Real Estate Report: Homebuilders, REITs and Singlefamily Homes

Are delinquencies about to rise for real estate?

One of the most important parts of the economy and financial markets is real estate because it impacts all of us. Whether you are a homeowner, renter, or investor, your wallet is directly influenced by the macroeconomic forces driving real estate.

It is for this reason I have written a real estate report for you. No one can predict the future but I can assure you that after reading this report, you will have more clarity on how the real estate sector is functioning in the current environment.

If feel like this macro report helps you, could you do me the favor of sending it to someone who would benefit from it?

As always feel free to reach out if you have any questions. Enjoy!

Real Estate Report:

Summary: As we progress through the economic cycle, real estate continues to have unique tensions due to the change in consumption patterns since COVID-19, the stance of monetary policy, supply and demand imbalances, and the level of nominal activity. This report will break down the drivers and tensions in real estate to correctly define the risk-reward of homebuilders, REITs, and broad real estate prices.

Big Picture:

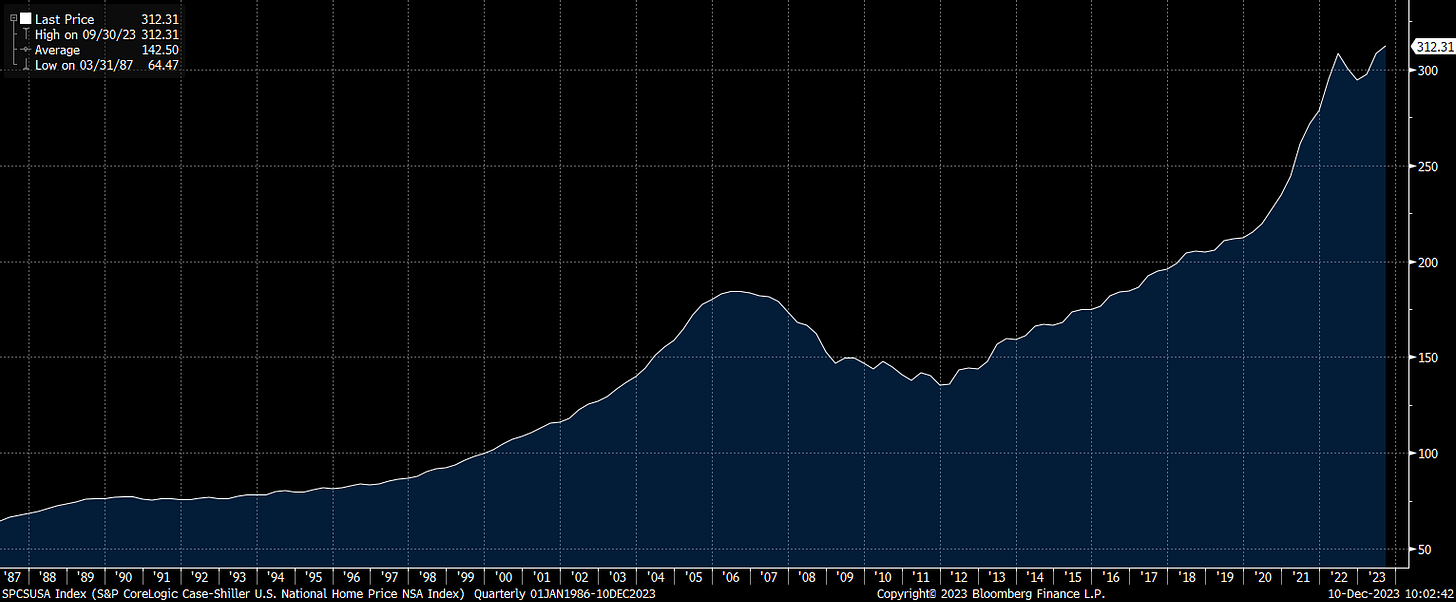

We continue to be at a point in the economic cycle where nominal growth is showing resilience as the FED is holding rates at an elevated level. YoY home prices decelerated as the FED hiked interest rates. However, due to the discontinuity with 2008 (this will be expanded upon below), YoY home prices are accelerating as the FED holds rates at an elevated level.

When we remove the YoY calculation, prices are making new highs on an outright basis.

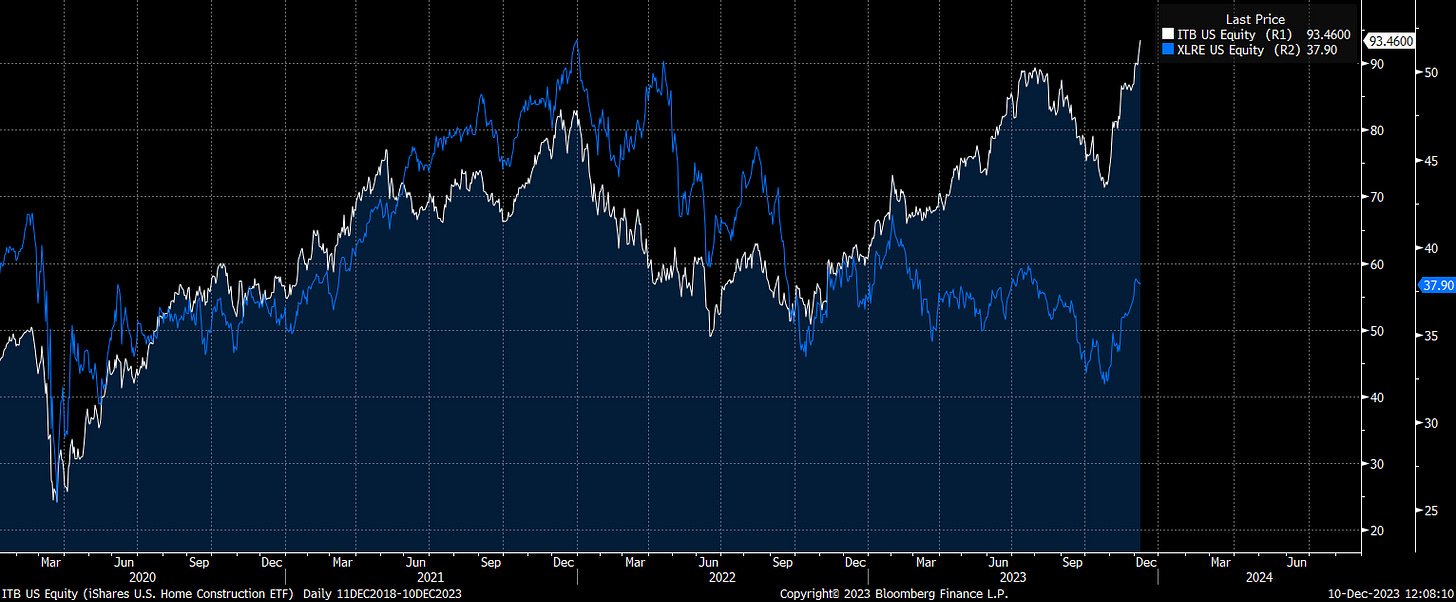

This dynamic with prices doesn’t necessarily indicate everything in the real estate market is operating at maximum efficiency with low risk. On the contrary, we are seeing one of the largest spreads between homebuilders and REITs that we have ever seen in history. This spread indicates the TYPE of risk and TYPE of macro regime we are in.

This dynamic can be further understood by breaking down the components of supply and demand.

Supply:

When we analyze the supply chain in the real estate market, there are several observations to note. First, building permits reached a cyclical high at the beginning of 2022 and have decelerated marginally from the high. Since the beginning of 2023, building permits have been accelerating marginally.

The next step in the supply chain is housing starts which also made a high at the same time as permits but has been flat since the beginning of 2023.

Housing completions decelerated marginally in 2023 but remain elevated:

As the building of new homes is completed, they enter the stock of inventories to be sold. The stock of inventories is made up of new homes and existing homes. The stock of EXISTING home inventory remains incredibly low on a cyclical basis.

Existing home sales remain incredibly low:

When we look at the supply of NEW homes, it remains at an elevated level:

Sales of new homes connect with this because they have fallen from their 2022 peak:

The main tension that exists on the supply side: existing homes are not entering the market to be sold. This is likely due to the low-interest rates that buyers locked in their financing at. However, new homes are entering the market and increasing supply. The supply of new homes is reasonable, especially when compared to the new home supply in 2008 but it is not enough to decrease prices, even when unaffordability is at such extreme levels. This brings us to the demand side of the equation.

Demand:

The demand side of the equation has two primary inputs: Credit and income.

Interest payments have risen considerably as the FED hiked interest rates. This caused an initial wave of unaffordability:

However, the mortgage-to-income ratio has actually decelerated from its high.

This is likely due to the rise in real wages and elevated nominal GDP.

Here are real wages (notice the most recent acceleration):

Nominal GDP QoQ:

Prices:

It is important to note that the Case Shiller Index made new highs as both unaffordability increased and the supply of new homes was putting downward pressure on prices.

This illustrates the TYPE of macro regime we are in which is inflationary. This has significant discontinuity from 2008 when mortgage origination credit scores were lower quality and a significant stock of homes had adjustable rate mortgages.

To have a pronounced and persistent move down in home prices, we would need to see a significant deterioration in the labor market that would constrain homeowners to sell their existing homes.

Delinquencies remain incredibly low on a cyclical basis and 2nd mortgage defaults haven't even begun to lead the way as they did in 2008:

Additional Notes About This Cycle:

In addition to the tensions noted above, COVID-19 has considerably changed both consumption habits and investment. The migration trends and new work-from-home patterns have put pressure on homebuilders to increase their construction projects.

Furthermore, the difficulty we have seen with supply chains has pushed domestic manufacturing to onshore a reasonable amount of their production base. This is likely why construction spending for manufacturing has increased so much:

REITs:

This brings us back to the tension between the price action of homebuilders (ITB) and REITs (XLRE):

There are several reasons for this divergence that have implications for the broader economy:

First, REITs have significantly more exposure to duration risk than homebuilders. It is not surprising that REITs underperformed homebuilders during 2022 and 2023 as nominal activity remained elevated and interest rates moved up.

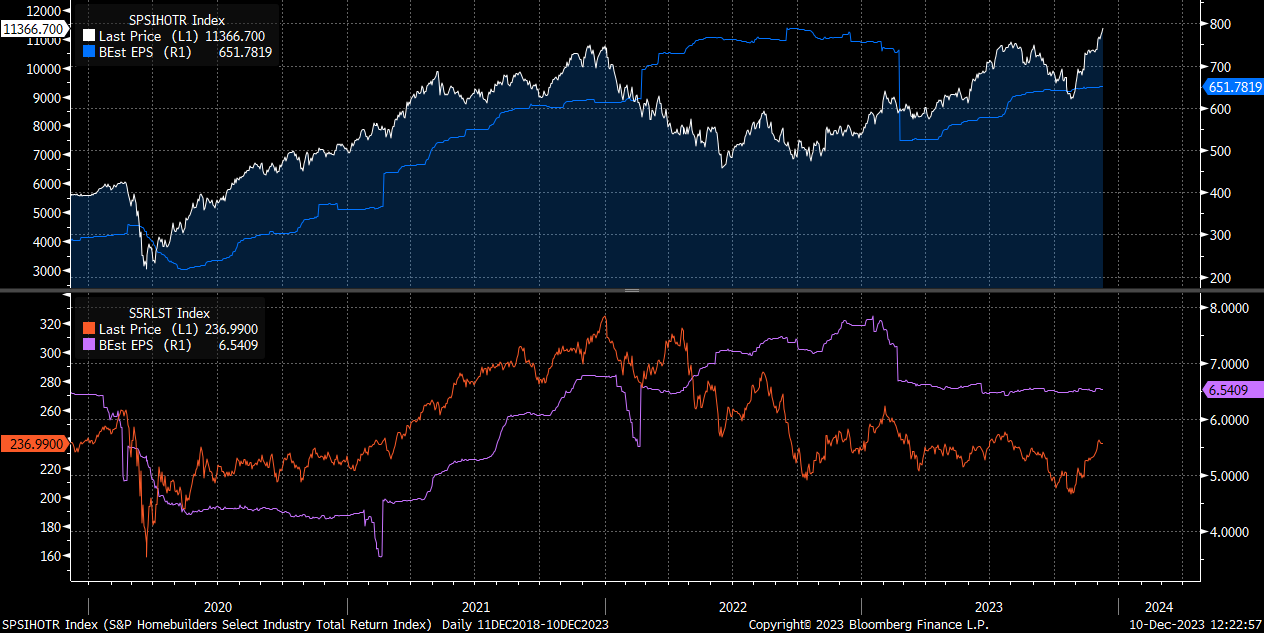

Second, REITs are being constrained to roll over large portions of debt that typically have shorter maturities than 15 or 30-year mortgages. This rolling over of debt puts pressure on earnings and increases credit risk. Here is a chart with the S&P REIT index (top panel with earnings expectation in blue) and homebuilders index (bottom panel with earnings expectations in purple). Notice the most recent upward move in earnings expectations for homebuilders while REIT earnings expectations remain flat. This occurred as homebuilders made ATH.

Third, the shift in consumption patterns from COVID-19 causes single-family homes to be a beneficiary AT THE EXPENSE of sectors in commercial real estate. Cap rates for office REITs have risen considerably.

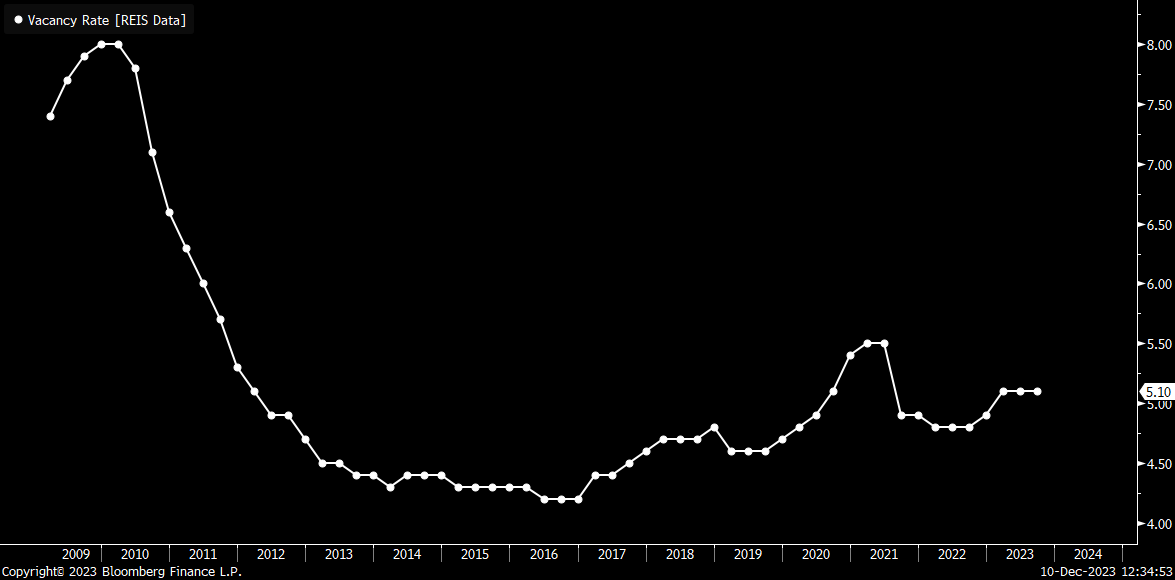

Vacancy rates for office REITs continue to rise:

Sales volume for office REITs is at lows:

And price per square foot is trending down:

However, residential REITs are not anywhere near as bad as office REITs. Cap rates for residential REITs have increased marginally but nowhere near as much as office buildings:

Vacancy for residential REITs remains low:

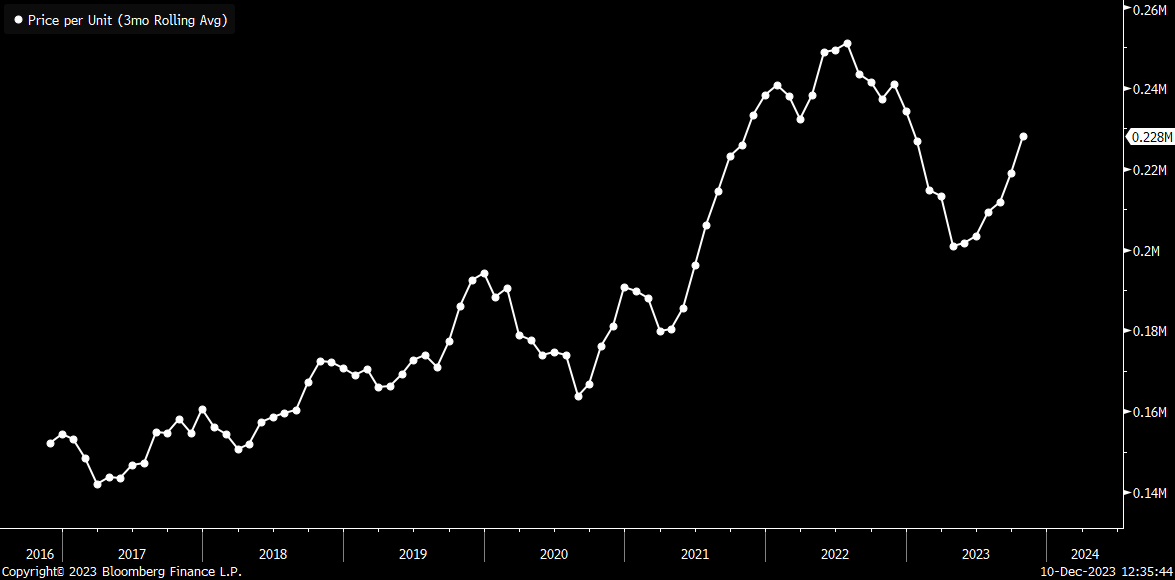

And the price per unit is accelerating now:

Retail REITs are similar to the situation in residential. Cap rates have risen marginally but not to an extreme:

Vacancy rates are predominantly unchanged from pre-COVID levels:

And the price per square feet is accelerating from the 2023 low:

As you can see, there are significant divergences taking place under the surface. The primary dynamic to note for real estate with where we are in the cycle is that inflation remains a larger impulse than credit risk and delinquencies.

Risk Reward and Asset Views:

Homebuilders:

Until we see a significant deterioration in the labor market and a pronounced rise in delinquencies, ITB is unlikely to return to the $55 level. Additionally, as long as nominal activity remains elevated in this environment of low adjustable rate mortgages, ITB is likely to continue to make bullish moves.

Single Family Homes:

Single-family home prices have bottomed on a YoY basis and there is unlikely to be widespread delinquencies similar to 2008. Prices can have momentary pullbacks as the supply of NEW houses comes online. However, the quality of FICO scores is functioning as a safety net against a pronounced move down in prices.

REITs:

REITs face significant headwinds from both the refinancing of debt and changes in consumption patterns. As the analysis above shows, significant divergences are occurring. There is likely to be some distress in specific REITs but the primary concern is duration risk. Continue to watch REITs correlation with bonds and the equity risk premium of various REITs to determine if the driver is duration risk or credit risk.

If you want further analysis on the macro regime and how it impacts each asset class, check out the macro report I recently wrote. It breaks down the tensions in the economy with even greater granularity:

Macro Report/Insights: Comprehensive Macro Report

Hey everyone, We are moving full force ahead with the new upgraded version of the Substack. If you are curious about it, you can check out the announcement articles here: Link and Link The Discord has been launched and we just finished the first macro webinar with almost an half hour of Q&A (

Well done. Thanks CF!

Thank you for a brilliant write up!