Macro Report/Insights: Geopolitical Volatility Is BACK!

How does geopolitical risk premia work?

Hey everyone,

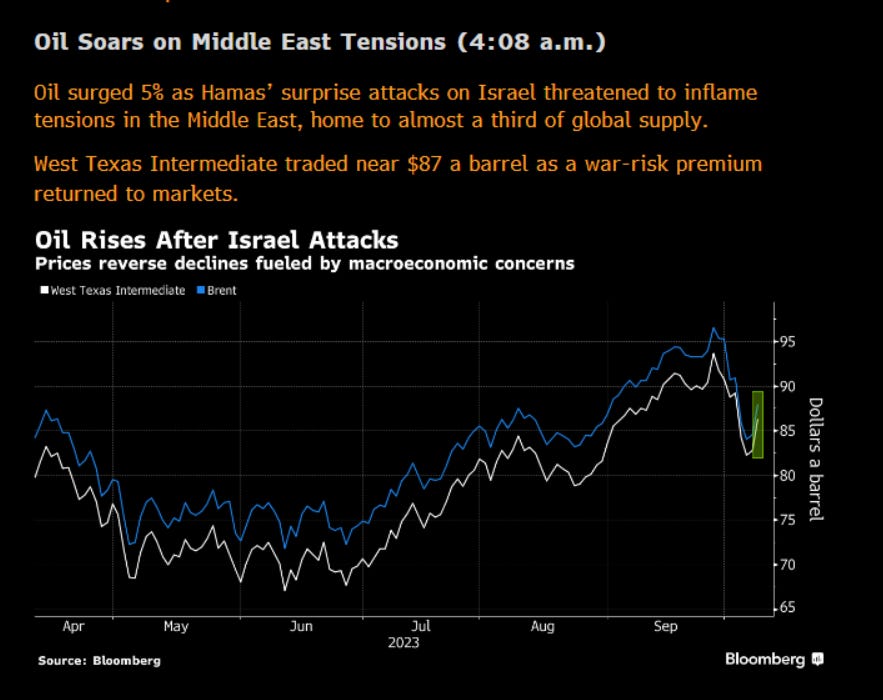

Just when the geopolitical risk premia had been squeezed out of markets, it came back:

In this article, we are going to use the events as an opportunity to dig deeper into geopolitics and connect them to current markets. Here are the things we will cover:

Structure:

The inherent connection between geopolitics and financial markets

The regime we are in with unipolarity vs multipolarity

The attack on Isreal and its impact on financial markets

What is the risk-reward of assets moving into this week?

The inherent connection between geopolitics and financial markets:

There is a fundamental connection between geopolitics and markets but over the past 40 years, US hegemony has basically decreased the impact. This has been the story for the entire world.

Globalization + US hegemony = we all make money and are very happy

Well, this narrative is being shocked. However, we need to be incredibly surgical when examining these ideas. The implication isn’t that US hegemony is over or that global shipping is toast. The world is a very complicated and interconnected place. Once something is out of place, capital immediately flows to where the new investment takes place.

For example, we saw an unprecedented rise in manufacturing spending while the FED was hiking interest rates! Why? Because there is clearly a demand for manufacturing.

If the risk of depending on China is too high, companies will pivot because if they don’t, their bottom line gets hit right away. Remember during COVID when stores didn’t change their prices but simply said they were out of x product? Well they don’t want to be caught with their pants down again.

Here is the deal, it’s always going to be difficult to truly gauge how robust a complex system like the global economy is. But we just went through an entire lockdown and reopening, plus an unprecedented speed of rate hikes and life is moving along just fine.

Now could it all fall apart tomorrow? Yeah maybe. Could this just be the biggest time lag before the worst recession in history? Yeah maybe. Or maybe not. What I know for sure is that I need to keep an open mind and adaptive focus as opposed to zeroing in on a specific outcome.

Big Picture:

When we take a step back though, the role of geopolitics is likely going to increase in the future which means more opportunities for active management. Passive management already has enough headwinds it's facing.

I truly believe this will be the golden age of active management. Those who can interpret the information correctly will benefit the most.

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

The regime we are in with unipolarity vs multipolarity:

Now let’s get a little more specific about the regime we are in:

Unipolarity in the geopolitical spectrum refers to a global structure where one state exercises most of the cultural, economic, and military influence. This condition is epitomized by the post-Cold War era, where the United States emerged as the predominant superpower, navigating the international system predominantly according to its own interests and values. In a unipolar world, the dominant power often sets the global agenda, establishes the norms, and has a significant influence over international institutions and global governance. This system, while stable due to a clear hierarchy, can generate resentment and opposition from other states, and potentially foster efforts to balance against or bypass the dominant power.

Contrastingly, multipolarity describes a global system in which multiple states possess significant power and influence, thereby establishing a more distributed power structure. In contemporary geopolitics, the rise of China, India, and the resurgence of Russia signal a transition towards a multipolar world. In such a system, no single power dominates, and various powers have the ability to influence international events, norms, and rules in a significant way. This distribution can lead to a more complex and dynamic international system, with various powers engaging in alliances, rivalries, and cooperation, creating a nuanced and potentially more unstable global environment due to the diffusion of power and competing interests.

Side note on the narrative surrounding this:

It was really interesting, the other day I was chatting with

about sentiment and narratives. You know how people say, “You should always fade sentiment or consensus opinions”? Well, something I realized is that people have been doing this all wrong. You need to “fade” differently depending on the TYPE of person you are reading.For example, Fintwit almost exclusively talks about tails in the distribution. They are perma bears or perma bulls selling their narratives by appealing to extreme fear or greed. There is always a GFC 2.0 or credit event around the corner on Twitter. Eventually, we will have a tail and they will say, “Look! See! I told you!.”

Inversely, you have investment bank research that can’t take extreme views or else they will be fired. They always take incredibly well-thought-out balanced views. They might not make a trade like Michael Burry during a recession but they will manage their risk incrementally.

Just think about these two TYPES of narratives. One is drawing attention to tails (perma bulls/bears on social media) and the other (investment banks) is drawing attention to the median part of the distribution.

How does this connect with geopolitics? Well, everyone on social media continues to talk about how the dollar is losing its reserve status and how the United States is losing its status as THE global power.

In my opinion, I think people are focusing on the wrong thing. The danger in geopolitics and society isn’t external, it’s internal. Just think about how many people have “migrated” from other countries into Europe and the United States. How many of them do you think are sleeper cells or terrorists? I am willing to bet at least a few given the volume of people we have seen come in.

Now regardless of your politics or views on migration, think about what will happen to markets when there is INTERNAL vs EXTERNAL conflict.

Internal conflict = bullish gun stocks. Look what happened to Smith and Wesson during the riots:

External conflict = bullish defense contractors. Look at Lockheed Martin during the Ukraine Invasion:

I actually touched on this dynamic last week before any news of war in Isreal occurred:

Brainstorms: FX, Bonds, BRICS, Geopolitics and S&P500 Earnings

We are going to cover several broad ideas in this article so try to keep up: First, let me be clear on my view of growth. I do not believe we will see a negative GDP print in Q4 of this year. Why? The largest line item of GDP (consumption) remains squarely positive on a YoY basis.

Side note: even if you aren’t actively trading markets, you might want to be watching these types of stocks as a signal because they will provide you with a clearer picture than the media.

The attack on Isreal and its impact on financial markets:

Now let’s get to this specific geopolitical event.

First, let me say, that I am no expert on what is happening in Israel or what will transpire. I do understand how markets work though and I will explain how I am thinking about this event.

Fundamentally, I think about any exogenous shock like this as an impulse that makes its way through markets. The question is, how big is the impulse and how much exposure does the entire system have to it?

The primary moves we have seen in response to the Isreal news are in oil and gold:

GC:

This is currently having a small impact on markets. Just think about it in comparison to the Ukraine Invasion. Thus far, very small.

I will be watching the Israeli Shekel against the dollar and euro here because if this impulse begins to fade, oil and gold could move back down in a hurry. The inverse could be true as well:

Remember how the EURRUB pair was leading oil during the Ukraine invasion? I would be watching for similar signals here:

If you need an educational explanation of FX within this context, please reference the 5 Part FX primer I wrote:

The Research HUB: FX Primer, Pt 5

Hey everyone, This is Part 5 of the FX Primer! 5-Part FX Primer Breakdown: Part 1: FX - Resources, The Big Picture, Variables, Aggregating Knowledge, and Essential Tools. Part 2: FX - Synthesizing Information from Part 1: Theory, Practice, Causal Mechanics vs. Regression Analysis.

Personally, I don’t think the impulse of this will carry into risk assets but I am cautious because if any major countries jump into the fight, this could get a lot bigger really fast.

I really liked Peter Zeihan’s video on this, especially in his points on how it could connect with Ukraine and Saudi Arabia:

What is the risk-reward of assets moving into this week?

With all of that context, let’s talk about this week!

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.