Macro Regime Tracker: The Volatility Regime

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

See all macro view laid out here:

And video breakdown here:

Main Developments In Macro

*TRUMP REPEATS CALL FOR SENATE TO PASS TAX BILL

*TRUMP COMMENTS ON POTENTIAL DEAL WITH IRAN IN TRUTH SOCIAL POST

*TRUMP: WILL NOT ALLOW ANY ENRICHMENT OF URANIUM FOR IRAN

*LEAVITT: TRUMP, XI WILL LIKELY TALK THIS WEEK

*LEAVITT: REMAIN OPTIMISTIC OF DEAL WITH EU ON TRADE

*GOOLSBEE: HESITANT TO MAKE TRANSITORY ARGUMENT FOR TARIFF INF.

*FED'S POWELL DOESN'T COMMENT ON ECONOMY, RATE OUTLOOK IN SPEECH

*GOOLSBEE: SURPRISINGLY LITTLE TARIFF IMPACT ON DATA OUT SO FAR

*TRUMP TARIFF LEGAL FOES ASK COURT TO HALT LEVIES DURING APPEAL

*LOGAN: WHEN RISKS CHANGE IN MATERIAL WAY, POSITIONED TO RESPOND

*LOGAN: CAN WAIT FOR MORE DATA, MORE CERTAINTY ON GOVT POLICIES

*TRUMP AND XI LIKELY TO SPEAK THIS WEEK: CNBC

*LOGAN: IMPORTANT TO THINK ABOUT TAILORING REGULATORY POLICY

*LOGAN: POTENTIAL RISKS OF TARIFFS ARE HIGHER UNEMPLOYMENT, INF.

*LOGAN: MISSING ON EITHER SIDE OF OUR MANDATE WOULD BE COSTLY *LOGAN: POLICY IS WELL POSITIONED FOR THE RISKS WE'RE FACING

*LOGAN: MONETARY POLICY IS WELL POSITIONED TO WAIT, BE PATIENT

*FED'S LOGAN: RISKS ARE BALANCED ON BOTH SIDES OF MANDATE

*LOGAN: DESPITE UNCERTAINTY, OVERALL ECONOMY HAS BEEN RESILIENT

*DALLAS FED PRESIDENT LORIE LOGAN COMMENTS DURING MODERATED Q&A

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Real Estate Spreadsheet Video: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

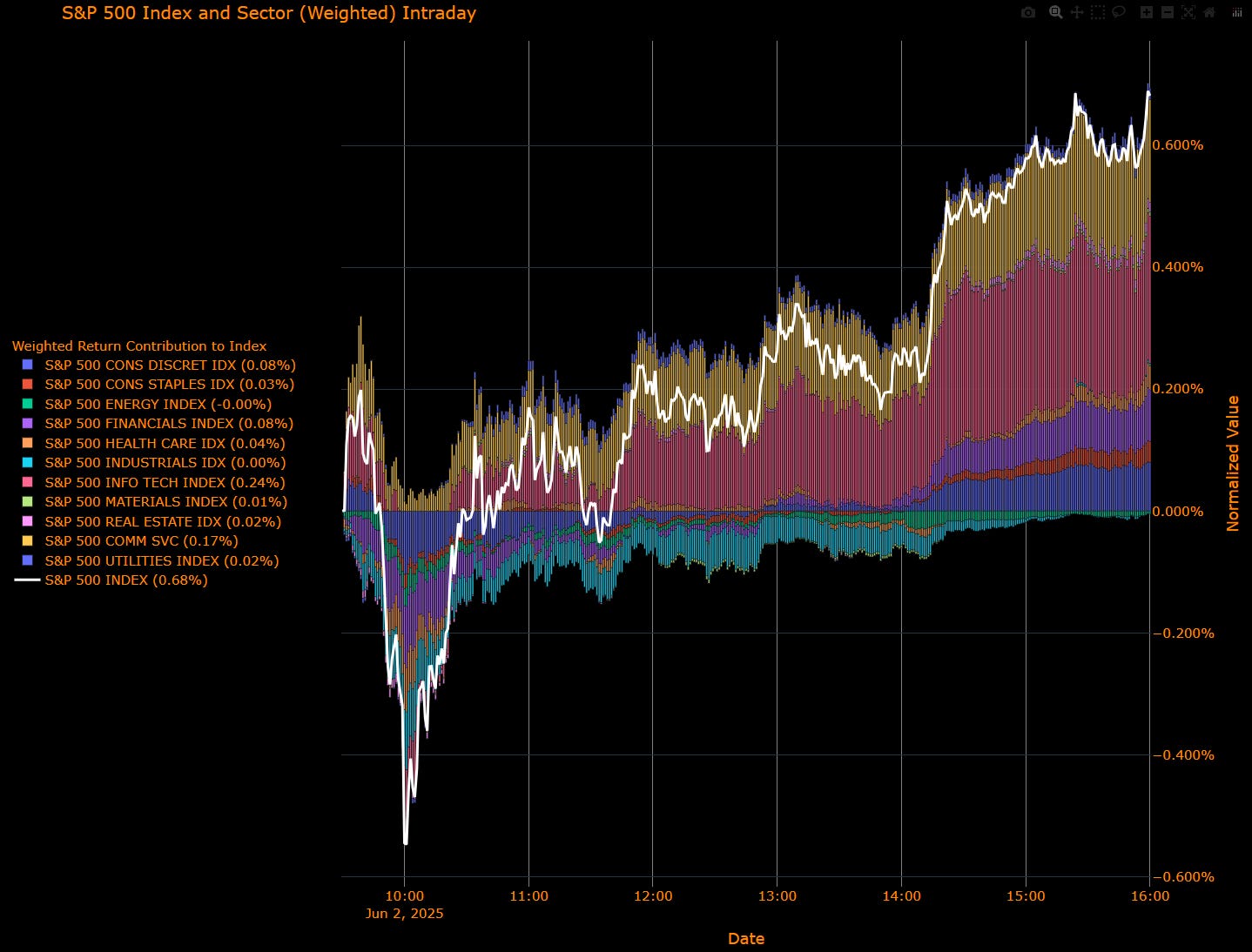

S&P 500 Wrap — Index Gains +0.68%, Communication Services and Tech Lead Gains; Energy Underperforms

Sector-by-Sector Contribution Snapshot (Weighted Impact)

Communication Services (+0.17 pp) – Largest positive contributor, boosted by robust investor appetite for stable demand outlook and resilient earnings profiles.

Information Technology (+0.24 pp) – Strong contributor reflecting renewed investor optimism amid tech recovery, particularly in chipmakers like Nvidia.

Consumer Discretionary (+0.08 pp) – Positive contribution driven by improved consumer sentiment and reduced trade-related concerns.

Financials (+0.08 pp) – Benefited from stabilizing yields and resilient banking sector performance.

Health Care (+0.04 pp) – Modest positive impact due to defensive positioning and consistent sector demand.

Consumer Staples (+0.03 pp) – Mild contribution reflecting sustained investor interest in stable, defensive-oriented companies.

Utilities (+0.02 pp) – Small positive contribution amid continued yield-oriented investor interest.

Real Estate (+0.02 pp) – Modestly positive, supported by investor demand for yield stability amid current interest rate dynamics.

Materials (+0.01 pp) – Minimal positive contribution reflecting stable commodity market conditions.

Industrials (~0.00 pp) – Neutral impact as investors balance manufacturing outlook with trade uncertainties.

Energy (-0.00 pp) – Slightly negative contribution, impacted by ongoing caution around global economic growth and fluctuating oil prices.

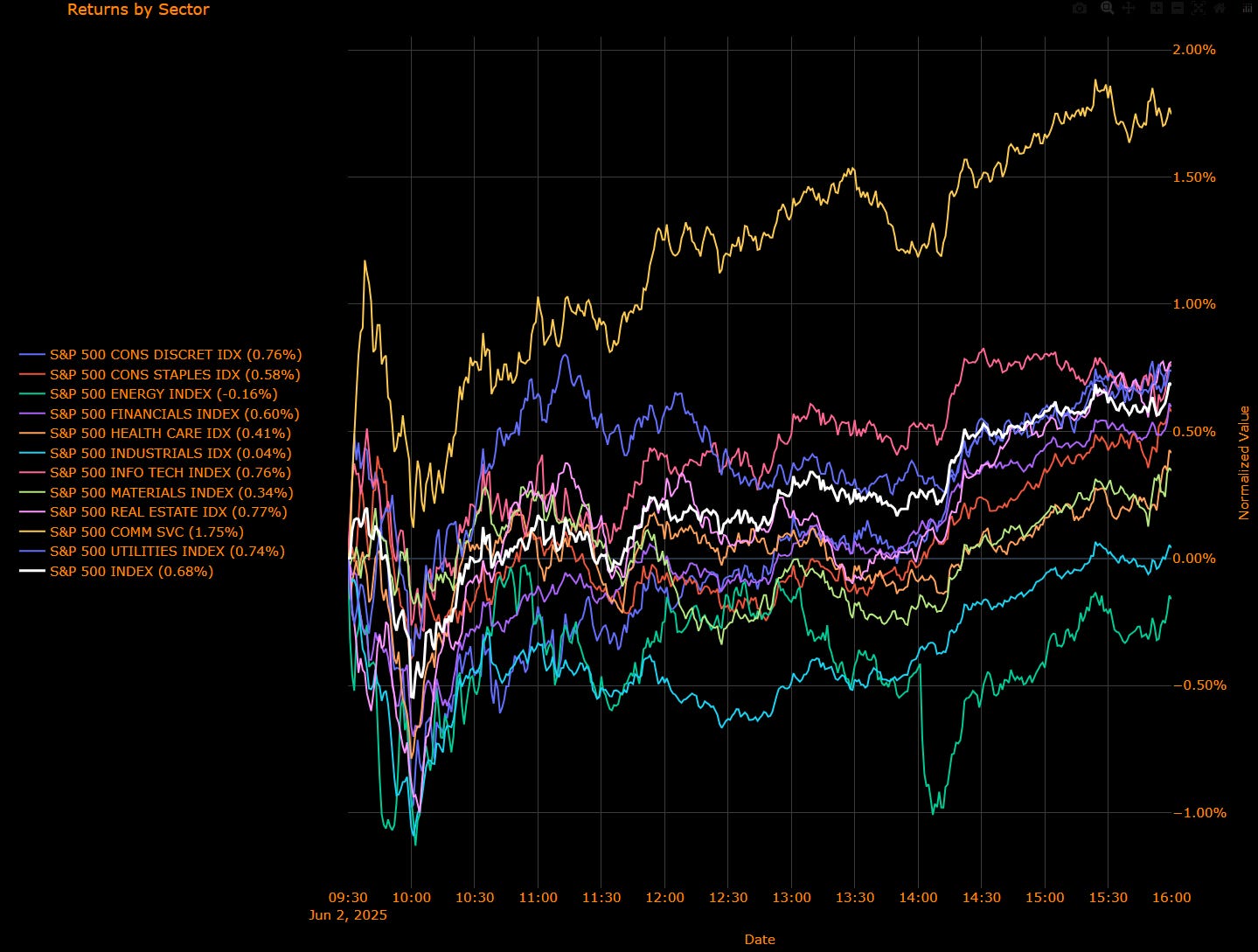

Sector-by-Sector Performance Snapshot (Unweighted Returns)

Communication Services (+1.75%) – Top-performing sector with significant investor optimism driven by stable earnings outlook.

Real Estate (+0.77%) – Strong performance reflecting continued investor demand for yield amid steady rate expectations.

Information Technology (+0.76%) – Outperformed significantly, supported by renewed optimism in semiconductor and tech stocks.

Consumer Discretionary (+0.76%) – Positive returns as consumer confidence and trade-related sentiment improved.

Utilities (+0.74%) – Solid gains reflecting continued investor demand for defensive, dividend-paying stocks.

Consumer Staples (+0.58%) – Gains demonstrating consistent defensive positioning among investors.

Financials (+0.60%) – Positive sector returns supported by yield stability and banking sector optimism.

Materials (+0.34%) – Modest gains reflecting stable commodity pricing and balanced investor sentiment.

Health Care (+0.41%) – Steady performance reflecting stable sector fundamentals and investor defensive preference.

Industrials (+0.04%) – Slight positive return amid cautious optimism regarding trade negotiations and manufacturing resilience.

Energy (-0.16%) – Lagging sector, reflecting ongoing investor concerns related to global economic outlook and volatility in energy markets.

Macro Overlay

The S&P 500 closed up +0.68%, driven primarily by gains in Communication Services and Information Technology sectors, supported by positive sentiment around trade dialogue expectations between Trump and Xi, as well as specific bullish momentum in chipmakers and tech companies. Energy lagged amid continued caution regarding global growth and mixed oil market signals. Market sentiment remains sensitive to evolving trade discussions, particularly US-China negotiations, as well as Federal Reserve guidance suggesting patience amid balanced economic risks.

Bottom Line

The S&P 500 advanced notably by +0.68%, led higher by Communication Services and Information Technology. Energy remained the weak spot. Investors should remain prepared for volatility influenced by trade headlines, central bank commentary, and economic data releases.

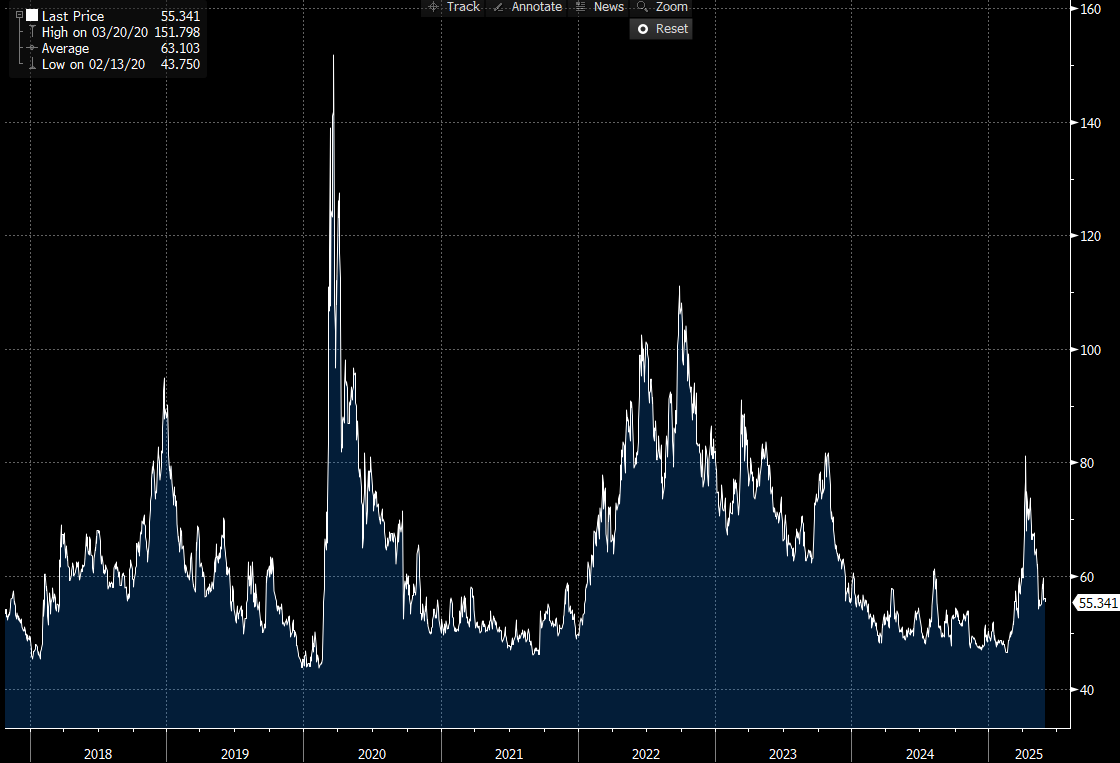

US IG Credit Wrap — Spreads Narrow to 55.3 bp as Trade Optimism Partially Offsets Macro Caution

Current Spread: 55.3 bp (▼ ~0.9 bp d/d), signaling modest tightening. Spreads remain notably below the 5-year historical average (~63.1 bp), indicating continued market stability tempered by cautious optimism.

Credit Context

< 60 bp: Stable, duration-friendly range supporting insurance and liability-driven investment (LDI) strategies.

60–70 bp: Neutral-to-cautious positioning recommended amid tariff uncertainties and macroeconomic volatility.

> 90 bp: Significant market distress—currently unlikely without a major escalation in geopolitical or macroeconomic shocks.

Macro Overlay

Today's slight tightening in IG credit spreads to 55.3 bp reflects cautiously improved investor sentiment stemming from anticipated trade discussions between President Trump and President Xi Jinping. Positive market reaction to the potential easing of U.S.-China tariff tensions partially offset ongoing macroeconomic concerns, such as uncertainty surrounding inflation dynamics, soft consumer spending trends, and subdued import growth figures. Treasury yields edged higher amid stabilizing sentiment, yet the broader economic environment continues to prompt cautious positioning given unresolved trade issues and regulatory uncertainties.

Credit markets currently exhibit resilience, balancing cautious optimism around trade developments with heightened vigilance toward macroeconomic signals and potential policy shifts by the Federal Reserve.

Bottom Line

IG credit spreads tightened modestly to 55.3 bp, demonstrating a cautiously optimistic market tone buoyed by improved trade sentiment.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.