The Research HUB: Alpha and Beta

What are really good returns?

Hey everyone,

Several of you have asked me to share some thoughts on how I think about alpha and beta in markets. There are tons of academic papers on defining and systematizing alpha and beta. These are incredibly helpful but sometimes they get a bit too heady. In this article, we will cover the academic side, practical side, and then I will end with some tangible examples of how I personally manage these.

Academic and Technical Side:

Let’s first define alpha and beta:

Alpha (α): Alpha is a measure of an investment's performance relative to a benchmark index. It represents the excess return of an investment compared to the return of a benchmark index. A positive alpha indicates that the investment has outperformed the benchmark, adjusted for risk, while a negative alpha means it has underperformed. Alpha is often used to assess the value added or subtracted by a portfolio manager. For example, if a stock portfolio returns 10% in a year when the relevant benchmark index returns 8%, the portfolio's alpha is 2%.

Beta (β): Beta measures the volatility or systematic risk of a security or a portfolio in comparison to the market as a whole. It is used in the Capital Asset Pricing Model (CAPM), which calculates the expected return of an asset based on its beta and the expected market returns. A beta of 1 indicates that the security's price will move with the market. A beta greater than 1 means the security is more volatile than the market, and a beta less than 1 indicates that the security is less volatile than the market. For example, if a stock has a beta of 1.5, it's theoretically 50% more volatile than the market.

Papers and Resources:

Here are some great papers that will get you started on this topic if you want to dive into it more.

The (Large) Effect of Return Horizon on Fund Alpha

Description: Discusses how alpha estimates from short-horizon returns can be misleading for fund performance evaluation over longer periods.

Characteristic-Based Returns: Alpha or Smart Beta?

Description: Explores how the explanatory power of a characteristic for both alpha and beta can vary over time, particularly in scenarios where profit opportunities might be arbitraged away.

Buffett's Alpha

Description: Examines Berkshire Hathaway's performance, noting a significant alpha to traditional risk factors and a Sharpe ratio of 0.79, but with adjustments when considering certain factors.

Link: Buffett's Alpha

Investor Risk Appetite and High-Beta Stock Valuation Around...

Description: Investigates a trading strategy involving betting against beta and betting on beta, yielding significant returns over a specific period.

Link: Investor Risk Appetite and High-Beta Stock Valuation Around...

Are ESG Alpha and Beta Benefits in Corporate Bonds a Mirage?

Description: Assesses the relationship between ESG factors and future returns and risks, finding significance in generating alpha and reducing beta for equities in certain regions.

Link: Are ESG Alpha and Beta Benefits in Corporate Bonds a Mirage?

Technical Qualifications:

It’s not hard to go into academic debates about alpha and beta because there are elements that are relative and not objective. The bottom line is that we are using the concepts of alpha and beta to further quantify HOW we are making decisions under uncertainty.

What complicates things even further is there are the absolute return guys who say that they don’t care about alpha or beta at all. They will say things like, I don’t care how much alpha I have if I am losing money. For example, if the S&P500 is down 50% and you are only down 20%, “technically” you have 30% alpha.

One thing I have learned over the years is that there is typically some type of silo of knowledge between academics and practitioners. Academics scoff at practitioners since they don’t care about the theoretical underpinnings of action. Practitioners will scoff at academics because they always have cool ideas that never work in the real world. To be fair, this silo has been narrowing but there is still opportunity for people who can merge the two correctly. Marcos Lopez de Prado is a great example of this.

Practical Side:

If you want a great resource on how to think about practical decision-making within the framework of alpha and beta, check out the Resolve Asset Management Master Class: Link

These guys do a great job of setting a proper foundation for decision-making under uncertainty. Actually, the first article I wrote on Substack covered some of these ideas as they relate to broad wealth management:

On the practical side, there are several fundamental principles you want to keep in mind when managing a portfolio:

What is the risk-free rate and how do other asset returns compare to that AND correlate to it? When I think about return streams today, the landscape has changed dramatically from 20 years ago. Today, momentum or CTA strategies are considered betas that contribute to a portfolio. For example, the Allocators Edge provides an excellent breakdown of all the various types of assets AND strategies for extracting returns from those assets.

The second principle is that there is ALWAYS uncertainty regarding the risk-free rate in both nominal and real terms. In our world, this is the FED Funds rate. As you have seen over the past 2 years, there is incredibly high uncertainty about the path of inflation and thereby the risk-free rate.

Third, this risk-free rate dynamic will connect with the specific currency and how a country relates to other countries. In the past, countries weren’t as interconnected in a globalized world. Today, everything is spread across the entire world from consumption, production, and the supply chain, all the way to those of us who trade in financial markets. If you want a breakdown of how some of these specific FX dynamics work, check out the FX primer I wrote:

How do I personally manage this process?

Let me talk big picture and then I will talk about my specific situation.

In general, I believe a portfolio should have some type of active exposure to beta. For example, if a specific asset has a 9% average return, is there some way I can actively manage my exposure to increase that return?

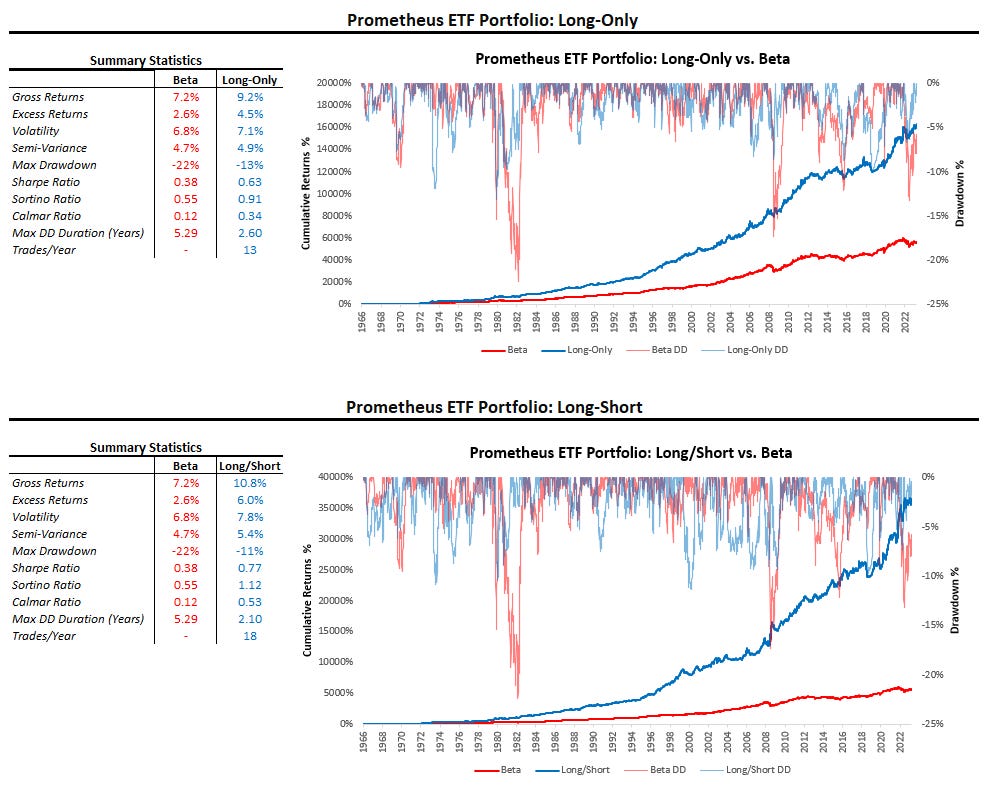

The Prometheus ETF portfolio is a great example of this. It manages exposure across all the major US assets to increase the returns and lower the drawdowns that would take place if you only passively held.

Now let’s say I have a managed beta process across stocks, bonds, commodities, and gold. This is a great foundation to add additional exposure depending on its correlation and contribution to a portfolio. In today’s world, it is easy for people to just throw a bunch of stuff in the same portfolio and call it diversified. In reality, a lot of extra returns are simply leveraged beta.

On top of this managed beta process, I can begin to take alpha trades but I need to ask myself, what is the trade-off for taking additional trades? It is in this context that I think about taking “large bets.”

This is how a typical portfolio might be run if we don’t take into account individual situations and constraints (which are really a huge deal and determine a lot) none of this matters.

My Process:

I have a unique position in that I am an active participant in financial markets for a living. Most people don’t have this benefit (or curse? lol). This means if I can have specific trades that would outpace my managed beta process, I will allocate more to those trades instead of my managed beta process. Why? Well, I really like taking big bets with large amounts of capital.

My typical process is when I find a trade that I want to put on in size, I decrease exposure to my managed beta process so that I can leverage up in a specific trade. Generally speaking, if you have some type of long-term asset base that you don’t want to sell for tax purposes, you can use this to leverage against. However, dynamically managing your leverage is a completely different issue.

My whole mindset is that my money “sits” in premade managed beta strategies while I hunt for alpha. However, you have to realize I spend the majority of my time hunting for alpha I can leverage up in. This is dramatically different from most market participants.

Part of the purpose behind this Substack is to show the entire process of building an exceptional foundation of knowledge to manage beta and hunt for alpha. This is why it always comes back to this quote:

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

Thanks for reading!

Do you agree that alpha is just undiscovered beta?