.

Sector Performance Breakdown

(Unweighted Daily Returns)

Comm Services (+0.99%) – Top performer. Meta, Alphabet, and streaming names led gains on renewed bullish sentiment around AI and digital ad spending.

Utilities (+0.13%) / Materials (+0.08%) – Defensive sectors held modestly firm but offered little overall lift. Viewed more as a passive hedge than active bet.

Info Tech (+0.03%) – Flatlining after early promise. Chipmakers faded into the close with Nvidia giving up midday gains.

Consumer Discretionary (+0.02%) – Directionless. Autos supported the space, offsetting weakness in retail.

Staples (–0.00%) – Completely flat. Investors are neither leaning into nor shunning the group — a classic sign of indecision.

Financials (–0.43%) / Health Care (–0.55%) – Significant underperformers. Health Care was unwound after a defensive run-up; banks weakened alongside the long-end rally.

Industrials (–0.72%) / Energy (–0.88%) – Deepest laggards. Industrials faced tariff-related caution, while Energy continues to suffer from demand-side angst.

Real Estate (–0.28%) – Weak, though not panicked. REITs and developers remain rate-sensitive as volatility returns to long-end bonds.

Macro Overlay: Calm Surface, Storm Beneath

Tariff Threats Resurface as Market Holds Its Breath

President Trump’s escalating tariff rhetoric re-entered focus after Press Secretary Karoline Leavitt warned that more tariff letters may be issued before August 1. With the EU rushing to reach a deal, traders are bracing for potential retaliatory spirals a dynamic that weighed heavily on cyclical sectors and stoked demand for duration and dollar alternatives. Treasury Secretary Bessent’s comments hinting at 100% tariffs on sanctioned Russian and Iranian oil buyers further added to geopolitical tensions and market unease.

Earnings Season: Resilience Meets Lofty Expectations

Earnings optimism remains, but the bar is high. Tesla and Alphabet will set the tone this week, especially for AI-linked optimism and valuation justification. Strategists continue to believe “the winners will keep winning,” but with the S&P 500 trading ~22x forward earnings, there’s little room for disappointment. The sector rotation into mega-cap tech continues, but participation is thinning.

Rate Relief Not Enough to Broaden Rally

Treasuries rallied — the 30-year yield dipped 4 bps to 4.95% and the dollar fell against all G-10 peers, yet equities couldn’t hold their early gains. That divergence suggests that rate relief alone is no longer sufficient to sustain a broad-based rally. Volatility remains “suspiciously low,” as Nationwide’s Hackett noted, and the streak without a 1% move now stretches deep into July. Investors may be lulled into complacency a risk if macro volatility spikes around tariffs, AI earnings misses, or Fed pushback.

A Market Grasping for Clarity

Monday’s price action was a tale of two tapes: new highs on paper, but weakness under the hood. The S&P 500’s headline resilience masks a narrow, fragile advance dominated by a handful of names. With Communication Services doing all the heavy lifting and cyclical sectors retreating, the rally looks less like a confident breakout and more like a defensive maneuver ahead of key earnings and potential trade war headlines.

US IG Credit Wrap: Spreads Edge Lower, but Complacency Sets In as Tariff Risks Simmer

Current IG Spread: 50.99 bp | 5-Year Average: 62.75 bp | 2020 High: 151.80 bp

Investment-grade credit spreads slipped to 50.99 bp on Monday, marking a fresh local low and reinforcing the theme of low-volatility carry-harvesting. While spreads sit well inside the five-year average and levels associated with systemic stress, the market tone feels increasingly dissonant: spreads are calm, but macro risks especially on trade are escalating. With the S&P 500 closing above 6,300 and long-end yields sliding, credit is comfortably priced… perhaps too comfortably.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: A Calm Market with a Fragile Core

Tariff Watch: Credit Ignores a Repricing Risk

Despite an increasingly hostile trade posture out of Washington with potential 30–100% tariffs looming over EU and Chinese exports credit markets remain largely unmoved. That may reflect faith in a last-minute deal or skepticism that tariff implementation will be broad or long-lasting. But the pricing disconnect between IG spreads and headline risk is growing wider, particularly for sectors with global exposure.

Rates Rally Offers Support, but Can’t Hide Fragility

The Treasury curve bull-steepened slightly Monday, with 30-year yields dropping 4 bps to 4.95%, lending support to long-duration credit. Still, even this duration tailwind didn’t spark spread tightening. If anything, the IG index’s inability to compress further in the face of falling yields and rising equity prices may suggest waning momentum.

Earnings Season Begins: Guidance in Focus

Early Q2 results have come in resilient particularly in telecoms and tech helping calm nerves around corporate health. But credit investors are watching for any signs of margin compression tied to rising input costs or tariff pass-through. Even a handful of weaker guides could shift sentiment fast, especially with the market priced for perfection.

Compression Fatigue Sets In

At 50.99 bp, IG spreads are trading below both the average and median of the past five years. There’s no sign of panic but neither is there evidence of fresh conviction. The market feels more like it's coasting on past momentum than pricing in forward risk.

The next test likely comes from earnings guidance and PCE inflation. A dovish Fed pivot or upbeat profit outlook could extend the calm. But if trade rhetoric hardens further, or if sticky core inflation resurfaces, this stretch of low-volatility carry could unwind quickly especially in the lower tiers of credit.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

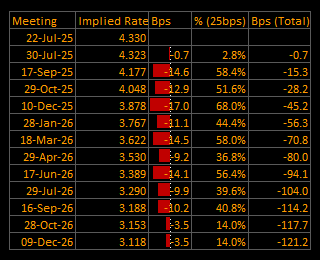

Short-End Rates Wrap: Curve Nudges to –121.2 bp as Soft CPI Sticks, But Tariff Fears Cloud the Path

Cumulative Implied Easing: –121.2 bp | Terminal Rate Seen at 3.12% (Dec 2026)

The OIS curve steepened slightly on Monday, with total implied easing through December 2026 expanding to 121 basis points — its most aggressive stance in over a month. Traders added conviction to the back half of the easing cycle, even as near-term expectations held steady. The curve remains anchored by confidence in disinflation, but signs of fraying are starting to creep in: the September cut probability remains below 60%, and political risk is quietly tightening its grip on the front end.

OIS-Implied Policy Path

Macro Overlay: The Curve Bends, But Political Winds Are Picking Up

Disinflation Narrative Firm, but the Market Is Front-Running the Fed

The OIS curve shows a classic soft-landing assumption: no cuts before September, then a steady grind lower into 2026. Monday’s move came not from a major macro catalyst, but rather a reinforcement of the existing narrative inflation is falling, and the Fed has room. The 5-year note yield dipped below 4.10%, and the 2s5s curve steepened modestly, in line with dovish sentiment.

But the market may be leaning too hard into this scenario. Even with CPI and PPI easing, Fed officials have shown no urgency to signal cuts and the risk remains that markets are pricing in a perfect glidepath without accounting for policy inertia.

September Cut: Still in Play, Still Conditional

Traders still assign ~58% odds to a September cut, little changed from last week. That’s notable: despite dovish inflation prints and a cooling labor market, the market wants confirmation likely in the form of Powell’s Jackson Hole remarks or the July PCE report. Until then, the 17-Sep-25 FOMC is a coin toss dressed as consensus.

Tariff Premium Begins to Creep In

While the curve is easing overall, there's a subtle sign of risk creep: shorter-dated meetings (July, September) are seeing slightly reduced odds of front-loaded cuts. The message? Investors are starting to wonder whether the looming Aug. 1 tariff deadline with threats of 30–100% duties on EU and Chinese goods could complicate the Fed’s flexibility or inject renewed inflation into the pipeline. That would muddy the path to a clean policy unwind.

Back-End Conviction Grows, But Fragility Lurks

The market now sees the Fed finishing near 3.12%, down from 3.27% just a few sessions ago. That shift was driven almost entirely by deeper cuts priced into the second half of 2026 a clear signal that traders see the easing cycle extending further, even as the economy softens gradually. Yet that conviction is extremely sensitive to policy credibility. If Powell’s position is again politicized, or if tariffs reaccelerate goods inflation, the back-end unwind could reverse swiftly.

Pricing Perfection, Bracing for Friction

With 121 bp of easing priced, markets are betting heavily on a clean disinflation glide and a Fed unencumbered by politics, trade, or credibility shocks. That’s a high bar. The curve is no longer just pricing macro it’s now a proxy for everything from Powell’s job security to EU trade negotiations to retail earnings resilience.

Every meeting after July is assumed to bring a cut. But the first one still isn’t locked in. That makes the next data point particularly July PCE and Jackson Hole, not just important, but pivotal. Because from here, the story is less about what’s priced... and more about what can still go wrong.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.