Macro Regime Tracker: The Melt Up Continues

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

We continue to see risk assets move in lockstep with the macro views I have been laying out. Today, we are seeing further confirmation of the rally as the sector that is lagging the most put up exceptional performance on the day. Homebuilders (ITB in the chart below) are beginning to break out of their underperformance and push higher.

Everyone has been excessively focused on all the bad things that can happen to real estate and the fact that mortgage rates are so high. It remains inconceivable to people that the consumer is strong, as I laid out in the video below.

Bottom line, risk assets remain skewed to the upside on a cyclical basis.

Bitcoin, ES, and RTY are all moving in lockstep to the upside. This will continue until we pull in all of the macro liquidity.

Bonds continue to face headwinds, but as I laid out in the chat, we need to wait till AFTER FOMC for further downside.

See all systematic models, strategies, and tear sheets below.

Main Developments In Macro

Macro Trade and Tariff Developments

TRUMP: INDONESIA TO ELIMINATE 99% OF THEIR TARIFF BARRIERS

TRUMP: INDONESIA TO SUPPLY US WITH CRITICAL MINERALS

TRUMP: US HAS TRADE AGREEMENT WITH INDONESIA

TRUMP: TALKING TRADE, WAR AND PEACE WITH MARCOS

TRUMP ON MARCOS MEETING: VERY CLOSE TO FINISHING TRADE DEAL

TRUMP: GETTING ALONG WITH CHINA VERY WELL

TRUMP: XI MEETING IN CHINA IN 'NOT TOO DISTANT FUTURE'

TRUMP: MAGNETS ARE COMING OUT OF CHINA VERY WELL

BESSENT: ABOUT TO ANNOUNCE A RASH OF TRADE DEALS WITHIN DAYS

BESSENT: CHANCE OF $2.8T TARIFF REVENUE OVER A DECADE

BESSENT: COULD ANNUALIZE TARIFF REVENUE AT $300B

BESSENT: TARIFF REVENUE IS 'BIG NUMBER,' COULD BE 1% OF GDP

BESSENT: A LOT OF DEALS INCLUDE SUBSTANTIAL INVESTMENTS IN US

BESSENT: TARIFFS ARE BRINGING MANUFACTURING BACK TO US

BESSENT: WE'VE MOVED TO 'A NEW LEVEL' IN CHINA TALKS

BESSENT: AUG. 1 IS A 'PRETTY HARD DEADLINE' FOR ALL COUNTRIES

BESSENT: CHINA DEAL EXPIRES AUG. 12

BESSENT: DOESN'T MEAN CAN'T NEGOTIATE AFTER TARIFFS GO UP

Federal Reserve Policy & Political Risk

TRUMP ON POWELL RESIGNING: HE'S GOT TO BE OUT IN 8 MONTHS

TRUMP CRITICIZES FED BUILDING COSTS

TRUMP: RATES SHOULD BE 3 POINTS LOWER, MAYBE LOWER

BESSENT: FED SHOULD BE CUTTING RATES NOW

BESSENT: FED HAS BIG MISSION CREEP, CAUSING HIGH SPENDING

WHITE HOUSE VISIT TO FED HQ PLANNED FOR THURSDAY: OFFICIAL

POWELL SAYS NEED BIG BANKS TO BE WELL-CAPITALIZED, MANAGE RISKS

BESSENT: IF POWELL WANTS TO STAY UNTIL MAY, HE SHOULD DO SO

BESSENT: NOTHING SAYS POWELL SHOULD STEP DOWN NOW

BESSENT: HAVE CONFIDENCE IN POWELL, FED CAN LOOK AT ITS COSTS

BESSENT: CALLING FOR AN INTERNAL REVIEW AT THE FED

BESSENT: INTERNAL FED REVIEW CAN BE PART OF POWELL LEGACY

BOWMAN SAYS TIME TO LOOK BACK, SEE WHAT'S WORKING ON REGULATION

Geopolitical & Other US-Relevant Political Headlines

TRUMP: MARCOS IS A TOUGH NEGOTIATOR

TRUMP STARTS SPEAKING IN OVAL OFFICE MEETING

TRUMP MET WITH BEZOS LAST WEEK IN OVAL OFFICE: CNBC

TRUMP APPROVES DISASTER FUNDS FOR MICHIGAN, WEST VIRGINIA

TRUMP POSTS ABOUT DISASTER ASSISTANCE ON TRUTH SOCIAL

LEAVITT: TRUMP, STARMER WILL FORMALIZE TRADE DEAL IN UK MEETING

WHITE HOUSE PRESS SECRETARY LEAVITT SPEAKS ON FOX NEWS

WHITAKER: CHINA NEEDS TO BE CALLED OUT FOR `SUBSIDIZING' RUSSIA

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

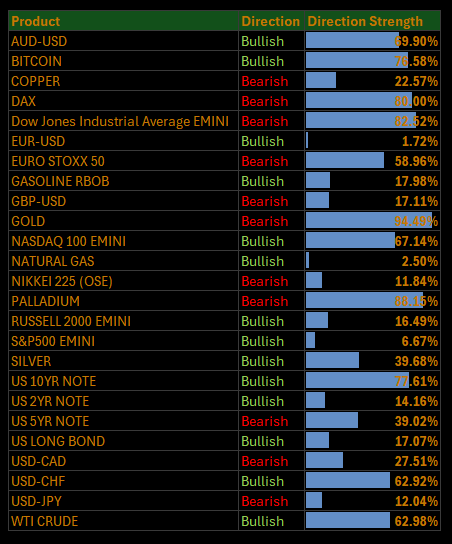

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

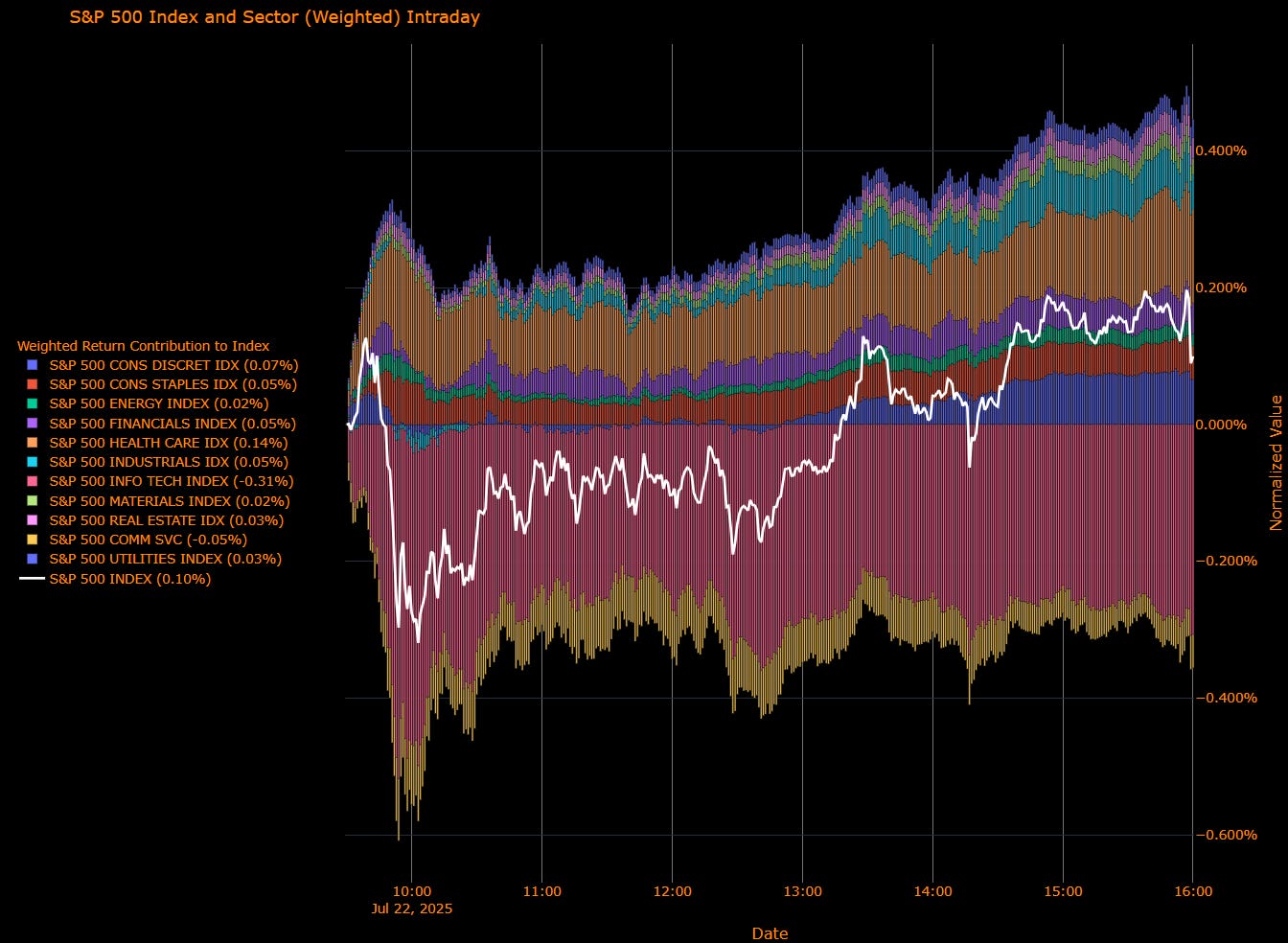

US Market Wrap: S&P 500 Inches Higher as Defensive Bid Returns, but Tech Weighs

The S&P 500 eked out a modest 0.10% gain on Tuesday, clinging to record territory despite weakness in heavyweight tech stocks. Under the hood, sector rotation picked up pace, with Health Care and Real Estate doing the heavy lifting as Info Tech sold off ahead of key earnings. Bond yields fell and the dollar weakened, extending Monday’s macro drift. Traders continue to grapple with the push-pull of megacap concentration, tariff risks, and a fragile Fed narrative all ahead of Tesla and Alphabet earnings.

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Health Care (+0.14 pp) – Top contributor. Strong earnings momentum and defensive rotation supported managed care and large-cap pharma.

Consumer Discretionary (+0.07 pp) – Lifted by autos and select retail ahead of GDP and income data. The group rebounded from Monday’s indecision.

Staples, Financials, Industrials (+0.05 pp each) – Modest gains across defensives and cyclicals. Financials benefited from stable rates; Industrials caught a tariff reprieve.

Utilities, Real Estate (+0.03 pp each) – Rate-sensitive segments found support as yields slid again. The REIT bid firmed despite Fed tension.

Energy, Materials (+0.02 pp each) – Flat to slightly positive. Commodity-linked names moved with oil and metals, but conviction was shallow.

Info Tech (–0.31 pp) – Clear laggard. Semis and software sold off ahead of Alphabet’s print, dragging on the index despite the broader gain.

Comm Services (–0.05 pp) – Gave back Monday’s gains. Streaming and ad-tech stalled after a blistering run-up.

Sector Performance Breakdown

(Unweighted Daily Returns)

Health Care (+1.52%) – Strongest performer, extending leadership. Strength in managed care and pharma; viewed as a safe harbor pre-earnings.

Real Estate (+1.46%) – Rates down, REITs up. Classic duration response as 10s fell and volatility stayed suppressed.

Materials (+1.22%) / Utilities (+1.11%) / Staples (+0.92%) – Solid defensive rotation. Demand for yield and resilience in pricing power narrative helped these hold firm.

Consumer Discretionary (+0.63%) – Auto strength continues; some catch-up from underperformance.

Energy & Industrials (+0.59%) – Held in line with broader market. Repricing of tariff tail risk likely aided sentiment.

Financials (+0.33%) – Stable day. The lack of fresh catalysts kept moves muted despite macro noise.

Comm Services (–0.50%) – Tech-adjacent but got dragged with Info Tech. AI exuberance paused.

Info Tech (–0.92%) – Sharp pullback as traders de-risk ahead of Tesla and Alphabet earnings. Nvidia, Microsoft, and other key names turned lower.

Macro Overlay: Fragile Leadership, Dovish Drift, Tariff Tension

Megacap Tension Mounts Ahead of Earnings

Markets are on edge heading into Tesla and Alphabet results, with the Magnificent Seven up over 40% from April lows. Info Tech's sharp pullback reflects both positioning fatigue and elevated expectations. AI-linked optimism remains the lifeblood of this rally, but the bar is sky-high.

Tariff Noise Returns Just as Cyclicals Stir

President Trump unveiled a new 19% tariff on Philippine exports while threatening broader trade penalties if deals don’t materialize by August 1. Treasury Secretary Bessent downplayed Fed Chair Powell’s removal but reignited scrutiny of the Fed’s spending highlighting the institution's “mission creep.” While headline calm persists, undercurrents of policy uncertainty are undermining risk appetite in cyclicals.

Rates Rally, But No Risk-On Follow-Through

Treasuries extended gains with the 10-year yield dipping to 4.34%, and the dollar slipped another 0.4%. Yet equities failed to follow through meaningfully a sign that the rate impulse is losing influence over broader positioning. Volatility remains compressed, but skew is building under the surface.

New Highs, Same Narrow Tape

Despite the S&P 500’s positive close, the index continues to climb with a limp. Sector breadth improved slightly from Monday’s stark divergence, but leadership remains fragile and defensive. The selloff in Tech is not yet disorderly but it’s a timely reminder that even small cracks in the megacap growth story can rattle the entire index.

Until earnings prove otherwise, this market is walking a narrow ledge supported by yield-sensitive defensives, fueled by AI dreams, and increasingly shadowed by trade policy brinksmanship.

US IG Credit Wrap: Spreads Static at 51 bp, but Market Complacency Reaches a New Peak

Current IG Spread: 51.11 bp | 5-Year Average: 62.75 bp | 2020 High: 151.80 bp

Investment-grade credit spreads held steady at 51.11 bp on Tuesday, barely budging from Monday’s levels and reinforcing the sense that credit markets have entered a phase of high-conviction apathy. Despite swirling risks from tariff brinksmanship to Fed leadership tension spreads remain locked in a tight, low-volatility band. With stocks at record highs, long-end yields drifting lower, and the dollar slipping, IG appears priced for perfection... or denial.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: Tight Spreads, Thin Ice

Tariffs? What Tariffs?

The White House’s increasingly aggressive tariff stance including a fresh 19% levy on Philippine goods and veiled threats toward the EU and China has yet to ripple through credit markets. Traders appear convinced this is all posturing. But the longer spreads sit near cycle tights while geopolitical risk ratchets higher, the more asymmetric the setup becomes. Global-facing names in autos, tech hardware, and industrials look particularly mispriced if tensions escalate.

Powell in the Crosshairs, But Credit Unbothered

Treasury Secretary Scott Bessent’s support for Powell this week (paired with Trump’s “he’s out in eight months” jab) failed to move the needle. That’s telling. Credit markets seem unwilling to price any Fed-related institutional risk a luxury that may not last if policy credibility comes into question or the Fed’s independence becomes a political football through election season.

Duration Tailwind Stalls Out

Rates rallied again Tuesday, with the 10-year yield down to 4.34%, but IG spreads didn’t follow suit. This disconnect suggests spread compression fatigue. Even with falling yields, credit is not repricing tighter possibly because positioning is full, or the macro narrative is just too foggy to justify new risk-taking.

Earnings Season: Caution Below the Surface

So far, earnings have come in solid Coca-Cola, GM, and Northrop all delivered better-than-feared results. But outlooks matter more than beats. RTX, for example, cut guidance citing tariff disruption. Watch for this theme to build: headline EPS can hide macro vulnerability, but weak guides and margin compression will hit spreads harder than missed bottom lines.

Compression Without Conviction

With spreads anchored near 51 bp, the IG market is signaling calm — but it feels more like inertia than confidence. Equity markets are levitating, yields are falling, and volatility is historically muted. And yet credit won’t tighten further.

In short: the market may be running out of narrative runway. The combination of narrow participation, macro policy drift, and latent trade risk has created a setup where everything has to go right… or spreads could gap wider fast.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

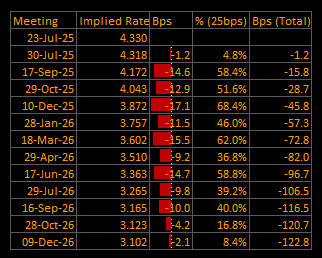

Short-End Rates Wrap: Easing Path Extends to –122.8 bp, but Market Clings to Smooth Glidepath

Cumulative Implied Easing: –122.8 bp | Terminal Rate Seen at: 3.10% (Dec 2026)

The OIS curve nudged steeper on Tuesday, with cumulative easing priced through December 2026 reaching 122.8 basis points a fresh high for the current cycle. Traders are extending conviction into late 2026 even as near-term cuts remain conditional. The market continues to bet on a "just right" landing: cooling inflation, a compliant Fed, and no real trade blowback. But the more the curve stretches toward a textbook unwind, the more it feels like investors are ignoring the noise outside the narrative.

OIS-Implied Policy Path

Macro Overlay: Priced to Perfection, Blind to Friction

September Cut Still Murky

The September FOMC remains the fulcrum of the curve. Traders see a ~58–60% chance of a cut, but there’s clear hesitation. That uncertainty is notable given dovish inflation prints and cooling macro data a sign the market wants hard confirmation via July PCE or Jackson Hole before locking it in. Until then, the front-end flirts with conviction but won’t commit.

Tariff Risks Pushed Aside — For Now

Despite mounting threats of 30–100% tariffs on EU, China, and Philippine goods, the market still sees no impact on the Fed’s easing path. July and September implied rates are nearly unchanged. That’s a risky assumption if tariffs re-ignite goods inflation or provoke supply-chain friction, the Fed may find its hand stayed longer than markets anticipate.

Political Noise Ignored, but It’s Getting Louder

With Treasury Secretary Bessent now publicly defending Powell’s tenure amid growing White House criticism, and Trump reiterating that Powell will be “out in eight months,” the risk of Fed politicization is no longer theoretical. Yet the curve prices none of it. A Powell departure voluntary or not could inject uncertainty around policy continuity or even delay the initial cut.

Back-End: Calm, Confident… and Exposed

Cuts of –14 to –16 bp are now priced for every meeting from March to December 2026, with the terminal rate pinned at 3.10%. That confidence reflects a view that the Fed can glide rates lower for another 18 months without hitting turbulence. But this stretch of the curve is highly fragile. A hawkish surprise, persistent core services inflation, or trade-linked inflation pulse could easily knock 25–40 bps out of the long end.

One Cut Away from a Repricing

The curve reflects a “no bad outcomes” world: inflation drifts lower, Powell stays in office, tariffs stay symbolic, and every cut happens on schedule. That might hold but the more the market front-runs the full cycle, the less margin for error remains.

The next true test comes with July PCE and Powell’s Jackson Hole speech. Until then, short-end rates will remain stretched between belief in the data… and growing disbelief in the silence around everything else.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.