Macro Views on Equities and Rates

You know how to fight six men, we can teach you to engage six hundred

You know how to fight six men, we can teach you to engage six hundred

-Batman The Movie

The skillful fighter puts himself into a position which makes defeat impossible, and does not miss the moment for defeating the enemy.

-The Art Of War

Big Picture:

We are finishing the trading week with CPI behind us and uncertainty ahead of us. Let me explain a very simple concept to you for how rates move through various catalysts: Path dependency causes agents to move variables to an extreme.

What does this mean? Think about how you can have two companies that are selling the same product in a market. They are directly competing against each other and trying to use all their resources to survive. As a result of the competition, if one company begins to take out debt to gain market share, the other company will be constrained to take out debt as well in order to remain competitive. This might be fine for a while but you begin to inject additional fragility into the system. On the upside, they take out a ton of debt in order to remain competitive, and then on the downside they lay off people in order to survive. This example illustrates that agents constrain each other to move variables to extremes in order to survive. Their goal isn’t efficiency, it’s survival.

It is these types of constraints that exist in the economy and financial market. The implication behind this is that due to the path dependency and constraints agents face, they will move things to extremes as opposed to constantly keeping things around a theoretical equilibrium.

Here is a tangible example: https://www.mikedp.com/articles/2021/11/3/zillow-exits-ibuying-five-key-takeaways . The problem we typically see is that the media and Twitter only focus on bearish examples in retrospect.

It works both ways! And it is much easier to identify it on the upside than trade it to the downside.

This same dynamic exists in the interest rate space and it is clear that market participants don’t understand this. Typically, strategists will extrapolate current trends or recent data prints instead of focusing on the unseen. See my previous articles on this idea (link and link). The goal is to identify the fragility of an idea or position as it relates to volatility.

Understanding these dynamics and connecting them to HOW people operate with seen and unseen variables is THE WAY to have an edge in markets and life.

In the department of economy, an act, a habit, an institution, a law, gives birth not only to an effect, but to a series of effects. Of these effects, the first only is immediate; it manifests itself simultaneously with its cause — it is seen. The others unfold in succession — they are not seen: it is well for us if they are foreseen. Between a good and a bad economist this constitutes the whole difference — the one takes account of the visible effect; the other takes account both of the effects which are seen and also of those which it is necessary to foresee. Now this difference is enormous, for it almost always happens that when the immediate consequence is favorable, the ultimate consequences are fatal, and the converse. Hence it follows that the bad economist pursues a small present good, which will be followed by a great evil to come, while the true economist pursues a great good to come, at the risk of a small present evil.

Market Views:

This brings us to where we are now. I have already written primers on every major asset (link). I will be expanding on this and going even deeper into how to analyze and operate through the macrocycle, especially as it relates to interest rates.

I have already laid out the macro views in the following articles:

Let’s expand and summarize these a little:

First, with core CPI showing a deceleration, this pushed traders to put up risk across all assets. However, this was primarily driven by goods.

As

has said over and over, once we get signs of inflation decelerating, software is going to melt up. IGV 0.00%↑ made a huge move up this week.Initial claims remain suppressed. Let me just say, that no one cares until claims move above 250k.

People are saying that housing is falling apart. The data points they are using are diffusion indices from the ISM. When you are modeling economic data, you map the outright data in its contribution to overall GDP and then show the diffusion of it. Try backtesting a diffusion index, there is a reason it is more noisy and produces more false signals.

On top of this, the GDP-nowcast is showing an acceleration in REAL GROWTH for all major line items:

Industrial production did come out today just below expectations this week and is marginally negative on a YoY basis. This happens a lot through cycles and there is an absence of evidence to make firm conclusions about further weakening in growth.

As I noted, we are operating between these levels on the short end. NFP and CPI caused ZT to move up to the top end of its range. We are unlikely to move BELOW the FOMC level.

As I noted in the macro report, we are in a period of time that has a lot of macro tensions. As a result, bonds are in a mean reversion regime on a cyclical basis.

Comprehensive Macro Report

Hello everyone, There have been a lot of new subscribers lately so let me just start by saying welcome. When I started this Substack, I intentionally wrote A TON of educational primers on every aspect of macro you could think of. I did this because your ability to think clearly about the world is your greatest asset in markets.

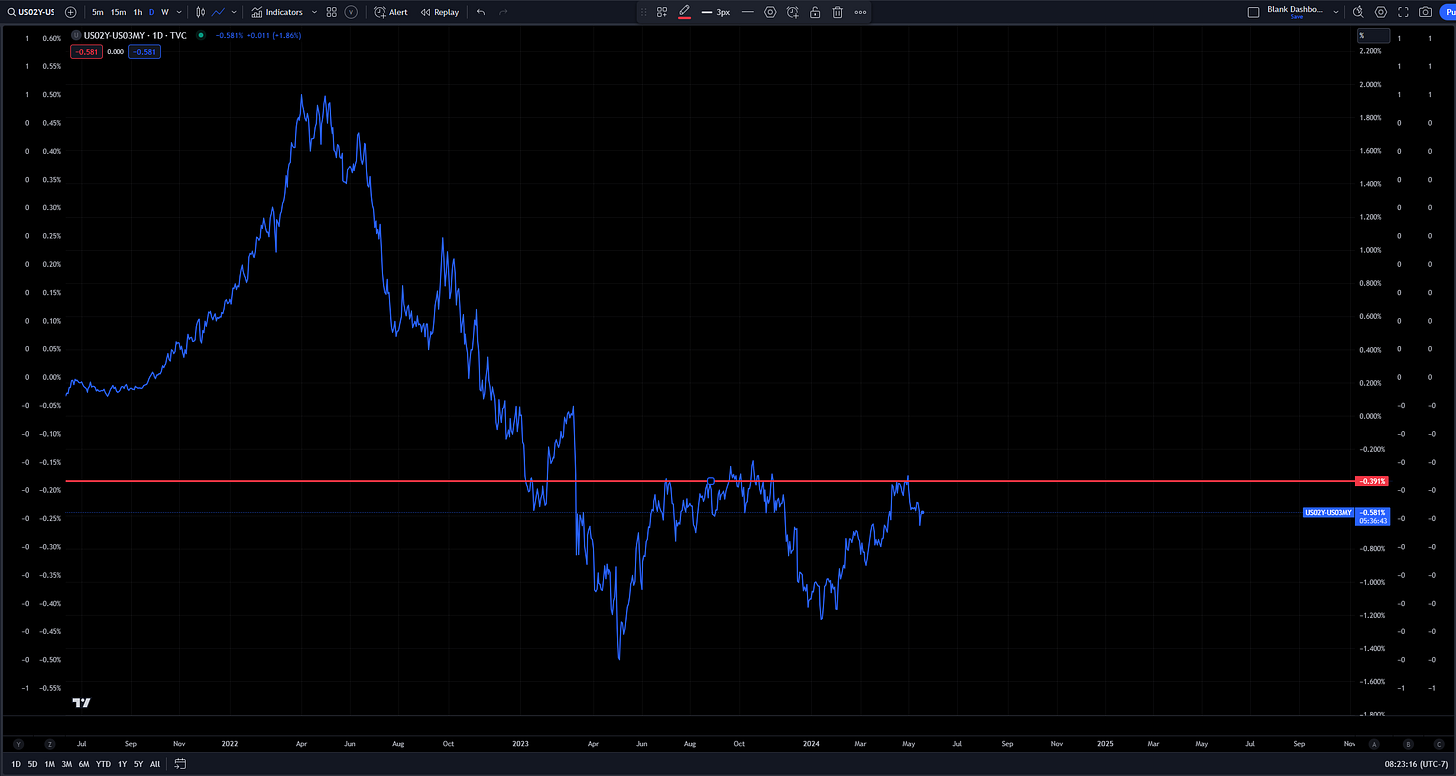

Notice how there is consistent difficulty in breaking ABOVE this level. The primary reason we have steepened is due to ZT selling off as opposed to the Fed cutting and pulling down 3m rates.

This is something I will go over more in the article over the weekend but you want to connect the levels I noted from the catalyst (FOMC, CPI, NFP) with the short end and long end. I am always watching how the curve is steepening or flattening across all durations. Notice how 2s10s are beginning to bottom marginally as we saw selling at the CPI level in ZT this week.

This is directly connected with the move we have seen in equities over the past two days:

While we are ending the CPI week with ATHs in ES and the VIX at 12, this is going to set the stage for the next macro move.

Several notes for paid subscribers on the specific trades I have shared in connection with the insights from above:

Trades:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.