Macro Regime Tracker: The Yen

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Last night’s comment on carry trade risk:

Tonight’s equity view as the Nikkei is down in the Asia session:

I will be sending out a positioning report to paid subscribers tonight with my views on the current set up we are seeing. You can see the recent videos I recorded here on the big picture macro regime:

As always, all the systematic strategies and models are laid out below. Thanks

Main Developments In Macro

US Macro & Policy

CHICAGO FED PRESIDENT GOOLSBEE SAYS IN INTERVIEW WITH SEMAFOR

HOUSE SPEAKER MIKE JOHNSON TALKS TO REPORTERS ABOUT SHUTDOWN

JOHNSON: IF THE SENATE PASSES SOMETHING, HOUSE WILL COME BACK

SENATE MAJORITY LEADER JOHN THUNE SPEAKS TO REPORTERS

THUNE: HAVING CONVERSATION ON NEW STOPGAP FUNDING DEADLINE

CHAVEZ-DEREMER: SHUTDOWN IS IMPACTING THE LABOR FORCE

CHAVEZ-DEREMER: UNABLE TO RELEASE OTHER DATA POINTS UNTIL THEN

CHAVEZ-DEREMER: WILL RELEASE BLS REPORTS WHEN GOVERNMENT OPENS

US LABOR SECRETARY LORI CHAVEZ-DEREMER SPEAKS TO REPORTERS

TRUMP: GOP WILL GET EVERYTHING APPROVED WITHOUT THE FILIBUSTER

TRUMP: SNAP BENEFITS WILL BE GIVEN ONCE GOVERNMENT REOPENS

Central Banks & Monetary Policy

BULLOCK: CAN RESPOND IN EITHER DIRECTION ON POLICY IF NEEDED

BULLOCK: THINK PRETTY CLOSE TO NEUTRAL, DON’T HAVE A BIAS

BULLOCK: DIDN’T CONSIDER RATE HIKE TODAY

BULLOCK: POSSIBLE NO MORE RATE CUTS, OR MIGHT BE SOME MORE

BULLOCK: RBA BOARD DIDN’T CONSIDER CUTTING RATES AT MEETING

BULLOCK: JOB MKT STILL A LITTLE BIT TIGHT VS FULL EMPLOYMENT

BULLOCK: RBA BOARD IS ALERT TO DOWNSIDE RISKS FROM EMPLOYMENT

RESERVE BANK OF AUSTRALIA GOVERNOR BULLOCK SPEAKS TO REPORTERS

BOWMAN: BASEL IS A PRIORITY BUT CAN’T LOOK AT CAPITAL IN VACUUM

SNB’S SCHLEGEL: INFLATION SHOULD RISE SLIGHTLY IN NEXT QUARTERS

SNB‘S TSCHUDIN: FX INTERVENTIONS ARE POSSIBLE

SNB’S TSCHUDIN: INFLATION FORECAST IS ‘WHERE WE WANT IT’

SNB‘S TSCHUDIN: CURRENTLY NO NEED FOR NEGATIVE RATES

ECB’S PATSALIDES: EUROPEAN ECONOMY IS SHOWING RESILIENCE

REHN: CRUCIAL TO MAINTAIN FULL FLEXIBILITY IN DECISION-MAKING

RBNZ: FINANCIAL STABILITY RISKS REMAIN HEIGHTENED

RBNZ: FIRMS EXPOSED TO DISCRETIONARY SPENDING ARE CHALLENGED

RBNZ: FRAGMENTATION OF GLOBAL TRADE AND FINANCE POSES RISK

RBNZ: BANKS REMAIN WELL PLACED TO MANAGE CURRENT UNCERTAINTY

RBNZ PUBLISHES SEMI-ANNUAL FINANCIAL STABILITY REPORT

PBOC RESUMED GOVERNMENT BOND TRADING IN MARKET IN OCT.

Fiscal & Political Developments (Global Relevance)

CANADA PROJECTS C$78.3B DEFICIT THIS YEAR; PREV EST. C$42.2B

CANADA SAID TO PREPARE C$50B INFRASTRUCTURE FUND IN BUDGET

REEVES: SEEKING FISCAL HEADROOM TO WITHSTAND GLOBAL TURBULENCE

REEVES: SEEK DECISIONS TO BUILD MORE RESILIENT PUBLIC FINANCES

REEVES: FOCUS ON GETTING DEBT DOWN IS A PRIORITY OF BUGET

REEVES: MY COMMITMENT TO UK FISCAL RULES IS `IRON-CLAD’

REEVES: BUDGET DECISIONS WILL BE FOCUSED ON LOWERING INFLATION

REEVES: CLEAR UK PRODUCTIVITY IS WEAKER THAN THOUGHT BEFORE

REEVES DECLINES TO REITERATE ELECTION PROMISES ON TAX

STARMER TELLS CABINET UK WON’T TAKE RISKS WITH MORE BORROWING

FRANCE SEPT. BUDGET DEFICIT EUR155.40B

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data,

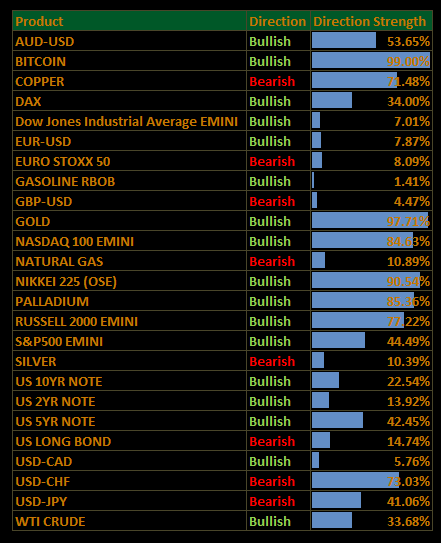

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

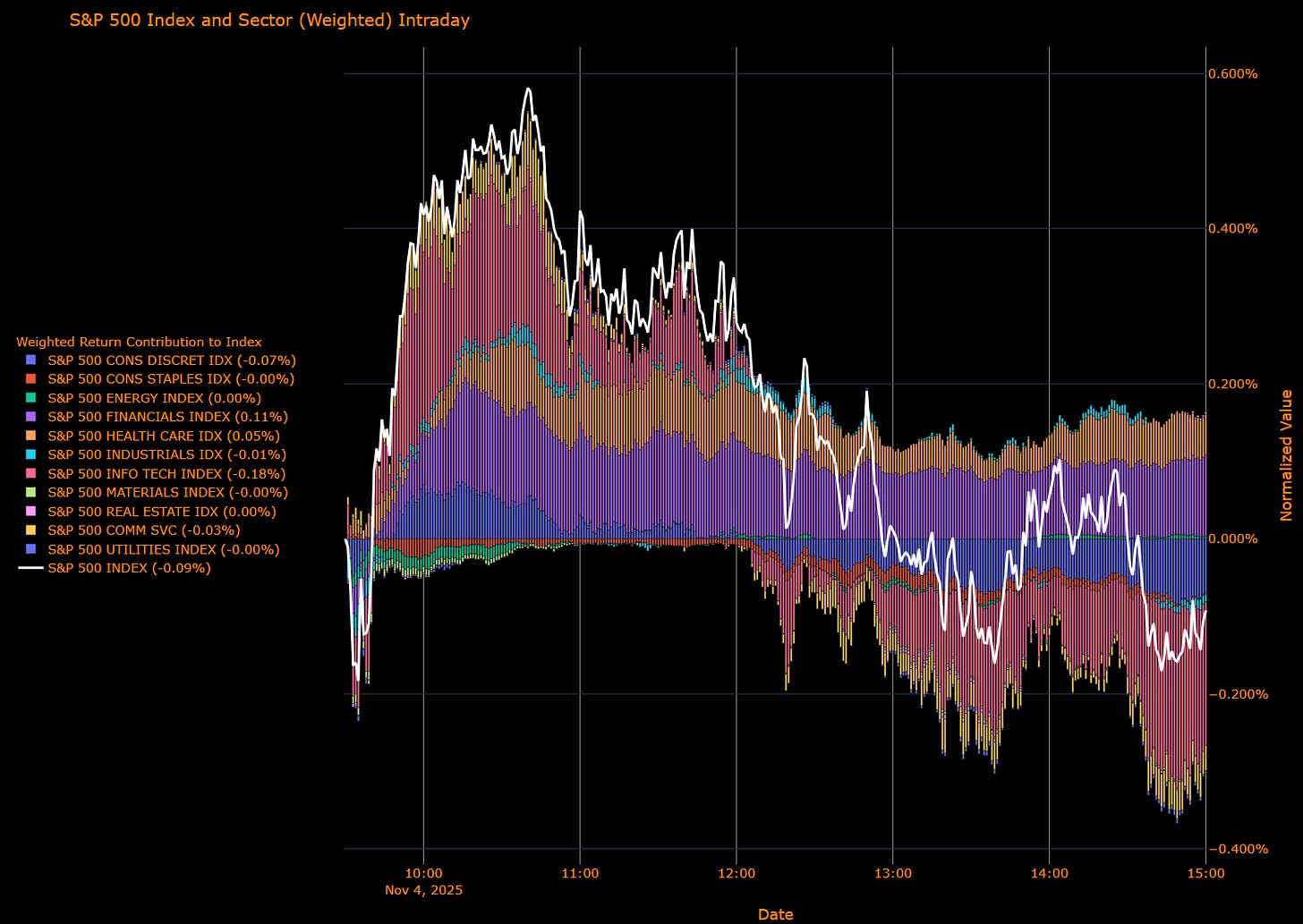

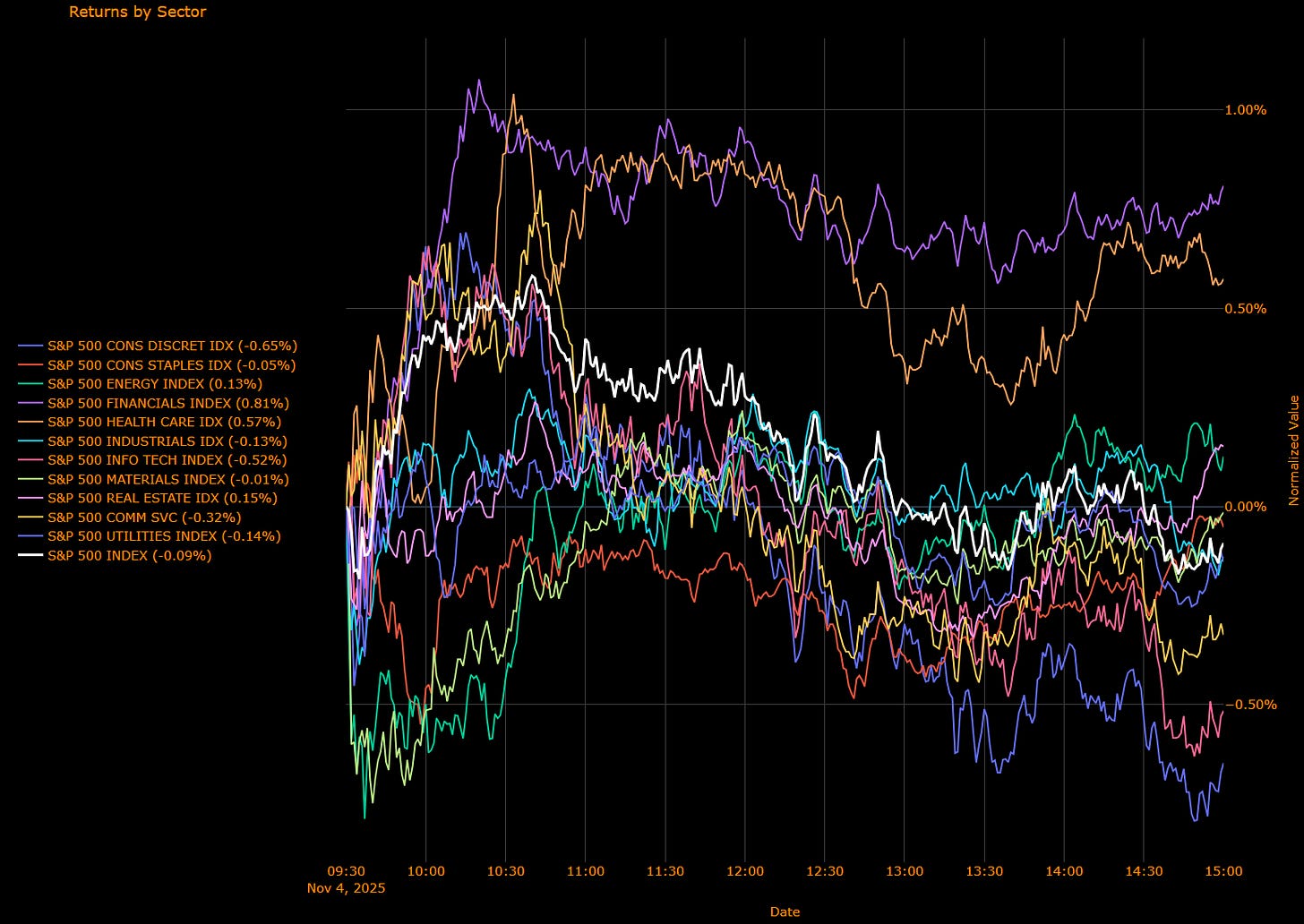

US Market Wrap: Early Pop, Late Fade; S&P −0.09%, Tech/Disc Drag, Financials/Health Care Cushions

A choppy session: a strong open gave way to a midday roll-over as mega-cap beta sagged and the dollar stayed firm. Today, felt like orderly de-risking rather than stress, banks and defensives did the heavy lifting while AI leaders cooled on valuation/guidance fatigue.

Sector Attribution

Weighted return contribution (Index −0.09 pp)

Drags: Info Tech −0.18 pp, Comm Svcs −0.03 pp, Cons Disc −0.07 pp, Industrials −0.01 pp

Offsets: Financials +0.11 pp, Health Care +0.05 pp (Energy/RE/Staples ≈ flat)

Unweighted performance (breadth)

Leaders: Financials +0.81%, Health Care +0.57%, Real Estate +0.15%, Energy +0.13%

Laggards: Cons Disc −0.65%, Info Tech −0.52%, Comm Svcs −0.32%, Utilities −0.14%, Industrials −0.13%, Staples −0.05%, Materials −0.01%

Intraday pattern: early surge, steady bleed into the close—classic “sell the strength” day with Tech/Disc fading and Financials/HC absorbing.

Macro Overlay

Policy/Rates: Long end steady-to-softer (10y ~4.09% on the day), consistent with “slower-not-faster” easing path; rate vol contained.

FX/Crypto: USD firm; crypto heavy, risk appetite thinner at the margin.

Earnings/AI: Guidance resets in AI hardware keep leadership fragile (post-print digestion; expectations still lofty).

Positioning/Flows: Street tone leans “healthy pullback/consolidation” after a powerful six-month run; CTAs skew to small net sellers near-term, which can amplify intraday fades.

Housing check: NAR shows first-time buyer median age at 40, affordability shock implies slower household formation churn, a modest headwind to rate-sensitive cyclicals even with mortgage rates off the highs.

The Read-Through

Leadership fragility: When Tech pauses, the index wobbles; today’s dip was primarily a mega-cap story.

No funding stress: Green Financials + firmer REITs argue this is rotation/de-risking, not a credit event.

Narrow tape, negative skew: Rich multiples + concentrated leadership keep pullback risk elevated until breadth repairs.

What I’m Watching

Fed speak / data void dynamics: Any hint that “skip-and-see” extends; watch reals and the front-end path.

USD & reals: Strong dollar + higher real yields would keep pressure on long-duration growth.

AI capex vs. monetization: Can guidance (AMD/SMCI et al.) sustain expectations without multiple compression?

Breadth repair: Do Financials/HC/Energy leadership broaden into Industrials/Materials, or does weakness rotate back into small caps?

Housing affordability: Turnover and pricing elasticity as a drag, or relief into Q4/Q1.

The setup remains Goldilocks-tilted but narrow. With policy gliding and rate vol subdued, the base case is range-bound churn. Until Tech’s grip loosens and breadth improves, the tape carries a tactical downside skew on any valuation/guidance wobble, though underlying liquidity and credit keep the medium-term bull case intact on dips.

Spreads Drift Wider but Still Calm; Carry Intact (IG OAS ≈53.8 bp)

US IG credit widened modestly alongside a risk-off equity tone and firm dollar, but the move was orderly. The Bloomberg US IG OAS prints ~53.8 bp (from ~52.1 bp yesterday), still inside the lower half of its 5-year range and far from stress. The message remains “carry first, volatility later” so long as rates vol stays contained and primary markets clear.

Where We Sit (from today’s chart)

IG OAS: ~53.8 bp (last 53.834)

5-yr average: ~61.9 bp → ~8 bp inside

Cycle tights: ~46.1 bp → ~7–8 bp above

2022 wides: ~111.2 bp → ~57 bp tighter

We’re near the top end of the 50–55 bp equilibrium band, but still comfortably tighter than the 5-yr mean and miles from the 2022 stress wides.

Macro & Tape Overlay

Equities: CEOs’ “brace for pullback” chorus hit mega-cap beta; breadth soft. Credit yawned, typical for a valuation-led equity wobble without funding stress.

Policy/Rates: 10y ~4.09%, path = slower-not-faster easing; that’s neutral-to-supportive for IG while rate vol is subdued.

FX/Crypto: USD bid, crypto heavy → risk appetite thinner at the margin, but no spillover to spreads yet.

Housing: NAR shows first-time buyer median age at 40 (affordability shock). Macro read-through is slower turnover, not an immediate IG negative given strong balance sheets and steady employment.

Mapping to IG Credit

Fair-value band: 50–55 bp still looks like “carry equilibrium.” At ~53.8, we’re near the top of that range.

Path to re-test the 40s: Needs either a clean disinflation + softer labor mix that pulls cuts forward or another leg lower in rate vol.

What pushes us 55–60+: A sharper equity drawdown that dents primary demand, a disorderly USD spike, or hawkish surprises that re-price the front end higher and lift rate vol.

Risk Markers to Watch

Primary market tone: order multiples/concessions, first place slippage shows up.

Rates vol (MOVE) vs reals: a reals-led back-up with rising vol would matter more than small yield shifts.

Breadth & credit beta: if narrow equity weakness broadens to cyclicals/credit proxies, expect OAS to test ~55–58.

Bottom Line

Today’s +~1.7 bp drift reflects equity valuation nerves, not funding stress. Carry remains king with IG anchored inside 50–55 bp; dips toward ~55–58 look buyable absent a material shift in the Fed path or a broad risk-off that challenges primary market clearing.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.