Macro Regime Tracker: The Macro End Game

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

Today I recorded a video explaining HOW the last 40 years have set the stage for WHERE we are moving in interest rates. You can find the full video here:

I want to share several additional things for you to keep an eye on:

First, whenever you have a regime change, there is a shift in cross sectional momentum (relative performance of assets) and correlations (assets moving together or inversely). The chart below shows ES (red) and then the Z score of bonds of their various durations vs ES (other colored lines). When the colored lines are moving up, stocks are falling against bonds. When the colored lines are moving down, ES is rallying against bonds. Why does this matter? You will notice that over the last 2 weeks, ES has been rallying aggressively against bonds. The implication is that even during the marginal rally in bonds since the last CPI print, equities continue to outperform. The signal you want to take away from this is that WHEN a recession begins to occur, ES will fall against bonds as implied volatility blows out.

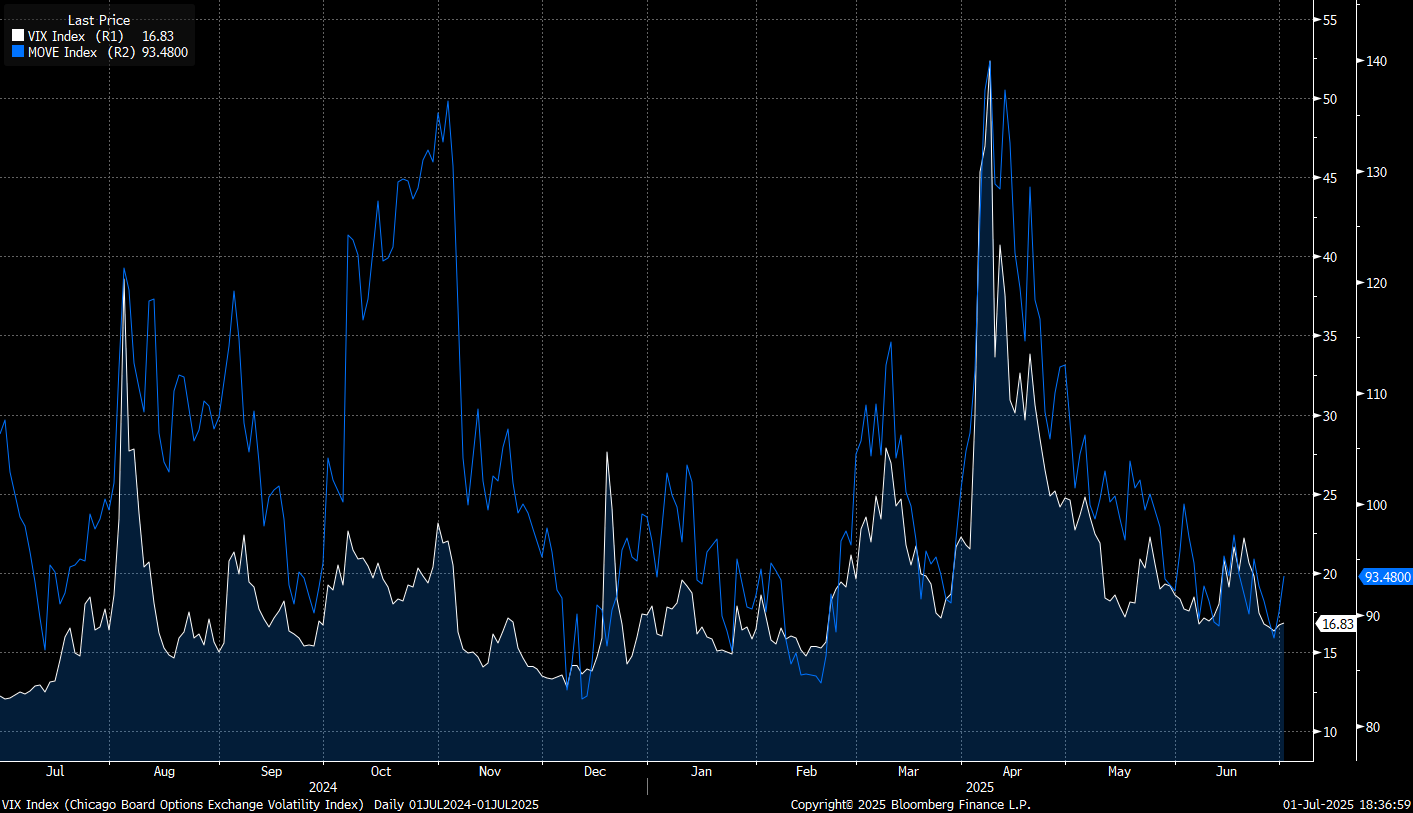

Second, we are compressing at a lower level in both the VIX and MOVE Index. This is setting the stage for the next move. (I laid out the logic for these moves in the macro report: LINK)

Third, we saw a marginal rotation in NQ and RTY today. The implication of this is that we are seeing managers selling tech to move into the Russell. While these types of moves don’t have a ton of persistence due to passive flows and the outright strength of Mag7:

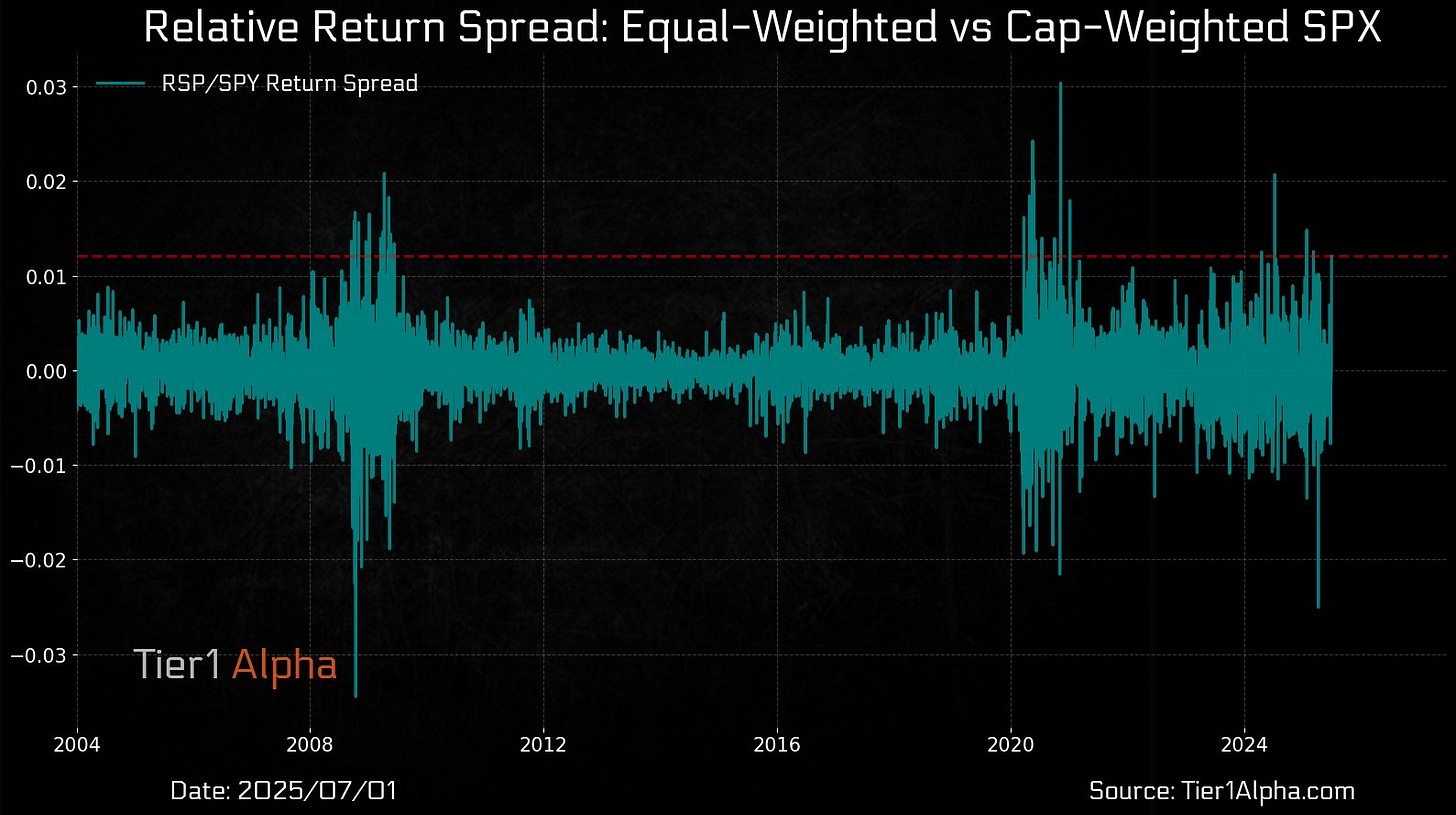

This is reflected in the RSP/SPY spread today, where broad equities rallied significantly more than Mag7:

The takeaway is that we are in the process of consolidating at a higher level in equities. I am watching the Nikkei and Yen closely here as we are in the Asia session because the Yen rallied as the Nikkei pulled back marginally from the high.

As I shared in the Macro End Game Video, this chart says a lot about the longer term trend. The Russell is rallying as 10s30s is steepening. The shorter term signals are important to take not of on an incremental basis but these flows are indicating strength in the economy.

The NFP print this week is likely to further confirm what the JOLTS print told us, that growth remains resilient.

All of the systematic models and tear sheets are below.

Main Developments In Macro

Federal Reserve / Monetary Policy

POWELL: WE EXPECT TO SEE HIGHER INFLATION READINGS OVER SUMMER

POWELL: INFLATION BEHAVING EXACTLY AS WE EXPECTED AND HOPED

POWELL: US ECONOMY IS IN A PRETTY GOOD POSITION

POWELL: WE SEE GRADUAL COOLING IN THE LABOR MARKET

POWELL: WATCHING CAREFULLY FOR UNEXPECTED LABOR MARKET WEAKNESS

POWELL: SOLID MAJORITY AT FED EXPECT RATE CUTS LATER THIS YEAR

POWELL: WOULD SAY WE'RE PROBABLY MODESTLY RESTRICTIVE

POWELL: CAN'T SAY WHETHER JULY IS TOO SOON TO CONSIDER A CUT

POWELL: WOULDN'T TAKE ANY MEETING OFF TABLE, DEPENDS ON DATA

POWELL: LEVEL OF DEBT IS SUSTAINABLE BUT PATH IS NOT

POWELL: WE THINK PRUDENT THING TO DO IS WAIT AND LEARN MORE

POWELL: WANT TO HAND ECONOMY IN GOOD SHAPE TO MY SUCCESSOR

POWELL: 'HAVE NOTHING FOR YOU' ON STAYING ON AS A FED GOVERNOR

FED CHAIR JEROME POWELL CONCLUDES PANEL COMMENTS AT ECB FORUM

US Economic Data

US MAY JOB OPENINGS 7.769M; EST. 7.300M

US JUNE ISM MANUFACTURING INDEX RISES TO 49; EST. 48.8

US S&P GLOBAL JUNE MANUFACTURING PMI AT 52.9 VS 52 PRIOR

US JUNE DALLAS FED SERVICE BUSINESS ACTIVITY -4.4

Fiscal Policy / Tax Legislation

TRUMP SAYS TAX BILL WILL HOPEFULLY PASS TODAY

TRUMP: I THINK 'WE'RE GOING WELL' WHEN ASKED ABOUT BILL

TRUMP ON TAX BILL: I DON'T LIKE CUTS

SPEAKER JOHNSON: A LOT OF WORK AHEAD BUT WE'LL GET TRUMP TAX BILL DONE

JOHNSON: SENATE AMENDED TAX BILL A LITTLE MORE THAN PREFERRED

SENATORS CALLED TO SENATE FLOOR AS TAX BILL NEARS FINAL VOTE

THUNE: BELIEVE GOP HAS A DEAL TO PASS TRUMP TAX BILL

SENATOR RON JOHNSON SAYS HE'LL SUPPORT TAX BILL: CNBC

BESSENT: THINK WE'LL GET SENATE TAX APPROVAL THIS AFTERNOON

BESSENT: THE TAX BILL 'MORE THAN PAYS FOR ITSELF'

BESSENT: 'WE COULD BE IN SURPLUS' WITH TAX BILL

BESSENT: MOVING TOWARD A VOTE ON THE TAX BILL TODAY

Trade & Geopolitics

TRUMP: JAPAN TO PAY 30%, 35% OR WHATEVER TARIFF WE DETERMINE

TRUMP: DOUBT WE'LL MAKE A DEAL WITH JAPAN

TRUMP: NOT THINKING ABOUT EXTENDING TARIFF PAUSE PAST JULY 9

BESSENT: 'VERY CLOSE' ON TRADE DEAL WITH INDIA

BESSENT: CHINA MAGNETS STILL NOT FLOWING AS THEY WERE PRE-APRIL

BESSENT: TRADE DEALS ARE NEXT WEEK'S AGENDA

BESSENT: CAREER TRADE STAFF SAY NEVER SEEN SUCH DEALS AS NOW

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

Here’s the updated S&P 500 Sector Wrap using the latest sector contribution and performance data, contextualized within Powell’s testimony, ongoing tariff uncertainty, and growing market fatigue near record highs:

S&P 500 Edges Higher by 0.17% as Rotation Favors Health Care, Materials; Tech Weighs

The S&P 500 closed up 0.17% on Wednesday, sustaining momentum into the new quarter despite mounting trade noise and sticky price signals. A notable rotation away from recent winners particularly tech and communications fueled gains in lagging sectors like Health Care, Materials, and Consumer Discretionary. Rate-sensitive groups remained broadly firm, while Treasury yields ticked higher following stronger-than-expected ISM and JOLTS data.

Sector Contribution Breakdown (Weighted Return to Index)

Health Care (+0.14 pp) – Top contributor, driven by managed care and pharma; defensive and growth narratives overlapped amid macro uncertainty.

Consumer Discretionary (+0.14 pp) – Rebounded strongly from Tuesday’s lag, led by autos and retail.

Financials (+0.11 pp) – Continued strength in banks and diversified financials as carry tailwinds held.

Industrials (+0.06 pp) – Lifted by transport and defense; saw catch-up after underperformance.

Materials (+0.04 pp) – Bid returned to metals and specialty chemicals as inflation protection plays.

Energy (+0.03 pp) – Modest gain despite crude volatility, driven by refiners and integrateds.

Consumer Staples / Real Estate (+0.02 pp each) – Mild outperformance on rate stability and shelter bid.

Utilities / Info Tech (0.00 pp / –0.29 pp) – Utilities tread water, while tech dragged on the index with sharp pullbacks in semis and mega-cap software.

Communication Services (–0.08 pp) – Second consecutive day of weakness in ad platforms and telecom.

Sector Performance Breakdown (Unweighted Index Returns)

Materials (+2.22%) – Best performing sector on broad strength across miners, packaging, and chemicals.

Health Care (+1.45%) – Managed care, biotech, and pharma names surged.

Consumer Discretionary (+1.37%) – Strong bounce led by autos and travel after prior day’s drag.

Energy (+0.86%), Financials (+0.75%), Real Estate (+0.75%) – Broad cyclical participation continued.

Industrials (+0.65%) – Steady grind higher in capex-sensitive names.

Consumer Staples (+0.39%), Utilities (+0.20%) – Defensive bid steadied, but no longer driving leadership.

Information Technology (–0.89%) – Heaviest drag; chipmakers underperformed alongside software fade.

Communication Services (–0.82%) – Selloff extended in ad tech and media.

Macro Overlay: Rotation Intensifies, Fed Steadies, Trade Clock Ticking

1. Powell Stays Cautious, Won’t Rule Out July

Fed Chair Jerome Powell reiterated that July is “not off the table” but emphasized a wait-and-see approach as tariffs complicate the inflation outlook. He noted inflation is behaving “exactly as expected,” and confirmed a solid majority at the Fed still see cuts later this year. Rate cuts remain a matter of timing, not direction.

2. Manufacturing Signals Stress

ISM Manufacturing rose to 49.0 (vs. 48.8 est), but new orders and employment deteriorated. Companies are accelerating headcount reductions and reporting demand uncertainty tied to tariff volatility. The index for prices paid surged to 69.7 — highlighting persistent upstream pressures even as consumption slows.

3. Trade Risks Amplify as July 9 Nears

Trump stated there will be no extension of the tariff pause, raising the prospect of renewed levies on Japan and others. Canada repealed its digital services tax to salvage negotiations, and the EU is angling for exemptions under a universal tariff framework. The White House is pushing to finalize a suite of bilateral agreements in the coming week.

4. Rates Firm as Job Market Resilient

May JOLTS showed 7.77M job openings well above estimates dimming the odds of near-term Fed easing. Treasuries sold off modestly, with 10s rising to 4.25%. The labor market remains tight, complicating the Fed’s tradeoff calculus.

Final Word: Broader Rotation, Thinner Leadership, Still Asymmetric

The S&P 500’s modest gain masks a powerful undercurrent: leadership is shifting fast, breadth is rotating, and sector dispersion is widening. With small caps outperforming and defensives stabilizing, this market is increasingly reliant on rotation not conviction for forward progress. The setup into the July 9 tariff deadline and July 15 CPI release remains tactically bullish but strategically cautious.

US IG Credit Wrap — Spreads Edge Lower to 50.56 bp as Market Treads Cautiously Amid Mixed Data, Trade Crosscurrents

Current Spread: 50.56 bp | 5-Year Average: 62.83 bp

Investment-grade (IG) credit spreads continued to grind tighter, falling to 50.56 bp their lowest since early 2024 as credit markets maintained a slow, cautious drift tighter in the face of macro ambiguity. While equity markets remain choppy and heavily rotational, the IG space remains rooted in a carry-friendly, wait-and-see posture. The market isn’t chasing risk, but it's also not fading it, as rate volatility stabilizes and fundamentals show more fatigue than fear.

Credit Context

< 60 bp: Stable, duration-friendly range supporting insurance and liability-driven investment (LDI) strategies.

60–70 bp: Neutral-to-cautious positioning recommended amid tariff uncertainties and macroeconomic volatility.

> 90 bp: Significant market distress currently unlikely without a major escalation in geopolitical or macroeconomic shocks.

Macro Overlay: Caution Without Capitulation

1. Powell Holds Ground, July Still Live

Chair Powell repeated his “patient but flexible” stance, saying July is “not off the table,” but inflation uncertainty tied to tariffs means the Fed prefers more data before acting. While the market remains priced for a September cut, Powell’s rhetoric reinforced optionality rather than urgency.

2. ISM Shows Manufacturing Still Contracting, Employment Weakens

June’s ISM Manufacturing Index rose modestly to 49.0, but new orders and employment dropped further, with the latter falling for a fifth straight month. The price paid index surged to 69.7, reflecting cost pressure despite flagging demand. From a credit lens, this mix continues to support carry, not credit expansion.

3. Trade Talks Progress, but Clarity Lags

The US and Canada reset talks after Canada repealed its digital services tax, and the EU is signaling willingness to accept a 10% universal tariff framework. Still, enforcement timelines, sector carve-outs, and implementation risk remain uncertain ahead of the July 9 deadline.

4. Jobs Data Resilient, but Market Still Bets on Cuts

The JOLTS report showed job openings rose to 7.77 million the highest since November reinforcing the Fed’s “luxury of time” narrative. The labor market remains solid, keeping July cuts unlikely. However, market pricing for two cuts by year-end is largely intact.

Final Word: No Rush, No Retreat

Spreads at 50.56 bp reflect a credit market sitting in a constructive middle ground skeptical of overexuberance in equities, but also unthreatened by the near-term macro path. The backdrop of mixed manufacturing, stable inflation expectations, and cautious policymaker tone means credit remains anchored — not widening on risk, but not compressing without conviction either.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Short-End Rates Wrap — Market Scales Back Slightly, But Still Prices Deep Easing Path with –122.9 bp by Dec 2026

The front-end of the curve softened marginally Tuesday, with cumulative rate cuts priced through December 2026 pulling back to –122.9 basis points, from –135.1 bp the prior day. The shift comes as OIS markets recalibrate around improving risk sentiment, a rebound in the dollar, and firm labor market signals. Still, the path to a Fed pivot remains largely intact: a September cut is nearly fully priced, July remains in the discussion, and Powell's cautious stance continues to anchor expectations, even as traders front-run the FOMC's formal signaling.

OIS-Implied Easing Path

Front-End Expectations

02-Jul-25: 4.330% → No live risk

30-Jul-25: 4.278% (–5.2 bp) → ~21% probability → Optional, not expected

17-Sep-25: 4.050% (–22.8 bp) → ~91% probability → September still base case

2025 Year-End Outlook

10-Dec-25: 3.686% → –64.4 bp cumulative → Market still sees 2–3 cuts this year

Full Cycle View

09-Dec-26: 3.101% → –122.9 bp cumulative → Lower-for-longer path persists despite tactical pullback

Macro Overlay: Jobs Firm, Powell Steady, Tariff Anxiety Fades

1. Powell Remains Non-Committal but Doesn’t Push Back on Cuts

Chair Powell repeated that July is not off the table, but his comments in Sintra reinforced a “wait-and-see” posture. He acknowledged tariff-driven inflation may yet materialize but said the Fed is “prepared to learn if the impact is higher or lower, or later or sooner.” The tone keeps optionality open while still biasing toward September as a pivot point.

2. Job Openings Surprise Higher, Labor Still Strong

May JOLTS: 7.77M job openings vs. 7.3M est → highest since Nov

This data reinforces the “luxury of time” Powell cited, but also increases the bar for a July cut. Wages are holding, unemployment remains low, and layoffs have slowed — all suggesting the Fed is not pressured to act immediately.

3. Consumer Still Wobbly, But Not Collapsing

Personal Spending (May): –0.3% m/m

Personal Income: –0.4% m/m

Savings Rate: Down to 4.5%

While the jobs market holds, consumption remains a soft spot — raising questions about household resilience heading into H2. Powell framed this as manageable, but the market views it as early justification for easing.

4. Trade Talk Tensions Ease Without Reflation

Canada: Repeals digital tax → US negotiations resume

EU: Open to 10% universal tariff structure with carve-outs

China: Rare earths deal finalized

These de-escalations reduce the risk of global inflation shocks. Powell noted trade is “hard to model,” but the market is increasingly convinced it won’t be a Fed-blocking inflation impulse.

Final Word: Market Takes a Breather, But Glide Path Intact

While the cumulative implied cuts slipped to –122.9 bp, the trend remains firmly dovish. September is the anchor, July is still in view, and no data including the stronger JOLTS print is hot enough to derail the easing narrative. Powell’s approach is patient and deliberate, but traders continue to price an eventual unwind that starts sooner rather than later. The recent risk-on rotation and stable inflation prints give the Fed room — and the market confidence to price cuts, even if the Fed isn’t ready to say it out loud.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.